You type in four secret numbers, press a button, and crisp banknotes slide out of a slot in a wall like magic.

But inside that metal box, there is no magic. Instead, there is a tiny robot counting notes at lightning speed, a secure connection talking to your bank, and a host computer checking your balance. Here is what is really happening when you use an Automated Teller Machine or ATM.

Most people walk past ATMs every day without thinking about the high-tech secrets hidden inside. These machines are actually powerful computers wrapped in thick steel armor. They are designed to do the job of a bank teller, which is a person who helps you with your money at a bank.

Before ATMs existed, you could only get cash when the bank was open. If the bank closed at 4:00 PM and you needed money for dinner, you were out of luck. This problem led to one of the coolest inventions in banking history.

The first ATM user was a famous TV actor named Reg Varney! He was the first person to ever withdraw cash from a machine in 1967. Back then, the maximum you could take out was only £10.

The First ATM in History

In 1967, a man named John Shepherd-Barron was annoyed that he could not get money because his bank was closed. He had a brilliant idea while he was taking a bath. He wondered if there could be a machine that dispensed cash just like a chocolate bar vending machine.

He took his idea to a bank in London called Barclays. They loved it and built the very first cash machine in a place called Enfield. It did not use plastic cards like we do today. Instead, it used special paper checks with a tiny bit of radioactive material that the machine could read.

It struck me there must be a way I could get my own money, anywhere in the world or the UK. I hit upon the idea of a chocolate bar dispenser, but replacing chocolate with cash.

Mira says:

"So the first ATM was basically like a giant, heavy vending machine for money! I wonder if it ever got a bill stuck like a bag of chips?"

Step 1: The Secret Handshake (Your Card and PIN)

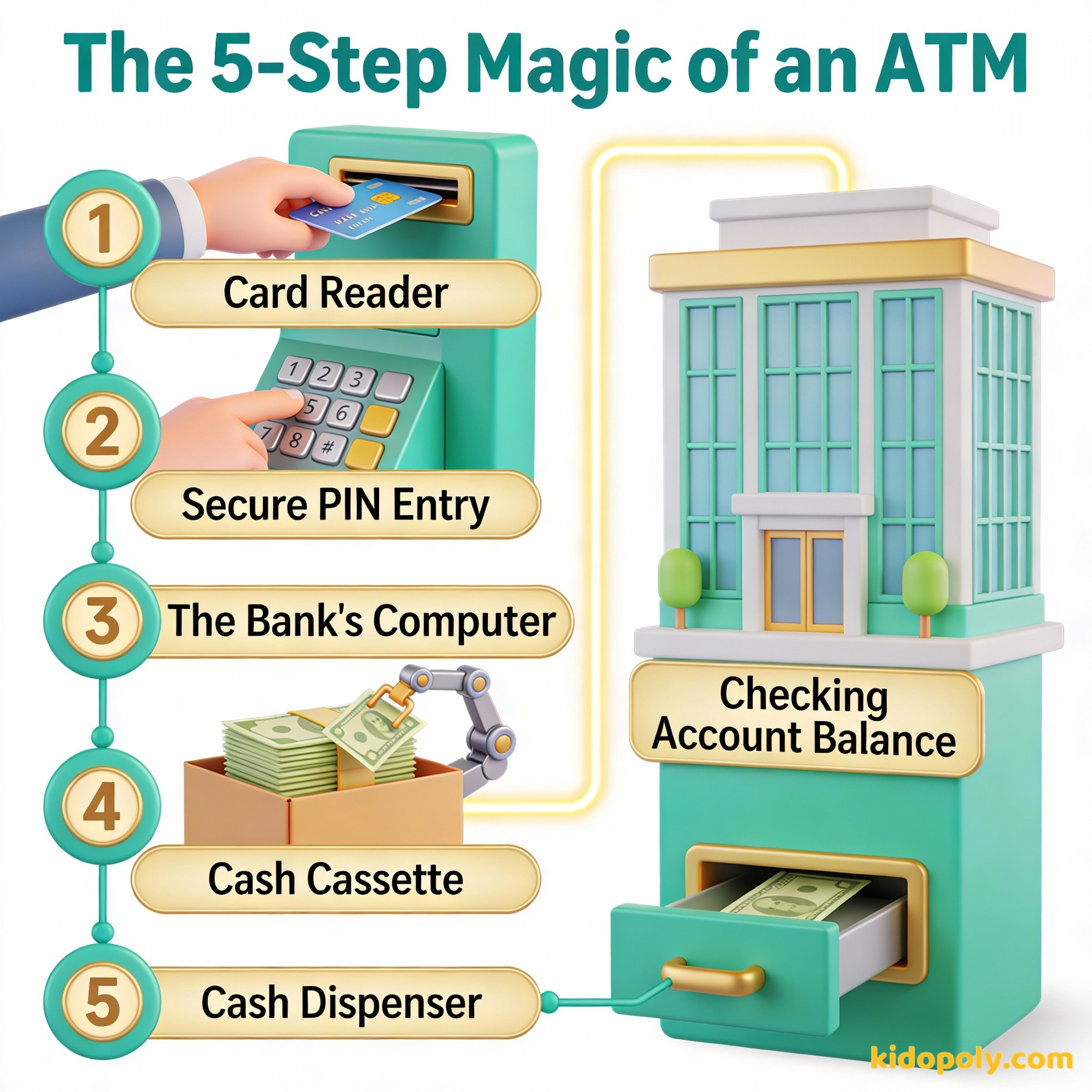

When you put your card into the machine, the ATM needs to know two things. It needs to know who you are and if you are allowed to take money from the account. The machine uses a card reader to get your information from a tiny chip or a magnetic stripe on the back of the card.

Next, the ATM asks for your Personal Identification Number or PIN. This is your secret four-digit code. It acts like a digital key that unlocks your account. Because only you should know this number, it keeps your money safe even if you lose your card.

Imagine the ATM is a high-tech fortress. Your PIN is the secret password to lower the drawbridge. If you type the wrong password three times, the fortress goes into lockdown and might even keep your card to keep the 'treasure' safe from an intruder!

Step 2: The High-Speed Phone Call

Once the ATM knows who you are, it sends a message over a secure network. This is like a private, encrypted phone line that connects the ATM to your bank. The ATM asks the bank's computer a very important question: Does this person have enough money in their account?

If the bank's computer says yes, it sends a digital 'thumbs up' back to the ATM. At the same time, the bank's computer marks down that you are taking money out. This happens in less than a second, even if the bank is hundreds of miles away.

Step 3: The Robot Inside the Box

This is the part most kids want to see. Inside the ATM are several large plastic boxes called cash cassettes. Each cassette is filled with a specific type of bill, like $10s or $20s. When you ask for $40, a mechanical arm starts to work.

Finn says:

"If the machine uses light to check the bills, does that mean it can tell the difference between a real $20 and a piece of paper I colored green?"

Inside the machine, rubber rollers grab the bills one by one. The machine uses optical sensors to look at each bill. These sensors are like tiny eyes that use light to check the thickness and size of the paper. This ensures the machine does not accidentally give you two stuck-together bills or a piece of scrap paper.

Most ATMs can dispense about 5 bills per second. If you asked for 100 bills, the machine would finish counting them in just 20 seconds. A human bank teller would take much longer to count them twice for accuracy!

Where Does the Money Come From?

ATMs do not have an infinite supply of cash. Depending on how busy a machine is, it might run out of money every few days. This is where cash logistics comes in. Heavy, armored trucks with security guards drive to the machines to refill the cassettes.

These guards have special keys and codes to open the thick steel safe inside the ATM. The safe is often made of reinforced metal that is several inches thick. It is designed to withstand fire, drills, and even small explosions to keep the cash safe until it is ready for you.

The most important thing to do if you find yourself in a hole is to stop digging.

Is It Free to Use an ATM?

Not always. Banks spend a lot of money to buy the machines, pay for electricity, and hire the armored trucks. To cover these costs, some machines charge an ATM fee. This is usually a small amount, like $2.00 or $3.00, just for the convenience of using that machine.

Most people try to use an ATM owned by their own bank because those are usually free for customers. If you use a machine at a corner shop or an airport that belongs to a different company, you might have to pay extra. It is always a good idea to check the screen for a fee warning before you finish.

These are usually free to use because they want to help their customers. However, they might be harder to find if you are far from home.

These are super convenient because they are everywhere, like at the cinema or the park. But they almost always charge a fee for the convenience.

Mira says:

"My parents always look for a specific bank logo on the machine. Now I get it, they are trying to avoid paying a fee for their own money!"

Keeping the Machine Safe

Because ATMs are filled with cash, people sometimes try to trick them. One trick is called skimming, where a criminal puts a fake reader over the card slot to steal information. To stop this, banks use green glowing lights on the card slot and anti-skimming technology.

Every ATM also has a hidden security camera that records everyone who uses the machine. There are also sensors that can tell if someone is trying to tip the machine over or break it open. If the machine feels a big vibration, it can send a silent alarm to the police immediately.

Money is such an amazing tool. It can do so much good, but you have to be the master of it, not the slave to it.

The Future of Cash Machines

Today, many ATMs are becoming even more high-tech. Some allow you to get money by just tapping your phone or using your fingerprint. In the future, you might not even need a plastic card at all. No matter how much they change, the goal will always be the same: making it easy for you to get your money whenever you need it.

Next time you are with a parent at an ATM, look for the 'Skimmer Check.' Gently look at the card slot. Is it loose? Does it look like a different color than the rest of the machine? Banks actually encourage people to be observant to keep everyone safe!

The Evolution of the Cash Machine

Something to Think About

If you were designing the ATM of the future, what would it look like and what cool features would it have?

Think about how you use technology every day. Maybe your future ATM doesn't use a screen at all, or maybe it can help you sort your savings into different goals automatically. There are no wrong answers!

Questions About Banking

How does an ATM know how much money I have?

Can someone hack an ATM to make it spit out all its money?

What happens if the ATM gives me the wrong amount of money?

You're Now an ATM Expert!

The next time you see someone using a cash machine, you'll know exactly what's happening behind the screen. It’s not just a hole in the wall - it’s a masterpiece of engineering, security, and global communication. Want to learn more about how that plastic card works its magic? Head over to our page on debit cards for kids to see the tech in your pocket!