The average American kid gets $30 a week in allowance, but research shows the amount matters less than the system.

Whether you give $5 or $50, what makes the difference is how you structure it. An allowance is essentially training wheels for your child's future financial literacy. It is a safe way for them to make mistakes with small amounts of money now so they do not make them with a mortgage later.

Most parents start thinking about an allowance when their child begins asking for every toy in the checkout aisle. It is a natural transition point. Instead of you deciding on every purchase, an allowance shifts the decision-making power to your child.

According to a survey by the AICPA, the average weekly allowance for American children is about $30. However, this varies wildly by age and region. Most kids start their first allowance around age 6.

Research from the American Institute of CPAs suggests that most parents believe an allowance teaches the value of a dollar. However, only a fraction of families actually have a consistent system. Without a plan, an allowance often becomes a random handout rather than a teaching tool.

Why Start an Allowance?

An allowance is not just about giving your child money for candy or video games. It is a practical curriculum for life. When children have their own money, they begin to understand scarcity, which is the idea that money is finite and choosing to buy one thing means not buying another.

Mira says:

"I noticed that when I use my own allowance to buy a toy, I take way better care of it. It feels like I actually 'own' it because I chose it and paid for it!"

By managing their own cash, kids learn to prioritize their desires. They experience the "pain" of a purchase and the reward of hitting a savings goal. This early exposure helps prevent the common adult struggle of living paycheck to paycheck.

I think the best age to start is as soon as they start showing an interest in money.

Choosing the Right System

There is no single "correct" way to handle an allowance, but most American families choose one of three popular frameworks. The best one is the one you can actually stick to every week.

- The Flat Rate (The Salary): You provide a set amount every week, regardless of chores. The philosophy here is that an allowance is a tool for learning, not a reward for work.

- The Commission (The Paycheck): Popularized by experts like Dave Ramsey, this system ties every dollar to a specific task. If the work does not happen, the money does not happen.

- The Hybrid Model: This provides a small base amount for basic financial learning, but offers extra "commission" opportunities for bigger household jobs.

Hold an 'Allowance Launch Meeting.' Sit down with your child and explain the new system. Let them pick out three jars or containers for their Spend, Save, and Give funds. Making it an 'event' makes them feel responsible.

How Much Should You Give?

A common rule of thumb in the US is the "dollar-per-age" rule. Under this system, a 7-year-old would receive $7 per week, and a 10-year-old would receive $10. It provides a clear, predictable escalation as the child grows older.

The 'Dollar-per-Age' Rule Example: - 6 years old: $6.00 / week - 10 years old: $10.00 / week - 15 years old: $15.00 / week Total annual cost for a 10-year-old: $520.00.

However, your family's budget and your local cost of living matter more than any rule of thumb. If you live in an expensive city where a movie ticket is $15, a $5 allowance might feel discouraging. The goal is to give enough that they can buy something small occasionally, but not so much that they never have to save up.

Finn says:

"If I get a dollar for every year I've been alive, does that mean I get a huge raise on my birthday? That's the best birthday present ever!"

Setting the Rules

Before the first dollar changes hands, you need to establish what the allowance covers. Does it pay for movie tickets? Does it cover the "extra" toy at Target? Being clear about these expectations prevents future arguments at the store.

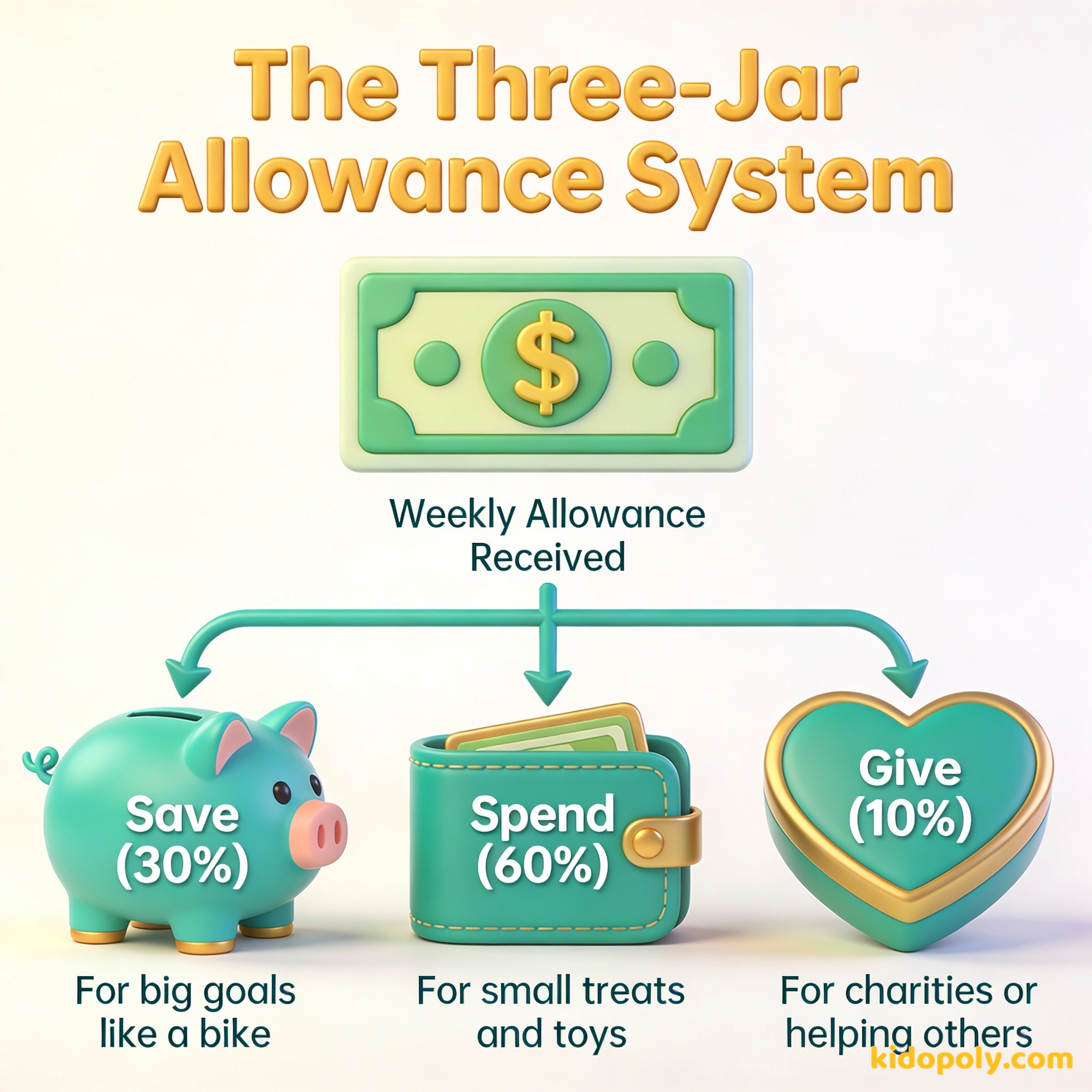

Many experts recommend the three-jar approach: Spend, Save, and Give. You might require your child to put 10% into a jar for charity and 20% into a long-term savings jar for big purchases. The remaining 70% is theirs to manage as they see fit.

Work creates money. We don't have an allowance, we have a commission.

The Importance of Consistency

The biggest failure of allowance systems is not the amount or the chores: it is the parent forgetting to pay. When payments are inconsistent, the child stops planning. They stop checking their jars and start asking you for money again because they cannot rely on their own income.

- Pick a specific day of the week (like Sunday evening).

- Set a recurring calendar alert on your phone.

- Keep a small stash of cash or use an allowance app to ensure you never miss a payment.

Imagine your child wants a $50 LEGO set. With a $10 allowance where they save $2 a week, they will reach their goal in 25 weeks. That waiting period is where the most valuable lessons about patience and reward happen.

Handling the "Work" Debate

One of the most frequent questions parents ask is whether allowance should be tied to chores. This is a personal family values decision. Some parents believe chores are part of being a family member and should not be paid, while others believe money should always be earned.

Teaches that money is earned through effort and work. Mimics the real-world job market.

Ensures the child always has a 'learning laboratory' of money to manage, regardless of their mood or chores.

If you want to dive deeper into this specific debate, you can explore our guide on [allowance-and-chores]. Regardless of which side you choose, make sure your child understands the "why" behind your decision. Transparency builds trust and financial confidence.

Mira says:

"Our family uses the hybrid system. I have my regular chores I do because I live here, but I can wash the car if I want to earn extra money for a new video game."

When to Start

Most experts suggest starting an allowance between ages 5 and 6. This is usually when children start to understand basic math and notice that things in stores have prices. For a detailed breakdown of what this looks like as they grow, check out our [allowance-by-age] resource.

Allowance is a teaching tool, not a payment for services rendered.

Something to Think About

What is one thing you want your child to learn about money that you wish you had known at their age?

There are no right or wrong answers here. Every family has different financial values. Use this question to guide which allowance system feels most authentic to your home.

Questions About Earning & Pocket Money

Should I pay my kids in cash or use an app?

What if my child spends all their money on something 'stupid'?

Do I have to give $30 just because that is the average?

Ready to get started?

The best time to start an allowance was yesterday: the second best time is today. Pick a system, gather your jars, and start the conversation. For more specific details on how to adjust these amounts as your child grows, explore our guide on allowance by age.