Your 10-year-old wants to go to the cinema with friends, buy a new game, and save for trainers. They cannot do all three on £5 a week, and that is exactly the point.

Welcome to the world of real budgeting. At age 10, your child is at a developmental pivot point where financial literacy moves from abstract concepts to practical life skills. This guide helps you navigate the transition from simple treats to financial independence.

Ten is a big number. It marks the end of the single digits and the beginning of a child's journey toward the teenage years. In the world of finance, this is the age where pocket money stops being a 'bonus' for sweets and starts becoming a training tool for life.

At this age, your child is cognitively ready to understand opportunity cost. They can finally grasp that spending money on a temporary snack today means they genuinely cannot afford the video game they want next month. This realization is the foundation of all adult budgeting.

A study by University of Cambridge researchers found that most children have formed their basic money habits by the age of seven. By age 10, those habits are becoming deeply ingrained, making this the perfect year for a 'money reset'.

How much pocket money is enough?

The most common question parents ask is the 'going rate' for a 10-year-old. According to recent UK surveys, the average amount typically sits between £4 and £7 per week. However, the specific number is less important than what that money is expected to cover.

Finn says:

"So if I pay for my own apps and cinema tickets, do I get a pay rise? It feels like I'm doing a job just to keep the same amount of fun!"

If the money is purely for 'extras' like a chocolate bar or a small toy, £4 might be plenty. If you expect them to pay for their own cinema tickets, gaming subscriptions, or gifts for friends, you might need to lean toward the higher end of the scale.

Do not save what is left after spending, but spend what is left after saving.

The transition to a monthly budget

Most younger children receive money weekly because their 'time horizon' is short. They find it hard to plan more than seven days ahead. By age 10, many children are ready to try a bi-weekly or even a monthly allowance.

Easier for kids to manage. Mistakes only last a few days. Best for kids who are still learning to resist impulse buys.

Teaches long-term planning. Simulates a real-world salary. Best for 10-year-olds who have shown they can save.

Moving to a monthly payment is a major step in financial responsibility. It forces them to pace their spending. If they spend their entire monthly allowance in the first five days, they have to live with the consequences for the next twenty-five. This is a safe environment to fail and learn before the stakes are higher.

Digital money and the first debit card

Is a 10-year-old ready for a bank account? In today's increasingly cashless society, the answer is often yes. Many parents find that physical coins are becoming less practical for the way 10-year-olds spend money, especially for online gaming or digital apps.

At this age, you might consider a prepaid debit card or a dedicated kids' money app. These tools allow you to set spending limits and see exactly where the money is going. It also introduces them to the concept of digital balances, helping them understand that money still exists even when they cannot touch it.

Mira says:

"My dad says using a card is like magic, but I have to remember the numbers on the screen are real money I've earned. It's harder to see it disappear than with a jar of coins."

Navigating peer pressure and social spending

Age 10 is often when social lives become more independent. Your child might start going to the shops or the cinema with friends without you. This introduces a new challenge: peer pressure.

- They may feel the need to buy what their friends are buying.

- They might struggle with friends who have significantly higher or lower allowances.

- They may be tempted to 'treat' others to fit in.

Imagine your child goes to the park with friends. Everyone decides to get an ice cream, but your child only has £1 left of their allowance. Do they borrow money? Do they go without? This moment, though small, is a masterclass in living within your means.

Talk to your child about these social situations. Remind them that everyone's family handles money differently. This is a great time to link back to your family's budgeting-basics and help them feel confident in their own financial choices.

Beware of little expenses, a small leak will sink a great ship.

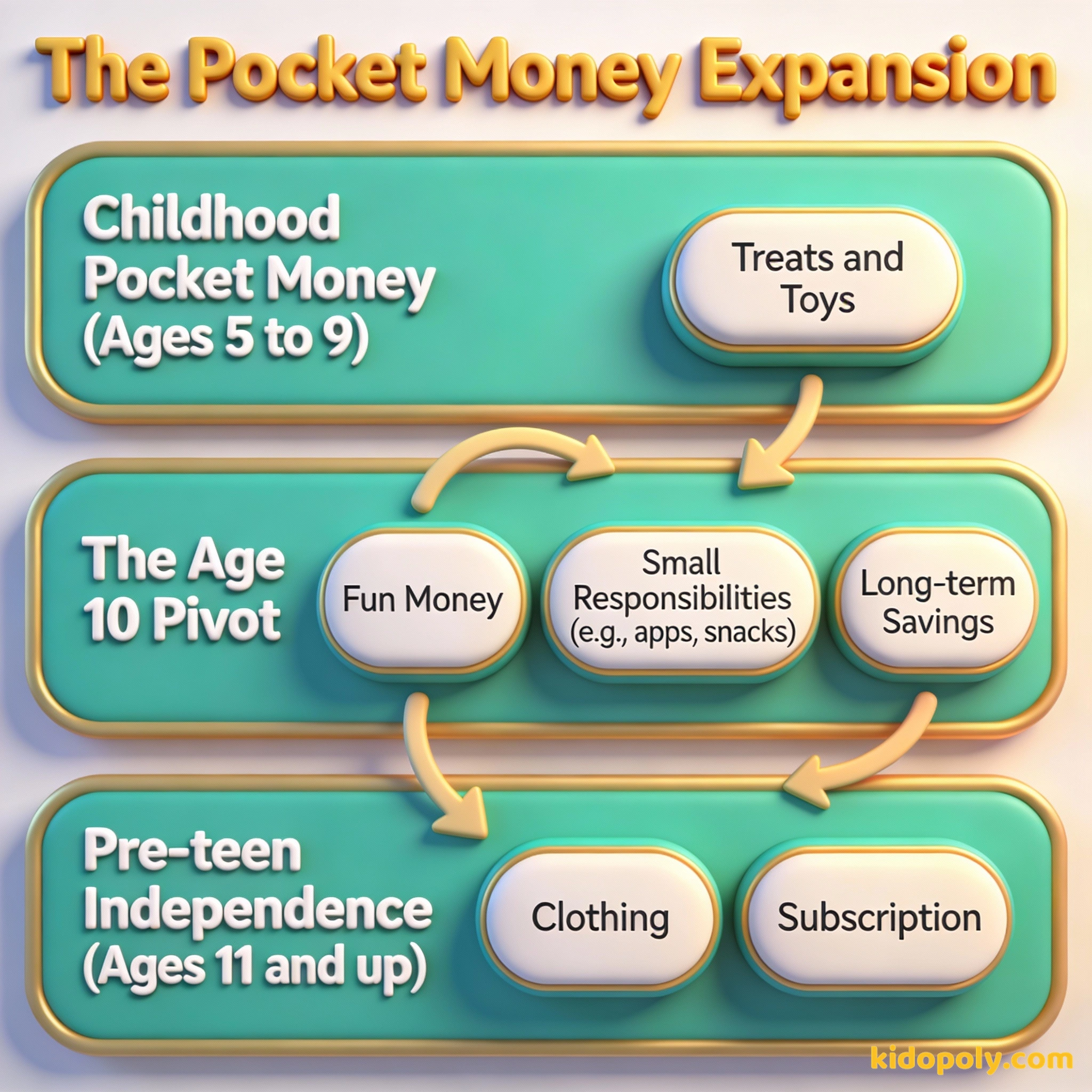

Expanding the budget: Responsibility shifts

To make pocket money a true learning tool, you can expand what it covers. Instead of just giving them more money, give them more financial duty. You might increase their allowance by £2, but explain that they are now responsible for buying their own mobile phone top-ups or cinema snacks.

The 'Wait 24 Hours' Rule: If your child wants to buy something that costs more than half their weekly allowance, ask them to wait 24 hours. If they still want it the next day, they can buy it. You will be surprised how often the 'must-have' feeling fades by morning.

This shift moves money from being a 'gift' to being a 'resource'. When a child has to choose between a large popcorn or saving that money for a new pair of headphones, they are practicing high-level decision making. It also reduces the number of times they have to ask you for 'extra' cash.

The entrepreneur spark

Many 10-year-olds start looking for ways to earn money beyond their basic allowance. This is the perfect age to encourage an entrepreneurial spirit. While basic household chores are often part of being a family, you might offer 'bonus' tasks for extra pay.

Finn says:

"Wait, if I wash the car and get paid, is that a salary or a bonus? I'm trying to figure out if I should start a car-washing empire on our street."

- Washing the car or clearing the garage.

- Helping a younger sibling with homework.

- Selling old toys or books online (with your supervision).

- Starting a small local project like pet-sitting or plant-watering.

Compare the costs: Weekly allowance: £5.00 Yearly total: £260.00 If they save just £1 a week: Total after 1 year: £52.00 Showing a 10-year-old the yearly total helps them realize that small, consistent savings turn into significant buying power over time.

Setting long-term goals

Finally, use age 10 to move beyond the 'save for next week' mindset. Encourage your child to set a 'big' goal that might take six months or a year to reach. Whether it is a brand-name pair of trainers or a specific LEGO set, the process of delayed gratification is a superpower in the modern world.

The most important thing to teach your kids about money is that you can’t have everything you want.

Something to Think About

If you could only pick one 'responsibility' to hand over to your 10-year-old right now, what would it be?

There is no right answer here. Some families choose social spending, others choose digital gaming costs. Reflect on your own family values and where your child is most ready to take the lead.

Questions About Earning & Pocket Money

Should pocket money be tied to chores?

What if my 10-year-old spends all their money at once?

How do I handle it if my child's friends get much more pocket money?

Ready for the next step?

Setting up pocket money for your 10-year-old is just the beginning of their journey. Once you have decided on an amount and frequency, you might want to dive deeper into the mechanics of their first plan. Check out our guide on pocket-money-by-age to see how things will change as they grow, or explore budgeting-basics to help them set up their first simple spreadsheet or savings jar system.