Imagine you get £8 a week in pocket money. That is £416 a year: enough for a brand new gaming console! But somehow, by the time December rolls around, you have got nothing left but a pile of empty snack wrappers. Where did it all go?

A budget is the difference between wondering where your money went and telling it where to go. It is a financial plan that helps you balance your income (money coming in) with your expenses (money going out) so you can reach your goals.

Most people think a budget is a list of things you are NOT allowed to buy. They think it is like a strict diet for your wallet. But actually, it is the exact opposite! A budget is a tool that gives you permission to spend your money on the things that actually matter to you. It is like having a superpower that lets you see into the future of your bank balance.

A budget is telling your money where to go instead of wondering where it went.

What is a Budget, Really?

In the simplest terms, a budget is just a plan. If you were going on a hike through a giant forest, you would want a map so you did not get lost. A budget is the map for your money. It ensures that you do not wander off and spend all your cash on small things you will forget about in ten minutes, like a random bag of sweets or a toy that breaks in a day.

The word 'budget' comes from the old French word 'bougette,' which means 'little bag.' In the olden days, people literally carried their planned money in small leather pouches!

When you have a plan, you stop guessing. You stop reaching into your pocket and feeling surprised that it is empty. Instead, you know exactly how much you have for treats, how much you need for your hobbies, and how much is growing in your savings for that one big thing you really want.

Finn says:

"But wait, if I make a budget, does that mean I can never buy a chocolate bar on a whim again?"

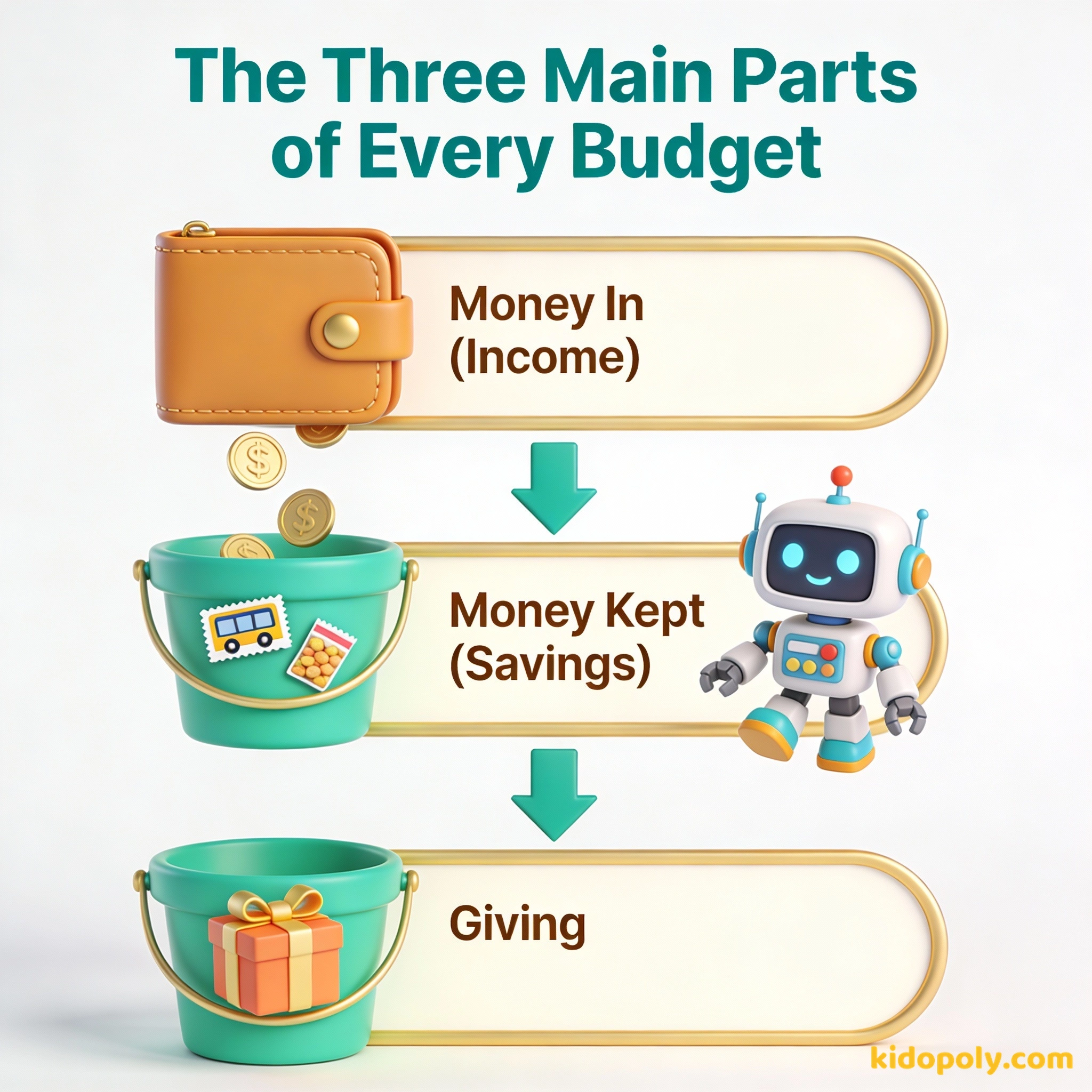

The Three Buckets of Money

No matter how much money someone has: whether it is a billionaire or a kid with a paper round: every budget is made of the same three parts. Think of these as three buckets that you pour your money into as soon as you receive it.

- Money In (Income): This is the starting point. For you, this might be pocket money, birthday gifts, or money you earned for doing extra chores.

- Money Out (Expenses): This is the money that leaves your hands. It covers things you need and things you want right now.

- Money Kept (Savings): This is the money you set aside for the future. This is the most important bucket because it is the one that grows.

The Golden Rule: 50/30/20

Since you are just starting out, you do not need a complicated spreadsheet. Most experts recommend a simple rule to help you decide how much money should go into each bucket. It is called the 50/30/20 rule. While adults use this for rent and bills, kids can use it to become master budgeters.

If you get £10.00 pocket money: - £5.00 goes to Needs (50%) - £3.00 goes to Wants (30%) - £2.00 goes to Savings (20%) In one year, that £2.00 a week turns into £104.00!

- 50% for Needs: These are things you have to pay for. For a kid, this might be a club membership fee, a bus fare, or buying a card for your nan's birthday.

- 30% for Wants: This is the fun part! This is money for cinema tickets, new game skins, or that extra-large milkshake.

- 20% for Savings: This money goes straight into your piggy bank or savings account. You do not touch it until you reach a specific goal.

Do not save what is left after spending, but spend what is left after saving.

Fixed vs. Variable Expenses

To make your budget work, you have to understand the two types of spending. First, there are fixed expenses. These are costs that are the same every single time. If you pay £5 a month for a gaming subscription, that is a fixed expense. You know it is coming, and you know exactly how much it will be.

Mira says:

"Actually, Finn, the budget makes the chocolate taste better because you know you can actually afford it without ruining your bike fund!"

Then, there are variable expenses. These are the sneaky ones! They change depending on your choices. Maybe one week you spend £2 on a snack, and the next week you spend £10 on a new book. Budgeting helps you keep an eye on these variable costs so they do not gobble up all your savings.

Imagine you are at the shop with £5. You see a cool comic for £4.50 and a giant bag of sweets for £2.00. Without a budget, you might buy the sweets and then realise you can't afford the comic. With a budget, you already know the comic is your goal, so the sweets never even tempt you!

Why Even the Richest People Budget

You might think that if you were a billionaire, you would not need a budget. But the truth is the opposite! The biggest companies in the world, like Apple and Disney, have huge teams of people who do nothing but manage their budgets. Even NASA has a budget for every single bolt and screw on a rocket.

I love the freedom of spending my money the moment I get it. It feels great to have a treat right now!

I love the freedom of knowing I can afford the big things I really want because I planned for them.

They do this because they know that money is a limited resource. Even if you have a lot of it, you can still run out if you do not have a plan. By using a budget, they ensure they have enough money to build the next iPhone or launch a mission to Mars. Your budget might be smaller, but the goal is the same: making sure you have enough to do the big things.

Mira says:

"It is like playing a strategy game. You only have a certain number of 'points' to spend, so you have to choose the best upgrades for your character!"

Budgeting vs. Just Saving

Some people think budgeting and saving are the same thing, but they are actually partners. Saving is the act of putting money away. Budgeting is the plan that tells you how much you are allowed to save and how much you are allowed to spend. Without a budget, you might save too much and never have any fun, or save too little and never reach your goals.

Beware of little expenses. A small leak will sink a great ship.

Label three jars: SPEND, SAVE, and GIVE. Every time you get money, divide it up immediately. Seeing the 'Save' jar get taller is way more exciting than just having a number in your head!

When you start looking at your money as a tool to be managed rather than just something to be spent, everything changes. You stop feeling like money is something that just 'happens' to you, and you start feeling like the boss of your own financial future. Ready to try it? Your first budget is just a few decisions away.

Something to Think About

If you could only spend your money on THREE types of things for the next month, what would they be?

There are no wrong answers here! Your budget should reflect what makes you happy and what you care about most.

Questions About Spending & Budgeting

What if my budget doesn't work the first time?

Should I budget my birthday money too?

Is a budget supposed to be for a week or a month?

You are Now a Budgeting Beginner!

You have learned the secret that most adults wish they knew sooner: a budget is a plan for freedom, not a cage. Now that you know the 'why' and the 'what' of budgeting, it is time to put it into action. Your next stop is learning how to build your very first budget from scratch.