Have you ever looked at your school building, the stadium where your favorite team plays, or the shopping center where you buy your clothes and wondered who actually owns them?

The answer is often a group of investors who use real estate to build massive amounts of wealth. Unlike stocks which represent pieces of a company, real estate is tangible property that you can physically touch and walk through.

Your school building, the shopping mall, and even the local park are all part of a massive world called real estate. While most people think of investing as numbers on a screen, real estate is the 'investing you can touch.' It is one of the oldest ways humans have built wealth, dating back thousands of years to ancient civilizations where land was the ultimate prize.

In the modern world, people buy entire buildings just to collect rent every month. Others buy tiny pieces of hundreds of buildings through something called a REIT, right from their phone. Real estate has created more millionaires than almost any other type of investment. Here is how it works.

Imagine you owned a tiny piece of the tallest skyscraper in your city. Every time a business inside that building paid their rent, a small portion of that money landed directly in your bank account while you were at school.

What Exactly is Real Estate?

Real estate is a fancy term for land and any permanent buildings or structures on it. It is not just about the house you live in. It includes everything from high-rise offices and giant warehouses to the forest land where timber is grown.

Investors usually divide property into different categories. Residential real estate includes houses and apartments where people live. Commercial real estate includes places of business, like shops, offices, and even those massive data centers that power the internet.

Mira says:

"Think of it like the ultimate game of Minecraft. But instead of just building for fun, you're building value that people are willing to pay for in the real world!"

The Two Ways Property Makes Money

There are two main ways that property owners grow their wealth. The first is through rental income. This is when a tenant: the person or business using the building: pays the owner a monthly fee for the right to stay there.

How Rent Works: If you own an apartment and charge $1,500 a month in rent: Monthly Income: $1,500 Yearly Total: $18,000 Costs (Repairs/Tax): -$5,000 Net Profit: $13,000 per year That profit is yours to keep or reinvest in more property!

The second way is through appreciation. This happens when the value of the property goes up over time. If an investor buys a piece of land for $100,000 and the city grows around it, that land might be worth $200,000 ten years later. This is the 'buy low, sell high' strategy in action.

Buy land, they're not making it anymore.

Why Real Estate is Unique

Real estate is very different from the stock market. Because there is a limited amount of land on Earth, especially in popular cities, the supply and demand usually works in favor of the owner. As more people want to live in a city, the price of the limited land there goes up.

Property is also less volatile than stocks. This means the price does not usually jump up and down wildly every single day. However, it is much harder to sell quickly. You can sell a stock in seconds, but selling a building can take months of paperwork and finding the right buyer.

The land under the famous McDonald's restaurants is often more valuable than the burgers they sell. McDonald's is actually one of the largest real estate companies in the world!

The Power of Leverage

One reason real estate builds so much wealth is a concept called leverage. This is basically using a small amount of your own money and borrowing the rest to buy something much more expensive. In real estate, this loan is called a mortgage.

Imagine you have $20,000. In the stock market, you can usually only buy $20,000 worth of stocks. But in real estate, you might use that $20,000 as a down payment to buy a $100,000 house. If the house value goes up by 10 percent, you did not just make 10 percent on your $20,000: you made a profit based on the full $100,000 value!

Finn says:

"So if I use a loan to buy a house, I'm technically using the bank's money to make myself richer? That sounds like a cheat code, but I guess you have to be careful about paying it back."

Can Kids Actually Invest in Real Estate?

You generally cannot buy a house or land until you are 18 (or older in some places). However, you do not need to buy a whole building to be a real estate investor. This is where REITs (Real Estate Investment Trusts) come in.

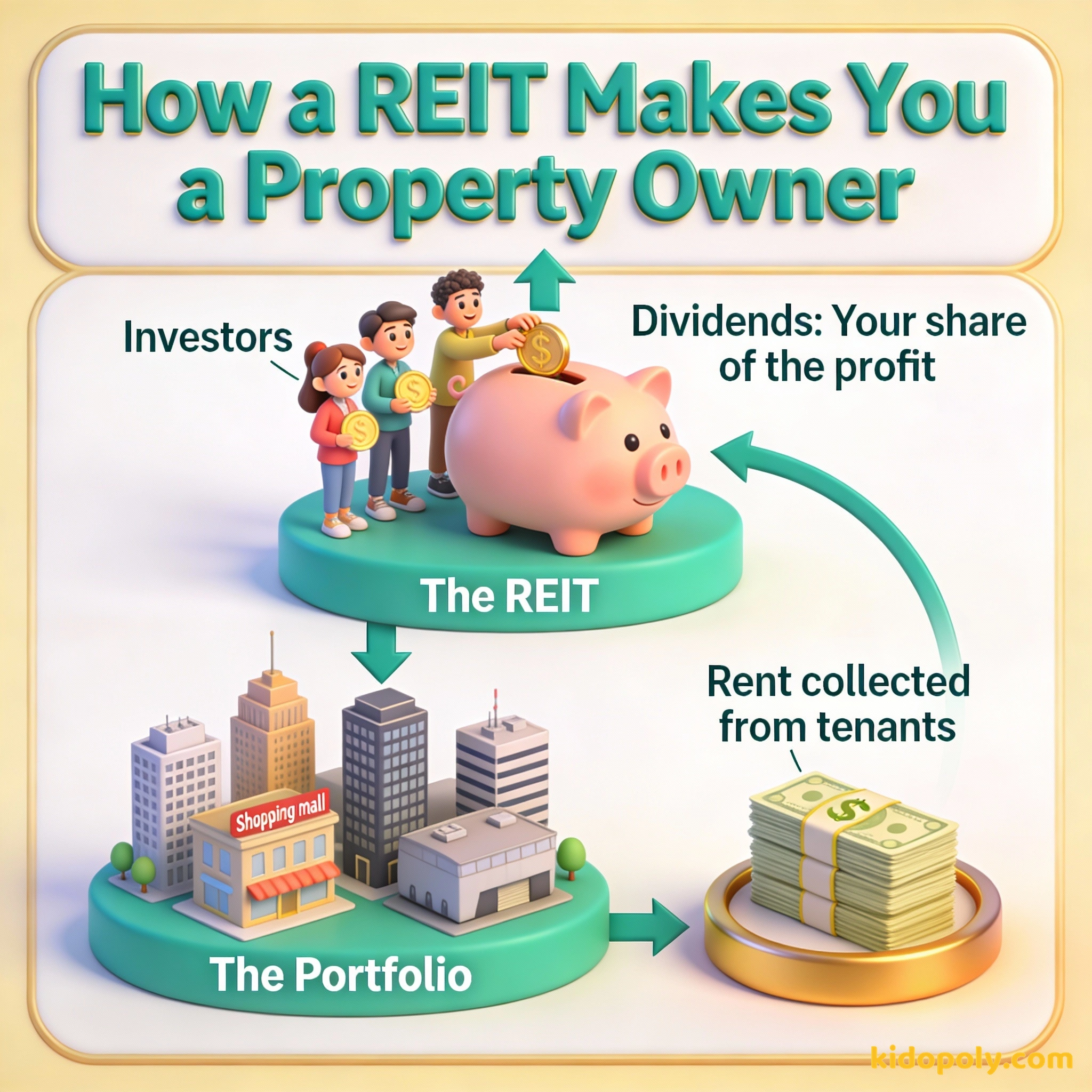

A REIT is a company that owns and manages a huge portfolio of properties. When you buy a share of a REIT on the stock market, you are buying a tiny slice of everything they own. It is like owning a single brick in a thousand different buildings.

Direct ownership is great because you have total control over the building and keep 100 percent of the profit.

REITs are great because you don't need much money to start, you don't have to fix anything, and you can sell your shares easily.

REITs are a great way to start because they are liquid, meaning you can sell your shares anytime you want. Plus, REITs are legally required to give most of their profits back to investors in the form of dividends. This means you get a 'rent check' in your account without ever having to fix a leaky toilet.

Mira says:

"REITs are so cool because I could literally own a piece of a pizza shop, a hospital, and a giant warehouse all at the same time for the price of a video game."

Why Prices Keep Going Up

You might have heard your parents talking about how expensive houses have become. This is usually because of scarcity. In popular places like London, New York, or Sydney, there is simply not enough land to build houses for everyone who wants to live there.

When many people want the same thing (high demand) and there isn't enough of it (low supply), the price goes up. This is why real estate in big cities is often seen as a safer bet than property in the middle of nowhere. Location is the most important rule in the property world.

Ninety percent of all millionaires become so through owning real estate.

The Risks of Property

No investment is perfect. Real estate requires a lot of maintenance. Roofs leak, heaters break, and taxes must be paid every year. If you own a building and cannot find a tenant, you still have to pay the bills even though you are not collecting rent.

There is also the risk of a market crash. While property values usually go up over long periods, they can drop for years at a time. This is why most real estate experts say you should only invest if you plan to hold onto the property for a long time, usually five to ten years or more.

Next time you are in the car, look for 'For Sale' signs. Use a real estate app (with a parent's help) to see how much those properties cost. Try to guess why one house is $300,000 and the one next to it is $500,000.

Real estate is the purest form of entrepreneurship.

Your Path to Property

Even though you cannot sign a deed for a house today, you can start preparing. Many successful investors started by studying their local neighborhoods. They noticed which areas were getting new shops and which were becoming more popular with families.

Understanding how land and buildings work gives you a massive advantage. While others are just looking at numbers on a screen, you will be looking at the physical world and seeing the hidden value in the buildings all around you. That is a true financial superpower.

Something to Think About

If you could own any building in your town, which one would it be and why?

This isn't just about pickings the biggest building: think about which one provides the most value to the community or which one you think will be most important in 20 years. Your values help decide where you should invest.

Questions About Investing

Can I buy a house before I am 18?

Why is location so important?

Is real estate better than stocks?

Keep Your Eyes Open

Now that you know the basics of real estate, you will never look at a building the same way again. Every brick, window, and plot of land is part of a giant financial puzzle. Want to see how real estate fits into a bigger plan? Check out our guide on what-is-investing to see how all these pieces move together!