Would you bet $1,000,000 that you could beat the smartest experts on Wall Street?

In 2007, billionaire investor Warren Buffett did exactly that. He wagered that a simple, boring index fund would make more money than a team of professional stock pickers over ten years. Most people thought he was crazy: how could a simple computer-tracked list beat a room full of geniuses? But when the ten years were up, the index fund had grown by 125 percent, while the experts only managed 36 percent. This is the story of the investing cheat code that anyone can use.

Imagine you are standing in a giant sweet shop. You have five dollars to spend. You could spend it all on one giant chocolate bar, but what if that bar turns out to be yucky? Or what if the shop runs out of that specific brand?

You would lose everything you spent. But what if you could buy one tiny bite of every single sweet in the entire shop for that same five dollars? If one chocolate bar is bad, it doesn't matter, because you still have the gummy bears, the lollipops, and the fudge to enjoy. That is the basic idea behind an index fund.

Imagine you are building a Lego city. You could buy one giant, expensive police station set. But if you lose a few key pieces, the whole thing is ruined. Now imagine buying a giant tub of 500 different small sets. Even if you lose the pieces to a tiny car, you still have 499 other sets to play with. That's the safety of an index fund!

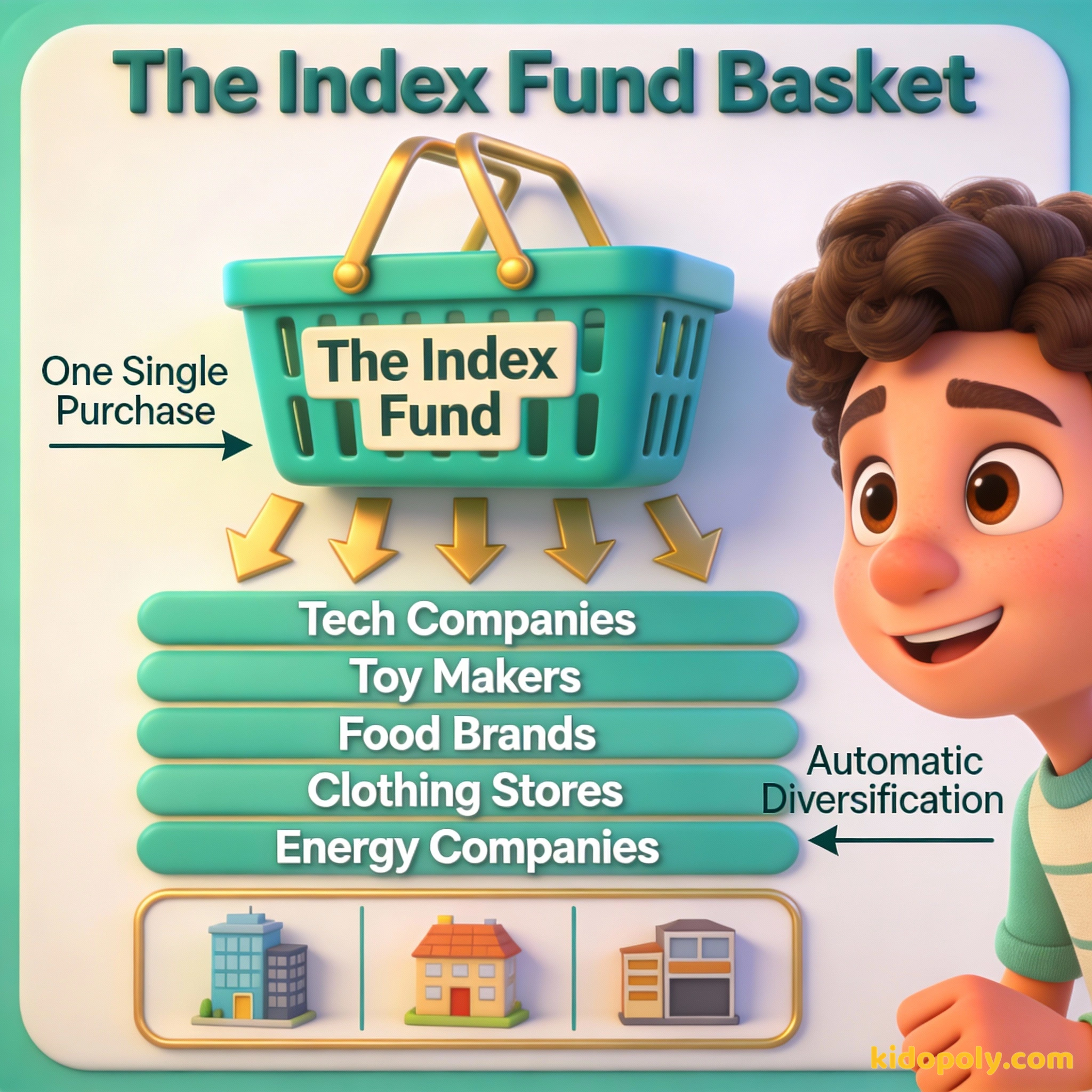

The Basket of Everything

When you buy a stock, you are buying a tiny piece of one specific company. If that company does well, your money grows. If that company has a bad year, you might lose money. It is like putting all your eggs in one basket.

An index fund is different. Instead of picking one egg, you buy the whole basket. An index fund is a special type of investment that automatically buys a little bit of many different companies all at once. It is a group of stocks that move together as a single unit.

Mira says:

"So an index fund is basically like a variety pack of snacks. Instead of one big bag of pretzels, you get a little bit of everything. If you don't like the pretzels, you still have the popcorn!"

Instead of you having to research which company is the best, the fund just follows a list. This list is called a stock index. It is like a leaderboard for the stock market. One of the most famous lists is called the S&P 500.

The 'S&P' in S&P 500 stands for Standard & Poor's. They are the company that creates the list! They don't sell the stocks themselves; they just decide which companies are big enough to be on the leaderboards.

What is the S&P 500?

The S&P 500 is a list of the 500 biggest and most successful companies in the United States. It includes names you probably know, like Apple, Microsoft, Disney, and Amazon. When people say 'the market is up today,' they usually mean this list is doing well.

When you invest in an S&P 500 index fund, you become a tiny owner of all 500 of those companies at the same time. You own a piece of the iPhone, a piece of Mickey Mouse, and a piece of the cereal you ate for breakfast.

By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.

Why the 'Boring' Way Wins

Most people think that to be good at investing, you have to be a genius who watches the news 24 hours a day. They try to 'pick winners' by guessing which company will be the next big thing. This is called active investing.

Index funds use passive investing. There is no human manager trying to guess which stock will go up tomorrow. Instead, a computer simply makes sure the fund owns exactly what is on the list. Because there is no expensive expert to pay, index funds have very low fees.

Professional investors often charge a 1% fee every year. An index fund might only charge 0.03%. If you have $10,000: - Professional Fee: $100 every year - Index Fund Fee: $3 every year Over 30 years, that extra $97 per year (plus the growth you missed) could cost you over $15,000 in 'hidden' costs!

These small savings in fees might not seem like much now, but over many years, they add up to a fortune. This is part of the reason why Warren Buffett won his famous bet. While the professional stock pickers were busy paying themselves big salaries and trading stocks constantly, the index fund just sat there and grew quietly.

The Power of the Whole Market

Individual companies come and go. Fifty years ago, the biggest companies in the world were very different from the ones today. If you had picked just one, that company might not even exist anymore! But the 'market' as a whole tends to grow over time.

Finn says:

"Wait, so if I own an index fund, I don't have to spend hours researching which companies are cool? The computer just does it for me by following the list?"

This is because humans are constantly inventing new things, building better technology, and finding ways to make businesses more efficient. By owning an index fund, you are betting on the entire world's progress rather than just one person's idea.

You try to find the one company that will explode in value, like finding a diamond in the sand. It is high risk, high reward.

You buy the whole beach. You might not find a giant diamond, but you own all the sand and everything in it. It is lower risk and very steady.

Historically, the S&P 500 has had an annual return of about 10 percent over the long term. This means that on average, the value of the index fund grows by 10 percent every year. Some years it goes down, and some years it goes up a lot more, but over decades, it has been a very reliable way to build wealth.

Built-in Protection

One of the coolest things about an index fund is something called diversification. That is a big word that just means you aren't relying on one thing to succeed. In a 500-company index fund, if one company goes bankrupt, it only represents a tiny fraction of your money.

Mira says:

"Exactly! It is like owning a piece of the whole shopping mall instead of just one store. Even if the shoe store closes, the cinema and the food court are still making money."

Think of it like a sports team. If one player has a bad game, the rest of the team can still win. An index fund is like owning the entire league! Even if a few teams lose, the league as a whole stays strong and keeps playing.

Don't look for the needle in the haystack. Just buy the haystack!

Index Funds vs. Individual Stocks

Choosing between an index fund and individual stocks is a big decision for any investor. While buying a single stock like Tesla or Netflix can be exciting, it is also much riskier. You are essentially saying, 'I know more than everyone else about how this one company will do.'

With an index fund, you are saying, 'I believe that successful companies will continue to succeed overall.' It takes the stress out of investing. You don't have to check the stock prices every day. You can just 'set it and forget it' and let the power of time do the work for you.

Ask a parent to help you look up the 'S&P 500 performance' on a search engine. Look at the chart for 'Max' or '10 Years'. You will see a line that zig-zags up and down, but notice how it generally keeps climbing toward the top right corner. That is the power of the market!

A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.

Looking at the Long Road

The secret to index funds isn't magic: it is patience. Because you own so many companies, you don't need to worry about the daily ups and downs of the news. You are playing the long game. For a kid, this is your biggest superpower because you have more time than anyone else to let your money grow.

The Rise of the Index Fund

Something to Think About

If you could own a little piece of any 10 companies in the world, which ones would you choose for your own index?

There are no right or wrong answers! Thinking about which companies you use every day is a great way to start understanding how the stock market works.

Questions About Investing

Can I lose money in an index fund?

Which index fund is the best?

Do I need a lot of money to start?

Your Investing Shortcut

Index funds prove that you don't have to be a math wizard or a Wall Street pro to be a successful investor. By buying the whole market, keeping your fees low, and being patient, you are using the same strategy that billionaires use to keep their wealth growing. Now that you know the 'cheat code,' you might want to learn more about stocks-for-kids or explore the different ways you can start your own investing journey.