By the time children leave primary school, most can solve complex maths problems, but many cannot explain what a bank does or why saving matters.

Financial literacy for elementary students does not require a separate subject. It needs practical, five-minute activities woven into the maths, PSHE, and history lessons already happening in the classroom. By introducing age-appropriate money lessons early, we help children build a foundation of financial capability that lasts a lifetime.

Many educators feel pressured to add more to an already crowded curriculum. However, teaching money is not about adding new topics, it is about applying existing skills to real-world scenarios. For children between the ages of 5 and 11, money is transitioning from a physical object to an abstract concept.

Do not save what is left after spending, but spend what is left after saving.

The Progression of Money Concepts

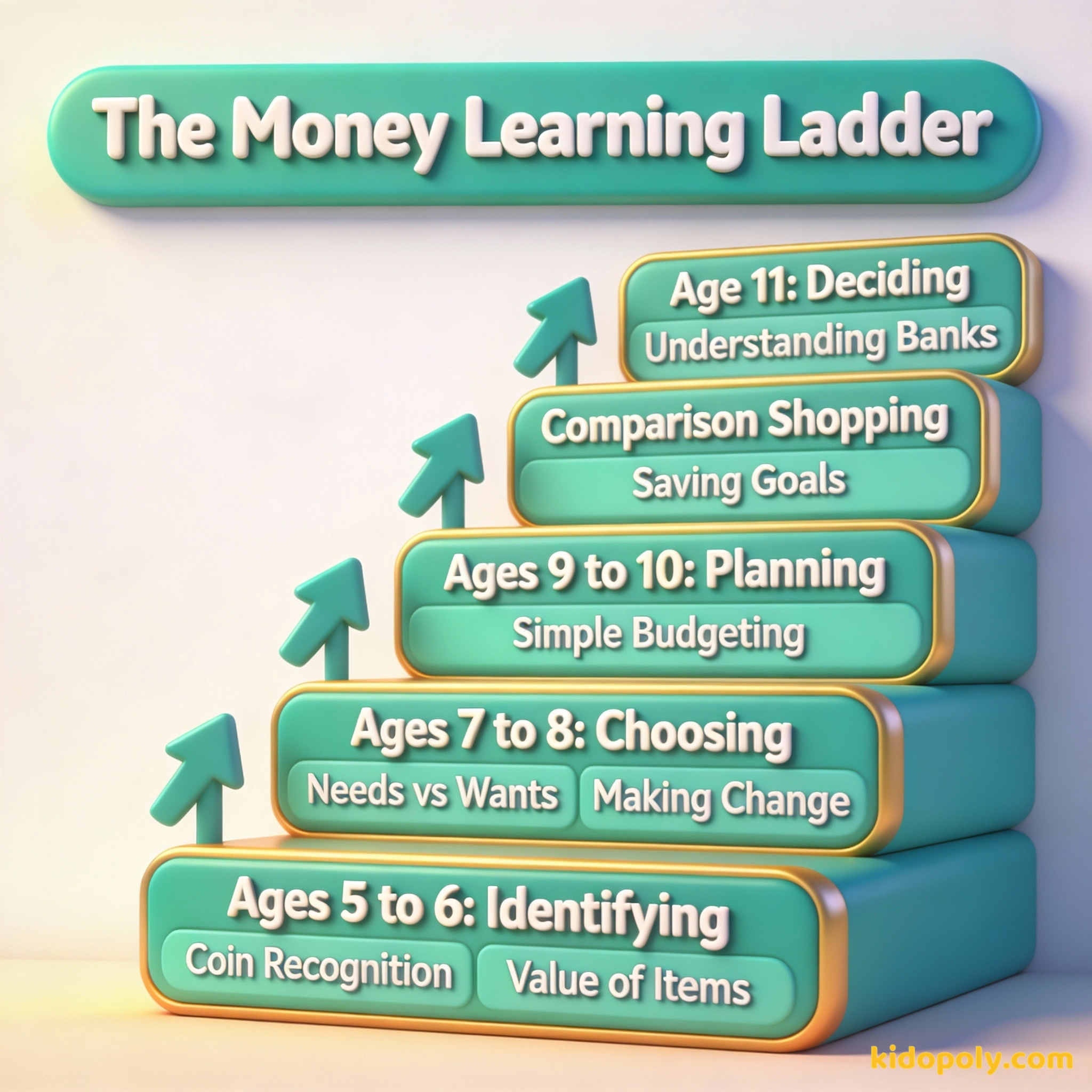

Financial literacy follows the developmental stages of a child. In the early years (Reception to Year 2), focus on the physicality of money. Children need to touch, count, and sort coins to understand that different physical objects hold different values. By ages 5 to 7, they should begin to understand that money is a finite resource used to purchase goods and services.

A landmark study by the University of Cambridge found that most children have formed their basic money habits - such as delayed gratification and planning ahead - by the age of seven.

As children move into Year 3 and 4 (ages 7 to 9), they undergo a cognitive shift. They move from concrete thinking to more abstract reasoning. This is the perfect window to introduce needs vs wants. They can begin to understand that choosing to buy one thing often means not being able to buy another, which is the heart of opportunity cost.

Mira says:

"I used to think 'wants' were just things I didn't have yet, but now I see they are choices. If I buy the cool stickers today, I might not have enough for the cinema trip on Friday!"

By the end of primary school (ages 9 to 11), students are ready for budgeting basics. They can handle multi-step problems, such as calculating discounts or comparing unit prices. This is also when they should explore the role of financial institutions and how digital payments work, bridging the gap between cash and the invisible money they see on screens.

Classroom-Ready Activities

To make these concepts stick, they must be active. A class economy or reward system is one of the most effective ways to teach the value of work and the discipline of saving. Students can 'earn' classroom currency for jobs or positive behaviors and 'spend' it on privileges or small items.

Set up a 'Classroom Token System.' Assign values to different jobs (like Paper Monitor or Desk Tidy). Create a 'Menu' of rewards: 5 tokens for 10 minutes of extra play, 20 tokens for a 'No Homework' pass. This teaches earning and delayed gratification.

Another powerful tool is the pretend shop. For younger students, this focuses on coin recognition and making change. For older students, you can introduce complexity by adding 'sales tax' or limited-time discounts. This forces them to use mental maths in a high-engagement environment.

Finn says:

"Wait, if our classroom shop has a 'Buy One Get One Half Price' sale, do I actually save money, or am I just spending more than I planned to?"

Cross-Curricular Connections

Financial literacy is the ultimate cross-curricular tool. In Maths, you can move beyond simple addition to calculating percentages and decimals through real-world price comparisons. In History, exploring the history of money - from bartering and shells to gold coins - helps children understand that money only has value because we all agree it does.

Physical cash helps younger children see money 'leave' their hands, making the cost feel real and helping them learn to count and make change.

Digital tools and apps prepare older students for the real world where most money is invisible, allowing them to practice tracking transactions electronically.

In PSHE (Personal, Social, Health and Economic education), money lessons focus on responsible choices. Discussing why some people choose to donate to charity or how advertising influences our 'wants' helps develop critical thinking. These discussions prepare students for the social pressures they will face as they enter their teenage years.

An investment in knowledge pays the best interest.

Standards and Frameworks

In the UK, the Money and Pensions Service (MaPS) provides a framework that emphasizes the 'financial capability' of children. They suggest that by age 7, many children have already formed their basic money habits. In the US, the Jump$tart Coalition and Council for Economic Education provide national standards that break down benchmarks for grades K through 12.

Comparison Shopping Exercise: Brand A Cereal: £3.00 for 500g Brand B Cereal: £5.00 for 1kg Ask students: Which is better value? (Answer: Brand B is £0.50 per 100g, while Brand A is £0.60 per 100g. Brand B saves you £1.00 per kilogram!)

These frameworks generally agree on four pillars for elementary students:

- Earning: How people get money through work or gifts.

- Spending: Making choices and understanding prices.

- Saving: Setting goals and the role of banks.

- Sharing: Using money to help others or the community.

Mira says:

"It is interesting how we use points in our classroom like real money. It shows that money can be anything as long as we all agree on what it is worth."

Making the Abstract Concrete

One of the biggest challenges for modern educators is the 'invisibility' of money. With the rise of contactless payments and apps, children rarely see physical cash change hands. This makes it harder to understand that money is being 'spent' rather than just 'tapped'.

Imagine you are on a desert island. You have a bag of gold coins, but your friend has a large bottle of fresh water. On this island, your gold cannot buy a burger or a toy. Suddenly, that water is worth much more than the gold. This is how we learn that the 'value' of money depends on what we need to survive.

To combat this, use visual aids like saving jars or progress charts in the classroom. When a class is saving for a reward, a physical thermometer that gets filled in as they 'earn' credit provides a visual representation of progress that a digital balance cannot match.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make.

Something to Think About

If you were given £10 to spend on your classroom, would you buy one big thing for everyone to share, or many small things for people to have individually?

There is no right or wrong answer here. This is about exploring your personal values and how you think about sharing and community resources.

Questions About Learning & Teaching Money

What is the most important money concept for a 7-year-old?

How do I teach money in a classroom without using real cash?

Should I teach elementary students about credit cards?

Build a Money-Confident Generation

Teaching financial literacy in elementary school is about giving children the vocabulary and the confidence to navigate the world. By making money lessons a natural part of the school day, we take the mystery out of finances. Ready to dive deeper into specific concepts? Explore our guides on what is money or start a conversation about needs vs wants today.