You just got a £25 Amazon gift card for your birthday. Within 10 minutes, you have added £47 worth of stuff to your basket. Now comes the hard part: choosing what to keep and what to remove.

That moment, making your money stretch to cover what you actually want most, is called budgeting. A gift card is the perfect place to practice because it is a fixed amount of money with a clear boundary on where you can spend it.

Imagine a gift card as a 'budget in a box.' It is a specific amount of money that can only be spent in one place. Unlike cash in a piggy bank, which you can spend anywhere, a gift card forces you to look at a specific set of choices and decide which ones are the most valuable to you.

Billions of pounds go unspent on gift cards every year because people forget they have them or lose the cards before using the full balance. Don't let the shops keep your money!

The Browse-First Strategy

When you get a gift card, it is tempting to buy the very first cool thing you see. But the secret to being a pro spender is the browse-first strategy. Before you click 'Buy' or head to the till, look at everything the shop has to offer in your price range.

Price is what you pay. Value is what you get.

You might find that the £15 Lego set you liked is actually less exciting than a combination of a £10 book and a £5 craft kit. By looking at everything first, you avoid that annoying feeling of seeing something better five minutes after you have spent your balance.

Finn says:

"Wait, if I have a £20 card and the thing I want is £19.99, but shipping is £3.95, can I still buy it? I guess I need to budget for the delivery too!"

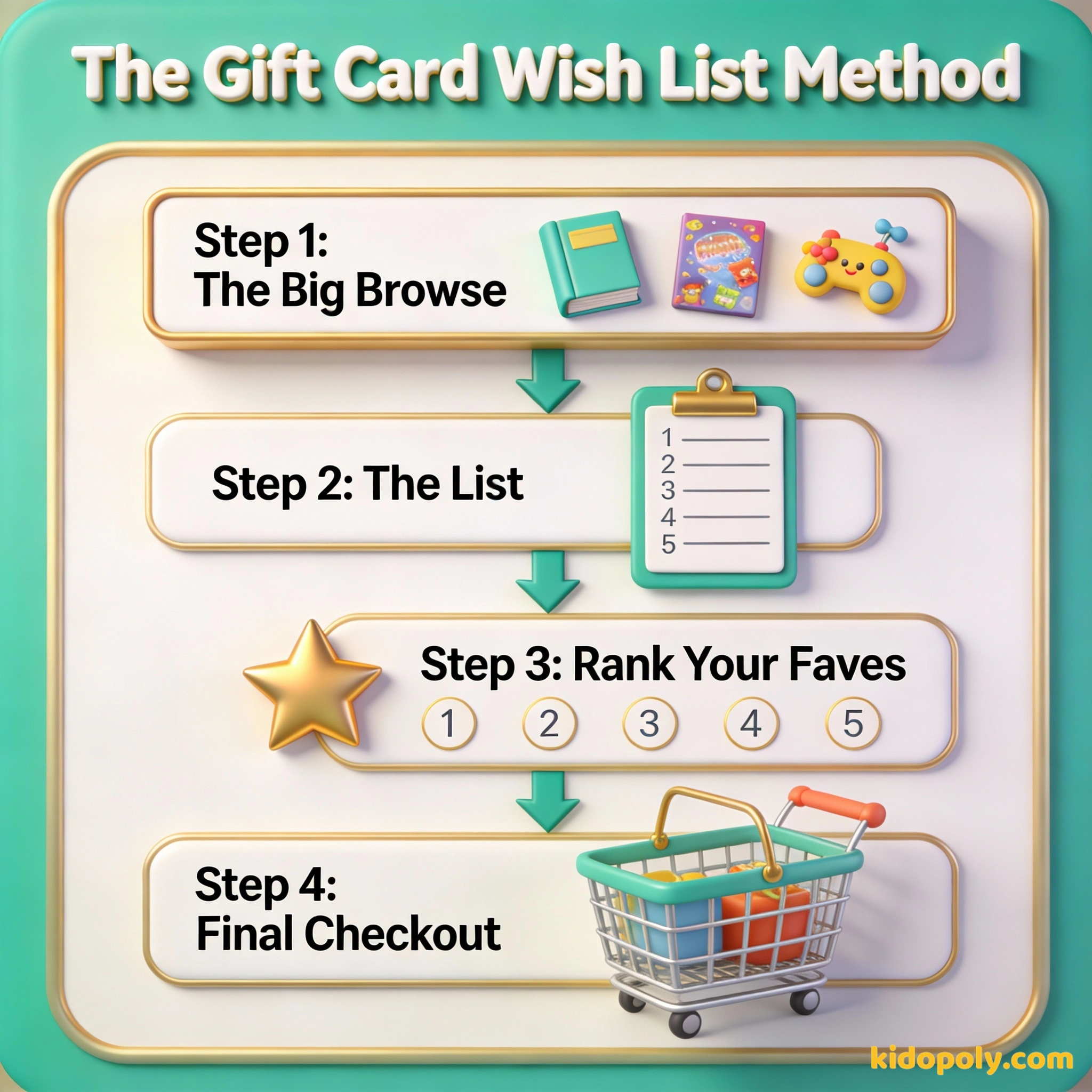

The Wish List Method

If you have a lot of things you want but not enough money on the card to get them all, try the Wish List Method. This is a classic budgeting tool used by adults, but it works perfectly for gift cards too.

- Write it all down: List every single thing you want from that shop.

- Check the prices: Note down exactly how much each item costs, including any shipping fees.

- Rank them: Put a number 1 next to the thing you want most, a number 2 next to the second best, and so on.

- Do the math: Add the prices up starting from number 1 until you hit your gift card limit.

Common Gift Card Mistakes

Even the smartest shoppers make mistakes. One of the biggest is impulse spending. This happens when you spend your card quickly just because the money is 'burning a hole in your pocket.' If you wait just 24 hours, you might realize you did not actually want that item as much as you thought.

The 24-Hour Rule: When you find something you want to buy with your gift card, wait exactly 24 hours before buying it. If you still want it just as much tomorrow, go for it! Usually, the 'must-have' feeling fades.

Another mistake is forgetting about the small balance. Many kids spend £22.63 of a £25 card and then throw the card away or forget about it. That remaining £2.37 is still your money! In digital shops like the Apple App Store or Roblox, a few pounds can often buy a small upgrade or a new song.

Mira says:

"Think of a gift card like a power-up in a game. You want to use it at exactly the right moment to get the biggest advantage, not just smash the button immediately!"

Platform-Specific Tips

Different gift cards have different rules. Here is how to handle the most common ones:

- Amazon: You can add the gift card to your account balance. This is great because you do not have to spend it all at once, and the balance never expires.

- Gaming (Roblox, PlayStation, Xbox): These often involve digital currency. Remember that the price you see might not include tax, so always keep a tiny bit of extra balance ready.

- Apple/Google Play: These are linked to your ID. They are perfect for small, regular treats like a new app or an extra level in a game.

Let's do the math on a 'leftover' balance: Card Total: £20.00 Item Price: £17.50 Remaining: £2.50 If you do this 4 times a year and forget the balance, you lose £10.00! That's enough for a whole new book or a movie rental.

Expiry Rules and Fees

In the UK and many other places, most gift cards eventually expire. This means if you do not use the money by a certain date, the shop gets to keep it! Always look at the back of the card or the email it came in to find the expiry date.

Beware of little expenses; a small leak will sink a great ship.

Some cards, especially the ones that work like credit cards (like a Visa gift card), might even have a maintenance fee. This is a small amount of money that gets taken off the card every month if you do not use it. It is like a tiny leak in a bucket. To stop the leak, use the card sooner rather than later.

Using Gift Cards as a Budgeting Exercise

Next time you get birthday cash, try treating it like a gift card. Tell yourself: 'I have £20 to spend at the toy shop, and once it is gone, it is gone.' This is called a fixed budget.

Imagine your gift card is a key to a secret treasure chest. Inside the chest are all the items in the shop. You can take whatever you want, but the key only has enough 'energy' to unlock a certain weight of treasure. How will you fill your bag to get the best loot?

By practicing with gift cards, you are learning how to make trade-offs. You are learning that choosing 'Item A' means you cannot have 'Item B.' That is the most important lesson in all of economics, and you are mastering it while buying things you love.

A budget is telling your money where to go instead of wondering where it went.

Finn says:

"So if I keep the last £1.50 on my card instead of losing it, I'm basically getting a free chocolate bar later. That's a win!"

Something to Think About

If you had a £50 gift card that could be used at ANY shop, would you spend it all on one big thing, or lots of tiny things?

There is no right or wrong answer! Some people prefer one high-quality item, while others love the excitement of many small surprises. It's all about what you value most.

Questions About Spending & Budgeting

What happens if my purchase costs more than the gift card?

Can I turn my gift card back into cash?

How do I check how much money is left on my card?

Ready to be a Gift Card Pro?

Now that you know how to treat a gift card like a mini-budget, you are ready to make your money go further. Remember to browse first, rank your favorites, and never leave those tiny balances behind! Want to learn more about how to manage your money? Check out our guide to budgeting-basics.