Have you bought a new video game or a pair of sneakers lately? If you spent 20 pounds, you might have already paid about 3.33 pounds in tax without even realizing it.

That invisible cost is called VAT, and it is just the beginning. Taxes are basically the membership fees we pay to live in a modern society, but they don't all work the same way. Understanding the different types of taxes is like learning the rules of a giant game that everyone has to play.

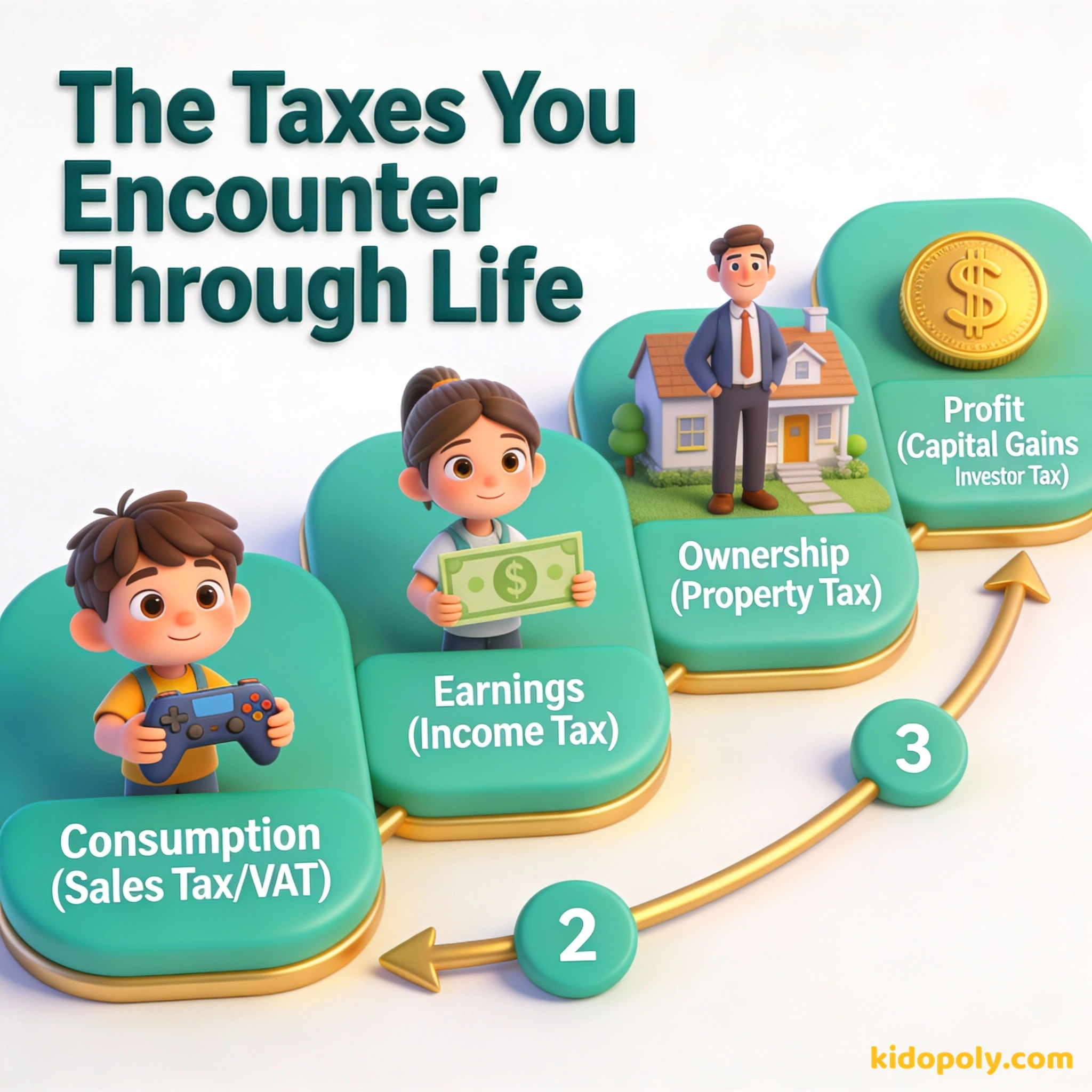

Most people think tax is just one big, boring bucket of money that disappears from their wallet. In reality, taxes are a collection of different systems that trigger at specific moments: when you earn, when you spend, when you own, and even when you sell something for a profit.

In Ancient Rome, there was once a tax on urine! It was collected from public toilets because the ammonia in it was used to clean clothes and tan leather. Taxes can be placed on almost anything the government thinks is valuable.

The Tax You Pay Right Now: Sales Tax and VAT

If you are a kid, you are probably already a taxpayer. Every time you buy a chocolate bar, a toy, or a digital game, you are likely paying Sales Tax or Value Added Tax (VAT). This is a tax on consumption, which is just a fancy word for buying and using things.

In many countries, this tax is already included in the price tag you see on the shelf. In others, like the United States, it gets added on at the checkout counter. Because this tax is a flat percentage for everyone, it is often called a regressive tax. This means that a person with very little money pays the exact same tax on a loaf of bread as a billionaire does.

Mira says:

"Think of VAT like a hidden 'delivery fee' for living in a country. You don't see the person delivering the services, but the fee is added to almost everything you grab from the shelf!"

Let's see how VAT works on a £60 video game: - Price of the game: £50.00 - VAT (at 20%): £10.00 - Total you pay: £60.00 You just contributed £10 to the tax system by buying one game!

When You Start Working: Income Tax

Once you get your first job, whether it is a paper round or working at a cafe, you will meet Income Tax. This is money taken directly from your earnings. However, most governments have a 'tax-free allowance' or a threshold. This means if you only earn a small amount of money as a kid, you might not have to pay any income tax at all!

In this world, nothing can be said to be certain, except death and taxes.

Income tax is usually a progressive tax. This is a system where the more money you earn, the higher the percentage of tax you pay. People who earn a lot of money might pay 40 percent of their income in tax, while people earning less might only pay 10 or 20 percent. This is designed to make the system fairer based on what people can afford to contribute.

People who earn more pay a higher percentage. It is based on the 'ability to pay' principle.

Everyone pays the exact same percentage, regardless of how much they earn. It is often seen as simpler but less fair to lower earners.

Owning a Home: Property and Council Tax

When you grow up and buy a house or an apartment, you encounter Property Tax (often called Council Tax in the UK). This isn't based on what you earn or what you spend, but on the value of where you live.

Even if you don't own a home yet, you are still affected by it. If your family rents a house, the cost of this tax is often built into the rent your parents pay. These taxes are usually collected by local governments to pay for things right in your neighborhood, like fixing the street lights or collecting the bins.

Making a Profit: Capital Gains Tax

Imagine you buy a rare Pokémon card for 10 pounds. Two years later, it becomes super famous, and you sell it for 100 pounds. You just made a 90-pound profit! In the adult world, that profit is called a 'gain,' and the government might want a slice of it through Capital Gains Tax.

Finn says:

"Wait, so if I buy a stock and it goes down in value, does the government give me money back? Or do I only pay when I'm winning?"

This tax applies to big things like stocks, bonds, or second homes. It is a tax on the 'extra' money you made by being a smart investor. If you sell something for the same price you bought it for, or for less, you usually don't owe any capital gains tax because you didn't make a profit.

Imagine you have a magic apple tree. Every time you pick an apple to eat, you give a slice to the village (Sales Tax). If you sell an apple to a friend for a silver coin, you give a tiny bit of that coin to the village (Capital Gains Tax). If you decide to keep the tree forever, you pay a small fee every year just for owning it (Property Tax).

The Big Picture: Why Different Types Matter

Governments use different types of taxes so they don't have to take too much money from just one place. If they only had income tax, it might be so high that people wouldn't want to work. By spreading it out across spending, earning, and owning, the system stays balanced.

Taxes are what we pay for civilized society.

There are even more specific taxes you might hear about. There is Inheritance Tax, which is a tax on money or property left to you when someone passes away. There are also Excise Duties, which are extra taxes on specific things like petrol or sugary drinks to encourage people to use less of them.

Mira says:

"It’s like a giant puzzle. Every time you move money or change what you own, a different piece of the tax system clicks into place."

Taxes You Will Encounter Later

As you get older, the types of taxes you pay will shift. Right now, you are mostly a 'Spending Taxpayer.' When you get a job, you'll become an 'Earning Taxpayer.' Eventually, you might become an 'Owning Taxpayer.'

The hardest thing in the world to understand is the income tax.

Next time you are at the shop with an adult, look at the bottom of the receipt. Can you find the line that says 'VAT' or 'Tax'? See if you can calculate what percentage of the total bill went to taxes!

Understanding these types of taxes helps you see the invisible strings connected to every pound or dollar you handle. It turns you from a regular shopper into a financially literate citizen who knows exactly where their money is going.

Something to Think About

If you were designing a new country, which type of tax do you think is the fairest way to collect money?

Think about whether it is fairer to tax people based on what they spend, what they earn, or what they own. There is no single right answer!

Questions About Money & Society

Do kids have to pay income tax?

What is the difference between sales tax and VAT?

Why are there so many different types of taxes?

You're a Tax Pro Now

Now that you know the different types of taxes, you can spot them everywhere. You've learned how taxes change as you grow up, from the VAT on your toys to the income tax on your future career. Ready to see where all that money actually goes? Check out our next page on 'What are Taxes For?' to see the magic in action.