Week one, your kid does every chore perfectly for $15. Week three, they decide they'd rather skip chores and skip the money. Does that mean your system failed?

Actually, that's their first real lesson in opportunity cost. When you link chores to money, you aren't just getting a cleaner house: you're building a miniature economy where your child learns that work creates value. This guide shows you how to implement a commission system that survives the initial excitement and becomes a part of your family's daily life.

Most parents start an allowance with the best intentions, but without a clear framework, it often dissolves into nagging. If you have decided to link money to work, you are moving away from a flat allowance and toward a commission model. This shift changes the conversation from 'Can I have five dollars?' to 'How can I earn five dollars?'

Work is a good thing. We were designed to work. It’s part of who we are. When kids work and get paid, they learn the connection between effort and reward.

The Commission System Explained

The most popular version of this approach is the Dave Ramsey commission model. In this system, children don't 'get' an allowance: they earn it. If they do the work, they get paid. If they don't do the work, they don't get paid. It sounds simple, but the magic happens in the consistency.

Finn says:

"So wait, if I decide to stay in bed and not feed the dog, I just... don't get the money? That sounds like a trade-off I might actually make sometimes!"

This method teaches kids that money doesn't just appear: it is a reward for service provided to others. It also shifts the power dynamic. Instead of you being the 'bad guy' who won't give them money, you are the employer who is ready to pay as soon as the job is done.

Base Chores vs. Bonus Commissions

Before you print a chart, you must distinguish between citizen chores and paid commissions. Citizen chores are things your child does because they are a member of the family, like clearing their own plate or making their bed. These are expected and unpaid.

- Citizen Chores (Unpaid): Personal hygiene, cleaning up their own toys, clearing their dinner spot.

- Paid Commissions: Tasks that benefit the whole house, like folding communal laundry, feeding the dog, or vacuuming the living room.

- Bonus Jobs: High-value, occasional tasks like washing the car or pulling weeds in the garden.

According to a T. Rowe Price survey, about 83% of parents who give an allowance require their children to do chores to earn it. The 'free ride' allowance is becoming a thing of the past!

Setting Your Chore Prices

How much should you pay? While there is no federal 'kid minimum wage,' many families find success with a 'dollar per year of age' weekly cap, or by assigning specific values to specific tasks. Use these real-world averages as a starting point for your chore pricing:

Typical Commission Rates: - Matching Socks: $0.25 per basket - Unloading Dishwasher: $1.00 - Folding Laundry: $2.00 - Cleaning Bathroom: $3.00 - Mowing Lawn: $5.00 - $10.00

Consistency matters more than the dollar amount. If you pay $0.50 for a task, make sure it is always $0.50. This allows your child to do the money math and plan for things they want to buy in the future.

Setting Up the System: Step-by-Step

Don't just start assigning tasks on a random Tuesday. Hold a family meeting to launch the new economy. This makes the system feel official and gives your child a sense of ownership over their new 'job.'

- List the Tasks: Brainstorm together what needs to be done around the house.

- Assign Values: Agree on the price for each task so there are no surprises on pay day.

- Set the Schedule: Pick a specific pay day (like Sunday evening) where you review the chart together.

- Define 'Done': Be clear about what a finished job looks like. For example, 'cleaning the room' includes under the bed.

Mira says:

"It's like a real job! I like knowing exactly how much I'll have for that new LEGO set if I just stick to the plan."

Tracking Progress with Charts

A physical chore chart on the refrigerator is often more effective than a digital app for younger children. The act of checking off a box or moving a magnet provides an immediate dopamine hit and visual proof of their hard work.

The 'Check-In' Hack: Instead of nagging throughout the week, have a 2-minute 'Stand-Up Meeting' every morning. Ask: 'What's on your list today?' It keeps the tasks top-of-mind without the friction.

For older kids, you might transition to a digital family economy board or a banking app. The key is that the tracking must be updated daily. If you try to remember who did what six days ago, the system will break down under the weight of arguments.

The best investment you can make is in yourself. But the second best is learning how money works before you have to earn it for real.

When Things Go Wrong: Redos and Deductions

What happens when a chore is done poorly? This is where many parents struggle. You have two main options: the redo policy or the deduction. A redo policy means the child doesn't get paid until the job meets the agreed-upon standard. A deduction means they get partial pay for partial work.

Ask the child to do it over until it's right. They learn that quality matters and that shortcuts don't actually save time.

Pay a lower amount for the job. They learn that 'B-grade' work receives 'B-grade' pay, mirroring some real-world freelance structures.

If a child chooses not to do a chore at all, they simply don't get the commission. Do not nag. Let them experience the 'poverty' of an empty piggy bank. The discomfort of not being able to buy a toy because they skipped their chores is a much more powerful teacher than a lecture.

Finn says:

"It was way harder to spend that $10 on a candy bar when I realized it took me two weeks of vacuuming to earn it."

The Goal: Financial Independence

Remember that the point of this system isn't to have a perfectly clean house. It is to give your child a safe environment to practice managing money. When they earn their own cash, they start to value their purchases differently. They learn to save for big goals and spend wisely on small ones.

A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life. That starts with knowing you can earn what you need.

Imagine your child wants a $40 video game. Without a chore system, they just beg. With a commission system, they look at their $5-per-week earning potential and realize they are exactly 8 weeks of hard work away from their goal. That realization is the birth of financial planning.

Something to Think About

What is one household task you currently do that your child might be ready to take on as a paid commission?

Think about your child's current maturity level rather than just their age. There is no right or wrong answer, only what fits your family's rhythm.

Questions About Earning & Pocket Money

Should I pay my kids for getting good grades?

What if my child says they don't need the money and refuses chores?

What is the best age to start a commission system?

From Chores to Confidence

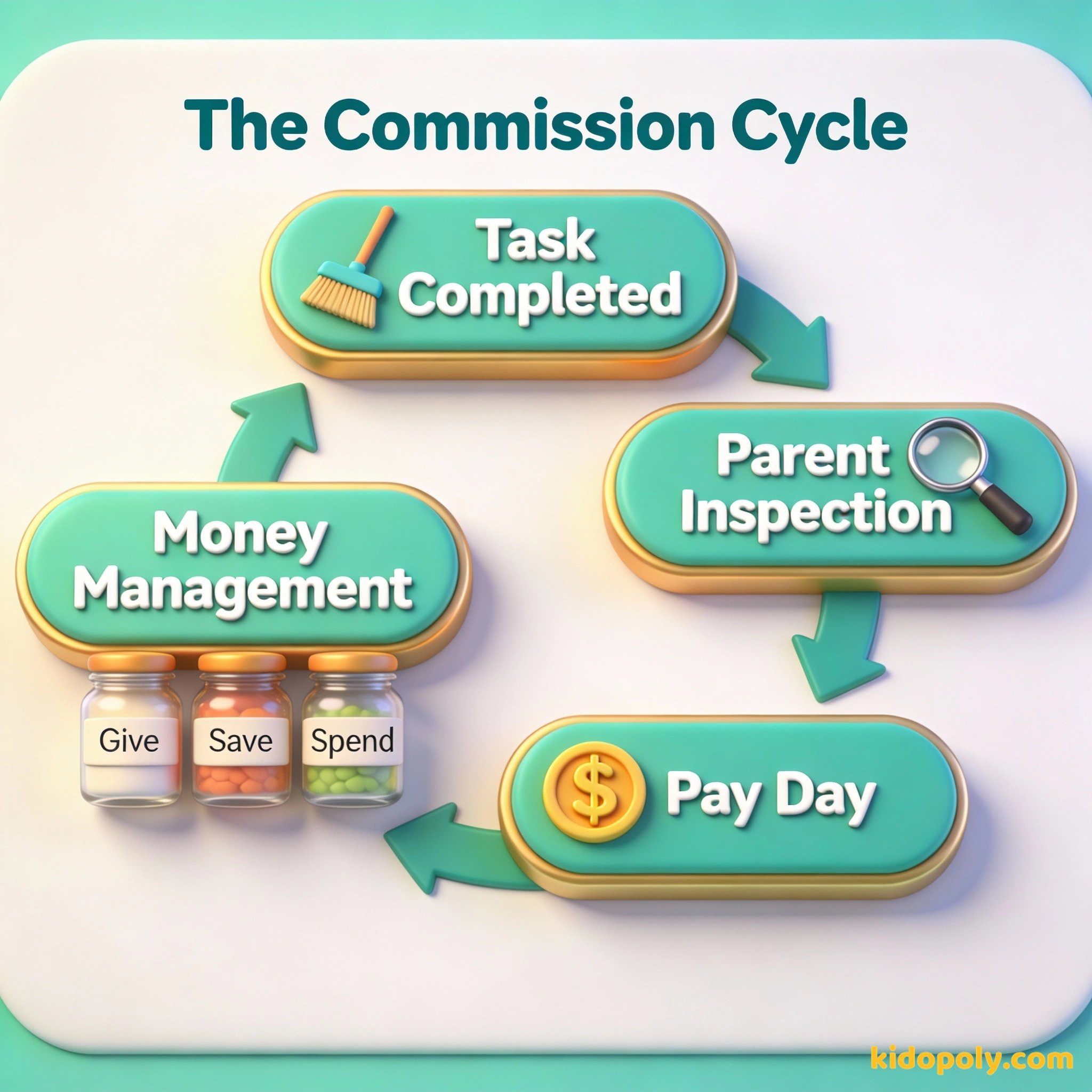

Setting up a commission system takes effort upfront, but the payoff is a child who understands the value of a dollar. Once they are earning, the next step is teaching them how to divide that income. Ready to see what they should do with those hard-earned dollars? Explore our guide on [allowance-for-kids] to learn about the Give, Save, Spend method.