Your 5-year-old hands the shopkeeper a £1 coin and gets a chocolate bar back. They don't understand change yet, but they just learned something huge: money is exchanged for things.

At age five, children are entering a peak window for financial literacy. They are moving from imaginative play to understanding real-world exchange and value. This is the perfect time to introduce a small, consistent amount of pocket money to help them practice basic counting and decision making.

Is 5 Too Young for Pocket Money?

Many parents wonder if five is the right age to start. Research suggests that by age seven, many of our permanent money habits are already formed. Starting at five gives your child a two-year head start to practice with 'training wheels' money before the stakes get higher.

At this age, children are usually learning to count to 10 or 20 in school. They can begin to recognize the difference between a copper coin and a silver one. Pocket money turns these abstract numbers into a tangible tool they can use to make choices.

A study by the University of Cambridge found that by age 7, most children have already grasped fundamental money concepts, such as the fact that money can be exchanged for goods and that you can't always have everything you want immediately.

How Much Pocket Money Should a 5-Year-Old Get?

Consistency is much more important than the specific amount. For most families in the UK, a range of £1 to £2 per week is the sweet spot. This amount is small enough that a 'bad' spending choice isn't a disaster, but large enough that they can actually buy something small after a week or two of saving.

Some parents choose to link the amount to the child's age: £1 for a 5-year-old, £2 for a 6-year-old, and so on. This makes the 'raise' predictable and something to look forward to on their birthday. You can read more about how these amounts evolve in our guide to [pocket-money-by-age].

The best time to start teaching kids about money is when they're five or six.

Mira says:

"I remember my daughter's first £1. She tried to buy a giant Lego set with it! It was the perfect moment to explain that different things have different price tags."

What a 5-Year-Old Brain Understands

To a five-year-old, a giant 2p coin might look more valuable than a tiny 5p coin because it is bigger. Their understanding of value is still developing. This is why using physical cash is essential at this age.

- They understand counting: They can count out five £1 coins to buy a £5 toy.

- They understand possession: They know that once the money is gone, the toy is theirs, but the money belongs to the shop.

- They understand waiting: They can grasp the idea of 'not today, but maybe next week' if they save up.

At age 5, 'Money Math' is all about recognition. Help them find different ways to make £1: - Two 50p coins - Five 20p coins - Ten 10p coins Sorting these on the table makes the math visual and fun!

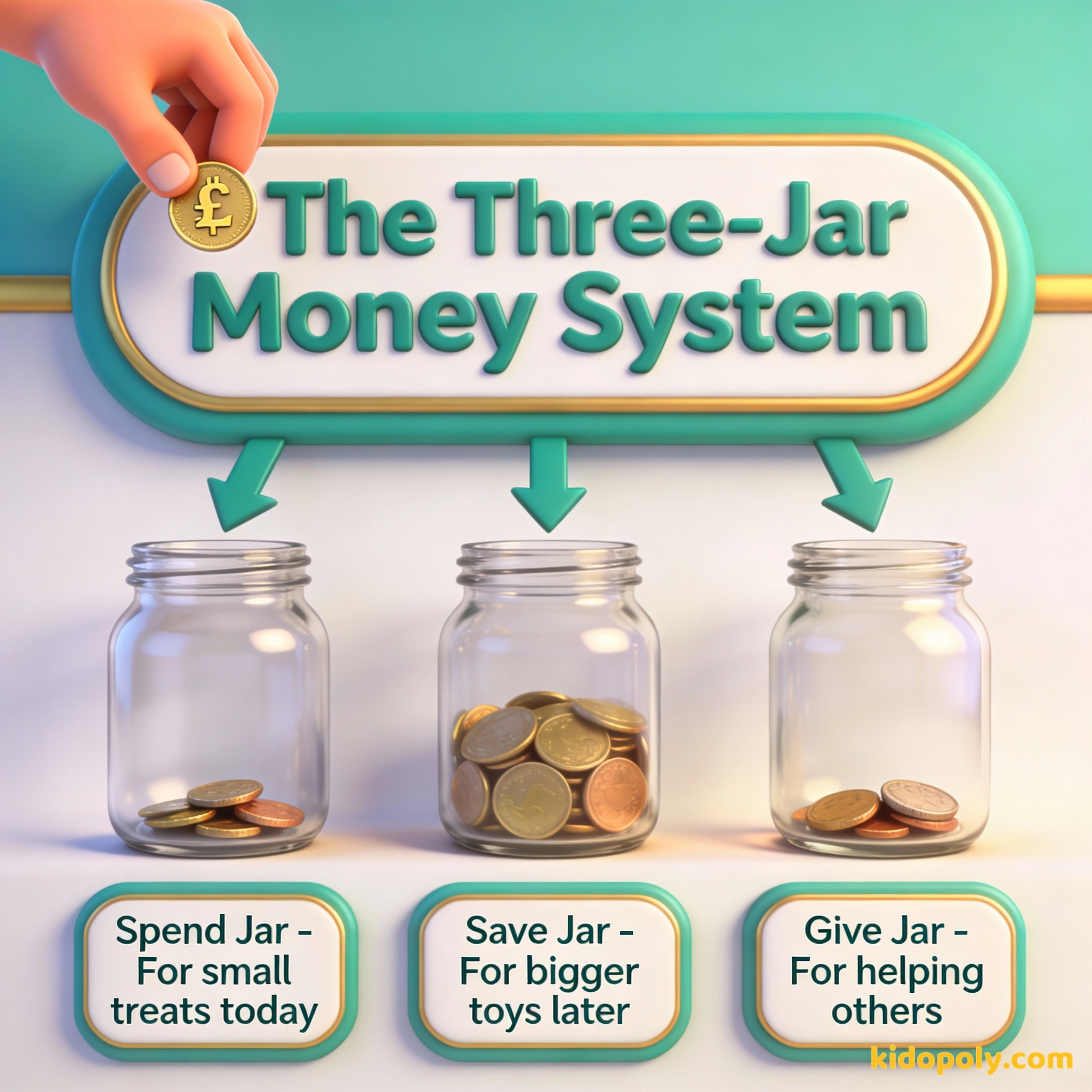

The Three-Jar System

When you start giving pocket money, don't just hand it over to be lost in a toy box. Use the Three-Jar System to teach the three main things we do with money: Spend, Save, and Give.

Using clear jars is a deliberate choice. It allows your child to physically see the 'Save' pile getting taller. This visual progress is a powerful motivator for a child who doesn't yet have a strong sense of the future. It turns saving from a boring concept into a visual game.

Finn says:

"If I put my money in the 'Save' jar, can I still see it? I think I'd like to count it every single morning to make sure it's still growing!"

Physical Cash vs. Digital Money

While we live in an increasingly cashless society, five is too young for digital banking apps. A 5-year-old needs the tactile experience of feeling the weight of the coins and hearing them clink in a jar. Digital numbers on a screen are too abstract for a brain that is still learning that 5 is more than 3.

Letting them hold the money as you walk into a shop builds a sense of responsibility. If they drop it, it's a lesson. If they hand it to the cashier, it's an achievement. These physical interactions are the building blocks of financial confidence.

An investment in knowledge pays the best interest.

First Shopping Experiences

One of the best ways to use pocket money is the 'first solo purchase.' While you are standing right there, let your child handle the entire transaction. This is about more than just buying a sticker pack: it is a lesson in social interaction and basic exchange.

The Coin Sort: Put a bowl of mixed coins on the table. Ask your child to group them by color (copper, silver, gold) or by size. This simple game is the first step in recognizing currency before they even start counting values.

Imagine your child wants a toy that costs £5. They have £2 in their jar. Instead of saying 'no,' you can say, 'You have two pounds, so you need three more pounds. That will take three more Saturdays.' You've just turned a 'no' into a goal.

Age-Appropriate 'Earning'

At five, 'work' should feel like helping the family team. While you may choose not to pay for basic chores like clearing their own plate, you could offer small amounts for 'extra' jobs. This introduces the concept that earning is the result of effort.

Keep these tasks short, as a five-year-old's attention span is limited. Think of things like matching all the socks in the laundry basket or helping to pull weeds in a small patch of the garden. If you want to dive deeper into the debate on whether to pay for chores, check out our article on [pocket-money-and-chores].

Mira says:

"We use a 'helping hand' chart. It's less about a job and more about seeing how our family works together to keep the house happy."

Starting the Journey

Starting pocket money at five is not about the money itself. It is about the conversations you have while counting coins on the living room floor. You are teaching them that they have agency and that their choices have consequences.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make.

Something to Think About

What was the first thing you ever bought with your own pocket money?

Sharing your own early money memories with your child helps them see that everyone starts somewhere. There are no wrong answers, just stories that help them learn.

Questions About Earning & Pocket Money

Should I take pocket money away as a punishment?

What if my child loses their pocket money?

When should I move from a weekly to a monthly schedule?

Your Child's Financial Foundation

Starting pocket money at age five isn't about the coins; it's about the confidence. By giving them a small amount of control now, you're preventing a lot of confusion later. If you're ready to see how this journey continues as they grow, take a look at our next guide for when they turn six.