Your 16-year-old earns £50 a week at their weekend job but still expects £10 pocket money. Your 14-year-old spends their entire monthly budget in the first week. Welcome to the teen money years: here is how to navigate them.

Teenage pocket money is no longer just about buying sweets or small toys. It is a vital training ground for financial independence and learning how to manage discretionary spending before leaving home.

The transition from childhood to young adulthood happens quickly, and money is often the biggest point of friction. During these years, you are moving away from being a walking ATM and toward being a financial mentor.

This guide explores how to scale pocket money, when to shift the responsibility of buying essentials, and how to eventually phase out handouts altogether. It is about building a bridge between 'asking for a fiver' and managing a salary.

How Much Pocket Money is Right?

There is no legal minimum or maximum, but looking at national averages can give you a baseline. In the UK, pocket money tends to jump significantly as children enter secondary school and begin socializing more independently.

According to the 2023 NatWest RoosterMoney index, the average pocket money for a 14-year-old in the UK is approximately £11.84 per week. This usually covers small luxuries and social activities.

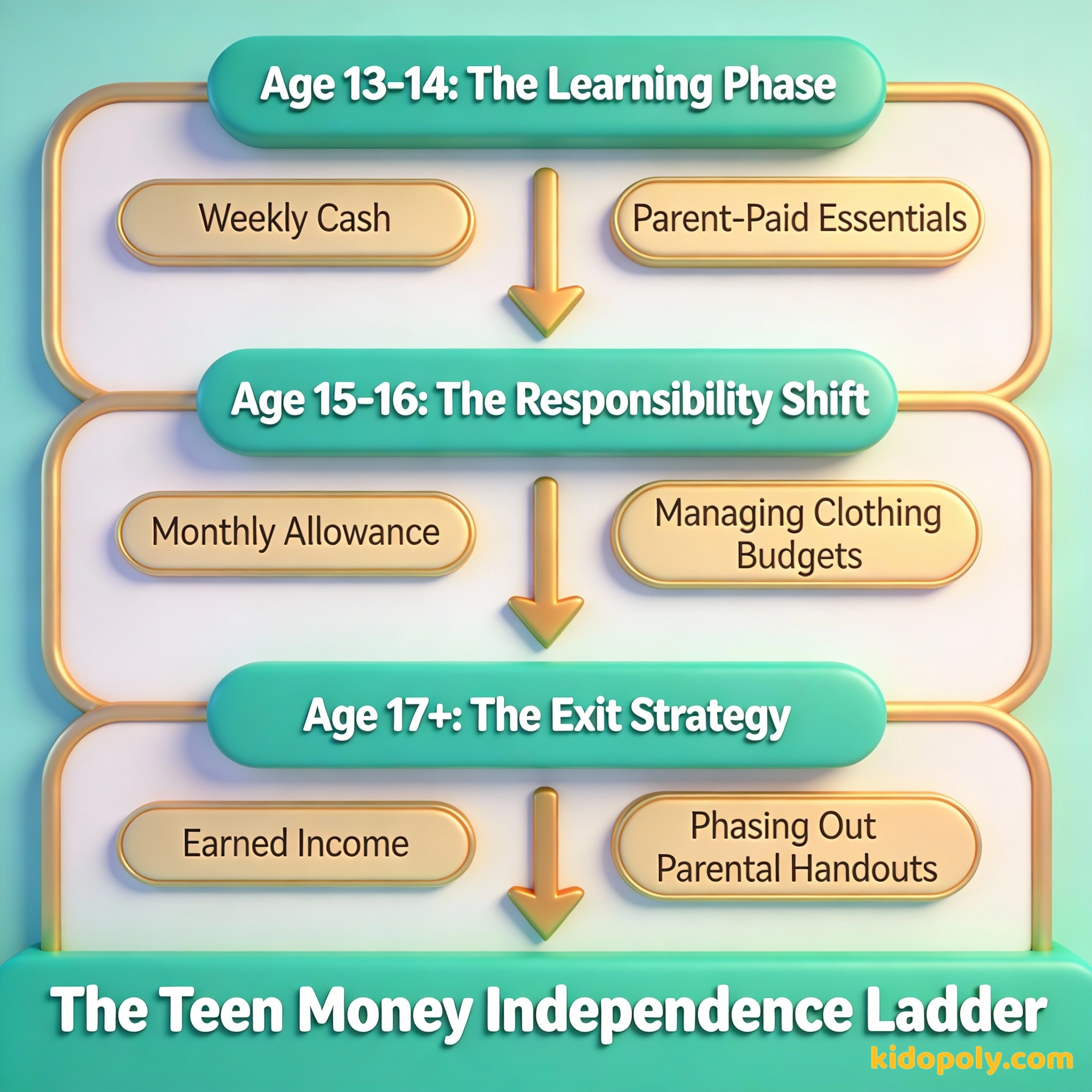

At age 13-14, many families land on £7 to £12 per week. By age 15-16, this often increases to £15 to £25 per week, or is converted into a monthly sum of £60 to £100. This increase usually reflects the teen taking on more costs, like their own cinema tickets or snacks with friends.

Do not save what is left after spending, but spend what is left after saving.

The Shift to a Monthly Allowance

One of the best moves you can make is switching from a weekly payout to a monthly allowance. Most adults get paid once a month, and learning to make money last 30 days is a skill that many struggle with well into their twenties.

Finn says:

"If I get all my money on the first of the month and spend it on a new game, does that mean I can't go to the cinema with my friends on the 20th?"

Start this around age 14 or 15. It gives them the freedom to make a big purchase early in the month, but teaches the hard lesson of 'running out' if they aren't careful. If the money is gone by day ten, resist the urge to top them up.

The 'Budget Handover': Sit down with your teen and list every regular expense you pay for them (Netflix share, phone, bus pass). Pick one and transfer the exact cost to them to manage. If they pay it on time for three months, move on to the next one.

The Clothing Budget Experiment

This is a classic step toward independence. Instead of you choosing and paying for every item of clothing, give your teenager a dedicated clothing budget twice a year.

The Clothing Experiment: Budget: £200 for 6 months Needed Items: - Winter Coat: £60 - New Shoes: £50 - Total Needs: £110 - Remaining for 'Wants': £90 If the teen buys designer jeans for £120, they are £30 short for their needs!

This amount should cover things they 'need' like jeans and shoes, as well as things they 'want'. If they spend the whole budget on one pair of designer trainers, they might have to wear their old coat through the winter. This is a safe environment to experience the opportunity cost of their choices.

When They Start Earning Their Own Money

When a teenager gets a part-time job, the pocket money conversation changes. It is a common dilemma: do you keep paying them if they are already earning? There is no right or wrong answer, but a 'tapering' approach often works best.

Mira says:

"In our house, when I started my Saturday job, my parents let me keep my pocket money as long as I put half of my wages into my long-term savings account."

Some parents choose to continue pocket money but require the teen to save 50% of their job earnings. Others reduce the pocket money by £1 for every £2 the teen earns. This keeps the incentive to work high while acknowledging their growing earning capacity.

The goal of a parent is to raise a child who can handle their own life.

The Pocket Money Exit Strategy

Pocket money should have an expiration date. The goal is for your child to be fully independent by the time they start a full-time career or finish university.

The parent provides a fixed amount regardless of what the teen does. This teaches how to manage a predictable income like a salary.

The teen earns money through specific tasks or jobs. This teaches the direct link between effort and reward.

- Year 11 (Age 16): Pocket money is fixed and covers all social lives and non-essential clothes.

- Year 12/13 (Age 17-18): Pocket money stays the same, but they take over paying for their own mobile phone contract or fuel.

- Post-School: Pocket money stops, replaced by support for specific needs (like rent) only if they are in full-time education.

Finn says:

"So the goal isn't just to get more money, it's to learn how to not need to ask for it anymore?"

Financial Tools for the Teen Years

Gone are the days of a dusty piggy bank. Teens need digital tools to track their spending. Many UK banks offer teen accounts with debit cards and apps that show real-time spending notifications.

Imagine a 19-year-old at university who has never had to pay a bill or decide between a pizza and a bus ticket. By giving your teen control now, you are making sure they aren't that person later.

Using these tools allows you to see where the money is going without hovering over their shoulder. It also introduces them to automated savings, where a small amount moves to a separate pot every time they spend.

I believe that through knowledge and discipline, financial peace is possible for all of us.

Transitioning from pocket money to independence is not a single event, but a series of small handovers. By the time they leave your roof, money should no longer be a mystery to them, but a tool they know exactly how to use.

Something to Think About

What is one 'essential' item you are ready to let your teenager be responsible for paying for?

There is no right answer here. It depends on your family's values and your teenager's maturity level. Think about what would give them the best learning experience.

Questions About Earning & Pocket Money

Should I stop pocket money if they get a part-time job?

What happens if they spend their whole monthly allowance in one day?

Should pocket money be tied to chores?

Ready for the Next Level?

Teaching your teen to manage their money is the final stage of the pocket money journey. Once they have a handle on their allowance, you might want to look at our guide on first-job or explore more advanced budgeting-for-teens strategies.