Your grandparents had to queue at a bank counter just to check how much money they had. Your parents started doing it on a bulky computer.

Today, you can check your balance in three seconds on your phone while waiting for the bus. Online banking has transformed from a rare luxury into a digital superpower that fits in your pocket. This shift to digital banking means we are handling money faster and more securely than ever before.

Imagine a world where you couldn't just check an app to see if you had enough money for a new game. You would have to find a physical building, wait for it to open, stand in a long line, and ask a person behind a glass window for a printed piece of paper. This was the reality for almost everyone just a few decades ago.

Now, the bank is essentially an icon on your home screen. This digital toolkit includes mobile apps, secure websites, and even the ability to pay for things by tapping your phone at a shop. It is a massive shift in how humans interact with value, moving from physical coins to invisible data.

The very first online banking service in the U.S. was launched in 1994 by the Stanford Federal Credit Union. Back then, websites were very slow and most people were still afraid to put their credit card numbers on the internet!

The Great Move: From Buildings to Bytes

Banking used to be about physical locations. You went to a branch to deposit cash, talk to a manager, or move money from one account to another. Today, most kids will grow up rarely needing to step foot inside a bank building.

This change happened in waves. First, banks introduced ATMs so people could get cash after hours. Then, they built websites so people could see their accounts on home computers. Finally, the smartphone turned banking into a 24/7 activity that you can do from your sofa or the school cafeteria.

The Evolution of Digital Banking

Finn says:

"If the bank is on my phone, where does the actual physical cash go when I use an ATM? Is there a tiny printer inside my screen? Just kidding, but it is weird that I can move money without touching it!"

How Your Bank Stays in Your Pocket

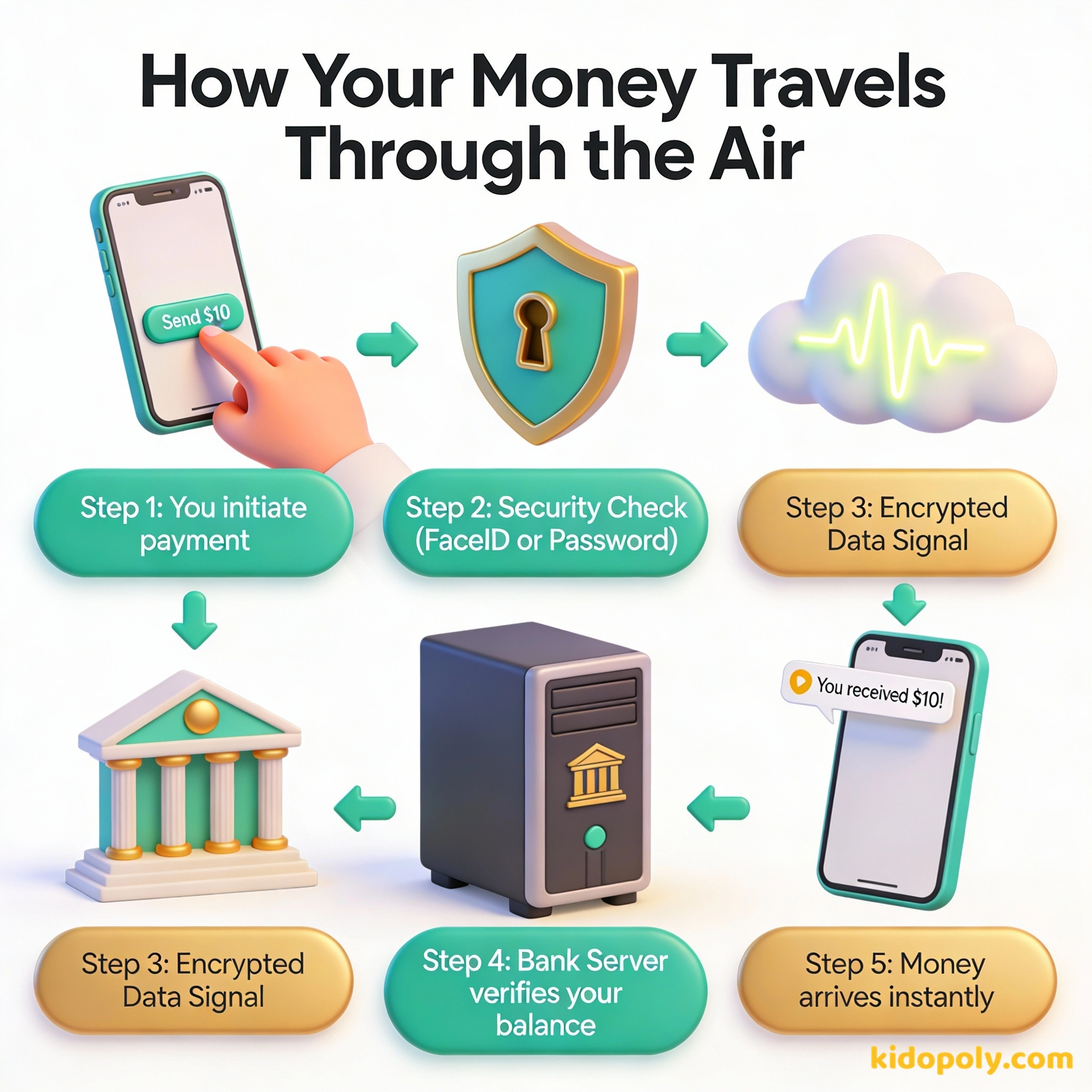

When you use an app to check your balance, you aren't just looking at a number on a screen. You are sending a request to a giant, high-security computer called a server. This server holds the master record of exactly how much money is in your account.

Online banking allows you to do almost everything a bank teller can do. You can check your balance, move money between accounts, or set up standing orders (which are automatic payments that happen on the same day every month). You can even freeze your debit card instantly if you lose it at the park.

Banking is necessary, banks are not.

The Digital Vault: Is Online Banking Safe?

If all your money is accessible through a phone, you might wonder how the bank keeps it safe from hackers. The answer involves some of the most advanced technology on the planet. Banks use layers of protection to ensure that only you can touch your money.

One major layer is encryption. This turns your financial data into a secret code that only the bank’s computers can read. Even if someone intercepted the signal, it would look like complete gibberish to them. It is like having a secret language that only you and your bank speak.

Next time you are on a banking website with a parent, look at the address bar. You should see a small padlock icon next to the URL. This means the site is using an encrypted connection to keep your data safe. If the lock is missing, don't enter any info!

Your Biometric Keys

Most modern banking apps use biometrics for security. This means using your unique body features, like a fingerprint or your face, to unlock the app. Since no two people have the exact same thumbprint or face shape, it is much harder for a stranger to get into your account than it would be to guess a four digit PIN.

Banks also use two-factor authentication (2FA). This is a fancy way of saying they check two different things to prove it is really you. For example, the app might ask for your password and then send a special code to your phone. It is like a house that requires both a physical key and a secret knock to get in.

Mira says:

"Think of encryption like a digital invisibility cloak. Your money details are moving through the air right now, but because of the code, nobody can actually see what they are!"

The Magic of Open Banking

Have you ever used an app that helps you save for a specific goal, like a new bike? These apps often use something called open banking. This allows you to safely give permission for a different app to look at your bank data.

It sounds a bit scary, but it is actually very controlled. You choose exactly what information the other app can see. This helps you use cool tools that can track your spending habits or find ways to help you save money faster. It is all about making your data work for you.

In 2023, roughly 75% of people in the United States used online banking as their primary way to manage money. If you have a town with 1,000 people: - 750 people bank on their phones or computers - 250 people still prefer visiting a physical branch That is a 3-to-1 ratio in favor of digital!

Banking is no longer somewhere you go, it's something you do.

Staying Smart with Your Digital Cash

Even with all this high-tech security, you are still the most important part of the safety chain. Being a digital banking pro means following a few simple rules. First, never share your login details with anyone, not even your best friend.

Second, try to avoid using public WiFi (like the kind at a cafe or a library) when you are looking at your bank account. Public networks are easier for hackers to watch. It is always safer to use your home internet or your phone's mobile data.

You can do your banking at 2 AM in your pajamas. You don't have to travel anywhere or wait in lines. You get instant alerts when money moves.

If your phone dies or you have no internet, you can't access your account. You also don't get to speak to a human face-to-face for advice.

Do We Still Need Physical Banks?

While most things can be done online, physical banks haven't disappeared entirely. Sometimes you might need to deposit a large amount of physical cash or talk to an expert about a very complex financial decision. However, for most of us, the days of waiting in long lines are over.

Online banking has made money feel more like a tool and less like a chore. By understanding how it works, you aren't just an app tapper. You are a digitally literate user who knows exactly how to manage, move, and protect your wealth in the modern world.

Privacy is a fundamental human right.

Mira says:

"It is like having a 24-hour financial assistant in your pocket. You don't have to wait for the world to open to start planning your next big goal."

Something to Think About

If you could design one new feature for a banking app to help kids your age, what would it be?

Think about what would make managing money more fun or easier to understand. There are no wrong answers, banking is constantly evolving based on what people need!

Questions About Banking

Can I have my own online banking account?

What happens if I lose my phone with the bank app on it?

Is digital money 'real' money?

You're a Digital Banking Pro

Now that you know how the digital vault in your pocket works, you are ready to take control of your financial future. Online banking is a tool that saves you time and keeps your money safe. If you want to see what kind of account might be right for you, check out our guide on kids bank accounts!