Your child refuses to tidy their room unless they get paid. Your sister's kids do chores happily for free. Who got it right?

The answer might not be what you expect, and the research has some surprises. Deciding how to handle pocket money and chores is one of the first major financial literacy hurdles parents face.

It is a scene played out in millions of homes every weekend. A parent asks a child to empty the dishwasher, and the child immediately asks, "How much will you pay me?"

This simple interaction touches on deep questions about family, work, and the value of money. Some experts argue that tying pay to work is the only way to teach a work ethic. Others believe that using money as a carrot actually ruins a child's natural desire to help out.

According to various national surveys, approximately 75% of parents in the UK and US give their children some form of pocket money, but they are split nearly 50/50 on whether it should be earned through chores.

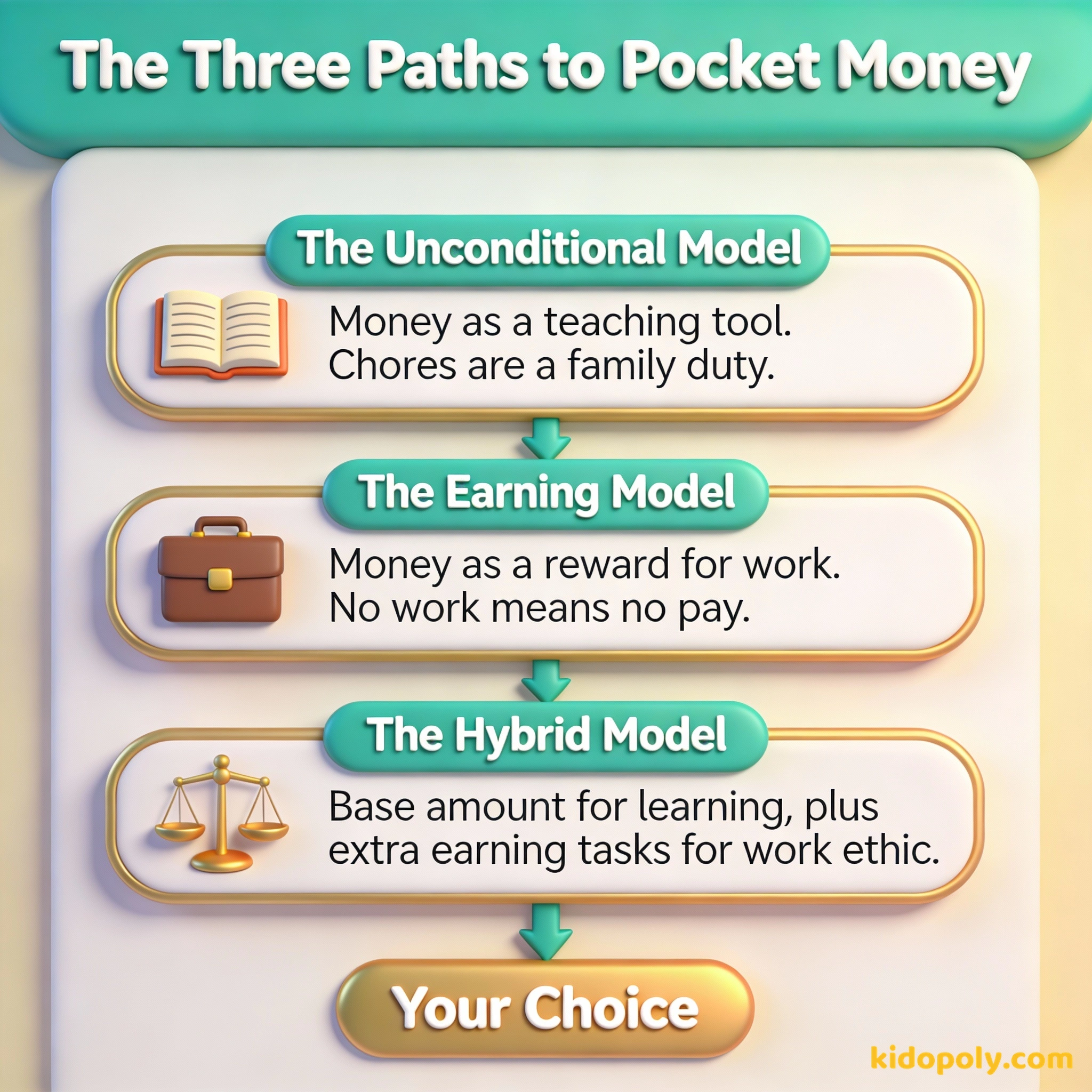

The Unconditional Model: Money as a Training Tool

In this model, you provide pocket money regardless of whether your child helps with the laundry. The philosophy is that pocket money is a tool for learning, much like a textbook is a tool for school.

Advocates of this approach, like financial expert Beth Kobliner, suggest that if money is a training tool, you should not take it away for bad behavior or skipped chores. If you do, the child loses the opportunity to practice budgeting and saving.

An allowance is a teaching tool, not a reward for good behavior or a payment for chores.

When money is unconditional, chores are framed as a "contribution" to the household. You do them because you are part of a family, not because you are an employee. This separates the act of helping from the act of earning.

- It ensures consistent practice with money management.

- It prevents chores from becoming optional (i.e., "I don't need money this week, so I'm not cleaning").

- it emphasizes family cooperation over transaction.

Mira says:

"It's like our family is a little team. We all help out because we live here, but the money part is for learning how to be smart with our cash."

The Earning Model: The Commission Approach

On the other side of the debate is the belief that money should only be given when it is earned. This is often called the "commission" model. It mirrors the real world: if you do not show up for your job, you do not get a paycheck.

Proponents argue that this model builds a strong connection between effort and reward. It teaches children that wealth is something you create through service and labor.

Teaches that money is a direct result of effort and work ethic. Prepares them for the 'real world' of employment.

Can make chores feel optional and may decrease the child's natural desire to help for the sake of the family.

However, child psychologists often point to a risk called the "overjustification effect." This happens when an intrinsic motivation (helping because it's the right thing to do) is replaced by an extrinsic motivator (money).

I don't give my kids an allowance. I give them a commission. They work, they get paid. They don't work, they don't get paid.

If the money stops, the child might stop helping altogether. They may start to view every household task as a negotiation, asking "What's in it for me?" before lifting a finger.

The Hybrid Model: The Best of Both Worlds?

Many modern financial educators suggest a middle ground. In the hybrid model, a child receives a small base amount of pocket money for the purpose of learning to manage funds.

On top of this, parents offer "extra earning opportunities" for tasks that go above and beyond daily expectations. This allows the child to experience both the security of a budget and the excitement of earning.

- Base pay: For learning to save, spend, and give.

- Extra tasks: For learning the value of hard work.

- Family chores: Expected tasks that remain unpaid (like cleaning their own room).

Consider this balance: - Base Training Amount: £5.00 (Guaranteed) - Extra Earning Task: £2.00 (Optional) Total potential: £7.00 This gives the child a 'floor' for budgeting while leaving room for 'growth' through effort.

What Does the Research Say?

Studies on pocket money and chores show mixed results, which is why there is no single "correct" answer. Some research suggests that kids who receive unconditional pocket money are actually better at financial planning later in life.

Finn says:

"If I don't do my chores one week, does that mean I'm just broke for the weekend? That makes it hard to plan for the LEGO set I want!"

Conversely, other studies indicate that kids who earn money through work develop a higher sense of self-efficacy, or the belief that they can influence their own future. The key seems to be the conversation around the money, rather than the model itself.

Hold a 'Family Money Meeting.' Instead of dictating a model, ask your child how they think it should work. You might be surprised by their sense of fairness!

Age and Developmental Stages

How a child responds to these models often depends on their age. A five-year-old might not understand the logic of a complex hybrid system, whereas a teenager will likely appreciate the chance to earn more for bigger goals.

- Early Years (5-8): Keep it simple. A small, consistent amount helps them understand the physical nature of coins and notes.

- Middle Years (9-12): This is a great time to introduce the hybrid model as they begin to want more expensive items.

- Teens (13+): They can handle more complex "contracts" and higher-stakes earning opportunities.

The primary purpose of an allowance is to provide a tool for practicing, which means it shouldn't be tied to chores.

Finn says:

"What if I do my chores really well? Can I get a bonus like a real job? That would help me reach my savings goal way faster."

Making the Decision for Your Family

Ultimately, your choice should reflect your family's personal values. There is no evidence that one way is "morally" superior to the others.

If you value family contribution above all, the unconditional model might be your fit. If you want to emphasize the labor market, the commission model is strong. If you want a balance, the hybrid model is a flexible choice.

Imagine your child sees a new toy they want. In a chore-linked house, they might ask for extra work to get it faster. In an unconditional house, they would have to plan their savings over several weeks. Both teach valuable, but different, lessons.

Something to Think About

If you stopped paying for chores tomorrow, would your child still help out around the house?

Think about whether your current system encourages your child to be a 'helper' or an 'employee.' There is no wrong answer, only what works for your family's unique dynamics.

Questions About Earning & Pocket Money

What is the most common age to start pocket money?

Will paying for chores make my child greedy?

What happens if my child refuses to do chores even with payment?

Your Next Step

Now that you understand the different models, why not try one for a month? Remember, you can always change your mind as your child grows. The most important thing is that they are learning to handle money under your guidance.