Have you ever wondered why a rare Pokémon card suddenly costs $100 while others are worth pennies? Or why a new pair of limited-edition trainers can double in price the day after they launch?

The secret behind these price jumps is the exact same thing that moves the stock market. Every single day, stock prices go up and down because of a giant, global game of supply and demand. Understanding this tug-of-war makes you a smarter observer of the economy and helps you see how the world's biggest companies really work.

Imagine you are at a school fair where everyone wants a specific brand of chocolate bar. There are only ten bars left in the whole school. If twenty kids want to buy them, the person selling the bars can raise the price because people are willing to pay more to make sure they get one.

This is the core of how the stock market works. A stock price isn't a fixed number set by a boss in an office. It is a living, breathing number that changes every second based on how many people want to buy it versus how many want to sell it.

In the old days, stock prices weren't updated on computers. They were printed on long strips of paper called 'ticker tape.' People would crowd around the machines just to see if a price had changed by a few cents!

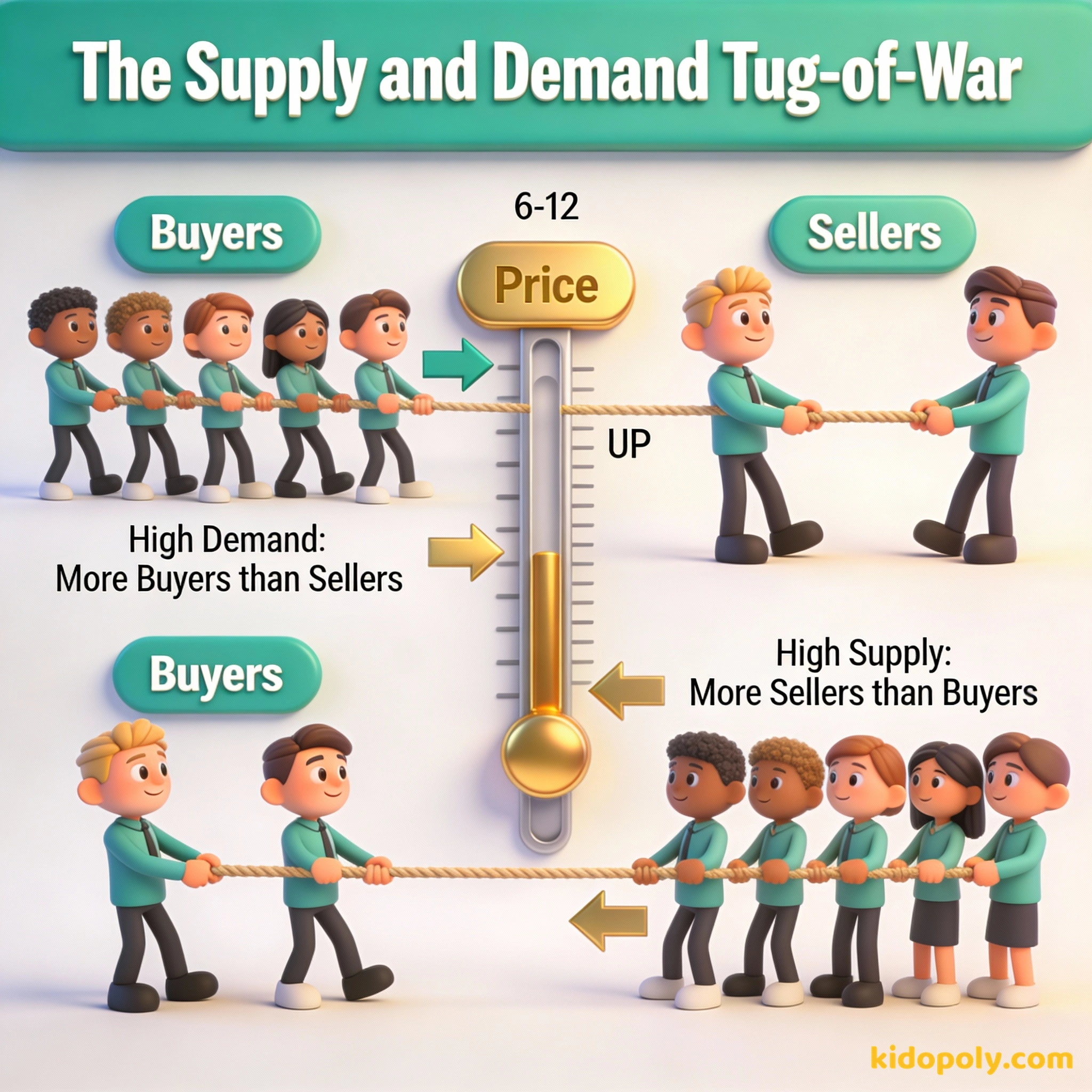

The Tug-of-War: Supply and Demand

To understand price moves, you have to look at the relationship between two groups of people: buyers and sellers. This is a concept called supply and demand. When more people want to buy a stock than there are people willing to sell it, the price goes up.

On the other hand, if a lot of people are trying to sell their stock but nobody really wants to buy it, the price will drop. Think of it like a massive game of tug-of-war. The rope is the price, and each side is pulling as hard as they can based on what they think the stock is worth.

Mira says:

"So, if a famous YouTuber wears a certain brand of hoodie and everyone rushes to buy it, the price on resale sites goes up because the demand is high but the supply is low. Stocks are just hoodies for grown-ups!"

The School Report Card: Company Earnings

What makes people decide to pull on the 'buy' or 'sell' side of the rope? Usually, it is because of how well the company is doing. Every three months, big companies release something called an earnings report.

Think of this like a school report card for the business. It tells the world how much money the company made, what new products they are building, and if they think they will grow in the future. If a company gets straight 'As' on their report card, more people will want to own a piece of it, which pushes the price up.

Behind every stock is a company. Find out what it's doing.

News, Rumors, and Competitors

Prices also move because of what is happening in the news. If a tech company announces a revolutionary new VR headset, investors get excited and start buying. But if a competitor launches a better product for a cheaper price, people might get worried and start selling.

Even things that seem unrelated can move prices. If the price of electricity goes up, it might cost a factory more money to build toys. This could lower their profits, making their stock price dip. The stock market is like a giant machine that processes every piece of news in the world and turns it into a price.

Let's calculate a price move: If a stock starts the day at $50.00 and it goes up by 10%, what is the new price? 1. Find 10% of $50: $50 / 10 = $5.00 2. Add the increase to the original price: $50.00 + $5.00 = $55.00 If it then drops by 10% from $55.00, does it go back to $50.00? 1. Find 10% of $55: $5.50 2. Subtract: $55.00 - $5.50 = $49.50 Math trick: Percentage drops hurt more than percentage gains!

Finn says:

"Wait, if a company makes a billion dollars but people *expected* them to make two billion, does the price still go down? That seems like a tough grading system!"

Feelings: Fear and Excitement

One of the most surprising things about the stock market is that it isn't just about math and money. It is also about human feelings. This is often called market sentiment. When people feel happy and confident about the future, they tend to buy more stocks, which keeps prices high.

However, if people get scared or worried about a global event, they might panic and sell their stocks all at once. This can cause a price to 'crash' or drop very quickly. This is why prices can change every single second: because people's feelings and opinions are changing all the time.

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Imagine you are at an auction for a legendary comic book. The auctioneer starts at $10. Five people raise their hands. The price goes to $20. Now only three people have hands up. It hits $50 and only one person is left. The price stops moving the moment the last person who wants to buy finds the last person who wants to sell. That is a market in action!

Price vs. Value: The Designer Shoe Test

It is important to remember that the price of a stock is not always the same as its actual value. This is a tricky but powerful secret to learn. Imagine a pair of designer sneakers that normally cost $100.

If everyone suddenly decides those shoes are 'uncool' and the price drops to $20, the shoes are still the same high-quality shoes they were before. Their price changed, but their value as a good pair of shoes didn't. In the stock market, prices can bounce around for silly reasons, even if the company is still doing a great job.

Mira says:

"Exactly, Finn! It is all about expectations. It is like getting a B+ when your parents expected an A. Even though you did well, they might still be a little disappointed!"

The Roller Coaster of Volatility

When a stock price bounces up and down a lot in a short amount of time, we call it volatility. For new investors, this can feel like being on a scary roller coaster. You might see your favorite company lose value one day and gain it back the next.

Experts will tell you that this bouncing around is totally normal. If you zoom in on a single day, the price looks like a jagged zig-zag. But if you zoom out and look at the price over ten years, you often see a much smoother line moving upwards. Time is the secret ingredient that turns a bumpy ride into a steady climb.

Price is what you pay. Value is what you get.

Pick a brand you love, like Disney, Roblox, or Apple. Check their stock price today and write it down. Check it again every Friday for one month. See if you can find a news story that explains why the price moved up or down that week!

Something to Think About

If you owned a stock and the price dropped by 5% in one day, would you feel like selling it immediately, or would you wait to see what happens over the next year?

There is no right or wrong answer here. Your choice depends on whether you focus more on the daily 'zig-zags' or the long-term journey of the company. What kind of thinker are you?

Questions About Investing

Why do stock prices change every second?

Is it normal for a stock price to go down?

Can one person move a stock price?

You’re Now a Market Detective

Next time you hear on the news that the 'market is up' or a 'stock has crashed,' you’ll know exactly what is happening behind the scenes. It isn't magic, it is just millions of people playing the world's biggest game of tug-of-war. Ready to learn more about how to navigate this market? Head over to our guide on stock-market-for-beginners to see where all this buying and selling actually happens!