Imagine there are two ways to make money from a local bakery. You could buy a piece of the bakery and become one of the owners, or you could simply lend the bakery owner some money to buy a new oven.

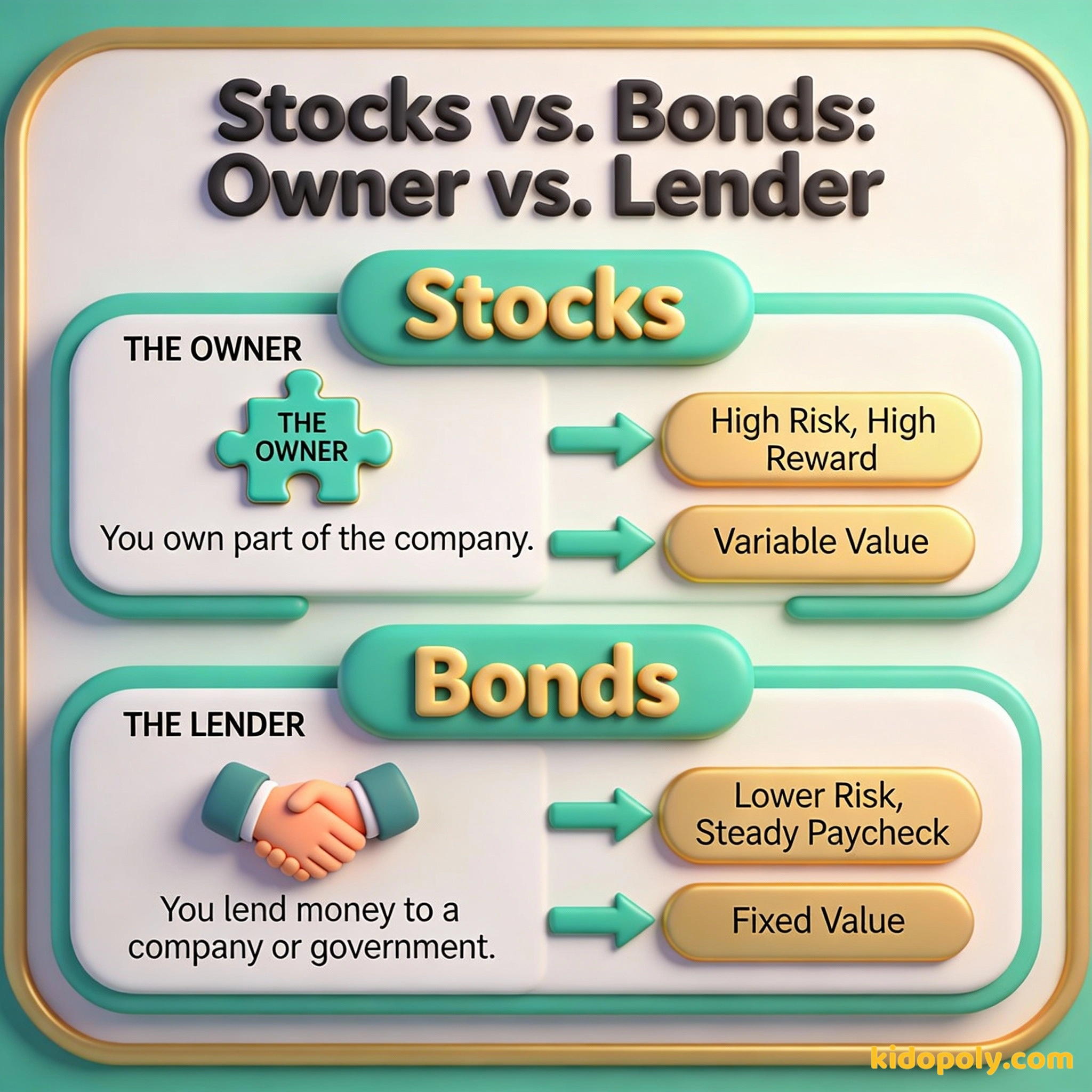

If you buy a piece, you are an owner who shares in the profits when things go well. If you lend money, you are a lender who gets paid back with a little extra. This is the basic difference between stocks and bonds, and understanding which one to choose is like having a financial superpower.

When you start your investing journey, you will hear people talk about 'The Market' all the time. Usually, they are talking about two very different things: stocks and bonds. Both are ways to help your money grow, but they behave like two different types of athletes on a team.

Stocks are like the star strikers in football: they can score a lot of points and win the game, but they also have moments where they miss the shot. Bonds are like the reliable defenders: they might not score the winning goal, but they keep things steady and predictable. To build a winning portfolio, you need to know how to use both.

Imagine you have $100. If you buy a stock in a toy company, you own part of the factory. If they invent the next big holiday toy, your $100 could turn into $500! But if kids stop playing with toys, your $100 could turn into $50. If you buy a bond, you lend them the $100. They promise to give you back $105 next year, no matter how many toys they sell.

Stocks: The Path of the Owner

When you buy a stock, you are buying a tiny slice of a company. If that company grows and makes more money, your slice becomes more valuable. This is why many people love stocks-for-kids, because you get to grow alongside famous brands like Disney, Apple, or Roblox.

Because you are an owner, you take on more risk. If the company has a bad year, the price of your stock might drop. However, over a long time, stocks have historically grown much faster than almost anything else. It is a bumpy ride, but it usually leads to a bigger treasure chest at the end.

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

Finn says:

"So if I buy a stock, I'm basically the boss of a tiny part of the company? Does that mean I can tell them what color to paint the offices?"

Bonds: The Path of the Lender

Buying a bond is very different. Instead of owning a piece of a company, you are acting like a bank. You lend your money to a company or even the government for a set amount of time. In return, they promise to pay you back your original money plus a little extra, which is called interest.

Bonds are generally considered much safer than stocks. You can read more about how they work in bonds-explained. Because the payment is usually guaranteed, bonds do not grow as fast as stocks do. They are the 'slow and steady' part of your investment plan.

Governments use bonds to pay for things like schools, bridges, and even space missions! When you buy a 'Treasury Bond,' you are actually lending your money to the government to help build the world around you.

The Big Comparison: Risk vs. Reward

The biggest difference between these two is the relationship between risk and reward. In the world of money, if you want the chance to make a lot of profit, you usually have to accept the chance that you might lose money in the short term. This is the core of risk-and-reward.

Historically, the stock market has grown by about 10% per year on average over many decades. Bonds, on the other hand, usually grow by about 4% to 5% per year. That might not sound like a huge difference, but over ten or twenty years, that extra 5% adds up to a massive amount of money.

Let's see the power of growth over 10 years with $1,000: Stock Path (10% growth): Year 1: $1,100 Year 5: $1,610 Year 10: $2,593 Bond Path (5% growth): Year 1: $1,050 Year 5: $1,276 Year 10: $1,628 The stocks ended up with nearly $1,000 more than the bonds!

Why Investors Choose Both

If stocks make more money, why does anyone ever buy bonds? Imagine you are saving for a new bike you want to buy next summer. If you put that money in stocks and the market has a bad month right when you need the cash, you might not have enough for the bike.

Mira says:

"It is like having a garden. Stocks are the fruit trees that take years to grow but give you tons of food. Bonds are like the lettuce you can eat in a few weeks."

Bonds are great for money you might need soon because they do not bounce around in price as much. Most adult investors use a 'smoothie' approach. They mix a lot of stocks for growth with some bonds for safety. This helps protect them from the 'crashes' that sometimes happen in the stock market.

The stock market is a device for transferring money from the impatient to the patient.

The Age-Based Secret

There is a classic rule that investors use to decide how much of each they should own. It is called the 'Rule of 100.' You take the number 100 and subtract your age. The result is the percentage of your money that should probably be in stocks.

If you are 12 years old, the rule says 88% of your investments should be in stocks. This is because you have a long time to wait before you need the money, so you can handle the ups and downs. As people get older and closer to retirement, they usually move more of their money into bonds for safety.

I want my money to grow as much as possible, even if the price goes down sometimes. I have plenty of time to wait for it to recover.

I want to make sure my money is safe and I know exactly how much profit I will get. I don't like the idea of my balance dropping.

Finn says:

"Wait, if I'm only 12, the rule says I should have almost all my money in stocks. That sounds exciting but also a little scary if the price drops!"

Making Your Choice

Deciding between stocks and bonds is not about finding a 'right' answer. It is about knowing yourself and your goals. Are you a thrill-seeker who wants the highest possible growth over many years? You might lean toward stocks. Do you prefer knowing exactly how much you will have next year? Bonds might be your best friend.

An investment in knowledge pays the best interest.

A History of Returns

Remember, you do not have to pick just one. Most of the world's most successful investors own both. They use stocks to build wealth for the future and bonds to keep their money safe for today. By understanding the difference, you are already ahead of most adults!

Something to Think About

If you received $100 today, would you feel more comfortable being an 'owner' of a company or a 'lender' to one?

There is no right answer here. Your choice depends on what makes you feel excited versus what makes you feel safe. Think about your goals for that money.

Questions About Investing

Which is safer, stocks or bonds?

Can you lose money in bonds?

Why would anyone buy both at the same time?

Your Investing Adventure Begins

Now that you know the difference between being an owner and a lender, you are ready to start thinking like a real investor. Why not check out our page on 'Risk and Reward' to see how to manage the ups and downs of the market?