Monopoly has been teaching kids about money since 1935, but it also teaches them that the best financial strategy is to bankrupt everyone else.

Some money board games for kids are brilliant teachers that build lasting financial literacy. Others teach lessons you might eventually want to unteach as your child grows. This guide evaluates the classics and modern gems to help you choose the right educational board games for your next family night.

Most parents remember the marathon sessions of Monopoly from their own childhoods. While these games are staples of family life, the actual lessons they teach can be a mixed bag.

Monopoly was originally invented by Lizzie Magie in 1903 as 'The Landlord's Game.' She actually designed it to show the dangers of monopolies and land grabbing, not to celebrate them!

When you play a board game with your child, you are doing more than just passing time. You are giving them a safe laboratory to test out money management strategies without the sting of real-world consequences.

Finn says:

"But wait, if I buy the most expensive property in Monopoly, won't I run out of cash to pay rent if I land on someone else's space?"

The Classics: Monopoly, Life, and Payday

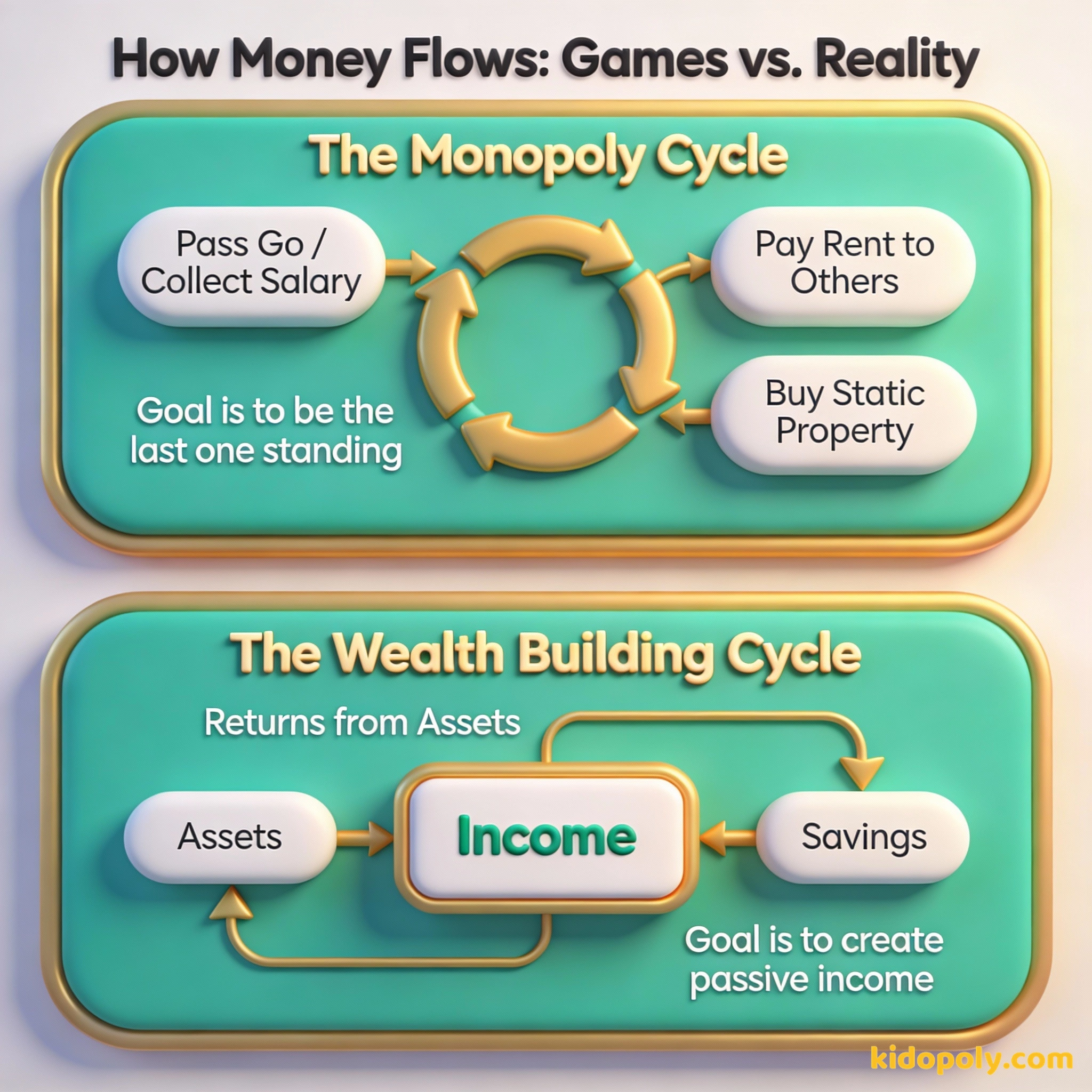

Monopoly is the world's most famous money game, but its financial lessons are specific. It teaches negotiation, property valuation, and the importance of cash flow to stay in the game.

However, it also rewards monopolistic behavior and rent-seeking, which are not exactly the skills needed for a balanced financial life. In the real world, someone else's success does not have to mean your bankruptcy.

Games are a great way to learn about money because they allow you to make mistakes without losing real money.

The Game of Life takes a broader view of finances. It introduces the impact of life choices, like whether to go to university or start a career immediately.

It is excellent for showing how insurance and major life events, like having children or buying a house, affect your bank balance. However, it relies heavily on luck rather than strategic choices, making it more of a simulation than a teaching tool.

The game follows a strict path where players just roll and move. There is little room for saving or investing strategy.

It starts great conversations about how career choices and education levels impact your lifelong earning potential.

Payday is perhaps the most practical of the older classics. It focuses on the monthly cycle of earning a salary and managing expenses.

Mira says:

"This reminds me of when we had to choose between getting that extra dessert or saving our pocket money for the weekend movie."

Kids learn to deal with bills, unexpected expenses, and the temptation of consumer deals. It is a fantastic tool for teaching basic budgeting and the reality of how quickly a paycheck can disappear.

Modern Standouts: Cashflow and Act Your Wage

Cashflow for Kids, created by Robert Kiyosaki, is designed specifically to teach the difference between assets and liabilities. It moves away from the 'collect a paycheck' mindset and focuses on building passive income.

In Cashflow for Kids, you learn about ROI (Return on Investment). If you buy a 'small business' for $500 and it pays you $50 every month: $50 x 12 months = $600 a year. Your money has paid for itself in less than a year! That is a 120% return.

This game is widely considered one of the best financial board games for kids because it changes the goal of the game. Instead of just accumulating cash, the goal is to have your investments cover your monthly expenses.

Teaching kids about money is about more than just numbers. It is about teaching them how to live.

Act Your Wage is a game from Dave Ramsey that focuses on debt-free living. It teaches kids about an emergency fund, saving for big purchases, and the danger of credit cards.

It is less about high-stakes investing and more about the discipline required to stay out of debt. This makes it a great choice for families who want to emphasize savings and responsible spending over aggressive wealth building.

Next time you play a money game, act as the 'Banker' but have your child do all the math for the change. It slows the game down, but it builds incredible mental math speed.

Starting Early: Games for Younger Children

For children aged 5 to 8, money concepts need to be much simpler. At this stage, the focus is on coin recognition and basic addition and subtraction.

Money Bags is a standout for this age group. Players move around the board and collect a specific amount of money using different combinations of coins. It turns basic money math into a puzzle, helping kids get comfortable with physical currency.

Finn says:

"So if I have four quarters, is that the same as having a one dollar bill? It feels like the quarters should be worth more because they are heavier!"

Why Physical Games Beat Digital Apps

While we cover many digital options in our guide to money-games-for-kids, board games offer unique benefits. The physical act of handing over bills and receiving change makes the transaction feel real.

Imagine your child has to decide whether to buy a property or save their cash for rent. In a digital app, it is a button click. In a board game, they have to physically count their remaining bills and realize they only have two $10s left. That visual 'emptiness' of the wallet is a powerful teacher.

Board games also require patience and face-to-face negotiation. These social skills are just as important for financial success as knowing how to balance a checkbook or understand interest rates.

The most important investment you can make is in yourself.

If you are looking for more ways to integrate these lessons into daily life, you might want to check out our guide on how to teach-kids-about-money for practical tips beyond the game board.

Something to Think About

If you won $1,000 in a game today, how would your strategy change if you knew it would be real money tomorrow?

This is a great dinner table question. There is no right or wrong answer, but it helps kids think about the difference between 'play money' and their actual values.

Questions About Learning & Teaching Money

At what age should I start playing money board games with my child?

Are modern money games better than the classics?

How can I make these games less frustrating for younger kids?

Level Up Your Family Game Night

Choosing the right board game is just the beginning. Whether you are navigating the linear path of Life or building a real estate empire in Monopoly, the conversations you have during the game are what stick. Use these games as a bridge to real-world discussions about your family's financial values and goals.