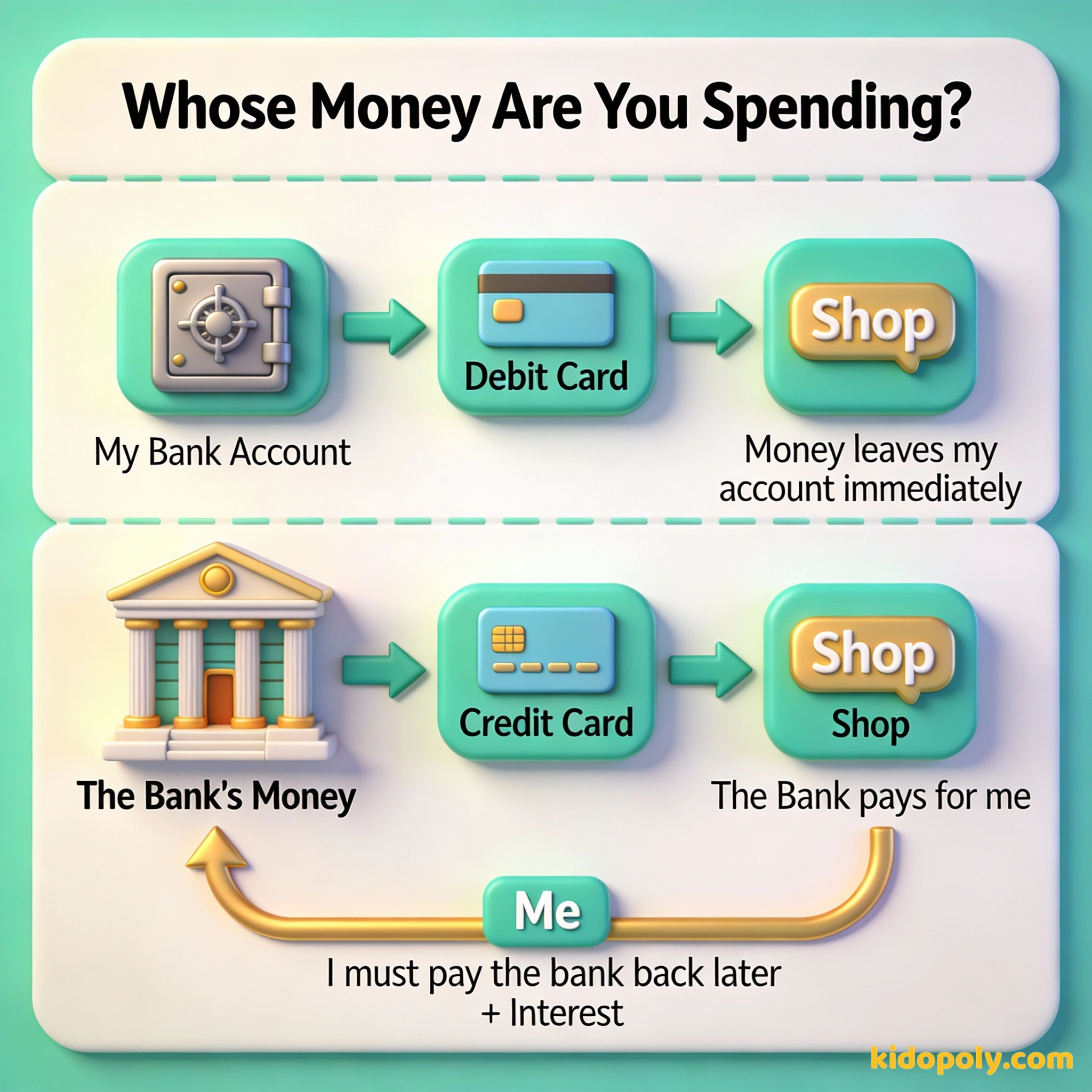

Imagine two cards that look almost identical. You can tap both at the same shop, and the cashier won't know the difference. But one spends money you already have, and the other quietly borrows money you will need to pay back.

Knowing which is which might be the most important money lesson you will learn as a teenager. Understanding the difference between a debit card and a credit card is like learning the rules of a high-stakes game before you start playing.

The Twin Cards: Spotting the Difference

If you look in a grown-up's wallet, you might see a stack of plastic cards. They all have 16-digit numbers, shiny chips, and a logo from a company like Visa or Mastercard. To a shop's card reader, they look exactly the same.

But in the world of money, these cards are actually opposites. One is a direct pipe to your own savings, while the other is a tiny, portable loan from a bank. Understanding this difference is the first step toward becoming a money master.

Imagine you are at the cinema. You tap your card for a bucket of popcorn. If it's a debit card, the money leaves your piggy bank at the bank instantly. If it's a credit card, the bank pays for your popcorn, and you get a note in the mail a month later asking for that money back.

Debit Cards: Spending What You Have

A debit card is a tool that lets you spend money you already own. When you get a debit card, it is linked directly to your checking account at a bank. This is a safe place where you keep the money you earn from chores, jobs, or gifts.

Think of a debit card like a digital straw. When you tap it to buy a sandwich, the card 'sucks' the money out of your bank account and sends it to the shop. If you have $20 in your account and the sandwich costs $8, you now have $12 left.

Finn says:

"So with a debit card, if I only have five dollars in my account, I literally can't buy a six-dollar comic book? That's actually kind of helpful for making sure I don't run out of cash!"

If you try to buy something that costs more than what is in your account, the card will usually be 'declined.' This is the bank's way of saying: 'Sorry, your straw reached the bottom of the cup!'

If you buy things you do not need, soon you will have to sell things you need.

Credit Cards: Spending the Bank’s Money

A credit card works differently. When you use one, you aren't spending your own money at all. Instead, the bank pays for the item for you. You are essentially telling the bank, 'Please buy this for me now, and I promise to pay you back later.'

Every time you use the card, you are building up a debt. At the end of every month, the bank sends you a bill showing everything you bought. If you pay back the full amount immediately, everything is fine.

The very first credit card wasn't actually plastic! In 1950, a man named Frank McNamara forgot his wallet at a restaurant. He was so embarrassed that he created the 'Diners Club' card, which was made of cardboard and allowed people to pay for their meals later.

But why would a bank just give you money to use for free? The truth is, they are hoping you won't pay it all back at once. If you only pay a small part, called the minimum payment, the bank starts charging you interest.

The Danger of the Debt Spiral

Interest is the 'rent' you pay to use the bank's money. On credit cards, this rent is usually very expensive. If you buy a cool pair of trainers for $100 but only pay back the minimum amount each month, those shoes could eventually cost you $150 or more because of the extra interest charges.

The Cost of Waiting: 1. You buy a $200 game console on a credit card. 2. The interest rate is 20%. 3. If you only pay the minimum each month, it could take you 2 years to pay it off. 4. Total cost? About $245. You paid $45 extra just for the privilege of waiting!

This is why some people find credit cards scary. If you keep spending more than you can pay back, your debt grows bigger and bigger like a snowball rolling down a hill. This is called a debt spiral, and it can take years to stop.

Mira says:

"It's like the library. If you're late returning a book, you pay a tiny fine. But with a credit card, the 'fine' is interest, and it keeps getting bigger every single day you don't pay."

Why Use a Credit Card at All?

If credit cards can be dangerous, you might wonder why anyone uses them. Why not just stick to debit? It turns out that when used carefully, credit cards have some 'superpowers' that debit cards don't have.

First, they offer better fraud protection. If someone steals your debit card and buys a TV, your actual cash is gone from your bank account immediately. With a credit card, the bank's money was stolen, not yours, and it is much easier to get the charges canceled.

Safe because you can't spend money you don't have. No debt, no interest, and very simple to use.

Offers rewards like points for flights or cash back. Helps you build a reputation (credit score) and has better protection if your card is stolen.

Second, credit cards help you build a credit score. Think of this as a digital reputation. If you borrow money and always pay it back on time, your score goes up. A high score tells people that you are trustworthy, which makes it easier to buy a house or a car when you are older.

Creditors have better memories than debtors.

Can Kids Get Credit Cards?

In most places, you have to be 18 years old to get your own credit card. This is because borrowing money is a legal contract, and you need to be an adult to sign one. However, some parents make their kids an 'authorized user' on their account to help them start learning.

Most kids start with a debit card instead. It's a great 'practice' card because it's impossible to go into debt. You can only spend what you've actually earned, which is the best way to learn how to manage a budget.

Finn says:

"I think I'll stick to my debit card for now. I like knowing that the money I'm spending is actually mine. It feels more like I'm the boss of my money!"

The next time you are out with a parent, ask them: 'Are you using a debit card or a credit card today?' Ask them why they chose that specific card for that shop. You might be surprised by their answer!

Which Card Wins?

There is no 'better' card, only the right tool for the job. A debit card is like a bicycle: it’s safe, easy to control, and takes you exactly where your own energy (money) can go. A credit card is more like a powerful motorbike: it can get you further and faster, but you need a lot more training to stay safe.

A credit card is a financial tool, but it's not a friend.

Learning the difference now means that when you finally get that piece of plastic in your hand, you'll know exactly which 'superpower' you are using.

Something to Think About

If you were given the choice today, would you rather have a card that only lets you spend your own money, or a card that lets you borrow from a bank?

There is no right or wrong answer! Think about how you handle your pocket money now. Do you like the safety of knowing it's already yours, or do you like the idea of building a reputation by borrowing and paying back?

Questions About Banking

Which is better for kids: credit or debit?

Do I have to pay a fee to use a credit card?

What happens if I lose my debit card?

Ready to Swipe?

Now that you know the difference between 'Your Money' and 'Bank Money,' you're ahead of many adults! If you want to dive deeper into how banks look after your cash, check out our guide on how debit cards work, or learn more about building your financial reputation in our section on credit scores.