You earned £150 from your weekend job this month. After topping up your phone, buying lunch twice, splitting an taxi, renewing Spotify, and buying those trainers on sale, you've got £11 left. Sound familiar?

Budgeting as a teenager isn't about jars or gold stars anymore. It is about managing real income from part-time jobs and taking charge of your own financial freedom. This guide helps you navigate the jump from pocket money to the real world.

Managing money as a teen feels different because the stakes are higher. You aren't just saving for a toy: you are often responsible for your own phone data, your bus fare, and your social life. This shift is the first step toward becoming an adult who knows how to make money work for them.

Do not save what is left after spending, but spend what is left after saving.

When you start earning your own cash, the 'Parent Bank' usually starts to close its doors. You might find you are now the one paying for your Netflix sub or that extra large fries. This is actually a superpower because you get to decide what your hard work buys.

In the UK, teenagers spend an average of over £2,000 a year, with a huge chunk of that going toward food, clothes, and digital entertainment.

The Challenge of Irregular Income

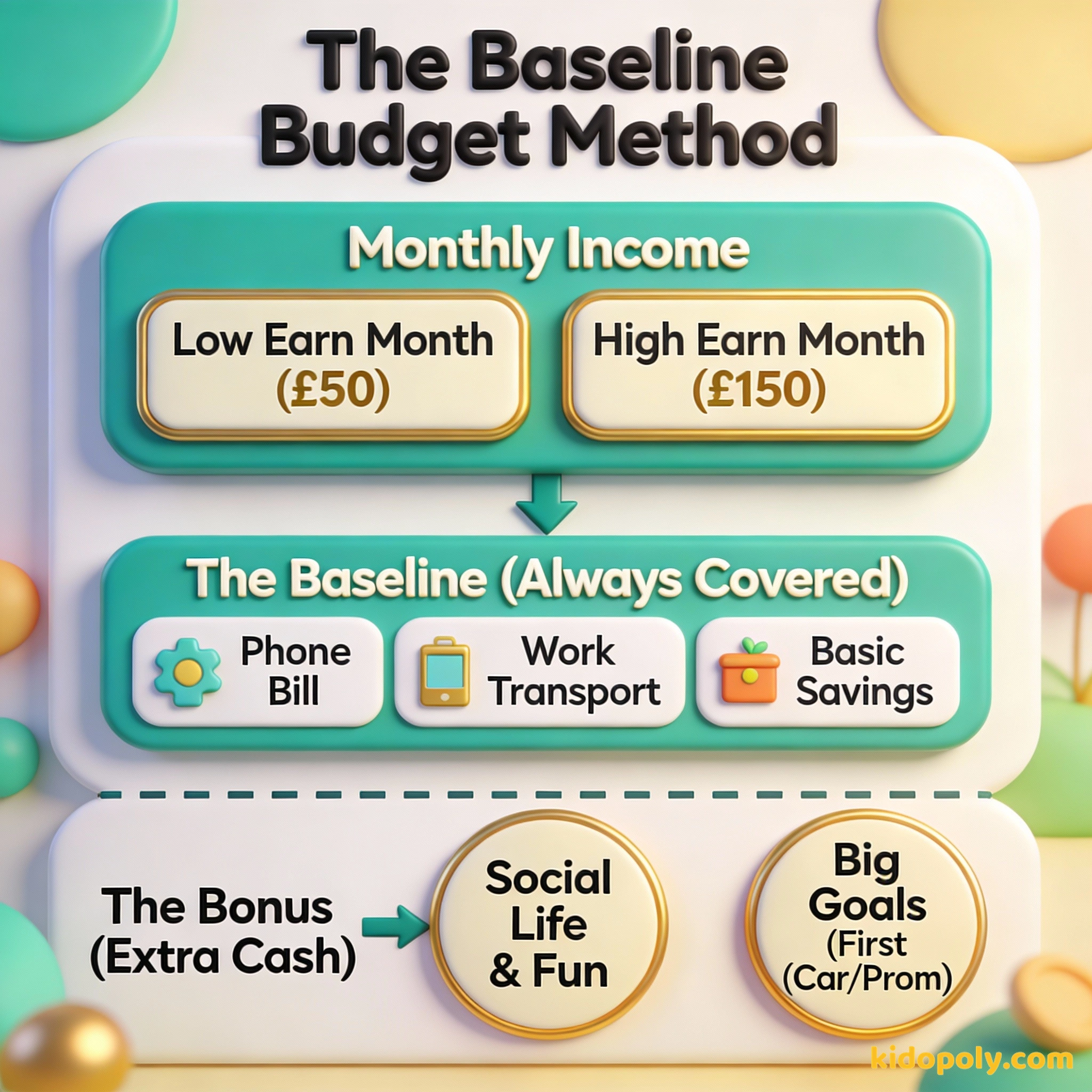

Most teen budgets have a major problem: your income is rarely the same every month. Some weeks you might get three extra shifts at the shop, but during exam season, you might not work at all. This makes traditional 'fixed' budgeting feel impossible.

To beat this, you need the baseline budget method. Instead of planning to spend exactly what you earned last month, you plan your 'must-haves' based on your lowest possible earning month. Anything extra you earn becomes a 'bonus' for your bigger goals.

Finn says:

"If I don't know how many shifts I'll get next month, how can I ever save for those new trainers?"

Where Does the Money Actually Go?

Real-world budgeting means tracking your fixed expenses first. These are the things that cost the same every single month. If you don't pay them, your phone gets cut off or you can't get to school or work.

- Phone Plans: Whether it is a contract or top-up, this is usually a teen's #1 bill.

- Transport: Bus passes, train tickets, or petrol if you are already driving.

- Subscriptions: Spotify, Netflix, or gaming passes can eat £30 a month without you noticing.

- Social Life: The 'hidden' expense of hanging out at cafes or going to the cinema.

The Subscription Stack: Spotify: £10.99 Netflix: £10.99 Xbox Game Pass: £12.99 Total: £34.97 per month Yearly Total: £419.64 That is the cost of 12 driving lessons just for apps you might not use every day!

Beware of little expenses: a small leak will sink a great ship.

Managing the Social Pressure

One of the hardest parts of teen budgeting isn't the math: it is your friends. It is hard to say 'I can't afford that' when everyone is ordering a takeaway. This is called social spending, and it's the fastest way to break a budget.

Mira says:

"I noticed that when we all hang out at the park instead of the burger place, I save enough in a month to pay for my whole phone bill!"

You don't have to be the friend who never comes out. Instead, try the 'Flex Fund' approach. Decide at the start of the week exactly how much you can spend on 'fun'. Once that cash is gone, you suggest free activities, like a park hang or a movie night at home.

Says 'Yes' to every pizza night and cinema trip because they don't want to miss out, then has to borrow money for the bus to work.

Checks their 'Social Pot' first. If it is empty, they suggest a gaming night at home. They always have enough for their goals.

Digital Tools That Actually Work

You don't need a leather-bound ledger to track your cash. Most successful teen budgeters use the tech they already have. Digital tools make it easier to see your spending patterns in real time.

- Banking Apps: Most 'teen' bank accounts now have 'pots' or 'spaces' to keep your savings separate from your spending money.

- The Notes App: A simple list of 'Money In' and 'Money Out' updated daily is often more effective than a complex spreadsheet.

- Budgeting Apps: Apps designed for teens can gamify the process and help you visualize your progress toward big goals.

The 'Wait 48' Rule: Before buying anything over £20 that isn't a 'need', wait 48 hours. If you still want it just as much after two days, it is a conscious choice, not an impulse buy.

Planning for the 'Big Ones'

Teenage life has some massive, one-off expenses that can't be covered by a single week's pay. We are talking about long-term goals like driving lessons, prom outfits, or a first car. These require 'sinking funds'.

Finn says:

"So a 'sinking fund' is just like a boss battle? I'm just gathering enough power-ups until I'm ready to take it on?"

A sinking fund is just a fancy name for a savings pot where you put a little bit of money away every month for a specific future cost. If driving lessons cost £1,200 and you want to start in a year, you need to tuck away £100 a month. Breaking it down makes the huge number feel achievable.

A budget is telling your money where to go instead of wondering where it went.

Remember, a budget isn't a cage. It is a map. It shows you exactly where you are going and ensures you have enough fuel to get there. Whether you are earning £20 or £200, the habits you build now are the ones that will make you financially fearless later.

Imagine it's your 17th birthday. Because you saved just £15 a week for the last year, you already have £780 sitting in a pot ready for your driving lessons. You are ahead of the game before you even turn the key.

Something to Think About

If you had an extra £50 this month, would you rather spend it on a great night out now, or put it toward a 'big goal' that might take a year to reach?

There is no wrong answer here! Budgeting is about balancing your happiness today with your dreams for tomorrow.

Questions About Spending & Budgeting

How much of my part-time job money should I save?

What should I do if my friends spend more than I can afford?

Should I use a budgeting app or just check my bank balance?

Your Money, Your Rules

Budgeting isn't about asking for permission: it's about giving yourself permission to spend on the things that actually matter to you. Now that you know how to handle your own income, why not take the next step and learn how to set up your very first budget?