Your 4-year-old thinks a shiny big coin is worth more than a small one, while your neighbor's child is already saving for a toy. Same age, totally different readiness.

Starting pocket money is a major milestone in financial literacy, but the right time depends on developmental signs rather than just a birthday. This guide helps you identify when your child is truly ready to handle their own currency.

Most parents begin the journey into pocket money when their child is between 4 and 7 years old. It is during these years that the concept of exchange starts to make sense. At age 4, a child might see you hand over a card at a shop and think the card itself is magic. By age 7, they usually realize that the card represents a specific amount of spending power.

The most important thing to do is start early. Teaching your kids about money is just as important as teaching them their ABCs.

Research suggests that many of our core financial habits are actually formed by the age of seven. A landmark study from the University of Cambridge found that by this age, children can grasp basic economic concepts and exhibit self-control. This doesn't mean you must start on their seventh birthday, but it highlights how early their little brains begin processing how the world works.

A major study by Cambridge University researchers found that children's money habits are mostly formed by age 7. This is when they begin to understand that money can be exchanged for goods and that some choices mean giving up other things.

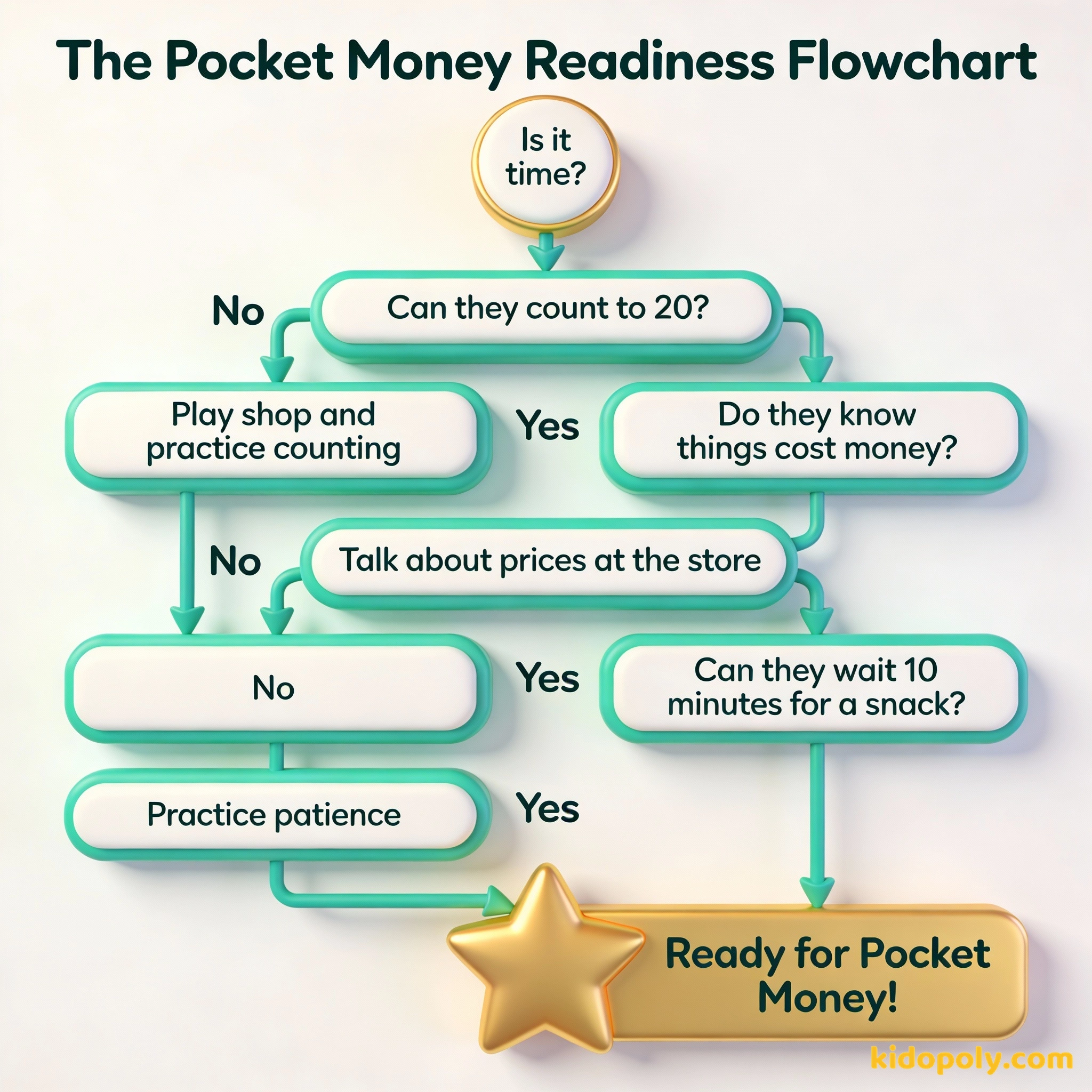

The Three Pillars of Readiness

Before you commit to a weekly schedule, look for three specific signs in your child's daily life. The first is numerical literacy. They don't need to be math geniuses, but they should be able to count past twenty and understand that 'more' is better when it's something they like. If they don't understand that two coins are usually better than one, they might struggle with the concept of an allowance.

Finn says:

"Wait, so if I get one coin every Saturday, but the dinosaur toy costs five coins, I have to wait five whole weeks? That feels like forever!"

The second pillar is an understanding of exchange. Watch how they play. If they play 'shop' and understand that they have to give you a plastic orange in exchange for a play-coin, they are getting close. They are learning that you cannot simply have everything you want: you must trade something of value for it.

Imagine you are at the zoo. Your child sees a toy penguin and screams, 'I want it!' If they don't have pocket money, the conversation is just 'Yes' or 'No.' If they have pocket money, the conversation becomes: 'You have £10 in your jar. That penguin costs £12. How can we make that work?' It shifts them from demanding to problem-solving.

Finally, look for signs of delayed gratification. This is the hardest part for many children (and some adults). If your child can wait ten minutes for a promised treat or understands that they can have one cookie now or two cookies after dinner, they have the emotional maturity to save. Pocket money is, after all, a lesson in waiting for what you really want.

The Pocket Money Readiness Checklist

If you are still on the fence, run through this quick checklist. If you can tick off at least four of these, your child is likely ready for their first small amount of financial independence:

- They have stopped trying to eat or hide random coins they find.

- They show interest when you pay for things at the grocery store.

- They understand that when money is gone, it's really gone.

- They can identify the difference between a coin and a button.

- They have expressed a desire to buy something specific, like a toy or a sticker.

- They can follow simple instructions with 2 or 3 steps.

Mira says:

"It's like when we trade stickers at school. If I give away my best sparkle sticker today, I don't have it tomorrow. Money is just a different way of trading."

Starting the First Conversation

When you decide the time is right, the way you introduce the concept is vital. Sit down at a quiet moment and explain that they are now old enough to have a little bit of their own money. Frame it as a responsibility rather than a gift. This is their tool for learning how to make choices, not just a bonus for being cute.

A strict schedule (e.g., every Saturday morning) helps kids learn to predict their income and plan their spending over a full week.

A flexible approach allows for 'bonus' moments, but it can make it harder for children to understand the concept of a budget.

You might say, "We are going to start giving you pocket money every Saturday. This money is yours to look after. You can spend it now, or you can keep it to buy something bigger later." Keep the language simple and the expectations clear. At this stage, the consistency of the delivery is more important than the logic behind the amount. If you want to dive deeper into how much to give, you can check our guide on pocket-money-how-much.

Allowance is a teaching tool, not a reward. You don't pay your kids for being part of the family, you give them money so they can learn how to handle it.

Cultural Differences in Starting Ages

It is worth noting that 'when' to start varies wildly across the globe. In some cultures, children are given small amounts of cash to run errands for the family as soon as they can walk to the local corner store. In others, money is considered a 'grown-up' topic that isn't discussed until the teenage years.

The Power of One Pound: If your child saves £1 every week: In 1 month: £4 (A comic book) In 3 months: £12 (A small LEGO set) In 6 months: £26 (A video game) Seeing the math helps them understand why waiting is worth it.

There is no 'wrong' cultural approach, but modern financial education experts generally lean toward an earlier start. The logic is simple: it is better for a child to make a £5 mistake when they are six than a £5,000 mistake when they are twenty-six. Giving them a small, safe environment to fail in is one of the best gifts you can provide.

Is It Too Late to Start?

If your child is ten, twelve, or even fifteen and you haven't started an allowance yet, don't panic. You haven't 'missed the window.' However, the approach needs to shift. For an older child, the focus isn't on counting coins: it's on budgeting for their own needs. You can bridge the gap by shifting existing expenses (like their phone credit or cinema trips) into their hands.

Try the 'Two Coin Test.' Give your child a choice: they can have one shiny pound coin right now, or if they can wait until after we finish the grocery shopping, they can have two pound coins. This is a classic test of delayed gratification and a great indicator of readiness.

Finn says:

"What happens if I lose my money? Is there a 'Lost and Found' for coins, or is it just gone forever?"

Starting later actually allows for more complex discussions about opportunity cost and interest. While younger children learn through the physical act of holding money, older children can quickly catch up by managing larger, more infrequent sums. For more details on adapting for different life stages, see our guide on pocket-money-by-age.

An investment in knowledge pays the best interest.

Regardless of the age you choose, the goal remains the same: raising a child who is comfortable with money, understands its value, and feels empowered to make their own financial decisions. The 'right' age is simply the age where your child is ready to start that conversation with you.

Something to Think About

If you could go back in time, what age would you have wanted to start learning about money?

There is no right answer here. Some parents wish they had started earlier to learn from mistakes, while others are glad they didn't have to worry about money until they were older. Talk with your child about when they feel 'grown-up' enough to handle their first coin.

Questions About Earning & Pocket Money

Is 4 years old too young for pocket money?

Should I wait until my child asks for pocket money?

What if my child is 10 and doesn't care about money yet?

Your Next Step

If you've checked the signs and your child seems ready, your next step is deciding the logistics. Head over to our guide on pocket-money-how-much to figure out a fair starting point for your family's budget.