Imagine your friend needs £10 to buy supplies for a lemonade stand. They promise to pay you back your £10 in one month, plus an extra £2 as a thank you. You just created a bond!

In the world of investing, a bond is a special kind of IOU. Instead of lending to a friend, you are lending your money to giant companies or even the government. They use your cash to grow, and in return, they promise to pay you back with interest.

Most people think of investing as buying a piece of a company. But there is another way to make your money grow that is more like being a bank. When you buy a bond, you are not buying part of a business: you are becoming a lender.

Imagine you lend your sister £20 to buy a new video game. You write a note that says: 'You owe me £20 on Christmas Day, and you must give me 1 chocolate bar every week until then.' That note is a bond! The £20 is the face value, the chocolate is the interest, and Christmas is the maturity date.

Think of it like this: governments and big companies often need huge amounts of money to do big things. A city might want to build a new swimming pool, or a company might want to build a factory. Instead of asking one person for a billion pounds, they ask millions of people for a little bit each.

Finn says:

"So if I buy a bond, I'm basically the boss of the government for a little while because they owe me money?"

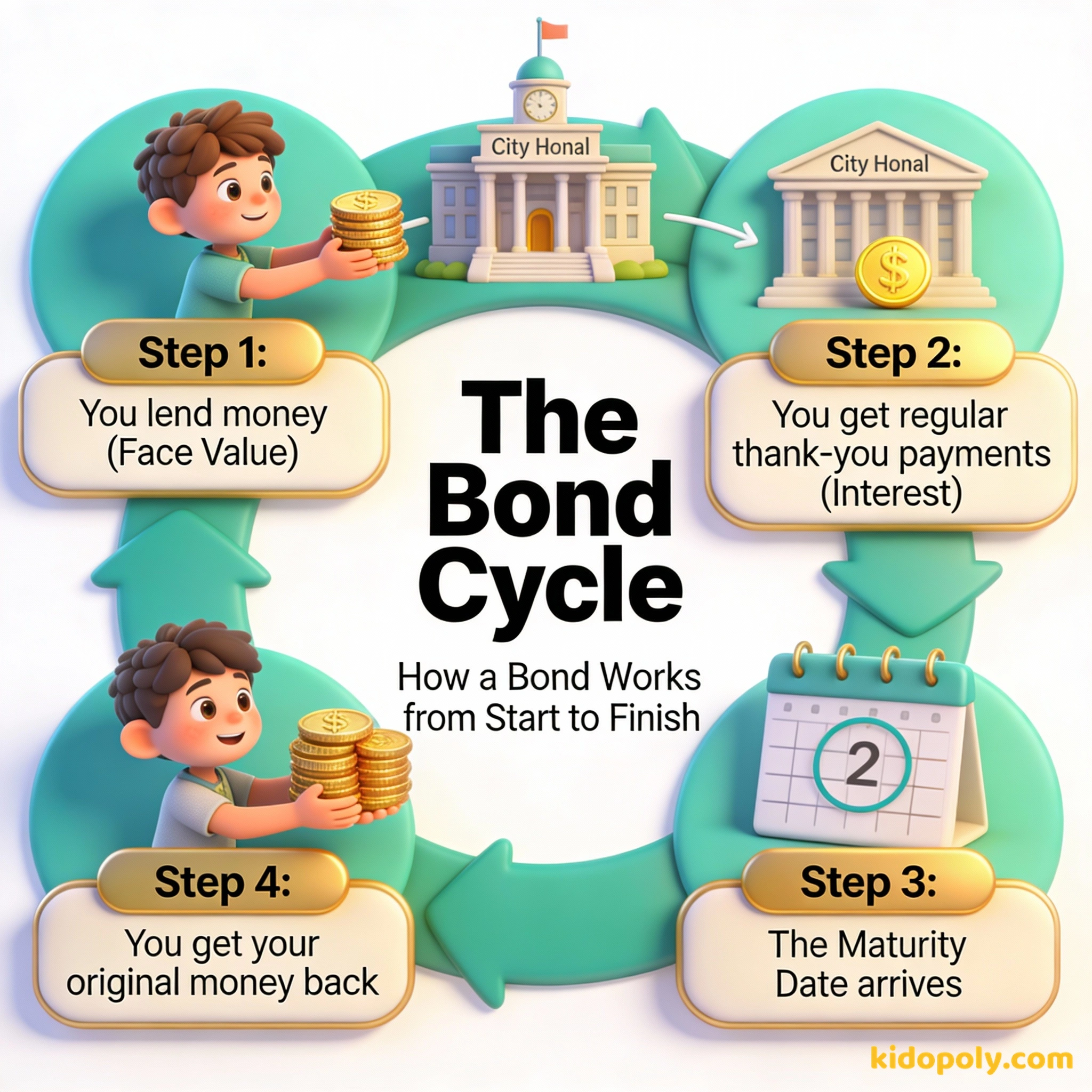

The Three Magic Parts of a Bond

Every bond has a specific set of rules. Unlike a stock, where the price can go up and down like a rollercoaster, a bond is a legal contract. It has three main parts that tell you exactly what to expect.

First is the Face Value. This is the amount of money you are lending right now. If you buy a bond for £100, the face value is £100. This is the amount the borrower promises to give back to you later.

Let's look at the numbers for a 'Yearly Thank You': - You buy a bond for: £100 - The Coupon Rate is: 4% - Interest earned per year: £4 - After 5 years, you have: £20 in interest - On the Maturity Date, you get back: your original £100 - Total money: £120!

Second is the Coupon Rate. This is a fancy name for the interest. If a bond has a 5% coupon rate, the borrower will pay you 5% of your money every year as a thank you. On a £100 bond, that is £5 every single year.

Finally, there is the Maturity Date. This is the official finish line. It is the exact date in the future when the borrower must pay back your original £100. Some bonds last for two years, while others can last for thirty years!

Investing is simple, but not easy.

Who Is Asking to Borrow Your Money?

Not all bonds are created equal. Just like you might trust your best friend to pay you back more than a stranger, some bonds are safer than others. There are two main groups that issue bonds to the public.

Government Bonds are usually considered the safest of all. When you buy these, you are lending money to the country. They use it to build roads, pay teachers, and run the military. Because governments can raise money through taxes, they almost always pay their debts.

During World War II, the government sold 'War Bonds' to regular people to pay for planes and tanks. Even kids could help by buying 'stamps' for 10 cents or 25 cents until they had enough to trade them in for a full bond!

Corporate Bonds are loans to companies like Apple, Disney, or Nike. These are a bit riskier than government bonds because companies can sometimes go out of business. To make up for that risk, companies usually offer a higher coupon rate to tempt you to lend to them.

Bonds vs. Stocks: Owner vs. Lender

One of the most important things to understand in investing is the difference between being an owner and being a lender. This is the core of the stocks-vs-bonds debate.

When you buy a stock, you are an owner. If the company becomes the next big thing, you could make a fortune! But if the company fails, you could lose everything. It is high risk and high reward.

Mira says:

"It's like the difference between owning the lemonade stand and just renting them the lemons. One is a gamble, the other is a deal!"

When you buy a bond, you are a lender. You do not own any of the company. You do not get a say in how they run things. However, you are first in line to get paid. Even if a company is having a bad year, they still have a legal duty to pay their bondholders.

An investment in knowledge pays the best interest.

Why Would Anyone Choose a "Boring" Bond?

If stocks can make you rich, why do people bother with bonds? Investors often call bonds the reliable sidekick of a portfolio. While they might not grow as fast as stocks, they are much more stable.

Bonds provide a steady stream of income. If you have a lot of bonds, you know exactly how much interest money is hitting your bank account every year. This makes them perfect for people who want to protect the money they already have.

High risk, high potential growth. You own a piece of the company's future.

Low risk, steady payments. You are a lender with a legal promise to be paid.

Most investors use a mix of both. They keep some money in stocks for growth and some in bonds for safety. This way, if the stock market has a bad day, the bonds act like a giant pillow to soften the fall.

Can Kids Actually Buy Bonds?

In many countries, you can actually start being a bond investor even as a kid! While you might need an adult to help you set up an account, there are special bonds designed just for savers.

In the UK, Premium Bonds are very popular. Instead of getting a fixed interest payment, your bond acts like a ticket in a monthly prize draw. You never lose your original money, but you have a chance to win cash prizes!

Mira says:

"Bonds are like the slow and steady tortoise in the race. They might not look fast, but they almost always cross the finish line."

In the US, many kids receive Savings Bonds as gifts from grandparents. These are safe, government-backed investments that grow in value over time. They are a great way to save for big goals like university or your first car.

Owning a bond is about having the security of knowing exactly when your money is coming back to you.

Ask your parents or grandparents if they have any old paper savings bonds tucked away in a drawer. Some older bonds were printed on beautiful paper that looks like play money, and some might still be earning interest today!

A Brief History of Lending

Something to Think About

If you had £100 to invest today, would you feel more comfortable being an owner (buying stocks) or a lender (buying bonds)?

There is no right or wrong answer here. Some people love the excitement of growth, while others prefer the peace of mind that comes with a steady promise. What feels more like 'you'?

Questions About Investing

What happens if a company can't pay back a bond?

Can I sell a bond before the maturity date?

Do bonds always pay the same interest?

Ready to Build Your Fortune?

Now that you know how to be a lender, you have a new superpower in your financial toolkit. Bonds are just one piece of the puzzle. To see how they fit together with other investments, why not check out our guide on stocks-vs-bonds or learn more about how what-is-interest makes your money multiply?