The old rule of thumb says you should give your child $1 per year of age, so a 10-year-old would get $10 a week. But does that rule still hold up in today's economy?

Recent American survey data suggests that the average allowance for a 10-year-old has climbed to $13 or more. Choosing the right amount for your family requires balancing market data with your own financial values and your child's maturity.

Deciding on an allowance amount is one of the first big financial decisions you make as a parent. It is not just about giving them 'spending money.' It is about providing a controlled environment where they can practice making mistakes before the stakes get too high.

A T. Rowe Price survey found that 75% of parents who give an allowance believe it is the single most effective way to teach their kids about the value of a dollar.

The $1 Per Year Rule: Is It Broken?

For decades, the standard advice for American families was the one-dollar rule. You simply give your child $1 for every year they have been alive, paid out weekly. Under this system, a 6-year-old receives $6 and a 15-year-old receives $15.

While this rule is easy to remember, it has struggled to keep up with inflation. According to a 2025 survey of American households, many parents are now padding these numbers to account for the rising cost of snacks, toys, and digital entertainment.

The best time to teach kids about money is when they are still under your roof and the mistakes only cost five dollars.

Average Allowance by Age in the US

If the $1 rule feels a bit thin, you might look at what other families are doing. Data from T. Rowe Price and digital banking apps like RoosterMoney show that American parents are becoming more generous as kids hit double digits.

Here is a breakdown of the current average weekly allowance ranges in the United States:

- Ages 4 to 5: $2 to $5 per week

- Ages 6 to 7: $5 to $7 per week

- Ages 8 to 9: $8 to $10 per week

- Ages 10 to 11: $11 to $13 per week

- Ages 12 to 13: $15 to $20 per week

- Ages 14 to 16: $25 to $50+ per week

Finn says:

"If a 10-year-old gets $13 a week, does that mean I can buy that new expansion pack every single month if I don't buy snacks?"

Matching Money to Responsibility

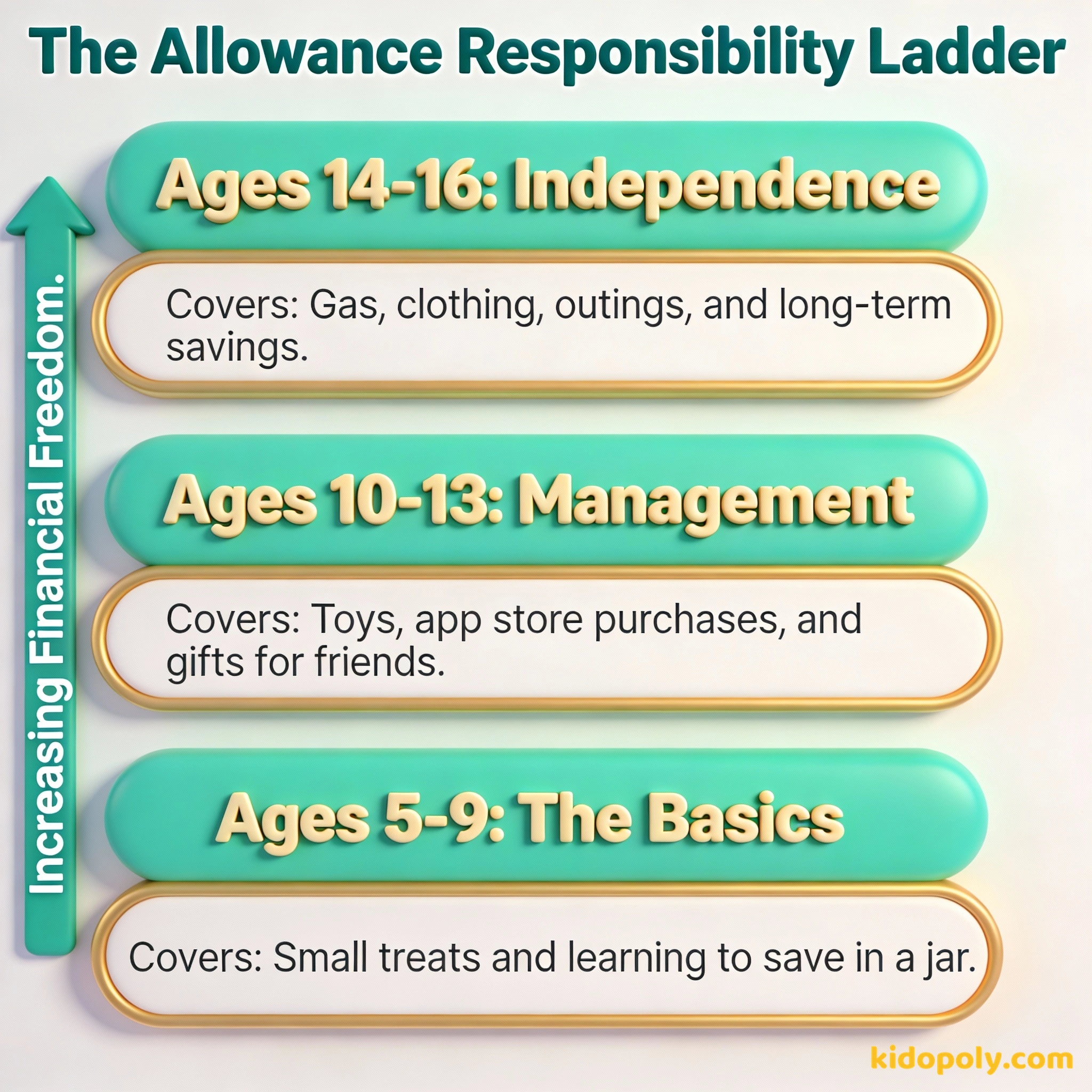

The actual dollar amount matters less than what that money is expected to cover. If you give a 14-year-old $50 a week but expect them to pay for their own clothes, gas, and movie tickets, they are learning much more than a 14-year-old who gets $10 just for candy.

In the early years, ages 4 to 7, the goal is tactile recognition. They need to see the physical bills and coins to understand that money is a finite resource. By ages 8 to 11, the focus shifts to short-term goals, like saving up for a specific LEGO set or a video game.

Let's look at the power of the $1 rule over time: Age 5: $5/week = $260/year Age 10: $10/week = $520/year Age 15: $15/week = $780/year Total potential 'practice money' by age 18: Over $9,000!

The Teenage Transition

When your child hits the 14 to 16 age band, allowance should begin to look more like a salary. This is the stage where you might transition them to a monthly payment rather than weekly. This forces them to budget over a longer period, which is a vital skill for adulthood.

Allowance is not a reward for work; it's a tool for learning.

Many parents choose to decrease or 'phase out' allowance once a teenager gets a part-time job. However, some experts suggest keeping a small base allowance tied to family responsibilities while letting the job income cover their 'wants.' This keeps them engaged with the family economy.

Mira says:

"I like the idea of a monthly allowance. It feels more like how you and Mom get paid, so I have to make sure I don't spend it all in the first week!"

The Annual Review System

To avoid constant negotiations, set up an annual review. Many families choose the child's birthday or the start of the school year to sit down and discuss the allowance amount.

- Review the previous year's spending and saving habits.

- Discuss new expenses they will be responsible for (like a cell phone bill).

- Adjust the weekly or monthly amount based on these new responsibilities.

- Update their savings goals for the coming year.

Try the 'Three Jar' method with your child's allowance. Have them split every payment: 50% for Spending, 40% for Saving, and 10% for Giving. It builds the habit of 'paying yourself first.'

Why Consistency Trumps the Amount

Whether you decide on $5 or $25, the most important factor is consistency. If allowance is skipped or paid late, the child loses the ability to plan. A predictable income allows them to experience the 'pain' of an empty wallet when they overspend and the 'pride' of a growing balance when they save.

Do not save what is left after spending, but spend what is left after saving.

Finn says:

"Wait, if I get a raise on my birthday, do my chores get harder too? Or is it just because I'm older?"

Gives the child full control to learn through trial and error, even if they waste money on 'junk.'

Parents guide purchases to ensure the money is used 'productively' or for high-quality items.

Ultimately, allowance is a training tool. It is the cost of your child's financial education. By giving them a set amount by age, you are providing the raw materials they need to build a lifetime of good habits.

Something to Think About

If you could go back and change how you managed your own allowance as a kid, what is the one thing you would tell your younger self?

There is no right or wrong way to handle money, but reflecting on your own childhood experiences can help you decide what values you want to pass on to your children today.

Questions About Earning & Pocket Money

Should I give allowance if they don't do chores?

What is the average allowance for a 13-year-old?

At what age should I start giving an allowance?

Start Small, Think Big

The specific dollar amount you choose today is just the beginning. The goal is to move your child from 'asking for things' to 'planning for things.' Once you have settled on an age-appropriate amount, your next step is to decide if you will connect that money to household tasks or keep them separate. You can explore that debate in our guide to allowance and chores.