Imagine you are standing in a shoe shop with your birthday money in your pocket.

You see a pair of solid school shoes that will last all year, but right next to them are the newest, glowing, high-tech trainers that your favorite athlete wears. One is a need, and the other is a want, but sometimes the line between them gets very blurry.

You have probably heard adults talk about needs and wants before. Usually, they make it sound like a simple list: food is a need, and a Nintendo Switch is a want. While that is mostly true, the way we spend money in the real world is a lot more interesting than a two-column list.

If you buy things you do not need, soon you will have to sell things you need.

Understanding the difference between these two categories is like having a secret map for your money. When you know which is which, you can make sure you have the things you truly require while still finding ways to get the things that make you smile. This is the first step to mastering smart-spending.

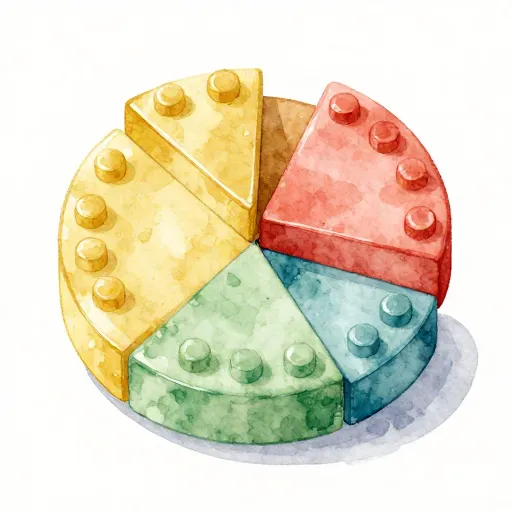

Most people spend about 50 percent of their money on needs, but this number can be higher or lower depending on where you live in the world!

The Basics: Survival vs. Style

At its simplest level, a need is something you absolutely must have to survive, stay healthy, and go to school or work. These are things like clean water, basic food, a safe place to sleep, and clothes that keep you warm and dry. If you do not have your needs met, life becomes very difficult or even dangerous.

Finn says:

"So if I need a coat to stay warm, but I really want the one with the cool patches, is the whole coat a want?"

On the other hand, a want is something that is nice to have, but you could live without it if you had to. Think of things like ice cream, comic books, or a faster internet connection for gaming. Wants make life more fun and comfortable, but they are not required for your wellbeing.

Welcome to the Grey Zone

Here is where it gets tricky. Life is not always black and white, and neither is money! Most of our spending happens in what we call the Grey Zone. This is when something starts as a need but turns into a want because of the version we choose.

Let's look at the 'Upgrade' cost: - Basic School Shoes: £20 - Designer Brand Shoes: £85 - The 'Want' Cost: £65 That £65 could pay for 13 cinema tickets or a brand new video game!

Let's go back to those shoes. You definitely need footwear to protect your feet and follow school rules. However, you do not need the specific pair that costs £100 just because they have a famous logo on the side. The shoes are the need, but the brand name is the want.

The 'Need the Category, Want the Upgrade' Framework

To help you make decisions, use this simple tool: separate the category from the upgrade. The Standard version usually covers the need, while the Upgrade is the want. This helps you see exactly where your money is going.

- Category (The Need): A backpack to carry your books to school.

- Upgrade (The Want): A backpack with your favorite movie character that costs double the price.

- Category (The Need): A healthy lunch to give you energy.

- Upgrade (The Want): A fancy dessert or a sugary drink from the cafe.

Beware of little expenses: a small leak will sink a great ship.

When you use this framework, you realize that you are often buying a mix of both. It is okay to choose the upgrade sometimes, as long as you know that is what you are doing! This helps you understand the value-of-money and what you are getting for it.

Mira says:

"It's like Minecraft! You NEED a pickaxe to mine, but you WANT a diamond one because it's faster and looks cooler."

Why Context Matters

Did you know that needs and wants can change depending on who you are and where you live? This is called context. For a student in a city, a bus pass might be a total need to get to class. For a student who lives right next door to the school, that same bus pass is a want.

Imagine you live in a place where the sun shines every day. Is a heavy, waterproof snow jacket a need? Probably not! But if you moved to the Arctic, that jacket would suddenly become the most important need you have.

Even your age changes things! For a teenager who has a part-time job as a social media manager, a high-quality smartphone might be a need for their work. For an eight-year-old who just wants to play Minecraft, that same phone is definitely a want. Your needs grow and change as you do.

Is it Okay to Spend on Wants?

Some people think that being 'good' with money means only ever buying needs. That is not true! The goal of learning about money is to have a balanced life. If we only ever bought needs, life would be pretty boring. No movies, no toys, and no birthday cakes!

Next time you want an 'upgrade' (like the expensive brand of cereal or the fancy pen), wait 24 hours. If you still want it tomorrow, it might be worth it. Often, the 'want' feeling fades away once you leave the shop!

Mira says:

"I realized that if I save money on the 'upgrades' for things I don't care about, I have more money for the 'wants' I actually love!"

The secret is making sure your needs are covered first. Once you have a plan for the essentials, you can use your remaining money for the wants that bring you the most joy. This is a big part of budgeting-basics: making sure there is room for both the 'must-haves' and the 'love-to-haves'.

People first, then money, then things.

Something to Think About

What is one thing you bought recently that you thought was a 'need' but turned out to be a 'want'?

There are no wrong answers here! Every person values things differently. Thinking about your past choices helps you become a master of your own money future.

Questions About Spending & Budgeting

Can a want ever become a need?

Should I feel bad about spending money on wants?

How can I explain to my parents that I 'need' something?

You've Got the Power!

Now that you can spot the difference between a need, a want, and an upgrade, you are ready to take control of your spending. Why not look at your Christmas or birthday list and see if you can label everything as a Need or a Want? Once you've mastered this, you're ready to learn the next big step: making your very first budget!