Did you know that Warren Buffett, one of the richest people in history, bought his very first stock when he was only 11 years old?

Buffett has often said his biggest regret was not starting even earlier. For young people today, the path to financial confidence begins with understanding how the stock market and compound interest work. You don't need a degree in finance: you just need the right investing for kids book to make the concepts click.

Most people think investing is something only adults in suits do. But the truth is: time is the most valuable asset in the world of money. If you start learning about the stock market now, you have a massive head start over everyone else.

The New York Stock Exchange was founded in 1792 under a buttonwood tree! Investors used to meet there to trade pieces of companies by hand.

Choosing the right book depends on how much you already know. We have divided these recommendations into three levels: Beginner, Intermediate, and Advanced. This helps you or your child find the perfect starting point without feeling overwhelmed.

Beginner: What Investing Actually Is

If you are new to the idea of putting money to work, start with books that focus on the big picture. These books explain that investing is not just about numbers: it is about owning a tiny piece of the companies that make your favorite sneakers, phones, and games.

Finn says:

"If I buy a stock and the company has a bad day, do I lose all my money right away? That sounds a little scary!"

'Growing Money' by Gail Karlitz and Debbie Honig is the gold standard for beginners. It uses very simple language to explain stocks, bonds, and mutual funds. It is perfect for ages 10 to 12 because it treats the reader like a smart person without using confusing wall-street talk.

The best time to start was yesterday. The next best time is today.

Another great entry point is 'The Kids' Guide to Money' by Steve Otfinoski. While it covers broader money topics, its sections on how the stock market was created are fantastic for history fans. It helps kids see that investing is a system humans built to help businesses grow.

Imagine you own 1 share of a pizza company. Every time someone in the world buys a slice of that pizza, a tiny, tiny fraction of that profit belongs to you because you are a part-owner.

Intermediate: How the Markets Work

Once you understand that investing means 'owning,' you are ready to learn 'how.' These books go deeper into how to pick companies and how the price of a stock goes up or down.

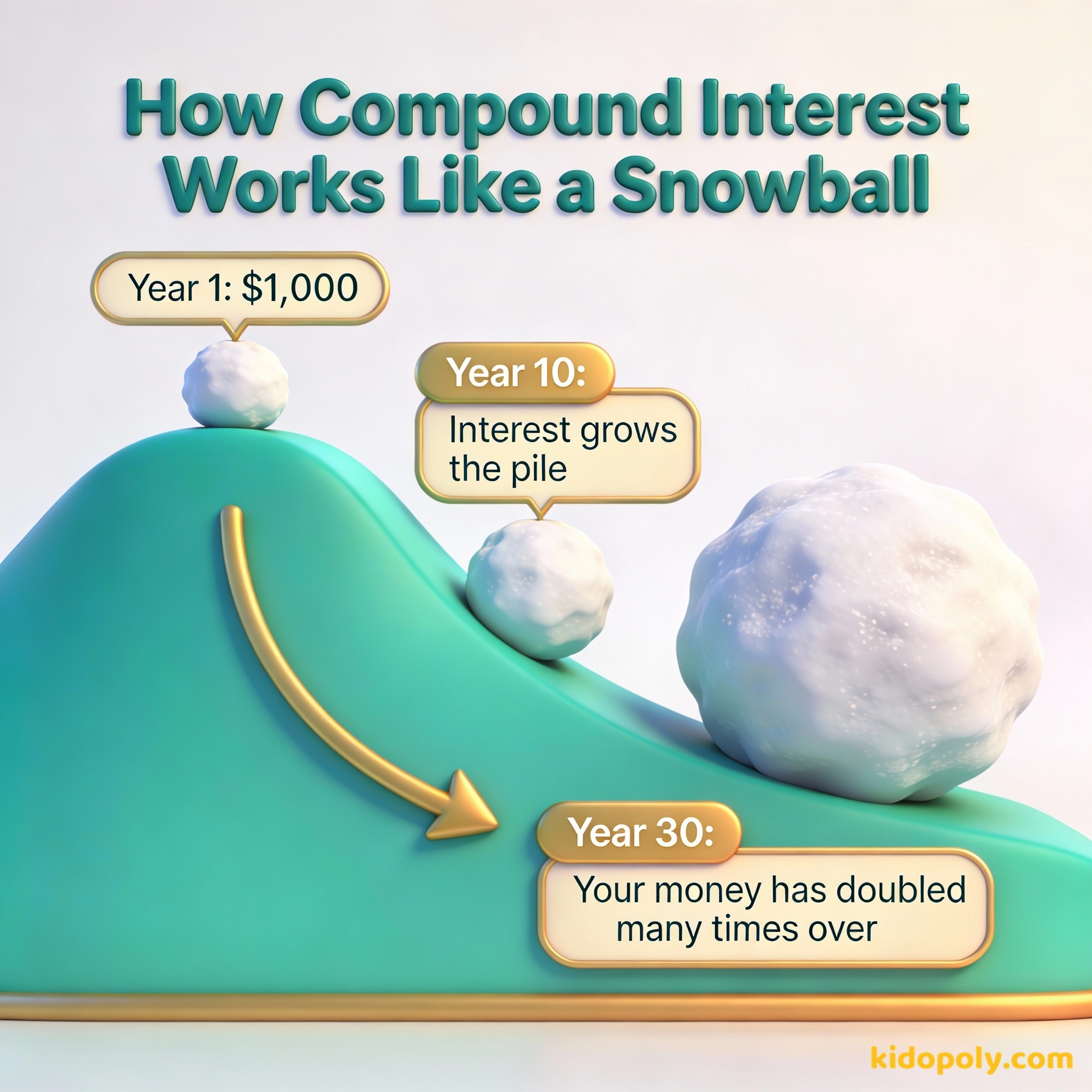

'How to Turn $100 into $1,000,000' by James McKenna and Jeannine Glista is a favorite among financial educators. It uses a very visual, graphic-novel style to teach the power of compound interest. It shows that you do not need to be rich to start: you just need a plan and a lot of patience.

This book is particularly good for families to read together. It includes a 'Millionaire's Roadmap' that helps you set goals. It teaches that the stock market is not a casino: it is a place where you build wealth over many years by staying consistent.

Mira says:

"Think of it like this, Finn: when you buy a stock, you're like a tiny partner in that business. If they sell more toys or shoes, your 'partnership' becomes more valuable!"

'Blue Chip Kids' by David W. Bianchi was actually written by a father for his son. It covers 100 different topics in short, two-page chapters. It is an excellent 'encyclopedia' of investing for a 12 or 13-year-old who has a lot of 'what if' questions.

If you invest $1,000 and it grows by 7% every year: - After 10 years: You have $1,967 - After 20 years: You have $3,869 - After 40 years: You have $14,974 Your original $1,000 did all that work just by sitting there!

Advanced: Real Strategies for Teens

If you are a teenager and you are ready to actually look at stock charts or understand how a company makes a profit, you need something more substantial. These books prepare young people for the reality of opening their first custodial account.

An investment in knowledge pays the best interest.

'The Motley Fool Investment Guide for Teens' by David and Tom Gardner is arguably the best book for the 14-16 age group. It is witty, slightly irreverent, and very honest. It teaches teens how to research companies they actually use, like Netflix or Disney, and how to ignore the 'noise' of the daily news.

Buying individual stocks of companies you like, which requires a lot of research and carries more risk.

Buying 'Index Funds' which hold hundreds of stocks at once, offering more safety and less work.

'Better to Be Rich than Stupid' by Kirsten Weiss is another strong choice for older teens. It focuses on the mindset of an investor. It emphasizes that your brain is your best tool for building wealth: not a lucky tip from a friend or a social media post.

Finn says:

"So if I read 'The Motley Fool,' I can actually learn how to pick which companies are doing a good job?"

What Makes a Good Investing Book?

Not every book about money is worth your time. When you are looking for an investing for kids book, you should look for three specific things:

- Relatable Examples: Does the book talk about companies you know? If it only talks about railroads and oil from 100 years ago, it might be boring.

- Realistic Returns: Avoid any book that promises you will 'get rich quick.' Good books emphasize that investing takes time.

- Clear Fundamentals: Look for books that explain diversification (not putting all your eggs in one basket) and the risks of the market.

Go to your local library and look for the 'Investing' section. See if they have 'How to Turn $100 into $1,000,000.' It is one of the most checked-out money books for kids!

The first rule of compounding is to never interrupt it unnecessarily.

Reading these books is the first step toward financial literacy. Once you finish one, you might want to learn more about what is investing or look for other money books for kids that cover budgeting and saving.

Something to Think About

If you could own a tiny piece of any company in the world right now, which one would you pick and why?

There are no wrong answers here. This is about thinking like an owner. Would you pick a company because you love their products, or because you think they are going to grow in the future?

Questions About Learning & Teaching Money

Are these books too hard for a 10-year-old?

Should I read these books with my child?

Do these books tell you exactly which stocks to buy?

Your Investing Journey Starts with a Page

Reading is the lowest-cost, highest-return investment you will ever make. By picking up one of these books, you are doing exactly what the world's greatest investors did at your age. Start with one that sounds fun, take your time, and remember that every expert was once a beginner who decided to open a book.