A new grandchild has arrived and you want to give them a financial head start. You could put $50 a month into a standard savings account: by their 18th birthday, that is $10,800 you have deposited. But with compound interest in the right account, it could be worth $15,000 or more.

Choosing the best savings account for grandchild depends on two main factors: how much tax you want to save and how much control you want to keep over the money.

When a new member joins the family, many grandparents feel a natural urge to provide a safety net. Whether you want to fund a future college degree or simply give them a boost for their first home, the strategy you choose today changes the outcome 18 years from now.

Before picking a specific bank, you need to understand the power of time. Because grandchildren are young, their money has the ultimate advantage: decades to grow. This growth is driven by compound interest, which is essentially the money your money earns, earning its own money.

The 18-Year Growth Effect: - Monthly Deposit: $50 - Total Deposited: $10,800 - Value at 5% Return: $17,460 - Value at 7% Return: $21,380 By investing rather than just saving in a low-interest account, you could nearly double your gift.

My wealth has come from a combination of living in America, some lucky genes, and compound interest.

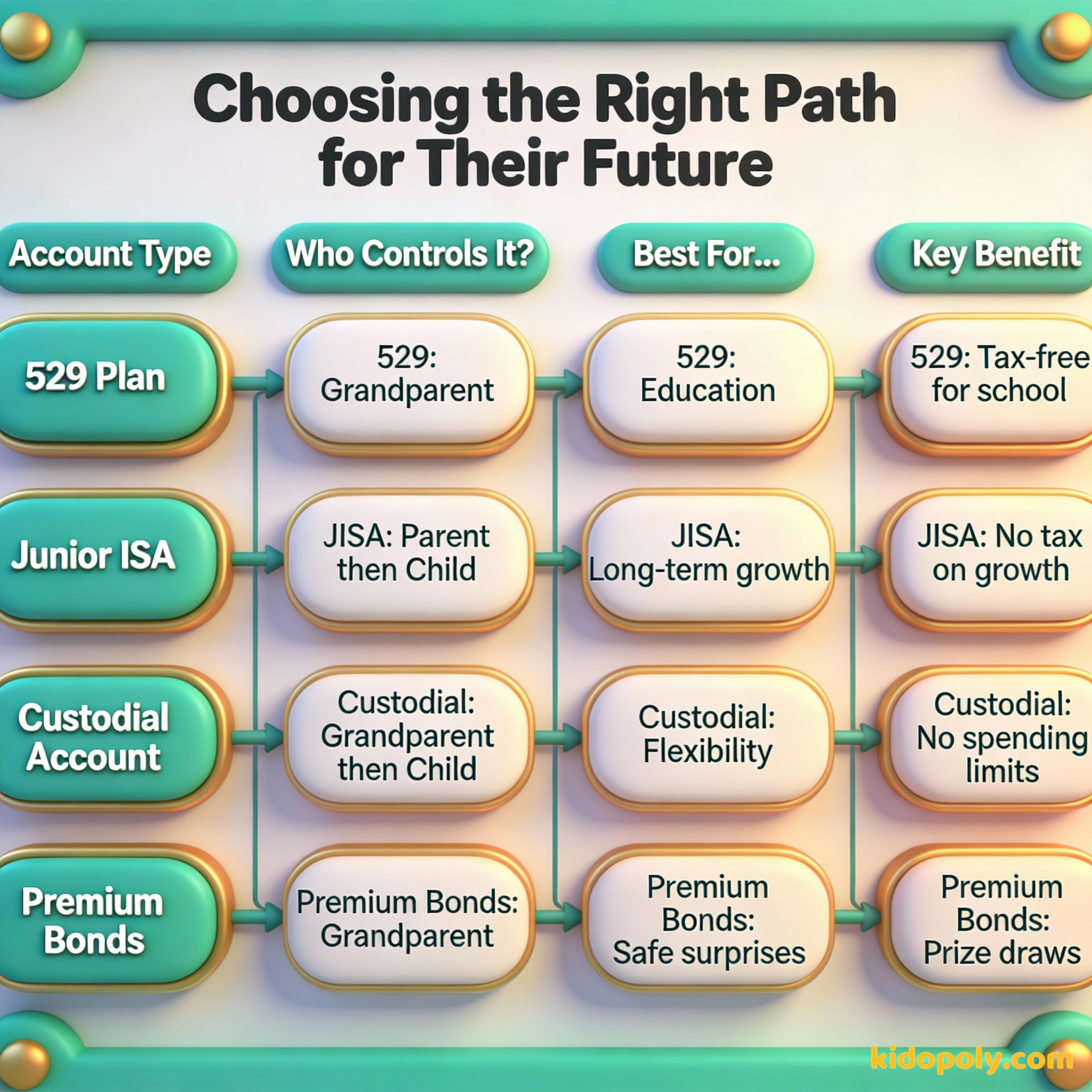

The US Toolkit: 529s and Custodial Accounts

If you are in the US, the 529 Plan is often the gold standard for grandparents. These are education savings plans that allow your money to grow tax-free. As the grandparent, you usually own the account, meaning you decide when the money is withdrawn.

Mira says:

"I like the 529 plan because it's like a special promise for their future education. It keeps the goal clear for everyone in the family."

A second popular US option is the Custodial Account (UGMA or UTMA). Unlike a 529, this money can be used for anything that benefits the child, not just school. However, once the child reaches the 'age of majority' (usually 18 or 21), the money legally belongs to them, and they can spend it however they wish.

In the US, recent changes to FAFSA (student aid) rules mean that money held in a grandparent-owned 529 plan no longer counts against a student's financial aid eligibility. This makes it one of the smartest ways to help without hurting their chances for grants.

The UK Toolkit: Junior ISAs and Premium Bonds

For those in the UK, the Junior ISA (JISA) is a powerful way to build a tax-free nest egg. Grandparents can contribute to an existing JISA opened by the parents. You can choose between a Cash JISA for safety or a Stocks and Shares JISA for potentially higher long-term growth.

If you prefer something more traditional, Premium Bonds from NS&I are a common choice. Instead of earning interest, each bond is entered into a monthly prize draw. It is a safe way to save because the capital is backed by the government, though your money might not grow as fast as it would in an investment account.

Finn says:

"Wait, if I have Premium Bonds, does that mean I could win a million pounds? That sounds way more exciting than 2% interest!"

Money makes money. And the money that money makes, makes money.

The Question of Control: Who Holds the Keys?

One of the biggest concerns for grandparents is making sure the money is used wisely. If you put money into a Junior ISA or a UTMA account, the child gets full control at age 18. For some, this feels like a risk: will they spend it on a car or a world tour instead of their education?

You put money in their name (JISA/UTMA). It's legally theirs at 18. This builds trust but carries the risk of a young adult spending it poorly.

You keep the account in your name. You decide when and how they get it. This protects the money but doesn't offer the same tax benefits.

If you want to keep the 'keys' to the vault longer, consider keeping the money in a high-yield savings account in your own name. You can designate the grandchild as a beneficiary. This keeps you in the driver's seat, but you may have to pay taxes on the interest earned each year.

Try the 'Matching' Strategy. For older grandkids who have a part-time job, offer to match every dollar they save with a dollar in their investment account. It teaches them the value of their own labor while accelerating their growth.

Tax Implications and Gifting Limits

Saving for a grandchild is a gift, and like all gifts, the government has rules. In the US, you can take advantage of the annual gift tax exclusion, which allows you to give a certain amount per year without filing a gift tax return. You can even 'superfund' a 529 plan by contributing five years' worth of gifts at once.

Mira says:

"It's not just about the tax, though. It's about showing our kids and grandkids that we are looking out for them, even years from now."

In the UK, gifts to grandchildren may fall under the 'annual exemption' for Inheritance Tax. It is important to remember that once money is inside a JISA or a 529, it is generally considered out of your estate, which can be a helpful part of family financial planning.

Imagine your grandchild is 22 years old. They have just graduated and want to move for a dream job, but they have no deposit for an apartment. Because you started a small monthly contribution the day they were born, you hand them a check that covers their first six months of rent. That is the power of a head start.

Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest.

Preparing for 'What If' Scenarios

Life happens, and plans change. Parents often ask: 'What if my grandchild doesn't go to college?' If you have a 529 plan, you can change the beneficiary to another grandchild or even yourself. Under newer US rules, you might even be able to roll some 529 funds into a Roth IRA for the child's retirement.

If a grandparent passes away before the child reaches adulthood, the 'successor owner' named on the account takes over. It is a simple step, but an essential one to ensure the money reaches the child as intended. For more on the basics of child accounts, see our guide on savings-accounts-for-kids.

Something to Think About

If you could only choose one, would you prefer your grandchild to have $20,000 for college or $10,000 that they are forced to manage themselves at age 18?

There is no right answer here. Some families value the educational safety net, while others believe the real-world experience of managing money is the better gift. Talk with your family about which goal feels more important.

Questions About Saving

Can I open a savings account for my grandchild without the parents?

Will my grandchild have to pay taxes on this money?

What happens if I need the money back?

Ready to plant the seed?

Saving for a grandchild is one of the most impactful financial moves a grandparent can make. Whether you choose the tax-efficiency of a 529 or the simplicity of a high-yield savings account, the key is to start as early as possible. If you want to see how these savings look from a child's perspective, check out our guide on compound-interest-explained.