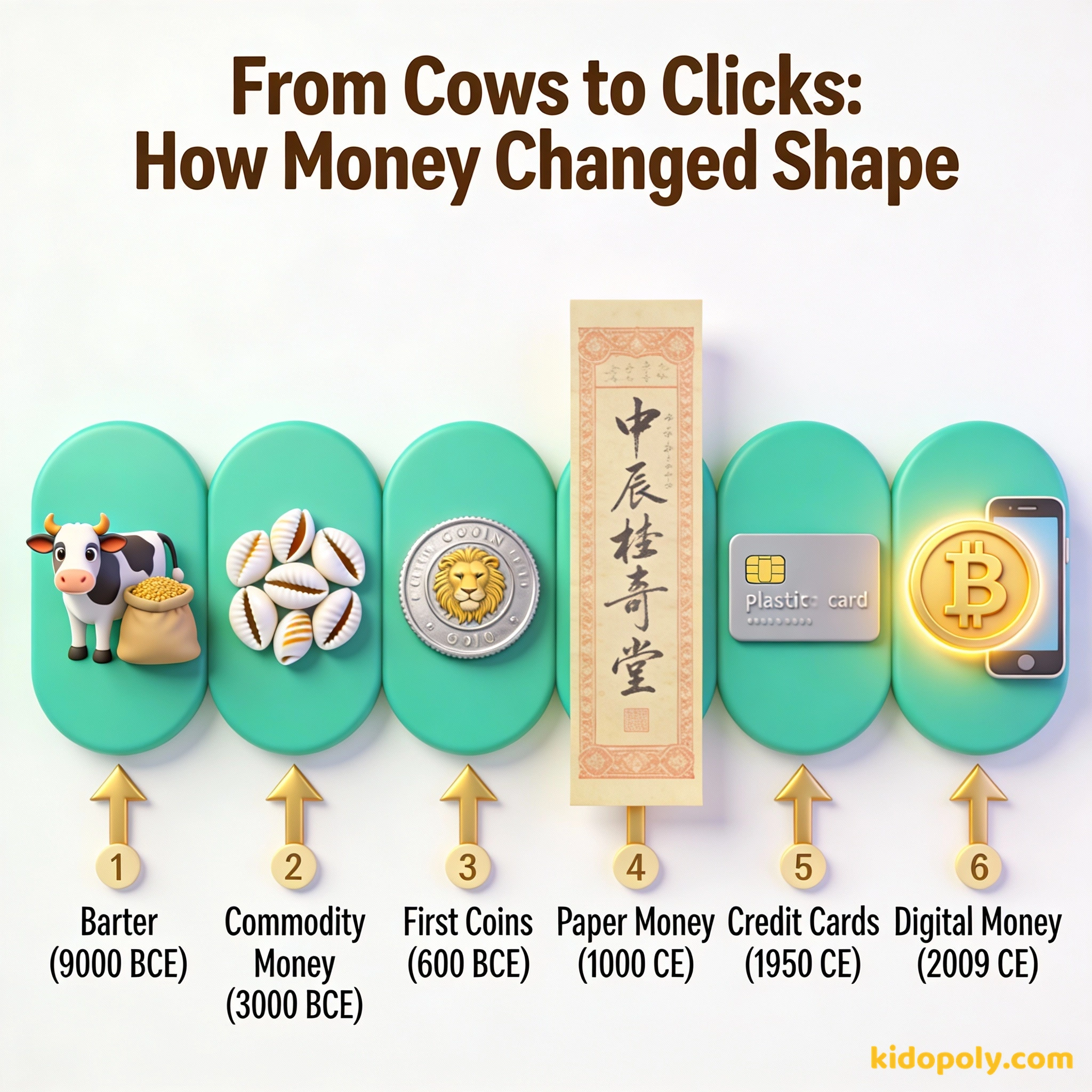

Next time you tap your phone to pay for a snack, remember: you are standing at the end of an 11,000-year journey.

This timeline shows every major leap in the evolution of money. From swapping cows to swiping cards, humans have invented amazing ways to track value and make trading easier.

Money is one of the greatest human inventions. It did not just appear one day: it grew and changed as humans built bigger cities and started trading across the world. By looking at a history of money for kids timeline, we can see how people solved the problem of buying what they needed.

The Era of Swapping (9000 BCE to 3000 BCE)

Before there were coins or bills, there was barter. This meant swapping things you had for things you wanted. If you had an extra sheep and needed a bag of grain, you had to find someone who had grain and wanted a sheep. It was a great system for small villages, but it could be very tricky if you could not find a trading partner.

In Ancient Rome, soldiers were sometimes paid in salt. The word 'salary' actually comes from the Latin word 'sal', which means salt! It was valuable because it kept food from spoiling.

Around 3000 BCE, people in China and Africa started using cowrie shells as a form of money. These small, pretty seashells were perfect because they were durable, easy to carry, and hard to fake. This was the first major step away from swapping actual items to using a placeholder for value.

Mira says:

"Think of cowrie shells like the first version of trading cards. Everyone agreed they were valuable, so you could swap them for almost anything else!"

He makes them so many that they could pay for all the riches in the world, and it costs him nothing.

The Birth of Coins and Paper (600 BCE to 1000 CE)

The next big jump happened in a place called Lydia (now part of Turkey) around 600 BCE. The King of Lydia ordered the first official coins to be minted. They were made of electrum, a natural mix of silver and gold, and stamped with a lion's head to prove they were real. This meant people did not have to weigh metal every time they bought something.

Imagine you wanted to buy a new bicycle, but you had to pay with cowrie shells. If a bike cost 10,000 shells, you would need several heavy buckets just to carry your money to the shop!

By 1000 CE, the Song Dynasty in China realized that carrying thousands of heavy metal coins was difficult for merchants traveling long distances. They invented the first paper money, called Jiaozi. These were essentially receipts that promised the holder they could trade the paper back for coins at any time.

Quick Guide: Milestones in Money

Finn says:

"I bet it was scary being the first person to use paper money in Sweden. How did they know the bank would actually give them their coins back?"

Going Global: Banknotes and Gold (1661 to 1900)

Europe took a while to catch up with China. It was not until 1661 that the Stockholm Banco in Sweden issued the first European banknotes. Just like in China, these were promises to pay the bearer in silver or gold coins. It was much easier for people to carry paper in their pockets than heavy metal bags.

Remember that time is money.

In 1816, the United Kingdom passed the Gold Standard Act. This was a huge deal because it officially linked the value of the British Pound to a specific amount of gold. Many other countries followed this plan, which meant that for about 100 years, you could technically walk into a bank and trade your paper cash for real gold bars.

Under the old Gold Standard in the USA: 1 Ounce of Gold = $20.67 This meant if you had a $20 bill, you basically owned almost one full ounce of gold held in a government vault!

The Plastic and Digital Revolution (1950 to Today)

In the modern era, money started to become invisible. In 1950, the first credit card was launched by the Diners Club. A man named Frank McNamara forgot his wallet at a restaurant and realized there should be a way to pay without carrying cash. This invention allowed people to borrow money instantly for their purchases.

The Barter Challenge: At your next lunch break, try to see if you can trade one item for something else. Can you trade an apple for a granola bar? How long does it take to find someone who wants exactly what you have?

By 1971, the world changed again when the United States ended the gold standard. This meant that money was no longer backed by physical gold in a vault. Instead, its value was based on the strength of the government and the trust of the people using it. This is how most currency works today.

Mira says:

"Digital money is basically like the gold coins you earn in video games, except you can use it to buy real-life pizza!"

In 2009, a mysterious person named Satoshi Nakamoto launched Bitcoin. This was the world's first cryptocurrency, a type of digital money that does not need a bank or a government to work. Today, we are seeing the rise of Central Bank Digital Currencies (CBDCs), where governments create their own digital versions of cash.

Cash is great because it works even when the power is out, and it helps you see exactly how much you are spending.

Digital pay is faster, you cannot lose it as easily as a coin, and it allows you to buy things from people on the other side of the planet.

Price is what you pay. Value is what you get.

Something to Think About

If you had to invent a new type of money today, what would it be?

Remember, there is no wrong answer. Money can be anything that people agree has value. Would you use digital points, colorful stones, or maybe something totally new?

Questions About How Money Works

When was money invented?

Who invented paper money?

Is Bitcoin real money?

You are part of the story!

Money has come a long way from swapping cows for wheat. Every time you save your allowance or use a digital app, you are part of this massive, ongoing history. Now that you know where money came from, are you ready to learn how it actually works today?