You go to the shop for a drink. You come out with a drink, crisps, a magazine, and a keyring you'll forget about by tomorrow. Total: £7.50. You planned to spend £1.20.

Your brain just pulled the oldest trick in the book on you. This is called impulse buying, and it happens when you buy something suddenly without planning it first. It's like a temporary glitch in your decision-making system.

Have you ever wondered why it is so hard to say no to that chocolate bar at the till? Or why a shiny new skin in your favorite video game suddenly feels like a life or death necessity?

It turns out that you are not just bad at choosing. You are actually fighting against your own biology. Shops and websites are designed to trigger a specific reaction in your head that makes spending money feel like a great idea, even when it isn't.

Imagine you are walking through a fair. You see a giant blue teddy bear. You don't even like teddy bears, but the lights are bright and everyone is cheering. Suddenly, you've spent £10 to try and win it. That's the power of the moment!

The Science of the Dopamine Hit

When you see something you want, your brain releases a chemical called dopamine. This is part of your brain's reward system. Most people think dopamine is released when you get the thing you want, but it actually happens before you buy it.

Dopamine creates a rush of excitement and anticipation. It is the chemical that says, "Go on, get it! It will be amazing!" This creates a feeling of instant gratification, which is the urge to have the fun right now rather than waiting for a bigger reward later.

If you buy things you do not need, soon you will have to sell things you need.

The Brain Tug-of-War

Inside your head, two systems are constantly arguing. First, you have the prefrontal cortex, which is the "Planning System." This part of your brain thinks about the future, your savings goals, and whether you actually need more stickers.

Second, you have the "Wanting System" deep inside your brain. This part doesn't care about next week. It only cares about how much fun you could have in the next five seconds. Usually, when you are in a shop, the Wanting System is much louder than the Planning System.

Finn says:

"So, my brain is basically a giant 'Buy Now' button that I have to learn how to lock?"

Environmental Triggers

Shops are experts at waking up your Wanting System. They use triggers, which are sights or sounds that nudge you to spend. Have you noticed how the most colourful, exciting items are always at eye level?

- The Till Trap: Small, cheap items are placed where you wait in line because you are bored and more likely to grab something.

- Limited Offers: Signs that say "Only 3 left!" or "Today only!" make your brain panic and think you will miss out if you don't act fast.

- The Scent Effect: Some shops even pump in special smells, like fresh cookies, to make you feel happy and more likely to spend.

Dopamine is so powerful that it can make you feel 'buyer's high.' This is the temporary rush of happiness you feel the exact moment you pay for something. Unfortunately, this high usually lasts less than an hour!

Digital Impulse Traps

Impulse buying isn't just for physical shops. In fact, it is often harder to resist online. Websites use one-click buying to make the gap between wanting and owning as small as possible. If you don't have to get your wallet out and type in numbers, your Planning System doesn't have time to wake up.

In video games, you might see loot boxes or mystery crates. These are the ultimate impulse traps because they combine the rush of buying with the excitement of a surprise. You aren't just buying an item: you are buying the hope of getting something rare.

Mira says:

"Exactly! It's like your brain is a scientist running an experiment on you, but you can learn to hack the results."

Your Impulse Defense Guide

Knowing how your brain works is your first line of defense. But you also need physical strategies to stop your money from disappearing. Here are the best tricks used by money experts:

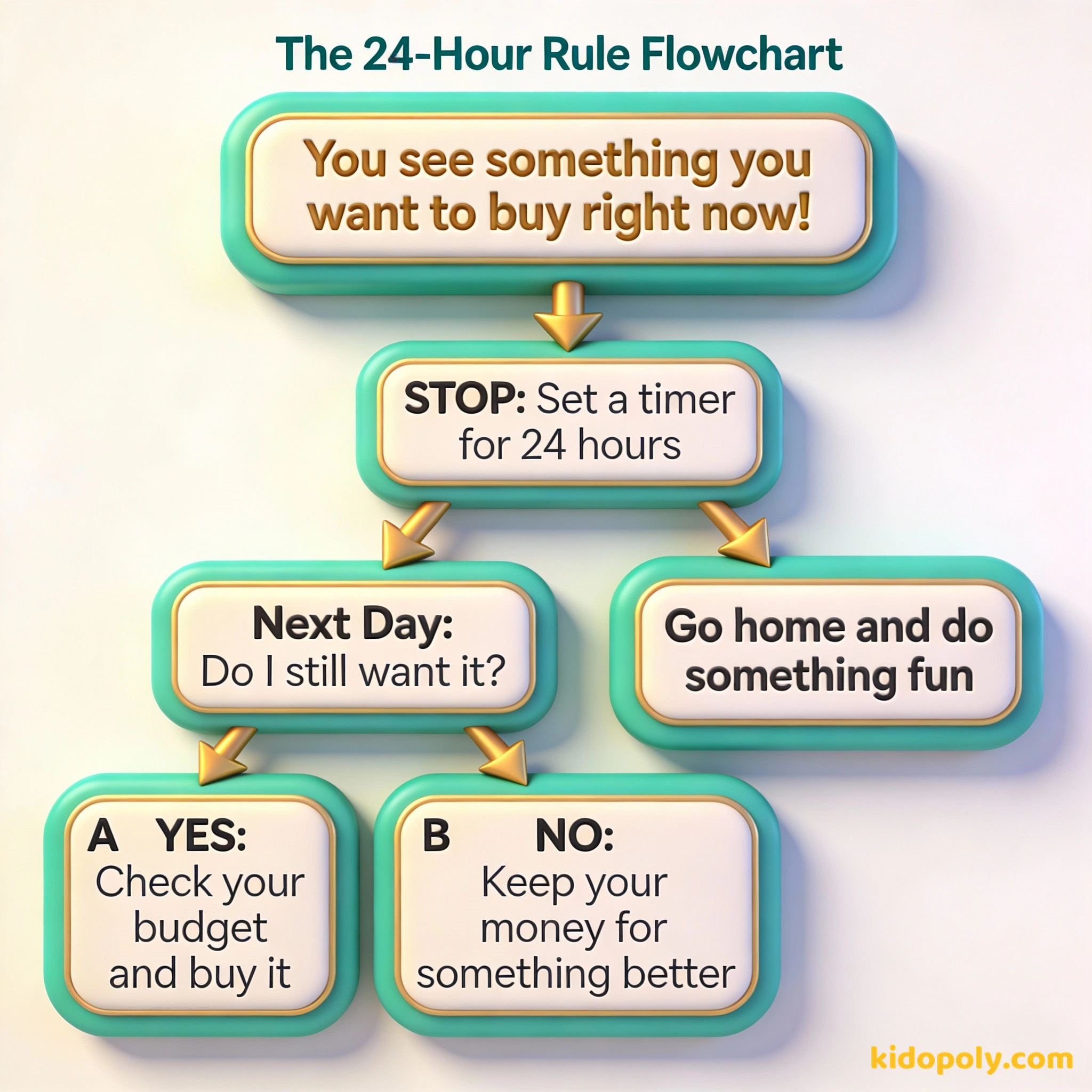

- The 24-Hour Rule: If you see something you want that isn't on your list, you must wait 24 hours before buying it. Usually, the dopamine fades and you realize you don't actually want it.

- The Walk Away Test: Physically leave the shop or close the tab. If you still want the item ten minutes later when you are in a different environment, it might be a real want.

- The Phone-a-Friend Check: Ask someone else, "Do you think I need this?" Often, saying the purchase out loud makes it sound much less sensible.

Beware of little expenses: a small leak will sink a great ship.

Understanding Buyer’s Remorse

Have you ever bought something, felt excited for ten minutes, and then felt a bit sad or annoyed with yourself? That feeling is called buyer's remorse. It happens when the dopamine wears off and your Planning System finally takes back control.

Instead of feeling bad, use buyer's remorse as a signal. It is your brain's way of learning. Next time you feel that "must-have" urge, try to remember the feeling of remorse. It can help you distinguish between a need vs want.

The 'Is It Worth My Time?' Test. Calculate your 'hourly rate' (maybe based on chores or pocket money). If a game skin costs £10 and you earn £2 an hour, ask yourself: 'Is this skin worth 5 hours of washing the car?'

Is Impulse Buying Always Bad?

Not necessarily! Money is meant to be enjoyed. If you have followed your budget and you have some "fun money" set aside, a small impulse purchase is totally fine.

Finn says:

"I guess if I save £5 by not buying a random keyring, I'm actually £5 closer to that new bike I want."

The goal isn't to never spend money. The goal is to make sure you are the one making the decision, not a clever shop layout or a sneaky brain chemical. When you control your impulses, you have more money for the things that truly matter to you.

The 'Small Change' Snowball: - One impulse snack per week: £1.50 - Total over a year: £78.00 - That is enough to buy a brand new AAA video game or a high-quality pair of headphones!

People first, then money, then things.

Something to Think About

Think about the last thing you bought on impulse. If you had to wait 24 hours, would you still have bought it?

There is no right or wrong answer here. It is just a way to see how your Planning System and Wanting System work together.

Questions About Spending & Budgeting

Is it okay to impulse buy sometimes?

Why do I feel sad after buying something I wanted?

How can I stop impulse buying in video games?

You Are in the Driver's Seat

Now that you know the tricks your brain and shops play, you are much harder to fool. The next time you feel that 'must-buy' rush, remember: that's just dopamine talking. Take a breath, wait a day, and decide for yourself where your money goes. Check out our page on 'smart-spending' for more ways to make your money work for you!