Imagine you and your best friend both put £100 into a bank account on the exact same day.

You both have the same starting amount, called the principal, and the same 5% interest rate. But ten years later, your friend has more money than you. The reason isn't magic: it is the difference between simple interest and compound interest.

Most people think interest is just a small reward for saving money. While that is true, there are actually two different ways to calculate that reward. Understanding the difference is like knowing a secret cheat code for your bank account.

Simple interest is the straightforward version. Compound interest is the 'supercharged' version that helps your money grow faster over time. Let's look at how they work side-by-side.

Mira says:

"It's like leveling up in a video game. Simple interest is like getting 10 XP every day. Compound interest is like getting XP based on how high your level already is!"

What is Simple Interest?

Simple interest is exactly what it sounds like: simple. It is a fixed amount of money you earn based only on the original amount you put in. If you put £100 in a box and the bank gives you 5% interest every year, they only look at that original £100.

Every single year, you get the same reward. In this case, 5% of £100 is £5. So, every year on your birthday, the bank drops £5 into your account. It never changes, no matter how much money is actually sitting in there.

Simple Interest Calculation: Principal (£100) x Rate (5%) = £5 Year 1: £100 + £5 = £105 Year 2: £105 + £5 = £110 Year 3: £110 + £5 = £115 It's always plus five!

What is Compound Interest?

Compound interest is much more exciting for savers. Instead of only looking at your original deposit, the bank looks at your total balance. This includes the interest you earned in previous years.

We call this 'interest on interest.' It means your money starts working for you. As your balance gets bigger, the interest payments get bigger too, which makes the balance grow even faster next time.

Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it.

The 10-Year Showdown

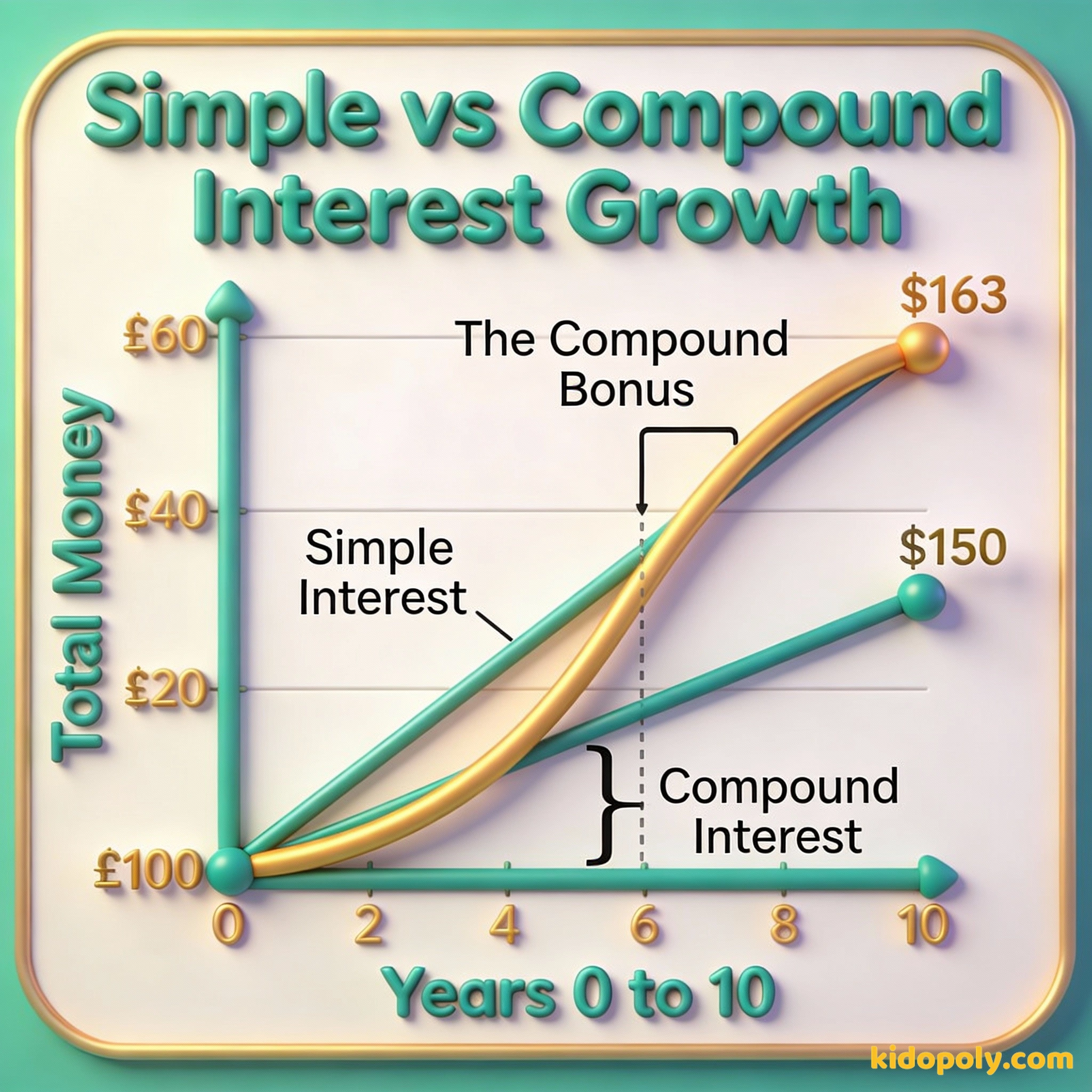

Let's see what happens to that £100 over a decade. We will use a 5% interest rate for both. At first, you might think the difference is too small to care about, but watch what happens as the years go by.

In Year 1, both accounts earn exactly £5. You both have £105. But in Year 2, the simple interest account earns another £5, while the compound account earns 5% of £105. That is £5.25.

Imagine you have a magic apple tree. Simple interest is like the tree growing 5 apples every year. Compound interest is like those 5 apples falling to the ground, turning into 5 NEW trees, which then grow their own apples too!

- Year 1: Both have £105. The gap is £0.

- Year 3: Simple has £115. Compound has £115.76. The gap is 76p.

- Year 5: Simple has £125. Compound has £127.63. The gap is £2.63.

- Year 10: Simple has £150. Compound has £163. The gap is £13.

That £13 gap might not seem huge yet, but compound interest is a marathon runner, not a sprinter. If you left that money alone for 30 years, the simple interest account would have £250, but the compound account would have over £432!

Finn says:

"Wait, so even though they both start at 5%, the compound one actually makes more than 5% of the original hundred pounds? That's like getting a bonus for having a bonus."

The Snowball vs. The Flat Line

To remember the difference, think of two shapes: a flat line and a snowball. Simple interest is like a flat line. It stays the same every year, adding the exact same block of money to your pile.

Compound interest is the snowball. When a snowball starts rolling down a snowy hill, it's tiny. But as it rolls, it picks up more snow. Because it is now bigger, it picks up even MORE snow on the next turn.

The amount you earn is fixed. It's predictable and stays the same every year. Great for short-term loans where you want no surprises.

The amount you earn grows. It starts slow but speeds up over time. This is the ultimate tool for building long-term wealth.

Where Do You Find Them?

Banks and businesses use these two types of interest in different places. Usually, you want compound interest when you are saving, but you might prefer simple interest if you are the one borrowing money.

Savings accounts and investment accounts almost always use compound interest. This is why adults tell you to start saving as early as possible. They want you to give your 'money snowball' the longest hill possible to roll down.

My wealth has come from a combination of living in America, some lucky genes, and compound interest.

Simple interest is often used for short-term loans. If you borrow money to buy a car or a specific type of personal loan, the interest might be calculated simply. This makes it easier to know exactly how much you will owe in total.

In the 1700s, Benjamin Franklin left £1,000 to the city of Boston in his will. Because of compound interest, by the time the city could spend it 200 years later, that money had grown to nearly £3 million!

Why Borrowers Beware Compound Interest

Compound interest is a superhero when you are saving, but it can feel like a villain if you owe money. If you have a credit card balance and don't pay it off, the bank charges you compound interest on what you owe.

This means you end up paying interest on the interest you haven't paid back yet. This is how small debts can grow into giant ones very quickly. It is the same snowball effect, but it's rolling toward your wallet instead of into it.

Finn says:

"So the rule is: I want the snowball to work for me when I save, but I want to avoid the snowball when I'm borrowing money. Got it!"

Money makes money. And the money that money makes, makes money.

Choosing the Best Path

You cannot always choose which interest type a bank uses, but you can choose how you use them. For your long-term savings, look for accounts that offer compound growth.

If you want to dive deeper into how the 'math magic' actually works, you can check out our page on compound interest explained. If you are just starting your journey, it helps to understand what is interest in the first place.

Ask a parent or teacher if they have a savings account. Ask them: 'Does this account earn simple or compound interest?' If they say compound, ask them how long they have been letting that snowball roll!

Something to Think About

If you had £100 right now, would you rather put it in a simple interest account you can take out anytime, or a compound interest account you have to leave alone for 10 years?

Think about what is more important to you: having the money ready for a toy today, or having a much larger 'snowball' for something big in the future. There is no wrong answer, it's all about your goals!

Questions About Saving

Which type of interest earns you more money?

When do banks use simple interest?

Why is compound interest better for saving?

Start Your Snowball Today

Now you know the secret: time is a saver's best friend. Whether you are saving your pocket money or birthday cash, choosing compound growth and being patient can turn a small pile of coins into a mountain. Ready to see exactly how the math works? Head over to our guide on the power of compound interest!