Imagine walking into a bank with a five-pound note and demanding a chunk of real, shiny gold in exchange for it. Would they give it to you?

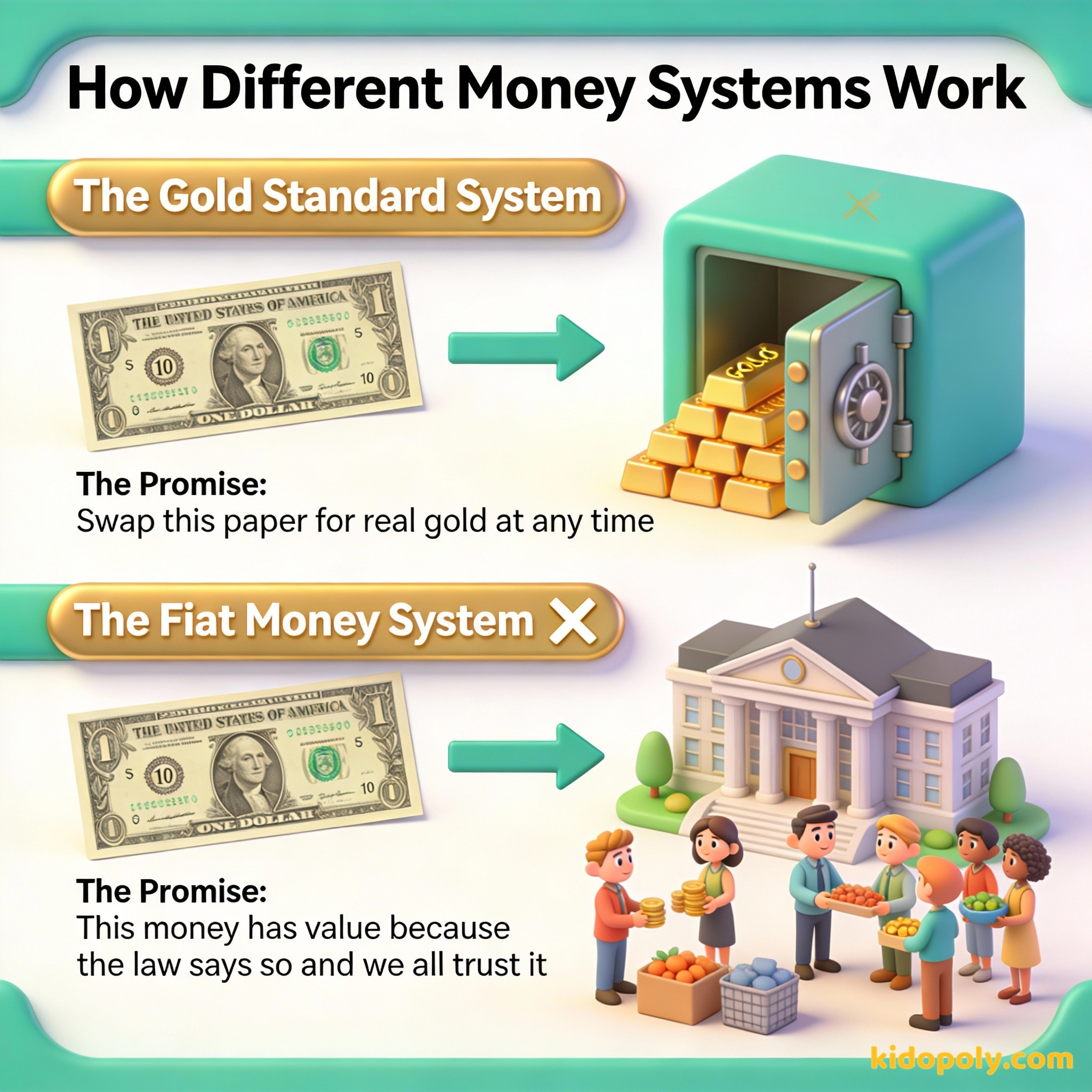

Until 1971, the answer would have been 'yes.' For most of history, money was just a receipt for a physical treasure. Today, we use fiat money, which is a system built on government authority and public trust rather than gold bars in a vault.

Until August 15, 1971, every US dollar was a legal promise. It meant the government actually had a specific amount of real gold sitting in a high-security vault to back up that bill. If you had enough dollars, you could technically trade them for the gold itself.

Then, one Sunday night, President Richard Nixon went on television and changed everything. He told the world that the US would no longer trade its gold for dollars. This event is now called the Nixon Shock.

The strength of a nation's currency is based on the strength of that nation's economy.

Suddenly, the money in people's wallets was no longer a receipt for gold. It became something called fiat money. This was a massive shift that still causes debates between economists today.

Team Gold: The Gold Standard Explained

The gold standard is a system where a country's currency is directly linked to gold. In this system, the government cannot print more money than they have gold to back it up. It acts like a giant anchor, keeping the value of money steady.

The US keeps about 147 million ounces of gold at Fort Knox in Kentucky. That sounds like a lot, but if you put it all together, it would only make a cube about 20 feet on each side!

Under this system, money was basically a 'claim check.' Think of it like a coat check at a theater. The ticket in your hand isn't the coat, but it proves the coat exists and belongs to you.

Mira says:

"This is like a limited-edition sneaker drop. If there are only 100 pairs in the world, they stay valuable. If everyone has them, they aren't special anymore!"

- Stability: Prices usually stay the same over long periods because the government can't just print infinite cash.

- Global Trust: Everyone in the world agrees that gold is valuable, so it makes trading between countries easier.

- Discipline: It prevents governments from spending way more money than they actually have.

The Problem with Gold

If the gold standard was so stable, why did we stop using it? The problem is that gold is very heavy, hard to move, and, most importantly, there isn't very much of it. As the world's population grew and businesses got bigger, we needed more money to keep the economy moving.

Imagine your school uses a 'Marble Standard.' You can only buy lunch if you have a blue marble. If the marble mine closes and no new marbles are found, kids can't buy lunch, even if the kitchen is full of food. That's the danger of the gold standard!

If the government can only create money when they find new gold mines, the economy can get stuck. Imagine if you wanted to start a business but the bank couldn't lend you money simply because no one had dug up a new yellow rock that week. This can lead to deflation, where prices drop but nobody has any money to buy anything.

The gold standard is already a barbarous relic.

Team Fiat: The Power of the Promise

Today, almost every country uses fiat money. The word 'fiat' is Latin for 'let it be done.' It means the money has value because the government declares it has value. It is not backed by gold, silver, or diamonds.

Take a close look at a bank note. You will usually see the words 'This note is legal tender.' This is the government's official 'fiat' decree. It's their way of saying: 'We promise this is real money, so you must use it!'

Instead, fiat money is backed by trust. You accept a $10 bill because you trust that the shopkeeper will accept it, and the shopkeeper trusts it because the government says it must be accepted for all debts. It's a giant circle of belief that keeps the world running.

Finn says:

"Wait, so if the government can just print more money whenever they want, why don't they just print enough for everyone to be a billionaire?"

- Flexibility: Governments can create more money during emergencies, like a pandemic or a big recession, to help people stay afloat.

- Growth: The amount of money can grow as the economy grows, rather than being stuck at the speed of gold mining.

- Control: Central banks can adjust the money supply to try and keep the economy healthy and avoid crashes.

It keeps the government from printing too much money, which prevents inflation and keeps the value of your savings stable.

It allows the government to respond to emergencies and lets the money supply grow as fast as the population and technology.

The Great Debate: Which is Better?

This is where things get interesting. There is no 'correct' answer, only different theories. Most modern economists believe fiat money is better because it allows the economy to grow and gives us tools to fight financial crises. They think the gold standard is too rigid for the modern world.

Mira says:

"It's all about balance. Too much money makes it worth less, but too little money means the economy stops growing. It's like a game of Jenga!"

However, some people worry that because fiat money can be printed endlessly, it will eventually lose its value through inflation. These people often prefer 'hard assets' like gold or even digital versions of gold, like Bitcoin.

The Road from Gold to Fiat

Why it Matters to You

Every time you see a price change at the store, you are seeing this debate in action. When the government 'prints' more fiat money, the money already in your piggy bank might lose a little bit of its 'purchasing power.' That is the trade-off for having a flexible system.

Gold gets dug out of the ground in Africa... then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility.

In recent years, the debate has moved into the digital world. Many people who like the idea of the gold standard but live in a digital age are moving toward cryptocurrency. They like that Bitcoin, for example, has a limited supply, just like gold.

In 1970, an ounce of gold cost $35. Today, that same ounce of gold costs over $2,000. This doesn't mean gold got 'better.' It means the fiat dollar lost some of its value compared to gold over 50 years. This is why some people still call gold the 'ultimate' money.

Whether we use gold, paper, or digital code, the most important part of money is that we all agree it works. Understanding the system behind your coins makes you more than just a spender: it makes you a master of how the world actually works.

Something to Think About

If you were starting your own country, would you choose the Gold Standard or Fiat Money?

There is no right or wrong answer here! Think about whether you value safety and stability (Gold) or growth and flexibility (Fiat) more.

Questions About How Money Works

Does the US still have gold in Fort Knox?

Is fiat money 'fake'?

Can a country go back to the gold standard?

The Master of Your Money

Now you know the secret behind every note in your wallet. It's not about the paper itself, but the massive system of trust and history that gives it power. Want to see how this trust can sometimes go wrong? Check out our page on inflation-explained to see what happens when too much fiat money enters the system!