Can a simple bedtime story really change how your child handles their first paycheck ten years from now?

A well-chosen book can do what lectures cannot: it makes a child actually want to learn about financial literacy. By using stories to explore money management, you can plant seeds of wisdom that grow alongside your child from preschool through their teenage years.

Most parents feel a bit of pressure when it comes to teaching kids about money. We want them to be responsible, but we do not want to bore them with spreadsheets. Books offer a perfect middle ground, providing a framework for conversations that feel like fun rather than a chore.

Finn says:

"If I read a book about money, does that mean I'll automatically know how to get a raise on my allowance?"

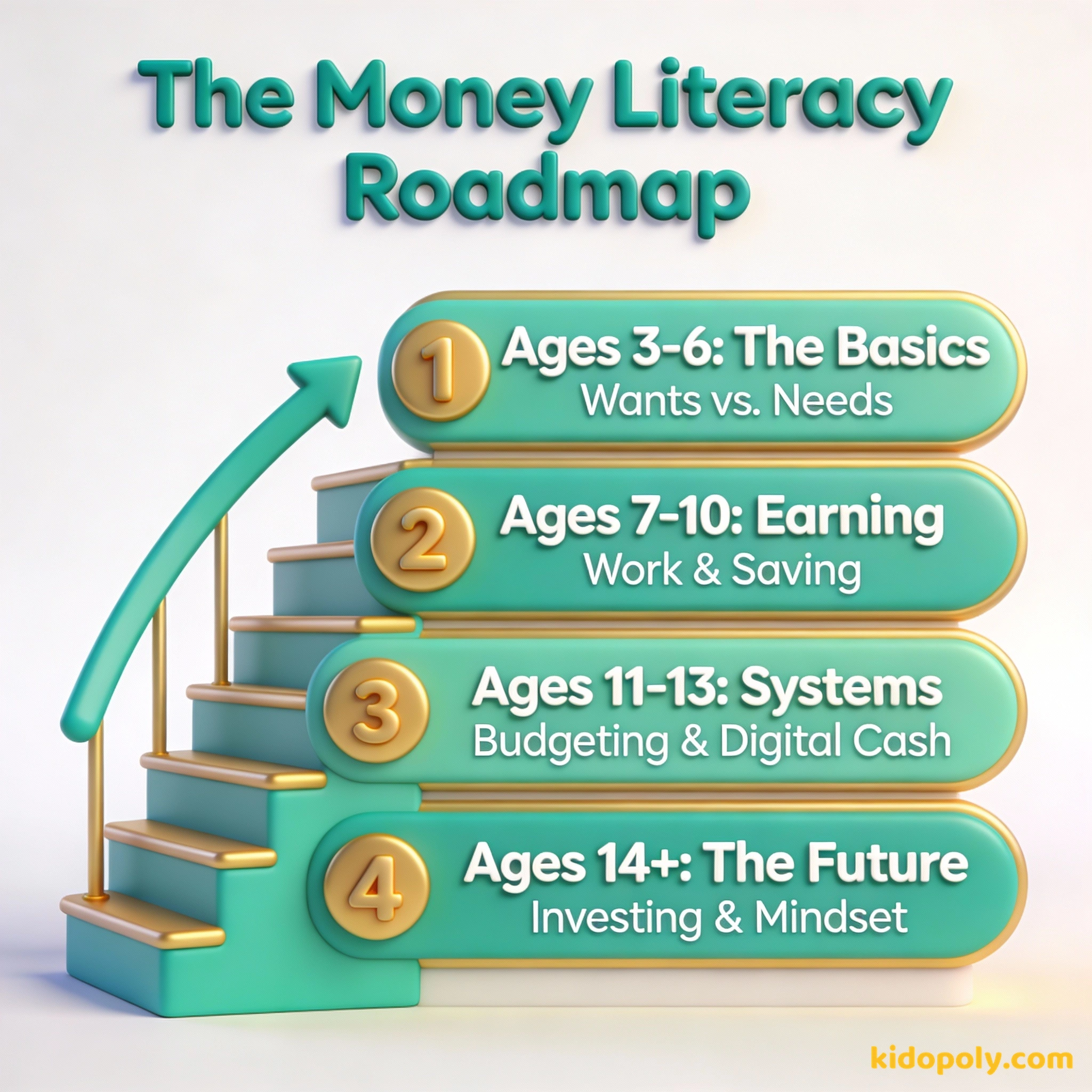

Picture Books for the Early Years (Ages 3 to 6)

At this stage, children are just beginning to understand that money is a limited resource. They see us tap a card or a phone and items magically appear, which can make money feel invisible. The goal of these books is to make the concept of scarcity and the difference between wants and needs tangible.

The best investment you can make is in yourself.

- Alexander, Who Used to Be Rich Last Sunday by Judith Viorst: This classic captures the struggle of impulsive spending. Alexander receives a dollar and watches it vanish through small, silly purchases.

- Bunny Money by Rosemary Wells: Max and Ruby go shopping for a birthday gift. It is a fantastic introduction to how quickly a budget can disappear when you are not paying attention.

- Sheep in a Shop by Nancy Shaw: A simple, rhyming story that introduces the idea of trading and what happens when you do not have enough money for your choices.

A study from the University of Cambridge found that by age 7, most children have already grasped the basic concepts of how money works and have formed their primary financial habits.

Building Foundations in Primary School (Ages 7 to 10)

By age seven, many children have developed basic money habits. They are ready to learn about earning, saving for longer-term goals, and the basics of entrepreneurship. These books move away from just 'spending' and toward 'managing.'

Mira says:

"I like the stories where the kids start a business. It makes me realize that even small choices at the shop actually add up over time."

- The Berenstain Bears' Trouble with Money by Stan and Jan Berenstain: The cubs start earning money but realize that making it and keeping it are two different skills. It is a great prompt for discussing how to teach kids about money through chores.

- The Lemonade War by Jacqueline Davies: This fiction favorite introduces business concepts like marketing, competition, and profit margins through a sibling rivalry.

- Rock, Brock, and the Savings Shock by Sheila Bair: Written by a former FDIC chair, this story uses two brothers to demonstrate the incredible power of compound interest in a way kids actually understand.

After reading a book about earning, try the Three Jar system: label three jars 'Spend,' 'Save,' and 'Give.' When your child gets money, let them decide how to split it among the jars based on what they learned.

Middle Grade Systems and Logic (Ages 11 to 13)

As children enter their pre-teen years, their financial world expands. They may have their own debit cards or digital accounts. This is the time to introduce more formal systems and the logic behind budgeting.

Money habits are set by age seven.

- Finance 101 for Kids by Walter Andal: This is a comprehensive guide that covers everything from credit scores to the stock market. It uses relatable examples to explain why we pay taxes and how banks work.

- How to Turn $100 into $1,000,000 by James McKenna and Jeannine Glista: This book focuses on the 'wealthy mindset.' It teaches kids that saving is not just about not spending, but about making their money work for them.

- Heads Up Money by DK: Like all DK books, this is highly visual. It covers the 'why' of economics, helping kids see how their individual choices fit into the global economy.

Imagine you have a magical penny that doubles every day. On day one, you have one penny. By day thirty, you would have over five million dollars. That is the power of compound interest that many middle-grade books try to explain.

Real-World Readiness for Teens (Ages 14 to 17)

For teenagers, money is no longer a concept: it is a reality. They are looking toward first jobs, cars, and university. The best books for this age focus on long-term wealth building and avoiding the common traps of the adult world.

Finn says:

"Some of these teen books talk about 'assets.' Is my bike an asset, or is it just a way to get to my friend's house?"

- Rich Dad Poor Dad for Teens by Robert Kiyosaki: This adapted version of the bestseller focuses on the difference between assets and liabilities. It encourages teens to think like creators and owners rather than just employees.

- Get a Financial Life by Beth Kobliner: While often read by young adults, it is a perfect guide for a sixteen-year-old. It covers the nuts and bolts of banking, taxes, and even the basics that lead into investing books for kids.

- I Want More Pizza by Steve Burkholder: This book uses a pizza metaphor to explain personal finance. It is short, punchy, and respects a teenager's time by getting straight to the point of how to grow their 'slice' of wealth.

An investment in knowledge pays the best interest.

The Rule of 72: To find out how many years it takes for your money to double, divide 72 by your interest rate. Example: 6% interest 72 / 6 = 12 years to double your money.

Selecting the right book is about matching your child's current interest level. You do not need to read every book on this list. Start with one that addresses a question they have already asked, like 'Why can't I have that?' or 'How do I get more money?'

Focus on fiction books that use stories and characters to teach moral lessons about money and greed.

Focus on non-fiction books that teach technical skills like banking, interest rates, and budgeting.

Something to Think About

Which book from your own childhood taught you the most about how the world works?

There are no right or wrong answers here. Some of us learned from a story about a lemonade stand, while others learned from watching their parents manage a household budget. Share that memory with your child to show them that everyone starts somewhere.

Questions About Learning & Teaching Money

At what age should I start reading money books to my child?

Are older books like The Berenstain Bears still relevant today?

Should I choose fiction or non-fiction for my teenager?

From Page to Piggy Bank

Reading is just the first step. The real magic happens when the story ends and the conversation begins. Use these books as a springboard to talk about your own family's values. If you are ready to move beyond reading, check out our guide on how to teach-kids-about-money in everyday life.