You already know more about some companies than most adult investors do.

Which trainers are cool right now? What games is everyone playing? The companies behind your favourite things might be some of the best stocks you could buy. This guide helps you turn that consumer knowledge into a financial framework for your first investment.

You spend money every day on things you love. Whether it is the shoes on your feet or the app on your phone, you are a customer. Being a customer gives you a huge advantage because you see which companies are winning and which ones are losing.

In 1997, a company called Amazon went public. If you had invested £1,000 back then, it would be worth over £2 million today! Of course, not every company grows like that, but it shows what is possible.

Investing is not just about numbers on a screen. It is about becoming a part-owner of a real business. When you buy a share, you own a tiny piece of that company. If the company does well, your piece of the pie can become more valuable over time.

Invest in What You Know

One of the most famous investors in history, Peter Lynch, believed that regular people could beat professional investors by simply looking around them. He called this the 'invest in what you know' principle. For a kid, this means looking at the brands you see every single day.

Know what you own, and know why you own it.

Think about your daily routine. You might wake up and check an iPhone (Apple), eat a bowl of cereal (Kellogg's), put on your Nike trainers, and play a game on your Nintendo Switch. These are all huge, publicly traded companies that you can own.

Mira says:

"I realized that almost everything in my kitchen is made by just three or four huge companies. It is like I am already an expert on what they sell!"

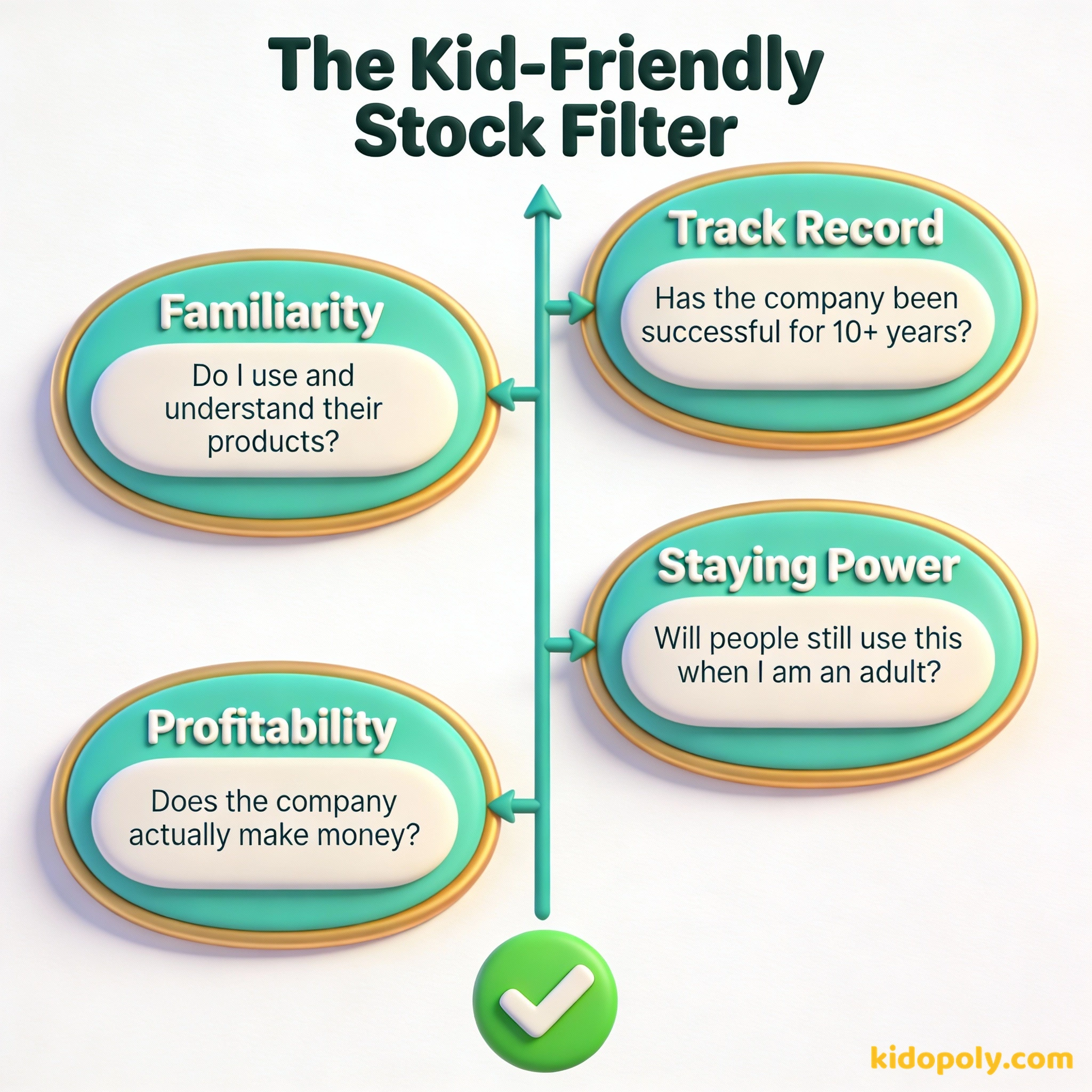

The Kid-Friendly Stock Checklist

Not every company you like is a good investment. Some companies are 'trends' that disappear after a year. To find the best stocks for kids, you need to look for specific traits that suggest a company is strong and stable.

- Brand Recognition: Is the name famous all over the world?

- Long Track Record: Has the company survived for decades through good and bad times?

- Understandable Business: Can you explain how they make money in one sentence?

- Profitability: Does the company actually make more money than it spends?

Checking these four boxes helps you avoid risky 'penny stocks' or companies that are just a flash in the pan. You want companies that are established, meaning they have a solid foundation and a history of success.

Go on a 'Brand Hunt' in your house. Find 5 items and look up who owns them. You might find that your favorite snacks, toys, and tech are all owned by companies you can invest in!

Categories to Explore

To help you get started, we can group some kid-friendly stocks into categories. These are companies that many young investors choose because their products are everywhere. Remember, these are examples of companies that fit the framework, not a list of what you must buy.

- Entertainment: Companies like Disney or Netflix. They own the stories and movies people love.

- Technology: Giants like Alphabet (the company that owns Google and YouTube) or Microsoft (which owns Xbox).

- Apparel: Brands like Nike or Adidas. People always need shoes and sports gear.

- Food and Drink: Global names like McDonald's or PepsiCo.

Finn says:

"If I buy a share of a video game company, does that mean I technically own part of the characters in the game? That's actually pretty cool."

The Power of Dividends

Some stocks do something extra special: they pay you just for owning them. This payment is called a dividend. Not all companies pay them, but many established ones do. It is like the company is sharing its profits directly with you.

If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes.

Imagine owning a stock that pays you a few pounds every few months. You can take that cash and buy more shares, which is a great way to grow your money faster. We have a whole page about dividend-investing if you want to see how that math works.

Let's say a stock costs £100 and pays a 3% dividend every year. £100 x 0.03 = £3 You get £3 a year just for owning it. If you have 10 shares, you get £30! That is money earned while you sleep.

Can You Afford a Share?

Some stocks are expensive. A single share of a big tech company might cost £150 or even £2,000. That is a lot of pocket money! Luckily, you do not always have to buy a full share. Many modern investing platforms allow you to buy fractional shares.

Imagine you want to buy a share of a big tech company that costs £200, but you only have £20. With fractional shares, you can buy exactly 10% of that share. You still get 10% of the dividends and 10% of the growth!

With fractional shares, you can invest as little as £1 or £5. You will own a tiny slice of that expensive share. This makes it possible to build a portfolio of several different companies even if you only have a small amount of money to start with.

Picking Stocks vs. Index Funds

While picking individual stocks is exciting, it can be risky. If you put all your money into one company and that company has a bad year, your investment goes down. This is why many people prefer an index fund.

You get to pick companies you love and potentially see huge growth if they succeed.

You get instant diversification and lower risk because you own a piece of everything.

An index fund is like a basket that holds hundreds of different stocks at once. Instead of trying to pick the 'best' one, you own a little bit of everything. It is a more 'set it and forget it' way to invest. Many families choose to do both: have most of their money in index funds and a little bit in a few stocks the child chooses.

Mira says:

"My dad says we use index funds for the boring, safe growth, and I get to pick two stocks for my 'fun' portfolio. It's the best of both worlds."

How to Start Your Research

Before you ask a parent to help you buy a stock, do your homework. Use a website like Yahoo Finance or Google Finance to look at the company's '5-year chart'. Does the line generally go up over time? Look for recent news. Are people still excited about their new products?

Don't look for the needle in the haystack. Just buy the haystack!

Investing is a long-term game. The best stocks for kids are usually those you plan to hold for five, ten, or even twenty years. By starting now, you have the most powerful tool in finance on your side: time.

Something to Think About

If you could only own one company for the next ten years, which one would it be and why?

Think about which product or service you think will be even more important in the future than it is today. There is no right or wrong answer!

Questions About Investing

What is the best stock for a 12 year old to buy?

How much money do kids need to start investing in stocks?

Can I lose all my money in a stock?

Ready to Pick Your First Share?

Choosing your first stock is a big milestone. It turns you from a consumer into an owner. Once you have identified a company that passes your checklist, the next step is to talk to a parent about how to actually buy it. You can learn more about the different types of [investing-accounts-for-kids] to see which one fits your family's goals best.