Next time you are at the supermarket, hand your child a 10-pound note and ask them to find everything you need for dinner without going over budget.

In 20 minutes, they will learn more about financial literacy than a month of lectures could ever teach. This guide shows you how to turn everyday life into a powerful, stress-free money education for your family.

Money is one of the most important tools your child will use in their life. Yet, many of us feel awkward talking about it. We worry about saying the wrong thing or making our kids feel stressed. The truth is that teaching money does not have to be a formal lesson.

The Supermarket Dinner Challenge: Give your child £10 and a list of 3 ingredients needed for dinner. Let them choose the brands and sizes. If they come in under budget, they can put the change in their Save jar.

It happens in the checkout line, on the way to school, and at the kitchen table. It is about moving from abstract numbers on a screen to real-world decisions. When you make money a normal part of the conversation, you take away the mystery and replace it with confidence.

Do not save what is left after spending, but spend what is left after saving.

The Power of Show, Don't Tell

Kids learn how to handle money by actually handling money. You can talk about budgeting for hours, but a child will not truly understand until they have a physical coin or note in their hand. Physical money makes the concept of scarcity real.

Finn says:

"If money is just numbers on your phone, how do I know when it's all gone? It feels like it never runs out until the card stops working!"

When you give a child cash, they can see it disappear when they buy something. Digital money is too abstract for young minds to grasp at first. Start with physical coins and notes so they can see the pile grow as they save and shrink as they spend.

According to a study by the University of Cambridge, many of our adult money habits are actually formed by the age of seven. This is why starting early with simple concepts is so vital.

Use every shopping trip as a mini-lab. Ask your child to help you find the best value for cereal or bread. Show them two different prices and explain why you are choosing one over the other. This simple act teaches comparison shopping and value for money.

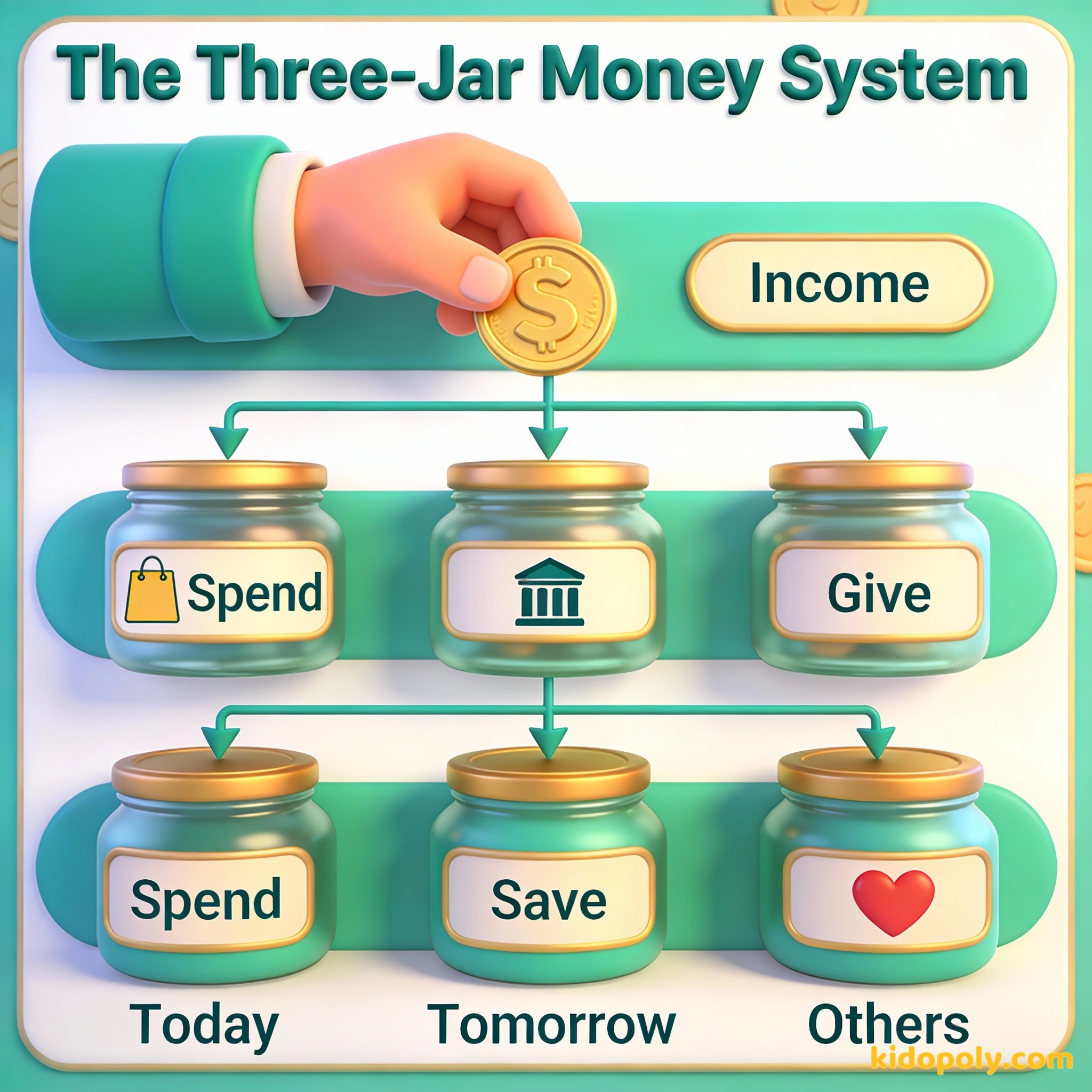

The Three-Jar Framework

A simple way to organize money lessons is the three-jar method. Instead of one piggy bank, give your child three clear jars. Label them Spend, Save, and Give. This creates a visual map of how money works and teaches that not all money is for immediate use.

- The Spend jar is for immediate wants, like a small toy or a treat.

- The Save jar is for bigger goals that require waiting.

- The Give jar is for helping others, whether a charity or a gift for a friend.

Mira says:

"I like the Give jar the most. It makes me realize that my money isn't just for me, it can actually change things for someone else too."

This system teaches prioritisation without you needing to say a word. It allows your child to feel the weight of their decisions. If they empty their Save jar for a cheap toy today, they will quickly realize they have to wait longer for the bike they really wanted.

Buying a small toy now gives you happiness for a few hours, but the money is gone forever.

Waiting and saving for a larger goal gives you a bigger reward later and teaches you patience.

Reframing the Conversation

Many parents fall into the habit of saying, "We can't afford that." While often true, this phrase can create a sense of scarcity and anxiety. Instead, try reframing the sentence to reflect your values and choices.

"We are choosing not to spend our money on that right now because we are saving for our holiday."

An investment in knowledge pays the best interest.

This shift moves the child from a feeling of lack to a feeling of control. It shows them that money is a limited resource and that adults have to make choices too. It turns a "no" into a lesson about long-term goals and planning.

Comparison Shopping Example: Brand A Cereal: £4.00 for 500g (80p per 100g) Brand B Cereal: £6.00 for 1kg (60p per 100g) By buying the bigger box, you save 20p for every 100g you eat!

Letting Them Make Mistakes

It is incredibly hard to watch your child waste their pocket money on a plastic toy that will break in ten minutes. However, these are the most valuable lessons they will ever have. A £5 mistake at age seven is much better than a £5,000 mistake at age twenty-seven.

Finn says:

"Wait, so you're saying if I buy this cheap robot today, I'm actually saying 'no' to the Lego set I wanted next month? That's a hard choice."

When a child regrets a purchase, do not say, "I told you so." Instead, ask them how they feel about it. Ask them if they would make the same choice next time. This encourages reflection and helps them develop an internal compass for spending.

Imagine you have £5. You see a cool sticker book for £4.99. You buy it. Ten minutes later, you walk past a comic book you have wanted for weeks, but it costs £3.00. Because you spent your money on the stickers, the comic book is now out of reach. That feeling is the first step to becoming a smart spender.

Normalise Money at the Table

Money should not be a secret. While you do not need to share your exact salary, you can talk about the family budget in general terms. Mention when the electricity bill comes in or discuss how much you are setting aside for the car repair.

The goal of money is to make you feel secure.

This transparency removes the taboo. When kids see that money is something adults manage with a plan, they stop seeing it as something to fear. They begin to see it for what it truly is: a tool to build the life they want.

Something to Think About

What is one thing our family spends money on that makes us really happy?

Use this question to start a conversation about values. There is no right or wrong answer: it is about understanding that we use money to support the things we care about most.

Questions About Learning & Teaching Money

When is the best time to start teaching kids about money?

Should I pay my child for doing chores?

How do I explain interest to a child?

Start the Conversation Today

The goal isn't to turn your child into a mini-accountant. It is to give them the tools to make informed, confident choices. Start small, use real money, and don't be afraid to talk about the 'why' behind your spending. For more specific guidance, explore our age-by-age guides below.