Getting your first bank account is one of those moments, like getting a house key or a phone, where you suddenly feel like the grown-up world just opened a door for you.

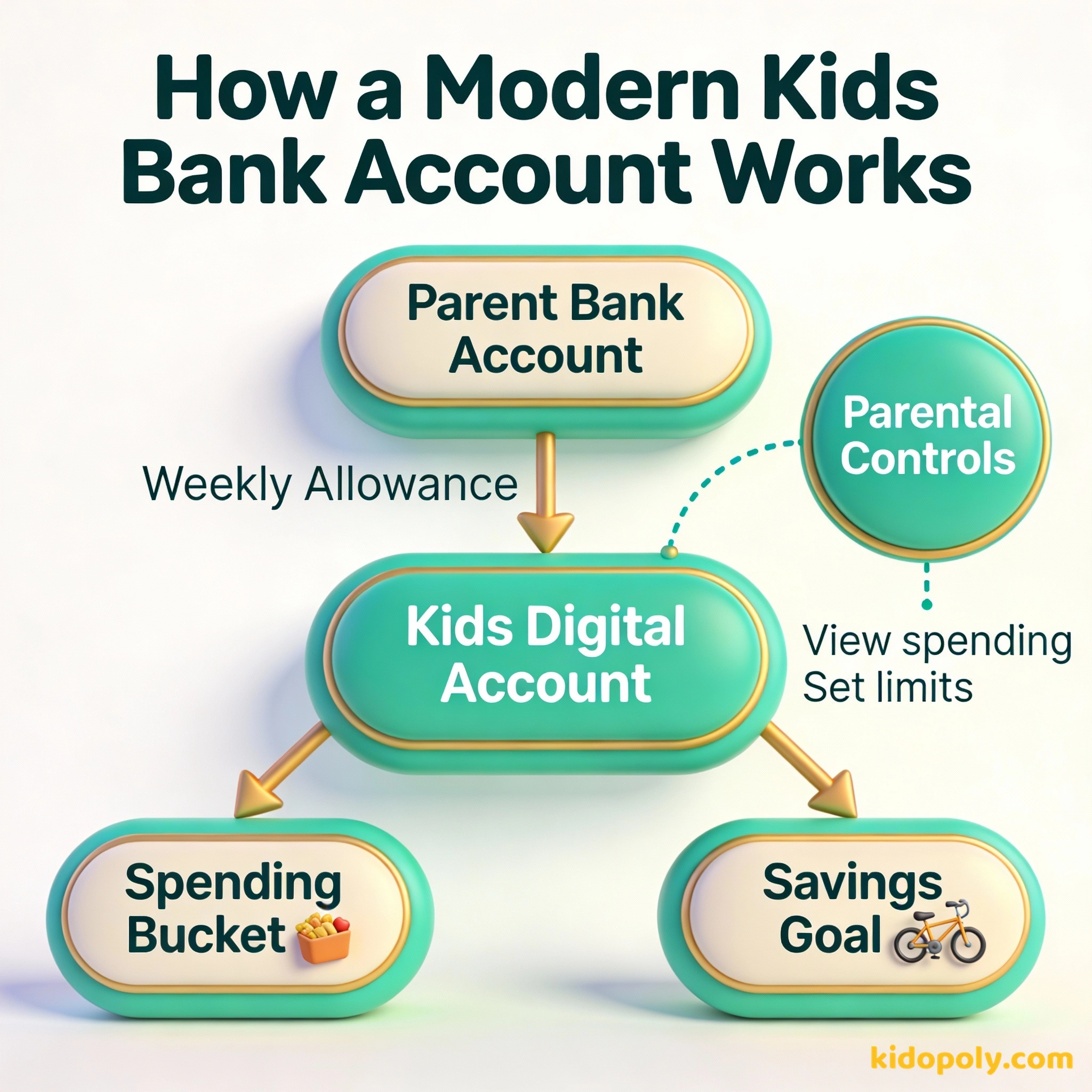

A kids bank account is more than just a place to put birthday money. It is a powerful tool for building financial literacy and learning how to manage digital currency in a world that is moving away from cash.

Having your own bank account is a major milestone. For kids, it represents a first taste of freedom and responsibility. For parents, it is a controlled environment to teach lessons about budgeting and delayed gratification before the stakes get too high.

I made my first investment at age eleven. I was wasting my life up until then.

While most of us grew up with a physical piggy bank, today’s money is mostly invisible. A bank account makes that invisible money tangible again through apps and dashboards. It gives you a place to see your wealth grow, even if you cannot touch the coins.

What Kinds of Accounts Can Kids Get?

Not all bank accounts are built the same way. Depending on your age and what you want to do with your money, you will likely choose between three main options. Each serves a slightly different purpose in your financial journey.

- Children’s Savings Accounts: These are designed for holding money long-term. They often have higher interest rates but might limit how often you can take money out.

- Youth Current Accounts: Similar to adult checking accounts, these allow for frequent spending and usually come with a debit card.

- Prepaid Card Accounts: These are often managed via an app. Parents load money onto the card, and kids can only spend what is available.

In the past, you had to walk into a physical bank building and talk to a teller to see your balance. Today, over 80% of young people check their money exclusively through mobile apps.

How Old Do You Have to Be?

The age you can start depends on the bank and the type of account. Most high-street banks offer basic savings accounts starting from birth, though parents must manage them until the child is older. For a current account with a card, the typical age threshold is between 7 and 11 years old.

Finn says:

"If I get a bank account at 11, does that mean I can buy whatever I want without asking? Or does my mom still get a notification on her phone every time I buy a snack?"

Once you reach age 11, many banks allow you to open a youth account that feels very much like an adult one. By age 16, most teens can manage their accounts almost entirely independently. It is a gradual process of handing over the keys to the financial car.

The Parent’s Role: Joint vs. Custodial

Until you are 18, a parent or guardian is usually legally required to help you manage the account. This usually happens in one of two ways. In a joint account, both the parent and the child have equal access to the funds and the account details.

In a custodial account, the parent technically owns the account on behalf of the child. They have the final say on transactions until the child reaches a certain age. This provides a safety net while you are still learning the ropes of spending limits and security.

What to Look for in an Account

When choosing your first account, it is tempting to look at the interest rate first. While earning a few extra pennies is nice, it is actually the least important feature for a kid’s account. At this stage, the experience of using the account matters much more than the growth of the balance.

Imagine you have $100 in an account with 1% interest, but the bank charges a $2 monthly fee. Interest earned in a year: $1.00 Fees paid in a year: $24.00 Total loss: -$23.00 This is why finding a 'Fee-Free' account is usually more important for kids than finding a high interest rate.

You should look for a high-quality mobile app that is easy to navigate. The best apps allow you to see your balance instantly and get notifications when you spend money. Features that allow you to set specific goals, like saving for a new game, are incredibly helpful for building habits.

An investment in knowledge pays the best interest.

The Evaluation Framework

To decide which account is right for your family, use this simple checklist. Do not just look at the brand name: look at the daily reality of using the card. You want an account that makes it easy to do the right thing with your money.

- Fees: Does the account cost money every month? Some app-based accounts have monthly fees, while traditional banks are usually free.

- App Quality: Is the app fun to use? Does it have features like 'round-ups' that save small change automatically?

- Parental Controls: Can parents see where the money is going? Can they lock the card instantly if it gets lost?

- ATM Access: Is it easy to get cash out if you need it for a school trip or a local shop?

Mira says:

"My bank app lets me put my birthday money into a 'Summer Holiday' folder. It’s way harder to spend it when I can see the picture of the beach I saved in there!"

Traditional banks offer stability, physical branches to visit, and are almost always free for kids. However, their apps can sometimes feel a bit boring or slow.

App-first accounts (neobanks) have amazing features like instant spending alerts and chore trackers. However, they often charge a monthly subscription fee.

Why the Emotional Milestone Matters

There is a psychological shift that happens when you move money from a jar to a bank. It starts to feel 'real.' When you have your own login and your own card, you are more likely to think twice before spending. It is no longer just 'parent money': it is your resource.

Before you open an account, sit down with your parent and look at two different bank websites. Count how many clicks it takes to find the 'Kids' section. If the website is confusing, the app probably will be too!

This sense of ownership is the foundation of financial confidence. Kids who manage their own accounts early are often more comfortable making complex financial decisions later in life. They understand that money is a finite tool that requires a plan.

Finn says:

"Wait, so if the interest rate is low, why don't I just keep my money in a shoebox? Is the app really worth the effort of signing all those papers?"

Our net worth is not the same as our self-worth.

Ultimately, the 'best' account is the one you and your parents will actually use together. It should spark conversations about what to buy now and what to save for later. Once the account is open, the real learning begins.

Something to Think About

If you had your own bank account today, what would be the very first thing you would set up a 'Savings Goal' for?

There are no wrong answers here. Your savings goals reflect what you value most right now, whether it is a new toy, a gift for a friend, or just the feeling of having a safety net.

Questions About Banking

Do I need my parents to open a bank account?

What is the difference between a savings and a current account?

Are kids' bank accounts safe?

Your Financial Journey Starts Here

Opening a bank account is just the beginning of your story with money. It is a tool that will help you turn your hard-earned cash into the things you want most in life. Ready to take the next step? Check out our guide on how to actually open your first account.