What if you could own a time machine that turned a single pocket money coin into a mountain of treasure?

You actually already possess the most valuable ingredient in the world for building wealth: time. While adults have to work hard for their money, you can make your money work hard for you using a phenomenon called compound interest. It is the secret weapon of billionaires, and because you are young, you have more of it than anyone else.

Warren Buffett is one of the richest people to ever live, with a fortune worth over $100 billion. He bought his first stock when he was 11 years old and started his first business at 13. But here is the part that will blow your mind: more than 99% of his wealth was earned after his 50th birthday.

My wealth has come from a combination of living in America, some lucky genes, and compound interest.

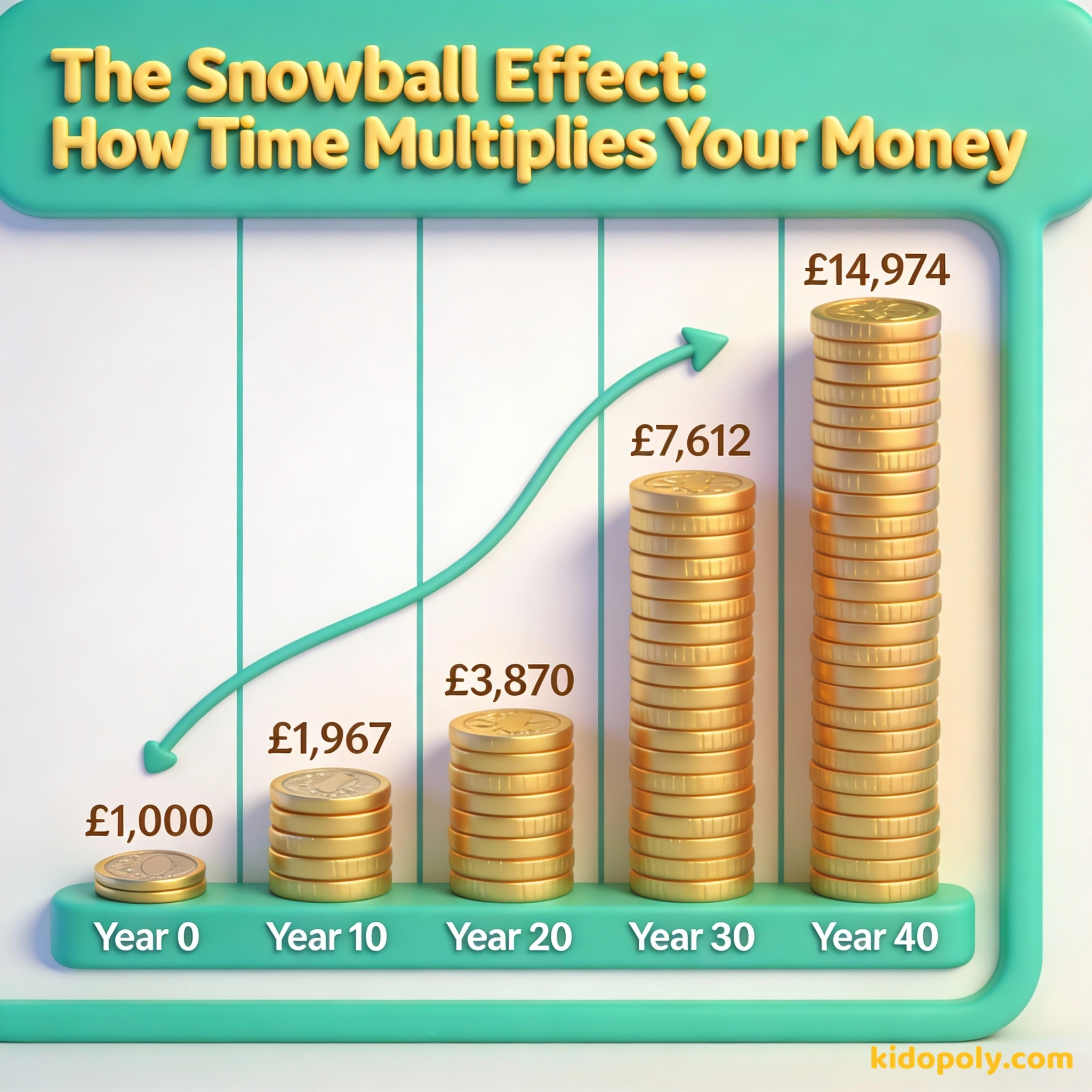

This did not happen because he suddenly became a genius in his 50s. It happened because he let his money grow for over seven decades. Compound interest is like a giant snowball rolling down a mountain: the longer the hill, the bigger the snowball gets. For a 15 year old, the 'hill' ahead of you is incredibly long.

Finn says:

"Wait, if 99% of his money came after he was 50, does that mean I have to wait forever to be rich?"

The Eighth Wonder of the World

Legend has it that even Albert Einstein, one of the smartest scientists in history, was obsessed with this concept. He reportedly called compound interest the eighth wonder of the world, saying that those who understand it earn it, and those who do not, pay it.

Imagine you plant a magic bean. On the first day, it grows one inch. On the second day, it grows by its own height, so it's two inches. On the third day, it doubles again to four inches. By the end of a month, your beanstalk would be taller than the tallest skyscraper in the world!

Whether he actually said those exact words or not, the logic is perfect. Compounding is the process where your money earns interest, and then that interest earns its own interest. Over a few years, it looks like a small ripple. Over 40 or 50 years, it looks like a tidal wave.

The Superpower of Starting at Age 10

To see the true power of this, let us look at two different people: Sarah and Alex. Sarah starts saving £100 every month when she is 10 years old. She does this for 10 years and then stops entirely at age 20, never adding another penny.

Age 10 Start: Save £10/month at 7% interest. By age 60, you have: £52,000. Total you put in: £6,000. Age 30 Start: Save £10/month at 7% interest. By age 60, you have: £12,000. Total you put in: £3,600. Starting 20 years earlier created £40,000 of extra wealth!

Alex waits until he is 30 years old to start saving. He also saves £100 every month, but he does it for 35 years straight until he retires. Even though Alex saved for much longer and put in way more of his own money, Sarah ends up with significantly more wealth because her money had a 20 year head start to compound.

Mira says:

"Not exactly, Finn! It means the work you do now is like setting up a massive domino run. Once it starts falling, it does the work for you."

The Rule of 72: Your Growth Calculator

How do you know how fast your money will grow? There is a famous mental shortcut called the Rule of 72. It helps you estimate how long it takes for your money to double in size at a specific rate of return.

Pick a number, any number! Now, pick an interest rate (like 6% or 8%). Divide 72 by that interest rate. That is how many years it will take for your money to double. If you start with £100 at 9% interest, you will have £200 in just 8 years!

If you have an investment growing at 10% per year, you divide 72 by 10. The answer is 7.2, which means your money will double roughly every seven years. This is why the 'long game' is so effective: if your money doubles at age 20, 27, 34, 41, 48, and 55, you have experienced six doubling periods.

Money makes money. And the money that money makes, makes money.

Why Adults Are Jealous of You

If you ask a 50 year old what they wish they had done differently with money, most will say: "I wish I started earlier." They have more money than you right now, but you have the one thing they can never buy back: decades of future growth. Starting with a small amount today is mathematically better than starting with a huge amount later.

Focuses on saving huge amounts of money later in life to 'catch up' but misses out on the growth years.

Focuses on saving tiny amounts very early, allowing time to do all the heavy lifting.

Imagine saving just your pocket money or birthday cash. If you can get that money into an environment where it can compound, you are building a financial fortress. You are not just saving for a toy next week: you are using long term growth to secure your entire future self.

Finn says:

"So basically, if I start now, I'm playing the game on 'Easy Mode' because I have more time than anyone else?"

The Magic Penny Scenario

Still not convinced that small numbers turn into giants? Think about the 'Magic Penny' riddle. If someone offered you £1 million right now, or a single penny that doubles in value every day for 30 days, which would you take? Most people grab the million.

In the magic penny scenario, on Day 15 you only have £163.84. You would feel 'poor' compared to the millionaire! But on Day 28, you have over £1.3 million. Compounding hides its power until the very end.

But by day 30, that doubling penny is worth over £5 million. For the first 20 days, it looks like almost nothing. But in those final 10 days, the compounding goes vertical. This is exactly how wealth building works: the magic happens at the end, but only if you start at the beginning.

Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't, pays it.

Something to Think About

If you could start 'planting' a financial seed today with just £1, what would you want that money to grow into for your future self?

There is no right or wrong answer here. Some people dream of travel, others dream of security, and some just like the idea of freedom. What does a 'big snowball' look like to you?

Questions About Saving

How much money do I need to start compounding?

Does compound interest only happen in bank accounts?

Can compound interest ever work against me?

Your Future Starts Today

Now that you know the secret of the world's wealthiest people, you have a choice. You can wait until you're 'an adult' to worry about money, or you can start your snowball rolling today. Even small amounts saved now will become giants later. Want to see exactly where to put that first pound? Check out our guide on why-start-investing-young to see the next step in your journey.