Imagine a chart on the kitchen fridge where your child can colour in each pound saved toward a £20 Lego set.

This simple act teaches more about money than any lecture ever could. A pocket money chart is more than just a record of chores: it is a visual financial literacy tool that helps your child master delayed gratification and money management from a young age.

A piece of paper on the fridge might seem old-fashioned in our digital world. However, for a child whose brain is still developing concrete logic, seeing a physical record of their money is transformative. It turns abstract numbers into a tangible reward.

Studies in neurobiology show that children's brains respond more strongly to physical rewards. The 'win' of placing a sticker on a chart releases more dopamine than seeing a number change on a screen.

Why Use a Pocket Money Chart?

Tracking money helps children understand that it is a finite resource. When money is just a number you mention, it feels like an endless supply. When it is a row of stickers or a coloured-in bar on a pocket money tracking sheet, they see it grow and shrink.

Mira says:

"Our chart is right next to the shopping list. It reminds us that money is part of our everyday family life, not a secret topic!"

Using a chart also helps avoid the weekly 'Did I get paid?' debate. It provides a clear, objective record that both you and your child can trust. This transparency builds financial confidence and reduces friction around money conversations.

Do not save what is left after spending, but spend what is left after saving.

Chart Types for Different Goals

Not every family uses pocket money the same way. You should choose a chart type that matches your current teaching goals. Some parents prefer to keep it simple, while others want to mirror real-world banking.

- Simple Tracker: A basic list of dates and amounts to record when money was given.

- Savings Goal Chart: A visual progress bar (like a thermometer) where the child colours in sections as they get closer to a specific purchase.

- Earn-and-Spend Ledger: A two-column sheet for 'Money In' and 'Money Out' to teach basic bookkeeping.

- Chore-Linked Chart: A grid where specific tasks are marked off to calculate the total earned at the end of the week.

Age-Appropriate Chart Designs

Your child's ability to process financial information changes as they grow. A chart that works for a five-year-old will likely bore a ten-year-old. Matching the design to their developmental stage is key to keeping them engaged.

Ages 4 to 6: The Visual Starter

At this age, children need high-visual, low-text charts. Use a pocket money reward chart that uses stickers or stamps. Instead of writing numbers, they might draw a picture of the coin they received.

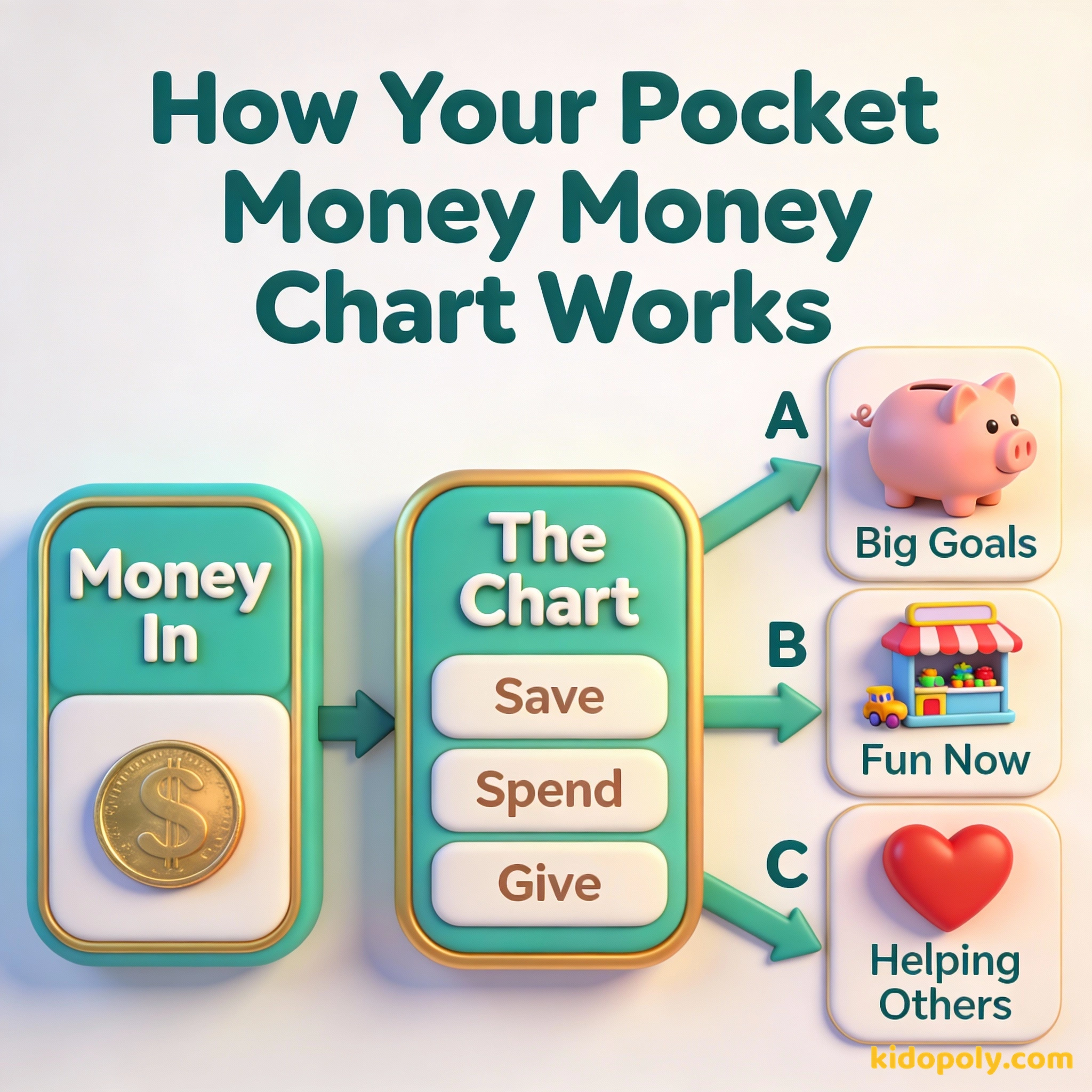

For younger kids, use the 'Three Jar System' alongside your chart. Label three jars: Save, Spend, and Give. Every time they earn money, they mark it on the chart and then physically drop the coins into the corresponding jars.

Ages 7 to 9: The Logic Builder

By age seven, children understand basic addition and subtraction. You can move to a chart with simple columns. They can start tracking their balance: how much they had, how much they spent, and what is left.

Finn says:

"If I colour in the chart but don't have the actual coins yet, does that mean the paper is like a bank statement?"

Ages 10 and Up: The Mini-Accountant

Older children are ready for more complexity. Their pocket money tracker might include categories like 'Save', 'Spend', and 'Give'. This is the perfect time to introduce the concept of a budget or even a digital spreadsheet if they are tech-savvy.

An investment in knowledge pays the best interest.

How to Use a Chart as a Teaching Tool

A chart is only as good as the conversation it sparks. Rather than just checking off boxes, use the chart as a weekly touchpoint. Sit down together for five minutes on 'payday' to review the progress.

Imagine your child wants a toy that costs £10. Instead of saying 'no', you point to the chart. They see they have £6. They can visually see they need £4 more. This shifts the conversation from your permission to their progress.

- Review the 'Why': Ask your child why they chose to spend or save certain amounts this week.

- Celebrate Milestones: If they reach a halfway point on their savings goal, acknowledge the effort it took to get there.

- Correct Mistakes Kindly: If the chart shows they spent all their money on day one, discuss how that felt when they wanted something else on day six.

Help your child calculate their progress. If the goal is £20 and they have £5: £5 / £20 = 0.25 0.25 x 100 = 25% They can colour in exactly one-quarter of their progress bar!

Digital vs. Paper Tracking

While we love the tactile nature of a printable pocket money chart, there comes a time to transition. Paper is excellent for building the initial mental models of money. However, as your child starts spending in a digital world, their tracking might need to move too.

Mira says:

"I like the paper chart because I can see my progress every time I go to get a snack. It keeps me from spending my 'Lego fund' on sweets!"

Did you know? Research suggests that people who physically write down their goals and track them are significantly more likely to achieve them than those who keep them only in their heads.

You might start with a paper chart on the fridge and move to a shared digital document or a dedicated app as they enter their teens. This path mirrors how they will eventually manage their adult finances.

Look at money not as a piece of paper, but as a tool.

Making the Move to Apps

When your child is consistently managing their paper chart without reminders, they might be ready for a digital upgrade. This usually happens around age 10 to 12. At this stage, the chart becomes a bridge to more advanced topics like interest and online security.

Paper charts provide a constant visual reminder on the fridge and are better for building initial habits in young children.

Digital trackers are more convenient for older kids who spend money online and allow for automatic calculations and history.

Something to Think About

If your family could only track one thing on your chart, would it be how much you save or how much you give?

There is no right answer here. This is a great way to talk about what your family values most: achieving personal goals or supporting your community.

Questions About Earning & Pocket Money

What should a pocket money chart include?

How do I make a pocket money reward chart?

What's the best way to visually track chores and earnings?

Start Your First Chart Today

A pocket money chart is a low-cost, high-impact way to start your child's financial education. Whether you use a simple piece of paper or a detailed ledger, the key is consistency. For more guidance on setting the right amounts for those charts, explore our guides on [pocket-money-how-much] and [pocket-money-by-age].