What if you could buy a single 'stock' that actually contained pieces of 500 different companies at the same time?

That is the power of an ETF, which stands for Exchange-Traded Fund. Instead of having to choose between buying Apple, Nike, or Disney, you can buy one single thing that includes all of them: and you can trade it just as easily as a regular stock.

Imagine you are at a massive candy store with 5,000 different jars. You have $10. You want to try the chocolate, the sour gummies, the licorice, and the rainbow drops. But each individual bag of candy costs $5. You can only pick two, and if one of them tastes terrible, half your money is wasted.

Imagine you are building a Lego castle. You could buy 500 individual tiny bricks one by one, which would take forever and cost a fortune in shipping. Or, you could buy one 'Castle Kit' that comes with all 500 bricks already inside the box. An ETF is that Lego kit for your money.

Now imagine the store manager creates a special 'Super-Sampler' bag. It has two pieces from every single jar in the store, and it only costs $10. By buying that one bag, you become the owner of a little bit of everything. In the world of money, that sampler bag is an ETF.

What Exactly is an ETF?

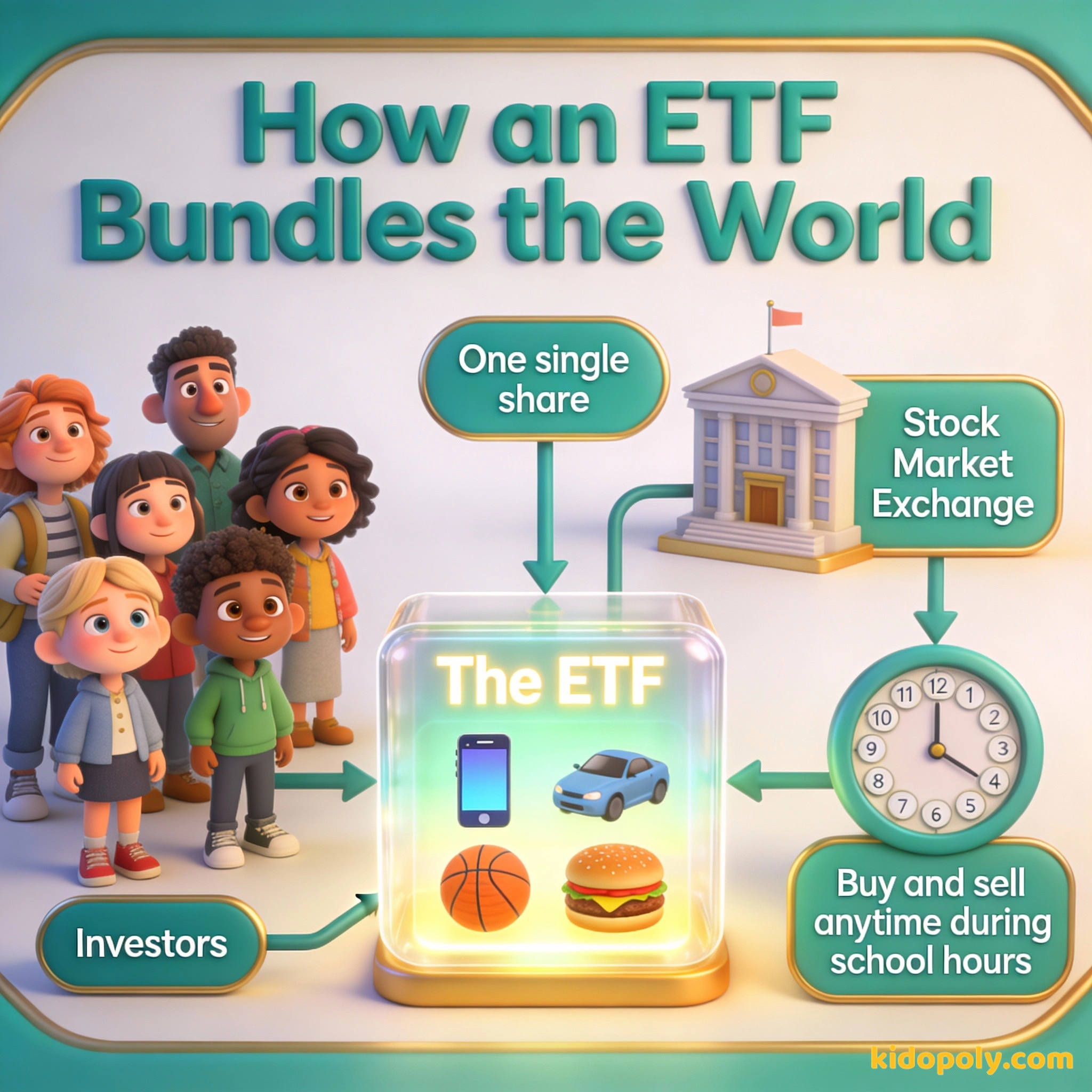

An ETF is a bundle of different investments, like stocks or bonds, that are grouped together into one single package. When you buy one share of an ETF, you are technically buying a tiny slice of every company inside that bundle. It is one of the most popular ways for people to start investing because it takes the guesswork out of picking winners.

Finn says:

"Wait, so if I buy a share of an S&P 500 ETF, do I actually own a piece of Apple and Nike at the same time? Even if I only have fifty bucks?"

Most ETFs are designed to track a specific list of companies called an index. For example, some ETFs track the 500 biggest companies in the United States. If those companies do well and grow, the price of your ETF share goes up. If they struggle, the price goes down.

The 'Exchange-Traded' Secret

To understand why ETFs are special, you have to look at the first part of their name: Exchange-Traded. This means these funds are bought and sold on a stock exchange, just like shares of Tesla or Netflix.

Don't look for the needle in the haystack. Just buy the haystack!

Before ETFs became popular, many people used index-funds. While index funds are also bundles of stocks, they have one big limitation: you can only buy or sell them once a day, after the stock market closes. ETFs changed the game by letting you trade your bundle any time the market is open.

- Stocks: You buy one company (like Disney).

- Index Funds: You buy a bundle, but you have to wait until the end of the day to trade.

- ETFs: You buy a bundle, and you can sell it five minutes later if you want to.

Buying 1 share of 10 different big tech stocks individually: - Total Cost: ~$1,800 - Trading Fees: 10 separate trades Buying 1 share of a Tech ETF that includes those same 10 stocks: - Total Cost: ~$400 - Trading Fees: 1 single trade You get the same exposure for much less 'upfront' cash!

Why Diversification is a Superpower

Financial experts love to talk about diversification. It is a fancy word that basically means 'don't put all your eggs in one basket.' If you spend all your savings on one single stock and that company has a bad year, you could lose a lot of money.

Mira says:

"It's like a Spotify playlist! Instead of buying ten different albums to get the songs you like, you just follow one 'Top Hits' playlist that stays updated for you."

When you use an ETF, your 'basket' has hundreds or even thousands of 'eggs' inside. If one company in the bundle goes bankrupt, it doesn't hurt you much because you still have 499 other companies working hard to make a profit. This spread-out risk is why many experts suggest ETFs as a great first step in what-is-investing.

Popular ETFs You Should Know

There are thousands of ETFs out there, but a few 'famous' ones represent the majority of the market. You might hear people use these weird three-letter nicknames, which are called tickers:

- SPY (S&P 500): This is the most famous ETF. It holds tiny pieces of the 500 largest companies in the US. When people say 'the market is up,' they are usually talking about these companies.

- QQQ (The Nasdaq 100): This bundle focuses on high-tech companies like Google, Microsoft, and Amazon. It is like a 'tech-heavy' version of the SPY.

- VTI (Total Stock Market): This ETF doesn't just want the big companies; it wants almost every public company in America, over 3,000 of them!

Focusing on one sector (like Tech) can lead to huge gains if that industry booms, but it's risky if that specific industry has a bad year.

A total market ETF is more stable because it covers everything from banks to grocery stores, though it might grow more slowly than a 'hot' tech stock.

Can Kids Buy ETFs?

While you usually have to be 18 to open a trading account yourself, many kids and teens start investing in ETFs through something called a custodial account managed by a parent. It is a way to start building a 'collection' of the world's greatest companies while you are still young.

A low-cost index fund is the most sensible equity investment for the great majority of investors.

One of the best things about ETFs is that they usually have very low fees. Since a computer is usually just following a list of companies (the index) rather than a high-paid manager trying to guess which stock is best, it costs very little to run the fund. This means more of the money stays in your pocket.

Finn says:

"I like that they trade all day. If I see a big news story at lunch, I don't have to wait until I get home from school to make a move!"

Choosing Your Own Adventure

Not all ETFs are the same. You can find 'Sector ETFs' that focus only on things you care about. If you think video games are the future, there is an ETF for that. If you care about green energy or healthcare, there are ETFs for those too.

The very first ETF in the United States was launched in 1993. It was the SPY (S&P 500) and it is still the most traded ETF in the world today. Before that, regular people had a much harder time owning hundreds of companies at once.

However, most long-term investors stick to the 'Broad Market' ETFs like the S&P 500. It is a way to bet on the entire economy growing over time rather than trying to predict which specific industry will win next week.

Know what you own, and know why you own it.

Ask a parent to help you look up 'SPY holdings' on a search engine. Look for the 'Top 10' list. You will likely see names you recognize like Apple, Microsoft, and Amazon. This shows you exactly which companies you would partially own if you bought that ETF!

In the end, an ETF is just a tool. It is a way to take the complicated world of stocks-for-kids and turn it into a simple, tradeable bundle. By owning a little bit of everything, you aren't just a consumer buying products: you are an owner of the companies that make them.

Something to Think About

If you could design your own ETF bundle, what three things would you want to include in it?

There are no wrong answers here. Some people choose things they use every day, while others choose things they think will be important in the future. Your values help shape how you see the world's economy!

Questions About Investing

What does ETF stand for?

Are ETFs safer than regular stocks?

Do ETFs pay you money?

Your Journey Into the Market

ETFs are like the training wheels of the investing world, but even the 'pro' cyclists still use them! They are a simple, powerful way to start owning a piece of the world around you. Now that you know how bundles work, why not dive deeper into the different types of things that can go inside them, like index-funds or individual stocks-for-kids?