Your parents get paid in pounds or dollars that the government creates. But what if there was money that no government controlled: money that lived on the internet, moved instantly across borders, and couldn't be printed to create more?

That is the promise of cryptocurrency. While regular money, also known as fiat currency, has been around for centuries, crypto is the new kid on the block. Both can be used to buy things, but they work in completely different ways. Understanding these differences is like learning the rules to two different types of superpowers.

Most of the money you see every day is fiat currency. This includes the paper bills in your wallet and the digital numbers in your parents' bank accounts. Governments and central banks decide how much of this money to create and how it should be managed.

The first time someone used crypto to buy a physical item was in 2010. A programmer paid 10,000 Bitcoins for two pizzas. At the time, that was about $40. Today, those same Bitcoins would be worth hundreds of millions of dollars! That is one expensive pepperoni topping.

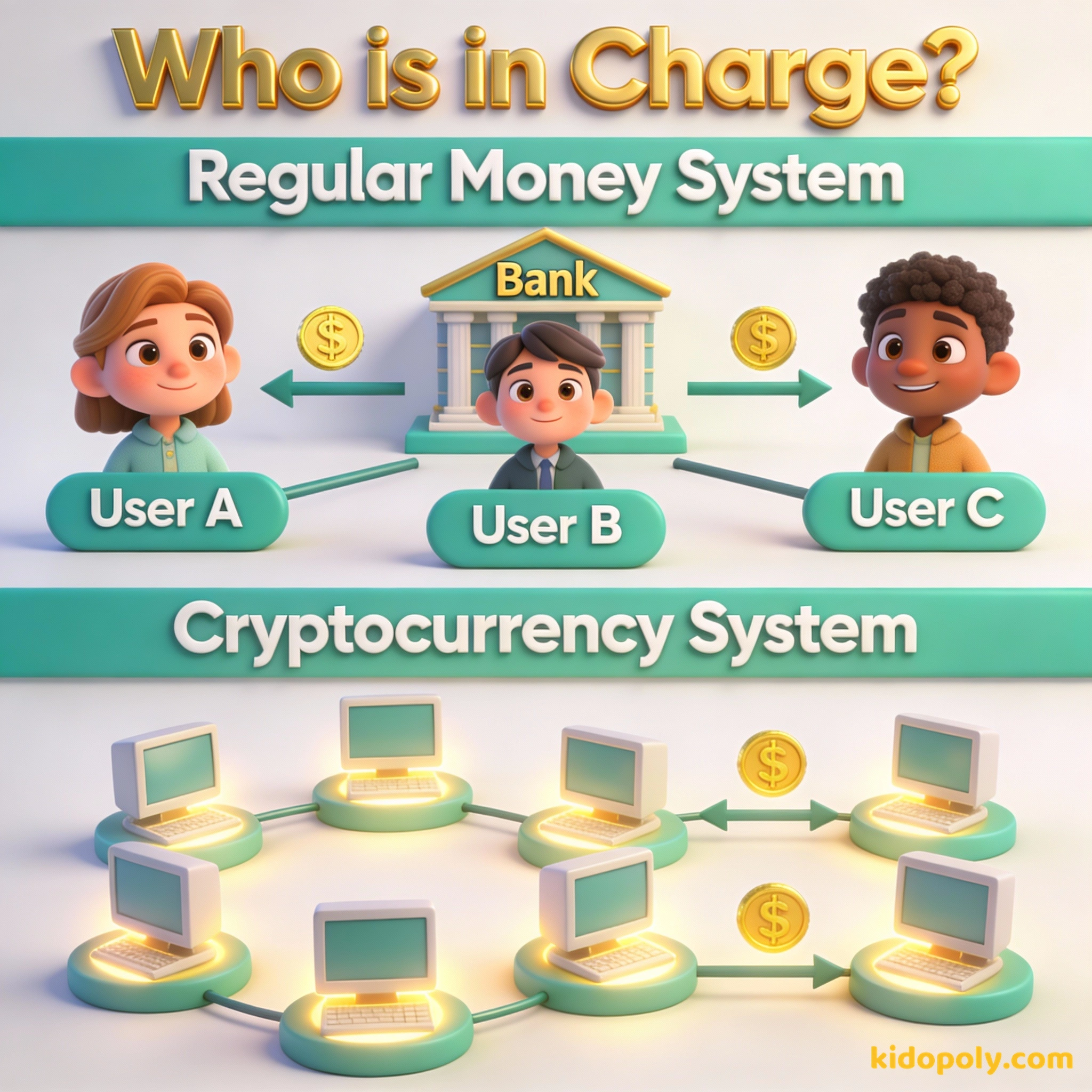

Cryptocurrency is different because it is decentralized. This means there is no boss, no CEO, and no government in charge of it. Instead, it is run by a massive network of computers spread all over the world. These computers use complex code to make sure every transaction is real and that nobody is cheating.

The Boss Factor: Who is in Control?

The biggest difference is who holds the remote control. For regular money, the government has the power. They can decide to print more money if the economy needs a boost. They also set the rules for banks, which are the gatekeepers of your cash.

Finn says:

"So wait, if there is no bank and no boss, who do I call if I forget my crypto password or if someone steals my digital wallet?"

With crypto, the code is the boss. Because no single person is in charge, the rules cannot be changed easily. If you want to send crypto to a friend in Australia, you do not need a bank to say it is okay. You just send it directly. This is called peer-to-peer payment.

Bitcoin is a technological tour de force.

The Supply: Can We Just Make More?

Imagine if everyone in your school was given 1,000 extra snack tokens tomorrow. Suddenly, a chocolate bar that cost 1 token might cost 10, because tokens aren't rare anymore. This is called inflation. Governments can print more fiat money, which can sometimes make the money you already have worth a little bit less over time.

Let's look at scarcity: Regular Money: If a government decides to print 10% more money, the prices of toys often go up to match. Your $10 might only buy $9 worth of stuff later. Crypto: Some coins like Bitcoin have a limit of 21 million. No matter how many people want them, more can never be created. This makes it 'digital gold' because it is scarce.

Many cryptocurrencies have a fixed supply. This means the code says there will only ever be a certain amount, and nobody can just 'print' more. People who like crypto often point to this as a reason why it might hold its value better than regular money over many years.

Speed, Fees, and Reversibility

If you send money to a friend through a bank, it might happen instantly on your app, but the actual 'settlement' can take days. Banks have to talk to other banks and double-check everything. Crypto moves faster because the network is always awake and works 24/7. However, crypto transaction fees can sometimes be high when the network is busy.

Mira says:

"It is like the difference between a school library and a free book exchange on the street. The library has rules and a librarian in charge, while the book exchange relies on everyone following the same code of honor!"

One big catch with crypto is that there is no 'undo' button. If you send regular money to the wrong person, a bank might be able to help you get it back. With crypto, once you hit send, that money is gone forever unless the other person decides to send it back.

In a decentralized world, you have total freedom. You are your own bank. No one can stop you from spending your money how you want.

In a centralized world, you have a safety net. If you make a mistake, a human can help. If a bank is robbed, your money is usually insured by the government.

Why Can't I Buy Milk with Crypto?

If you walk into a local shop, they are legally required to accept the national currency (like Dollars or Pounds). This is called legal tender. But they do not have to accept crypto. Most shops don't because crypto prices are very jumpy, a concept called volatility.

If you're looking for a stable store of value, you're not going to find it in a cryptocurrency.

Imagine if the price of a game console was $300 in the morning but $450 by dinner time. That would be confusing! Regular money is usually very stable, changing only a tiny bit each day. Crypto can go up or down by 10% or 20% in a single afternoon, which makes it hard to use for buying everyday things like milk or shoes.

Next time you are at the shops or in a city center, look at the windows of the stores. See if you can spot any stickers that say 'Bitcoin Accepted Here' or a QR code for 'Crypto Payments.' They are rare, but they are appearing more often!

The Ultimate Face-Off

To help you keep it all straight, here is how they stack up side-by-side:

- Who is in charge? Government and Banks (Regular) vs. Computer Networks (Crypto)

- Physical Form? Paper and coins exist (Regular) vs. Only digital (Crypto)

- Total Supply? Unlimited, decided by officials (Regular) vs. Often limited by code (Crypto)

- Can you get a refund? Usually yes (Regular) vs. Almost never (Crypto)

- Accepted everywhere? Yes, by law (Regular) vs. Only in a few places (Crypto)

The root problem with conventional currency is all the trust that's required to make it work.

Finn says:

"I guess I will keep my pocket money in pounds for now. I would hate for my savings to drop 20% right before I buy that new LEGO set!"

Regular money is the reliable engine that keeps the world's shops and businesses running today. Crypto is like a high-tech experimental jet: it is fast, exciting, and uses amazing new technology, but it is still a bit too bumpy for most people to fly every day. Both have their own version of 'value,' and both are likely to be part of our future.

Something to Think About

If you could design the perfect money for the future, would you want it to be managed by a government you can vote for, or by a computer code that never changes?

Think about whether you value safety and rules more, or freedom and technology. There is no right or wrong answer, as both systems are trying to solve the problem of how we trade with each other.

Questions About Investing

Is cryptocurrency 'real' money?

Why can't I just print my own crypto?

Will crypto replace dollars and pounds?

Your Money, Your Choice

Whether you choose to use regular money or explore the world of crypto, the most important thing is to understand the rules of the game. Now that you know the difference between fiat and digital currency, you can start looking at the prices in the world around you with a whole new perspective. Ready to learn more about the tech behind the coins? Check out our guide to Crypto Basics next!