Imagine your child stands at a shop counter with a handful of coins, only to find the store no longer accepts cash at all.

In a world where contactless payments have overtaken physical currency, teaching children to manage money using only coins and notes is like teaching them to drive using a horse and carriage. A kids' debit card serves as a vital training tool, helping your child navigate the digital economy with safety and confidence.

The transition from a physical piggy bank to a plastic card is a major milestone in financial literacy. For many parents, it feels like a big leap, but it is a necessary one. As cash disappears from high streets and school canteens, the ability to manage digital money is becoming a core life skill.

In many modern economies, cash is used for less than 15% of all transactions. For children growing up today, 'money' is almost entirely a digital concept rather than a physical one.

Using a card introduces your child to the reality of how money moves today. It moves invisibly, which is exactly why it is harder to manage than paper bills. By starting early, you give them a safe environment to practice before the stakes get higher in their late teens.

The Three Types of Cards for Kids

Not all cards are created equal. Depending on your child's age and your family's needs, you will likely choose between three main categories. Each offers a different balance of independence and oversight.

- Prepaid debit cards for kids: These are often provided by fintech companies and come with a dedicated app. You load money onto the card from your own account, and your child can only spend what is available.

- Bank-linked debit cards: These are usually part of a traditional children's bank account. The card is connected directly to the balance in their account, and they are typically available for older children, starting around age 11.

- App-based spending cards: These focus heavily on the educational experience, often including features for chores, savings goals, and giving to charity within the app itself.

An investment in knowledge pays the best interest.

Deciding between these often comes down to cost and features. Prepaid app-based cards frequently charge a monthly fee but offer much more robust parental controls than a standard high-street bank account.

Finn says:

"Wait, if the card is just a piece of plastic, how do I know if I'm running out of money before the machine says 'declined'?"

What Age is the Right Age?

Most financial experts suggest that age 8 is a great time to start with a prepaid debit card for kids. At this age, children understand the basic concept of trade: that money is exchanged for goods. They are also starting to make small independent choices, like picking out a treat at the shop.

By age 11, many children move to a more traditional children's debit card from a major bank. This is often timed with the move to secondary school, where they may need to buy lunch or pay for bus fares independently. This age range is perfect for learning how to check a balance before tapping a card at a reader.

Before you get the card, try the 'Contactless Challenge'. Next time you shop, let your child watch the card reader. Ask them to guess if the 'beep' means the money is gone instantly or if it takes time to travel to the bank.

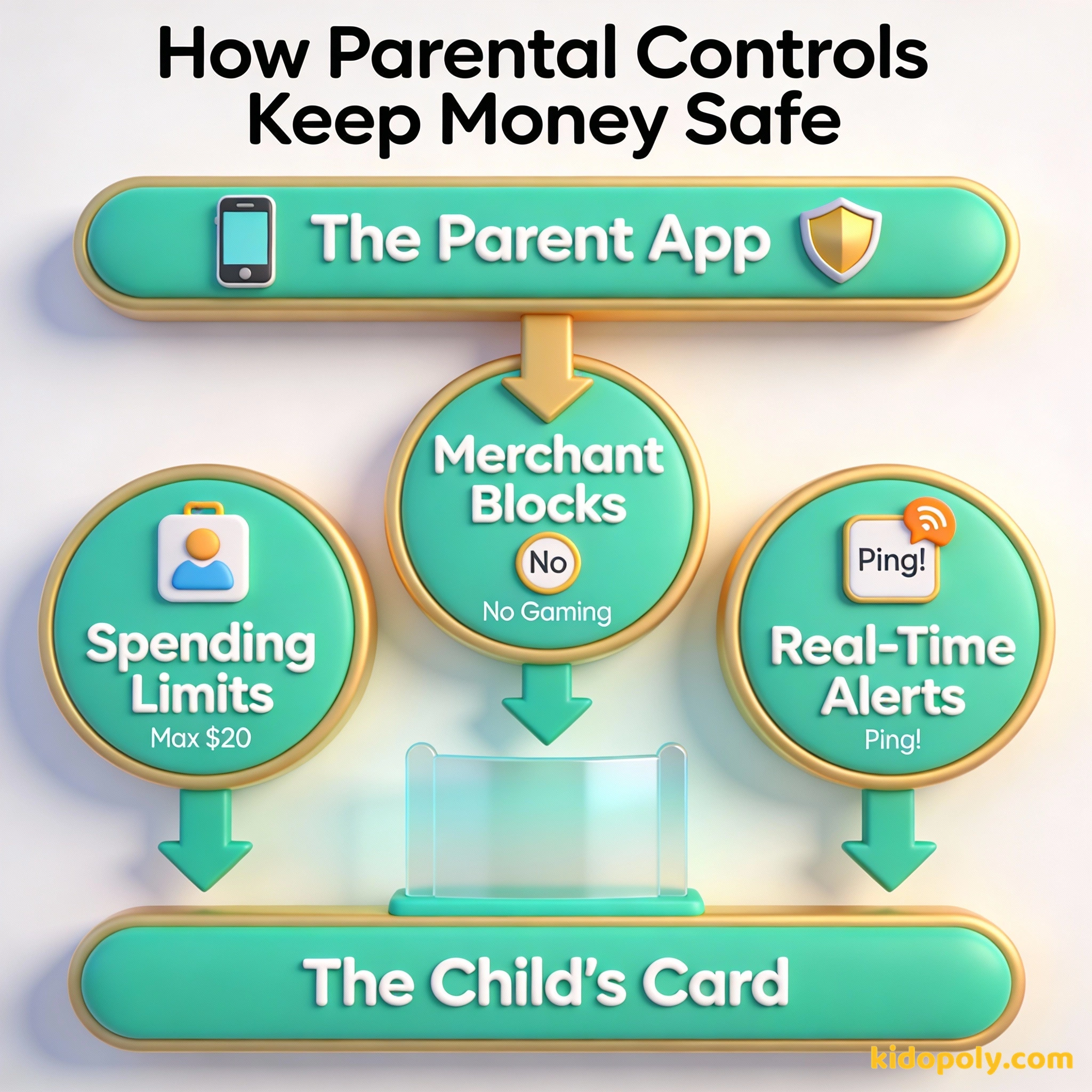

The Power of Parental Controls

One of the biggest advantages of a modern kids' debit card is the level of control you retain. Unlike cash, which is gone the moment it drops out of a pocket, a digital card can be managed with a few taps on your phone.

Most platforms offer several key safety features:

- Real-time notifications: You get a ping on your phone the second your child spends money, showing you exactly how much they spent and where.

- Spending limits: You can set daily, weekly, or monthly limits to ensure they don't spend their entire allowance in one afternoon.

- Merchant blocks: Many cards allow you to block specific types of shops, such as online gaming sites or gambling venues.

- Remote freeze: If the card goes missing, you can instantly 'freeze' it in the app so no one else can use it.

A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.

These controls aren't about spying. They are about providing 'training wheels' for financial responsibility. You can slowly loosen the restrictions as your child proves they can handle more freedom.

Mira says:

"I like that I can check my balance on my phone before I buy a book. It helps me decide if I should save my money for that bigger LEGO set instead."

Cash vs. Card: Which is Better?

Some parents worry that using a card makes money feel 'fake' to a child. While it is true that physical cash is excellent for teaching the basics to very young children, it has significant drawbacks as they grow. Cash is easily lost, cannot be used for online learning or hobbies, and offers no record of where it went.

Cash is tactile and easy to see. When the wallet is empty, the spending stops. It is the best way to teach the 'feeling' of spending for very young kids.

Cards provide a digital record and can be frozen if lost. They allow for online saving and spending, which is where most real-world commerce happens.

Using a card creates a digital trail. This allows you to sit down with your child and look at their spending history together. You can see that they spent 40% of their money on snacks and 60% on a new game. This data makes for much better learning moments than trying to remember where a $10 bill went.

The Cost of Lost Cash: If your child loses a $20 bill, that money is gone forever ($20 loss). If an app-based card costs $4.99 a month, but prevents the loss of that $20 and teaches them to save 10% of their allowance, which one actually saves you more over a year?

Keeping the Money Safe

Safety is a primary concern for every parent. It is important to know that most prepaid debit cards for kids have built-in protections. If the card is lost or stolen, your liability is usually limited, provided you report it quickly through the app.

The chains of habit are too light to be felt until they are too heavy to be broken.

Teach your child the basics of card safety from day one. This includes never sharing their PIN, not letting friends 'borrow' the card, and understanding that if they lose the card, they must tell you immediately. These habits will protect them for the rest of their lives.

Finn says:

"If I lose the card at the park, can someone else buy a thousand Robux with it before I get home?"

Learning to manage a card is about more than just shopping. It is about understanding balance, planning for the future, and navigating a world where the 'swipe' is the new standard. By starting now, you are ensuring they are ready for the financial reality of the 21st century.

Something to Think About

If you had a debit card today, what is the first 'responsible' thing and the first 'fun' thing you would do with it?

This is about your personal values. There is no right or wrong answer, but it helps to think about how you want to balance your needs and your wants.

Questions About Banking

What is the youngest age a kid can get a debit card?

Are kids' debit cards safe from hackers?

Does a kids' debit card affect my credit score?

Ready to take the next step?

A debit card is just one part of a child's financial toolkit. To see how these cards fit into a wider savings plan, explore our guide on kids' bank accounts or learn how to choose the right pocket money app for your family's routine.