Have you ever wondered if you are giving too much or too little pocket money compared to other parents?

Understanding pocket money by age is less about matching the national average and more about matching your child's developmental milestones. By tailoring the amount to their ability to understand delayed gratification and financial responsibility, you turn a weekly handout into a powerful teaching tool.

A 7-year-old who gets £5 a week but spends it all on sweets in one go isn't being greedy: they literally haven't developed the brain wiring for delayed gratification yet. Knowing what's normal at each age changes everything about how you approach this weekly ritual.

I think the biggest mistake is that parents sometimes wait until their kids are in their teens before they start talking about managing money.

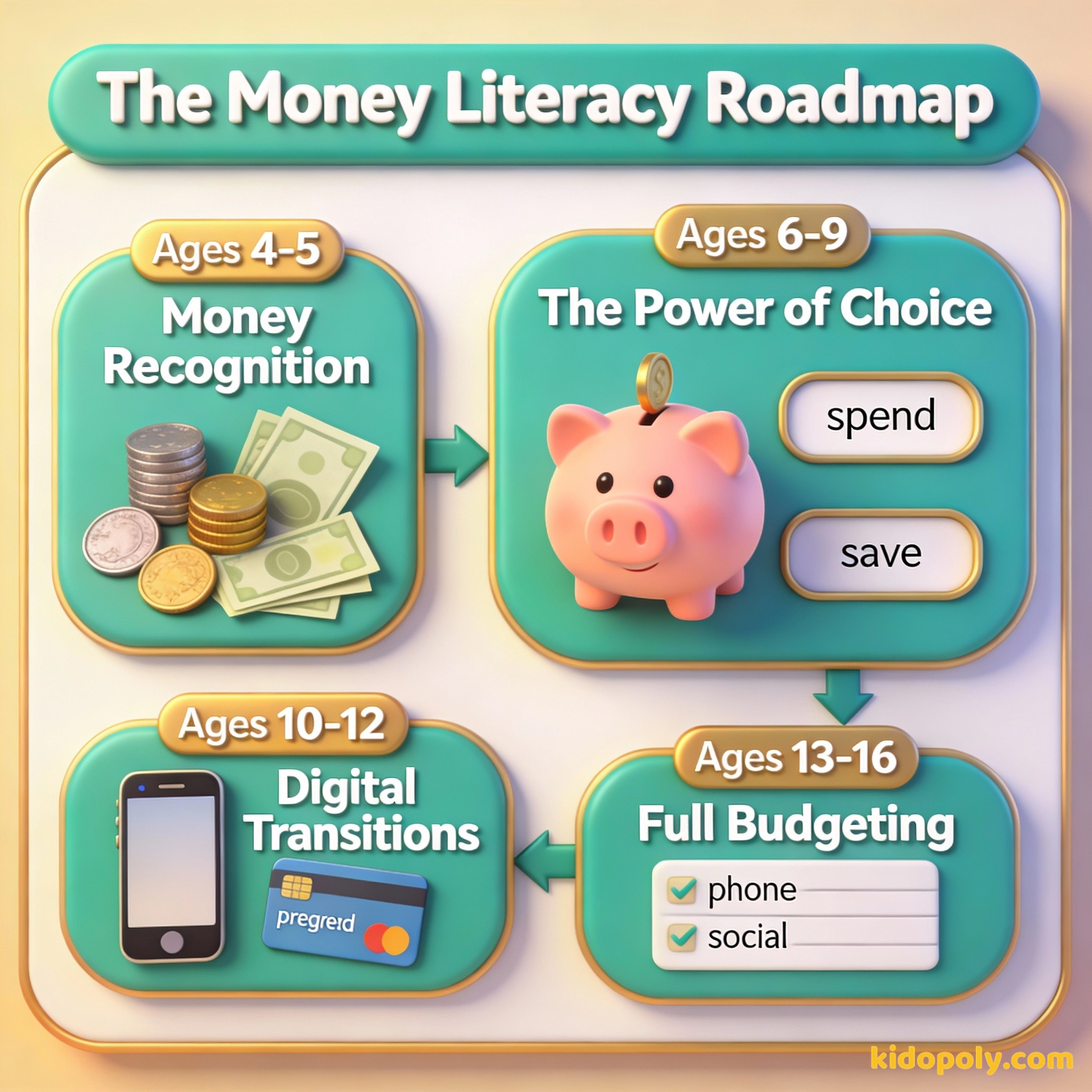

The Preschool Foundation: Ages 4 to 5

At this age, money is largely a physical concept. Children are beginning to understand that those shiny discs in your wallet are exchanged for things they want at the shop. While they cannot yet calculate change, they can grasp the idea of a trade.

Most parents start with a symbolic amount, often between £1 and £2 per week. The goal isn't for them to buy their own clothes, but to practice the physical act of handling coins and understanding that once the money is gone, it's gone.

Imagine you are at a market. You have five shiny gold coins. You can buy one big, juicy apple today, or you can wait until tomorrow when the farmer brings in the giant strawberries you love. This is the first step in learning that money is about choices.

- Key Skill: Identifying different coins and notes.

- Responsibility: Keeping their money in a safe place, like a piggy bank.

- Parent Tip: Use clear jars so they can see the physical pile of coins grow over time.

Finn says:

"If I only get £2, but the toy I want is £10, does that mean I have to wait five whole weeks? That feels like forever!"

The Primary Leap: Ages 6 to 9

This is the stage where the concept of saving becomes real. Around age 7, children start to understand that if they don't spend their money today, they can buy something bigger next week. Survey data from the UK suggests the average for this group ranges from £3 to £5 weekly.

At this stage, you might notice your child becomes more opinionated about what they want to buy. This is a perfect time to introduce the "Three Jar" system: one for spending, one for saving, and one for giving. It helps them visualize resource allocation without using complex terms.

- Key Skill: Simple addition and subtraction of money.

- Responsibility: Choosing one small thing to save for over a month.

- Parent Tip: If they run out of money mid-week, resist the urge to top them up. The 'lesson of the empty wallet' is most effective now.

The '10% Rule' is a great way to start simple budgeting. If your child receives £5.00: - £0.50 goes to the 'Give' jar - £1.50 goes to the 'Save' jar - £3.00 is for 'Spend' today This teaches them that not all money is for spending immediately.

The Pre-Teen Shift: Ages 10 to 12

As children approach secondary school, their social world expands. They may start going to the cinema with friends or buying snacks after school. This is often when parents transition from cash to digital money using prepaid cards or apps.

Teach your children to save: it is the most important lesson you can give them.

UK averages for this age group typically sit between £7 and £10 per week. However, this often includes specific responsibilities. They are no longer just buying toys: they might be responsible for their own gaming subscriptions or hobby supplies.

- Key Skill: Understanding digital balances and checking 'statements'.

- Responsibility: Managing a balance that lasts a full week or even a month.

- Parent Tip: Discuss the difference between a want (a new skin in a video game) and a need (credit for their phone).

Mira says:

"I noticed that when I started using a card instead of cash, it was way easier to forget how much I'd spent. I had to start checking the app every day."

The Teen Years: Ages 13 to 16

Pocket money for teenagers often looks more like a monthly allowance. By age 14, many UK teens receive between £15 and £30 per month. Some families choose to give more but require the teen to pay for their own clothes, bus fare, or phone bill.

According to the NatWest RoosterMoney Index, the average pocket money for a 10-year-old in the UK is approximately £5.36 per week, while 14-year-olds average around £10.42. However, these figures have been rising steadily to keep up with the cost of living.

This shift is crucial for teaching budgeting. When a teenager has to choose between a new pair of trainers and going out for pizza, they are practicing real-world adult trade-offs. It is much safer for them to fail at budgeting with £20 now than with a full salary later.

- Key Skill: Comparison shopping and looking for value.

- Responsibility: Covering at least one consistent monthly expense.

- Parent Tip: Treat the allowance like a 'salary' paid on a fixed date to encourage long-term planning.

The 'Wait-and-See' Challenge: If your teen wants a non-essential item over £20, ask them to wait 48 hours before buying it. If they still want it after two days, they can go ahead. You'll be surprised how many 'must-haves' lose their appeal after 48 hours.

Adjusting for Your Family and Region

While averages are helpful, they don't tell the whole story. Regional variations in the UK can be significant, with parents in London often giving more to account for higher transport and activity costs. Your own family's financial values matter most.

If you want to be rich, you need to be financially literate.

If you are unsure where to start, you can find a more detailed breakdown in our [pocket-money-how-much] guide. The most important thing is to be consistent. Whether you give £2 or £20, the habit of managing a limited resource is the real gift you are giving your child.

Finn says:

"So, once I'm 16, do I get to manage all my own money for clothes and stuff? That sounds like a lot of pressure, but also pretty cool."

Cash is tactile and makes the loss of money feel 'real' when you hand it over. It's excellent for younger children learning basic math.

Digital apps allow for automatic saving, easy tracking, and better security for older kids who are out and about.

When transitioning between age bands, have a conversation. Explain why the amount is increasing and what new responsibility comes with it. This keeps the focus on growth rather than just 'getting more stuff'. You can even use a [pocket-money-chart] to track these milestones together.

Something to Think About

What is one thing you wish you had known about money when you were your child's age?

There are no right or wrong answers here. Sharing your own 'money mistakes' or lessons with your child can be more educational than any textbook. It shows them that financial literacy is a lifelong journey.

Questions About Earning & Pocket Money

At what age should I start giving pocket money?

Should I give pocket money weekly or monthly?

What if I can't afford the 'average' amount for my child's age?

Ready to Start the Journey?

Now that you have a framework for how much to give, the next step is deciding when the time is right for your specific family. You might want to explore our guide on [when-to-start-pocket-money] to see if your child is showing the signs of being ready for their first 'payday'.