Could the government just print a billion pounds, give everyone a share, and make poverty disappear?

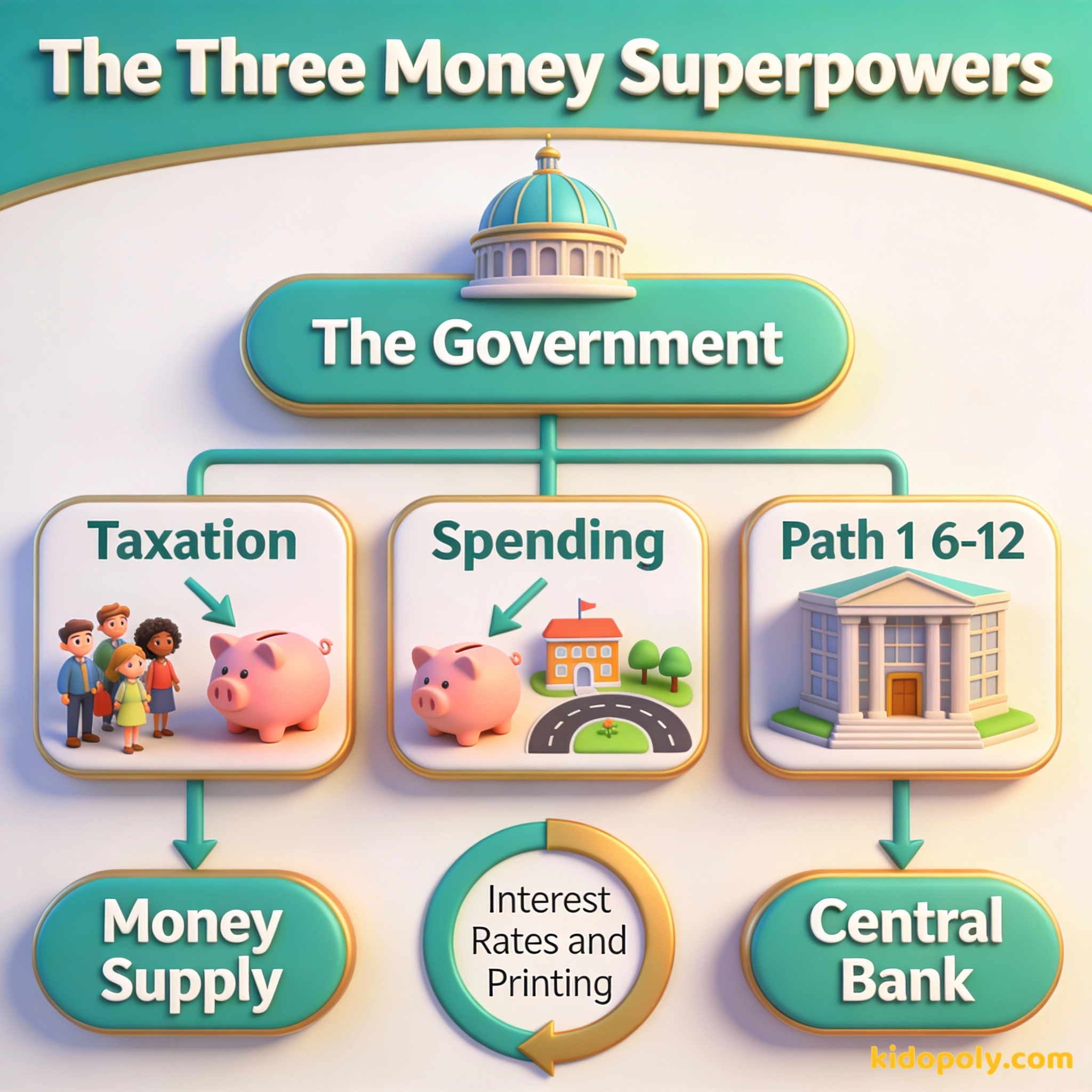

It sounds like a perfect plan, but it actually backfires in a big way. Governments have to balance three massive powers: taxation, spending, and the money supply to keep the economy healthy.

Quick question: could the government just print a billion pounds, give everyone a share, and make poverty disappear? It sounds like it should work.

But the last time a country tried something like that, Zimbabwe in 2008, prices doubled every 24 hours. People needed wheelbarrows of cash just to buy a single loaf of bread.

In 2008, Zimbabwe printed a 100 trillion dollar bill. Even though it had all those zeros, it wasn't even enough to buy a bus ticket in some places!

Governments have three massive "superpowers" when it comes to money. They can collect it, they can spend it, and they can control how much of it actually exists.

Understanding these powers helps you see why the price of your favorite snack changes or why a new park gets built in your neighborhood. Let's look at who is really pulling the strings.

Power 1: The Giant Piggy Bank

The first way the government controls money is through Taxation and Spending. Think of the government as a giant manager for a club that everyone in the country belongs to.

Finn says:

"So if the government is the 'club manager,' do I get a vote on how they spend my membership fees when I grow up?"

To keep the club running, they collect membership fees, which we call taxes. This money goes into a massive pool used to pay for things like schools, hospitals, and libraries.

Every year, the government creates a plan called a Budget. This is a big debate where leaders decide if they should spend more on space exploration or more on fixing the roads near your house.

The difficulty lies not so much in developing new ideas as in escaping from old ones.

When the government spends more money than it collects from taxes, it has to borrow the rest. This creates something called the National Debt, which is like the country's giant credit card balance.

Power 2: The Money Factory

You might think the people in charge of the government are the same ones who print the money. In most modern countries, that is actually not true.

Instead, there is a special, independent group called the Central Bank. In the UK, it is the Bank of England: in the USA, it is the Federal Reserve.

Mira says:

"It's like the Central Bank is a goalie! Their whole job is to stop the ball of 'too much money' from flying into the net and causing chaos."

Central banks are like the referees of money. They decide how much currency should be in circulation and set Interest Rates, which control how expensive it is to borrow money.

If politicians could print money whenever they wanted, they might do it just to make people happy before an election. But the Central Bank stays independent to make sure the money stays valuable.

Power 3: Controlling the Money Supply

This leads us back to our big question: why can't we just print more money? This is the power of the Money Supply.

Imagine you are at school and everyone trades rare stickers. If there are only 10 special dragon stickers in the whole school, they are worth a lot.

Imagine a snack costs $1. If the government doubles the amount of money in the world, but the amount of snacks stays the same: Old Price: $1.00 New Price: $2.00 You have more cash, but you can't buy any extra snacks!

But if the principal suddenly prints 1,000,000 dragon stickers and hands them to everyone, they aren't special anymore. Nobody would trade a sandwich for one.

When a government prints too much money, it causes Inflation. This means the money in your pocket loses its "buying power" because there is too much of it chasing too few goods.

Inflation is always and everywhere a monetary phenomenon.

The Balancing Act

Governments and central banks work together to keep the economy steady. If the government spends too much and the central bank prints too much, prices go up too fast.

If they don't spend enough, or if the central bank makes it too hard to get money, businesses might close and people could lose their jobs. It is a constant tug-of-war.

Take a look at a real banknote or coin. Look for the name of the 'Central Bank' or the signature of a government official. That signature is the government's promise that the money is real and can be used to pay for things.

This balance affects your life every day. It determines if your school has new computers, how much your parents earn at work, and even how much you have to save for that new video game.

Big Numbers, Big Responsibilities

When we talk about government money, the numbers get huge. You might hear people talk about a "trillion" dollars or pounds.

To give you an idea of how big that is, one million seconds is about 11 days. One billion seconds is about 31 years. One trillion seconds is about 31,700 years.

Finn says:

"Wait, if a trillion seconds is 31,000 years, then the National Debt is like a debt that would take forever to pay back!"

A national debt, if it is not excessive, will be to us a national blessing.

Even though the numbers are huge, the rules are similar to yours. Whether it is a government or a kid with pocket money, someone has to decide where the money comes from and where it goes.

The government should only spend exactly what it gets from taxes to avoid debt.

The government should borrow money to build big things like railways and schools that help the country earn more later.

By understanding how the government uses its money superpowers, you can understand how the world works. You aren't just a bystander: you are a future voter who will help decide how these powers are used.

Something to Think About

If you were the leader of your country for one day, what is the one thing you would spend more money on, and what would you spend less on?

There are no right or wrong answers here. Every person has different ideas about what makes a country great, and that is why budgets are debated so much in a democracy!

Questions About Money & Society

Why can't the government just give everyone a million dollars?

What happens if a country can't pay back its national debt?

Does the government control how much I spend?

You're the Boss of the Money

The government's money is actually the people's money. By learning how taxation, spending, and central banks work, you are learning how your society makes its biggest decisions. Want to see where that tax money actually comes from? Check out our page on [taxes-for-kids].