Imagine walking into a shop in 1990 with 26p in your pocket. You could walk out with a full-sized Mars bar. Today, that same chocolate bar costs about £1.00.

The chocolate didn't get four times bigger or taste four times better. In fact, it's pretty much exactly the same. What changed is the Purchasing Power of your money, a mysterious force called Inflation.

Have you ever heard your grandparents complain that a cinema ticket used to cost less than a pound? It sounds like a fairy tale, but it is actually true. In 1980, you could see a blockbuster movie for about 50p. Today, you might pay £10 or more for that same seat.

This is Inflation in action. It is the steady increase in the prices of goods and services over time. When inflation happens, every pound or dollar you own buys a little bit less than it did before. It is not that the items are becoming 'fancy,' it is that your money is becoming 'weaker.'

Imagine you have a giant balloon. Every year, you blow a tiny bit of air into it. The balloon is the price of everything in the world. It doesn't pop, but it just keeps getting bigger and bigger, making the world look a little different every decade.

Inflation is a quiet thief that eats away at the value of your money over time.

The Three Engines of Inflation

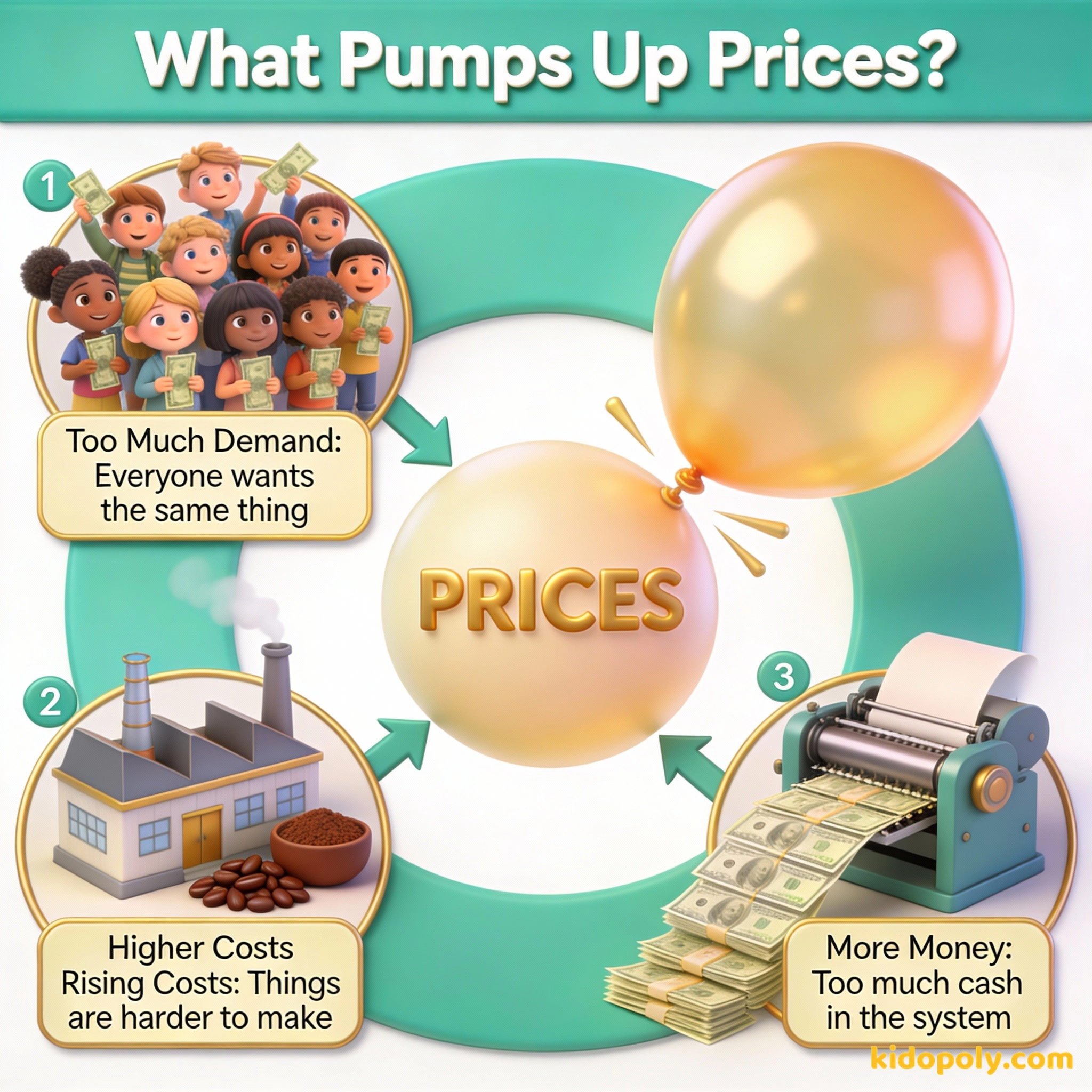

Inflation does not just happen by accident. Economists, who are people that study how money moves, usually point to three main reasons why prices start climbing. You can think of these as the 'engines' that push prices up.

First, there is Demand-Pull inflation. This happens when a lot of people suddenly want to buy the same thing, but there is not enough of it to go around. If every kid in your school suddenly wanted the exact same pair of trainers, the shop might raise the price because they know people will pay more to get them.

Mira says:

"So Demand-Pull inflation is like when a limited edition toy comes out and everyone tries to buy it at once? The price goes up because it’s so popular!"

Second, we have Cost-Push inflation. This happens when it becomes more expensive for companies to make the things you buy. If the price of cocoa beans goes up, the chocolate factory has to pay more for ingredients. To keep making a profit, they have to charge you more for the finished bar.

In 1999, a popular chocolate treat called a Freddo cost just 10p in the UK. By 2017, the price had risen to 30p! Many people use the 'Freddo Index' as a fun way to track how much inflation is affecting the things kids like to buy.

Finally, there is the Money Supply. If a government prints too much money and hands it out, there is suddenly way more cash in the system. When money is everywhere, it starts to feel less 'rare' and less valuable. Because money is easier to get, shops raise their prices to match the new amount of cash people are carrying.

Is Inflation Always a Bad Thing?

You might think that prices going up is always bad news. After all, who wants to pay more for sweets? But most experts believe that a tiny bit of inflation, about 2% every year, is actually healthy for a country.

When prices go up very slowly, it encourages people to spend or invest their money now rather than waiting. If you knew a bike would be much cheaper next year, you might never buy it. If everyone stopped buying things, shops would close and people would lose their jobs.

Prices go up slowly. People spend money because they know it might be more expensive later. This keeps the economy growing.

Prices go down. It sounds great, but people stop spending because they are waiting for things to be even cheaper. This can cause businesses to close.

Inflation is always and everywhere a monetary phenomenon.

When Inflation Goes Wild: Hyperinflation

Sometimes, inflation gets out of control and turns into Hyperinflation. This is like a financial horror movie. It happens when prices rise so fast that money becomes almost worthless in just a few days.

In Germany in 1923, prices rose so quickly that people had to carry their cash in wheelbarrows just to buy a loaf of bread. Some families even used stacks of cash as wallpaper because the paper money was cheaper than actual wallpaper. It was a total disaster for the Economy.

Finn says:

"Wait, if people used money as wallpaper, did they have to use glue, or was the money so worthless they just taped it up? That sounds like a waste of a lot of paper!"

Another famous example happened in Zimbabwe in 2008. The government printed so much money that they actually made a 100 trillion dollar note! Even with that much 'money,' people could barely afford to buy a bus ticket. It is a reminder of why keeping inflation low is a big job for world leaders.

If inflation is 5% this year, something that costs £100 today will cost £105 next year. £100 x 0.05 = £5 increase New Price: £105 That means your £100 note effectively 'lost' £5 of its power!

The Good News: Your Paycheck

Here is the secret that makes inflation manageable: wages usually go up too. If the price of bread doubles over ten years, the amount of money people earn for their jobs usually goes up as well. This means that even though things cost more, you can still afford them.

If you save your money in a bank, you can also earn Interest. This is extra money the bank pays you for letting them look after your cash. Ideally, you want your savings to grow faster than inflation so you can buy even more in the future.

Inflation is like a country's temperature: too cold and things stop moving, too hot and things start to burn.

Mira says:

"This is why my pocket money doesn't seem to go as far as it used to. I need to make sure my chores 'pay' more if the price of ice cream keeps going up!"

Interview a grandparent or an older relative. Ask them how much three things cost when they were your age: a cinema ticket, a loaf of bread, and a comic book. You will be amazed at how much 'stronger' their money used to be!

Looking Ahead

Inflation is one of those invisible forces that shapes your world every single day. By understanding it, you can make better choices about when to save and when to spend. You will also understand why that chocolate bar might cost £1.10 by the time you are a teenager!

Something to Think About

If you were given £50 today, would you spend it on something you want now, or save it for the future even though prices might go up?

There is no right or wrong answer here! Think about whether the joy of having something now is worth more than the risk of it costing more later.

Questions About How Money Works

Does inflation ever stop?

Why don't we just stop printing money?

How can I protect my savings from inflation?

You’re an Inflation Expert!

Now you know why that chocolate bar costs more than it used to. You’ve seen how prices are like a balloon and why a little bit of growth is actually good for the world. Ready to learn more about where money comes from? Check out our guide on why-money-has-value!