Imagine two people each borrow 10,000 pounds. Person A uses it to train as a plumber and earns 40,000 pounds a year. Person B uses it to buy a luxury hot tub that is only worth 3,000 pounds two years later.

Same amount borrowed, but two completely different outcomes. Learning the difference between good debt and bad debt is like having a financial superpower. It allows you to use borrowed money to build a better life instead of getting stuck in a money trap.

Most people think all debt is scary. They see it as a heavy weight that stays with you forever. While it is true that borrowing is a big responsibility, not all debt is the same.

In the UK, student loans work differently than other debt. You only start paying them back once you earn over a certain amount of money. If you never earn that much, you might never have to pay it all back!

In the world of finance, debt is just a tool. Like a hammer, you can use it to build a house or you can accidentally hit your thumb. It all depends on how you use it.

The Superpower: Good Debt

Good debt is money you borrow to buy things that will make you richer in the long run. These things are called assets. An asset is something that either goes up in value or helps you earn more money than you could before.

Good debt is debt that puts money in your pocket. Bad debt is debt that takes money out of your pocket.

Think about a student loan. You borrow money to go to university or trade school. This is an investment in your brain. Because you have those new skills, you can get a higher-paying job for the next 40 years.

Another example is a mortgage. This is a special loan used to buy a home. Houses often increase in value over time. Instead of paying rent to a landlord, you are slowly owning a piece of property that could be worth much more later.

Finn says:

"So if I borrow money to buy a lawnmower for my summer gardening business, is that good debt? It helps me earn more than the mower costs!"

- Education: Increases your earning power.

- Business Loans: Helps you start a company that makes a profit.

- Real Estate: Buying property that grows in value.

The Money Drain: Bad Debt

Bad debt is the opposite. This is money you borrow to buy things that lose value the second you take them out of the shop. These are often called consumables or expenses.

Imagine you buy a £500 games console on a credit card but only pay the minimum each month. With interest, that console could end up costing you £800 by the time you pay it off. You could have bought two consoles for that price if you had saved up!

If you use a credit card to buy the latest gaming console or a pair of designer trainers, you are using bad debt. By the time you finish paying back the loan, the console is old and the trainers are worn out. You paid interest for something that is now worth almost nothing.

Bad debt usually involves high interest rates. This means the bank charges you a lot of extra money for the privilege of borrowing. It is like paying a "patience tax" because you did not want to save up and wait.

Mira says:

"Bad debt is like eating your dessert before dinner. It feels great for five minutes, but then you're still hungry and you have to deal with the consequences later."

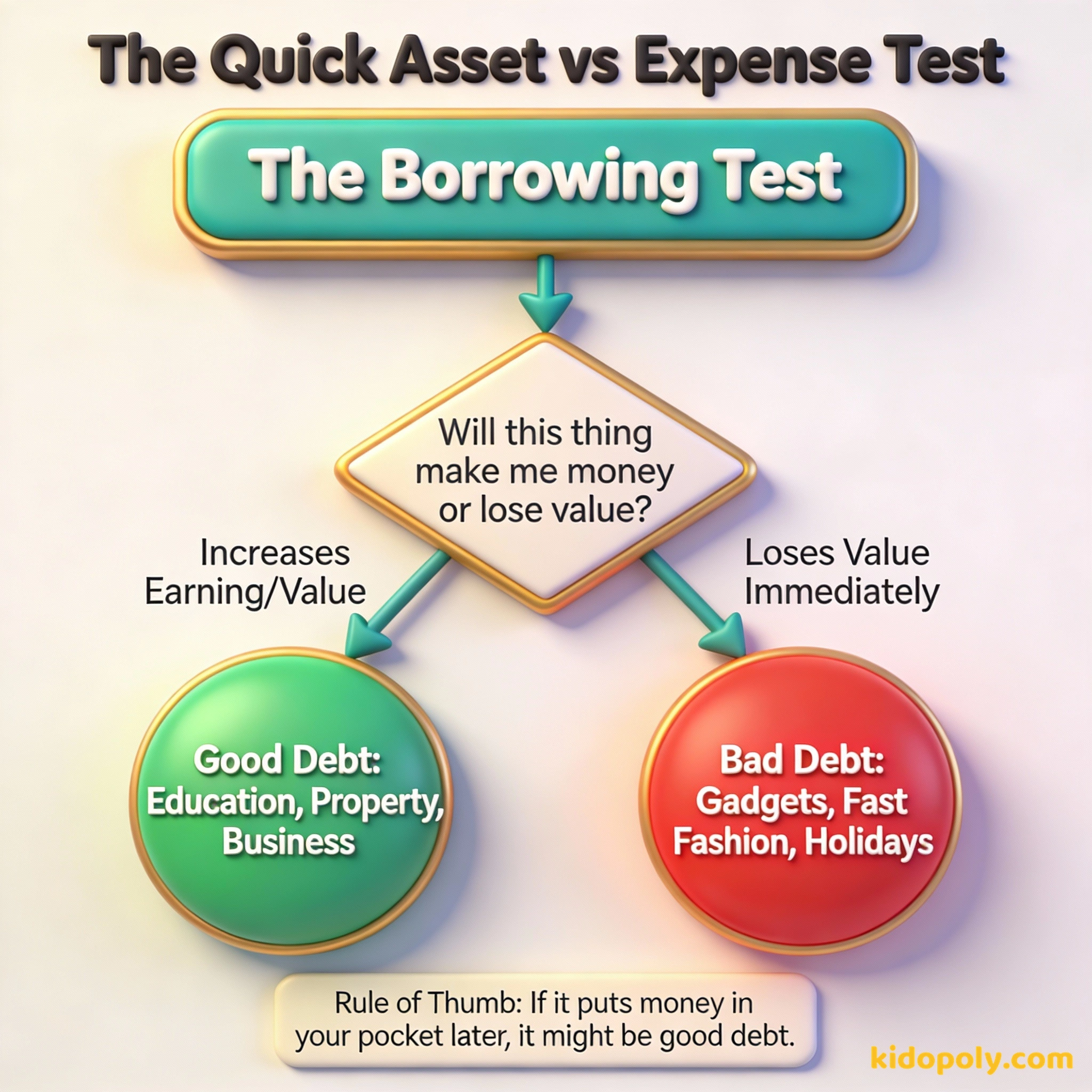

The Asset vs. Expense Test

How do you tell them apart? Use the Asset vs. Expense test. Before you borrow, ask yourself: "Will this thing make me richer or poorer over time?"

Next time you are at the shops, pick three items. For each one, ask: If I borrowed money to buy this, would it help me earn more money later? If the answer is no, it's a 'Bad Debt' candidate!

If the answer is "richer," it might be good debt. If the answer is "poorer," it is definitely bad debt. Most things we want right now, like fast food or cinema tickets, fail this test immediately.

Debt is dumb, cash is king.

The Dangerous Middle Ground

Sometimes, debt lives in a grey area. Take car loans, for example. You might need a car to get to work so you can earn money. That sounds like good debt. However, cars lose value very quickly.

THE DEPRECIATION DIVE: New Car Price: £20,000 Value after 1 min: £18,000 (Ouch!) Value after 3 years: £12,000 If you borrowed £20,000 to buy it, you still owe the bank nearly the full amount, but your car is worth £8,000 less!

Another tricky area is Buy Now, Pay Later (BNPL) services. They make it feel like you are not really in debt because the payments are small. But if you use them for clothes or snacks, you are still training your brain to spend money you do not have yet.

Red Flags: When Debt Becomes Dangerous

The most dangerous kind of debt is a payday loan. These are short-term loans with massive interest rates, sometimes over 1,000 percent. They target people who are struggling and can lead to a cycle of debt that is almost impossible to escape.

Finn says:

"Wait, 1,000 percent interest? That means if I borrowed £100, I could end up owing way more than that just in fees? That sounds like a trap!"

High interest is always a warning sign. If a loan has an interest rate of 20 percent or more, it is almost certainly bad debt. You should always check the Annual Percentage Rate (APR) before signing anything.

If you buy things you do not need, soon you will have to sell things you need.

A loan for a medical degree that leads to a high-paying career as a doctor.

A high-interest credit card loan for a holiday to a theme park.

Understanding these rules now gives you a head start. Most adults learn this the hard way after they have already made mistakes. By knowing how to spot the difference, you can make sure your future self is wealthy instead of worried.

Something to Think About

If someone offered you £1,000 today as a loan, what is the one thing you could spend it on that would make you 'richer' in five years?

There are no wrong answers here. Think about skills you want to learn, tools for a hobby that could become a job, or even a small business idea. Your values determine what is worth borrowing for.

Questions About Money & Society

Is it better to never have any debt at all?

Can good debt turn into bad debt?

Why do banks want me to take on bad debt?

You're Now a Debt Detective

Now that you know how to tell the difference, you can look at the world of borrowing with clear eyes. Debt isn't a monster to be feared, it's a tool to be mastered. Want to learn more about how to use your money wisely? Check out our page on what-is-credit to see how your borrowing habits build your financial reputation.