Almost every adult you know is in debt right now. Your parents probably have a mortgage for your house. Your favorite tech companies borrow billions of dollars every year, and your country owes trillions.

Is everyone just bad with money? Not at all. In the world of economics, debt is actually one of the most common and powerful financial tools in existence. It is the act of a borrower taking money from a lender with the promise to pay it back later.

Most people think of debt as a scary word that means you have run out of money. But that is not usually the case. Debt is simply a way to move money through time.

Imagine you want a high-tech telescope that costs $100. You only have $10. You could wait ten months to save up the rest, or you could borrow the $90 today. If you borrow it, you get to see the stars tonight, but you have to pay the money back from your future earnings.

Imagine you are building a massive LEGO castle. You have 100 bricks today, but you need 500. You can wait five weeks to get enough bricks, or you can 'borrow' the bricks from your friend's bin today. You get the castle now, but you'll have to give your friend your new bricks later.

When you borrow money, you are essentially making a deal with your future self. You are saying: "I want to use this money now, so I am okay with having less money later when I have to pay it back."

The Two People in Every Debt

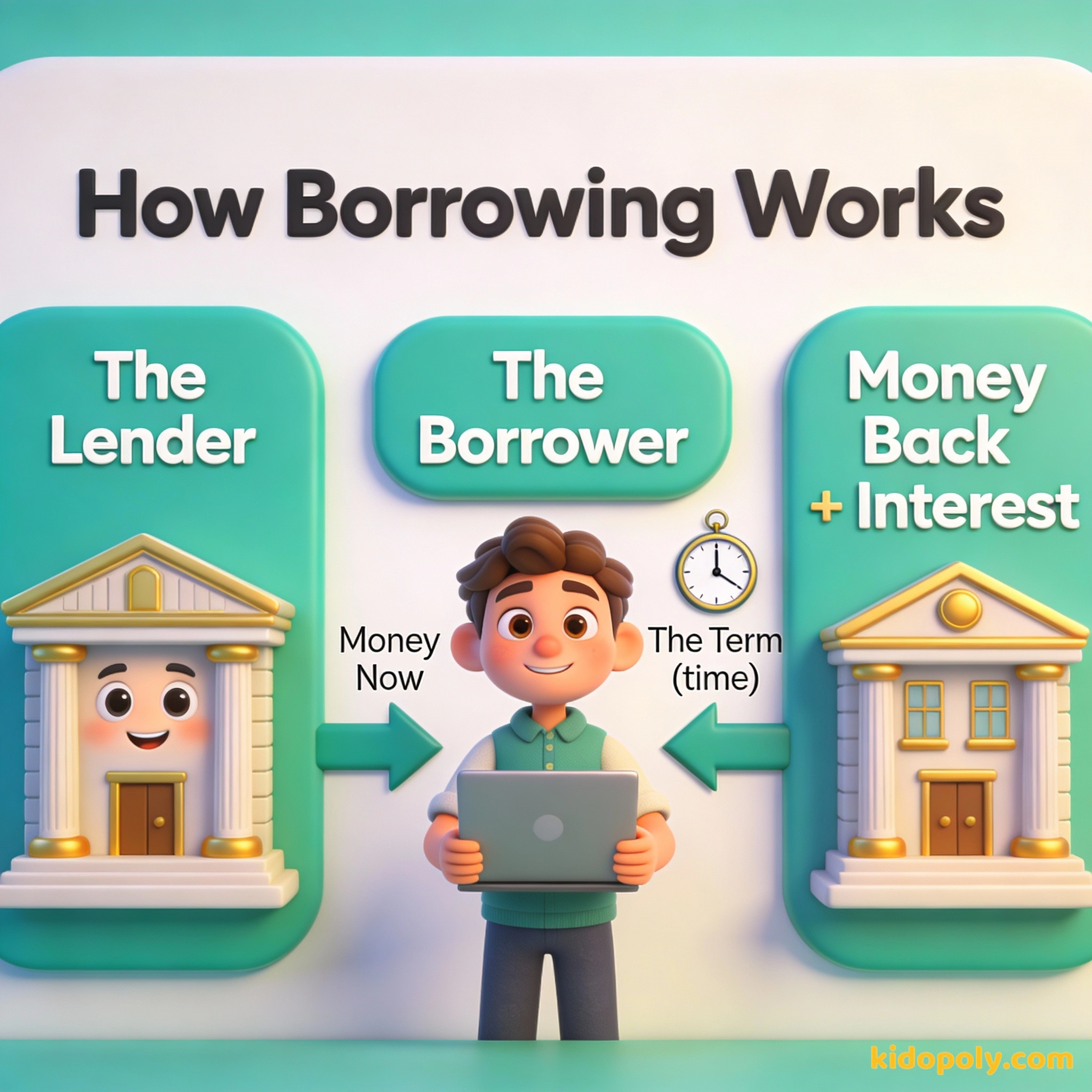

Every time debt happens, there are two sides to the story. First, there is the borrower, which is the person or company that needs the money right now. Second, there is the lender, which is the person, bank, or government that provides the money.

Debt is like any other weapon. It can be used for good or for bad.

Lenders do not just give money away for free. They are taking a risk that you might not pay them back. To make it worth their while, they charge a fee for the service of letting you use their cash. This is the core of how the whole system works.

Why Do People Borrow Instead of Saving?

If borrowing costs extra, you might wonder why anyone would do it. Why not just wait until you have the cash? The answer is usually about time and opportunity.

- Big Purchases: Some things, like a house (a mortgage) or a college education, cost so much that it might take 20 or 30 years to save the full amount. Debt lets people live in the house or get the degree while they are still young.

- Business Growth: A company might borrow money to build a new factory. If that factory makes more money than the debt costs, the company actually gets richer by borrowing.

- Emergencies: Sometimes things happen that we did not plan for, like a car breaking down. Debt acts as a safety net when you need money faster than you can earn it.

Finn says:

"So if I borrow $20 from my future self to buy a game today, does that mean Future Finn will be annoyed because he can't buy a pizza later?"

The Cost of Borrowing: Interest

When you borrow money, you almost always have to pay back more than you took. The original amount you borrowed is called the principal. The extra money you pay back is called interest.

Think of interest as "rent" for money. Just like you pay rent to live in someone else's house, you pay interest to "live" with someone else's dollars for a while. The longer you keep the money, the more interest you usually have to pay.

BORROWING $1,000 FOR A YEAR: - Principal: $1,000 - Interest Rate: 5% - Interest Amount: $50 - Total to Pay Back: $1,050 - Monthly Payment: $87.50

This extra cost is why people have to be careful. If you borrow too much, the interest payments can become so large that you do not have enough money left for your normal life. This is what people mean when they say they are "struggling with debt."

Real Numbers: The $1,000 Example

Let's look at how this works with real numbers. Imagine you borrow $1,000 to start a small business making custom sneakers. The bank agrees to let you pay it back over one year with 5% interest.

- You receive $1,000 (the principal) today.

- Over the next 12 months, you make small monthly payments.

- By the end of the year, you have paid back $1,050.

That extra $50 was the price of getting to start your business today instead of waiting a year. If your sneaker business made $200 in profit because you had that $1,000 to buy supplies, then the debt was a great tool. You paid $50 to make $200!

Debt on a Massive Scale

Debt is not just for people. It is the engine that runs the entire world. Almost every government on Earth uses debt to build roads, schools, and hospitals. Large companies use it to invent new phones and medicine.

The total amount of debt in the whole world is over $300 trillion. That is a number with 14 zeros!

This huge number sounds scary, but remember: for every dollar of debt, there is someone on the other side who is earning interest on it. It is a massive system of sharing and trading money across time.

Mira says:

"Think of it like this: Debt is like a boost pad in a racing game. It pushes you forward faster, but you have to be careful not to crash into a wall!"

If you buy things you do not need, soon you will have to sell things you need.

Debt is Like Fire

Financial experts often compare debt to fire. When fire is controlled, it is incredibly useful. It cooks our food, keeps us warm, and powers engines. But if fire gets out of control, it can be destructive.

The U.S. government has been in debt almost every year since the country was founded! Being in debt doesn't mean a country is 'broken,' it often means they are investing in the future of their citizens.

Being "in debt" is not a bad thing by itself. It is simply a state of being. The key is whether the person or company has a plan to pay it back. When someone has a plan and the income to cover their payments, debt is a powerful financial tool.

Borrowing vs. Saving

Should you always save up, or is it okay to borrow? There is no single right answer. It depends on what you are buying and how much it will help your future.

You own everything instantly. There are no monthly payments, and you don't pay any interest. It feels very peaceful and safe.

You get what you need right now. You can use the item to learn, work, or grow while you pay it off. It can help you reach goals faster.

Saving is safe because you never owe anyone anything. But it can be slow. Borrowing is fast, but it adds the pressure of having to make payments in the future. Learning when to use each one is the secret to being great with money.

Finn says:

"It sounds like debt is almost like a secret superpower. You just have to make sure you know how to fly before you jump off the building, right?"

The Master of the Tool

As you grow up, you will hear a lot of people talking about debt. Some will say it is terrible, and some will use it for everything. The most successful people treat it with respect. They know that borrowing is a way to speed up their goals, but they never forget that their future self is the one who will have to do the work to pay for it.

Debt is a bond that prevents you from going where you want to go.

Understanding debt means you are no longer afraid of a word. You can see it for what it really is: a bridge between who you are today and who you want to be tomorrow.

A Short History of Borrowing

Something to Think About

If you could borrow $100 today but had to pay back $110 next month, what would be worth the extra $10 to you?

There is no right or wrong answer here. Think about what is important to you: is it the time you save, the fun you have, or the money you keep?

Questions About Money & Society

Is debt always bad?

What happens if someone can't pay back their debt?

Why do banks lend money if it's risky?

Ready to see how debt becomes 'Good' or 'Bad'?

Now that you know debt is a tool, the next step is learning how to use it without getting burned. Some debts help you grow, while others just weigh you down. Click below to explore the difference between the two!