When you walk into a bank and hand over your birthday money, you probably imagine the teller walking to the back and putting your exact coins into a little box with your name on it. But here is a secret: that box does not exist.

In the world of finance, a bank is not just a safe storage unit for your cash. It is actually a busy, high-tech hub where your money goes to work. Within hours of you making a deposit, the bank might lend that exact money to a family down the street to help them buy a house or start a business.

Most people think banks are like giant, super-safe piggy banks. You put your money in, it sits there, and you take it out when you need it. While it feels that way when you use your debit card or visit an ATM, the reality is much more interesting.

Imagine you have a rare holographic trading card. You give it to a friend to keep safe in their folder. But instead of just keeping it there, your friend lends it to another kid to play a match, promising that if you ever want your card back, they will have one ready for you. That is exactly what a bank does with your dollars!

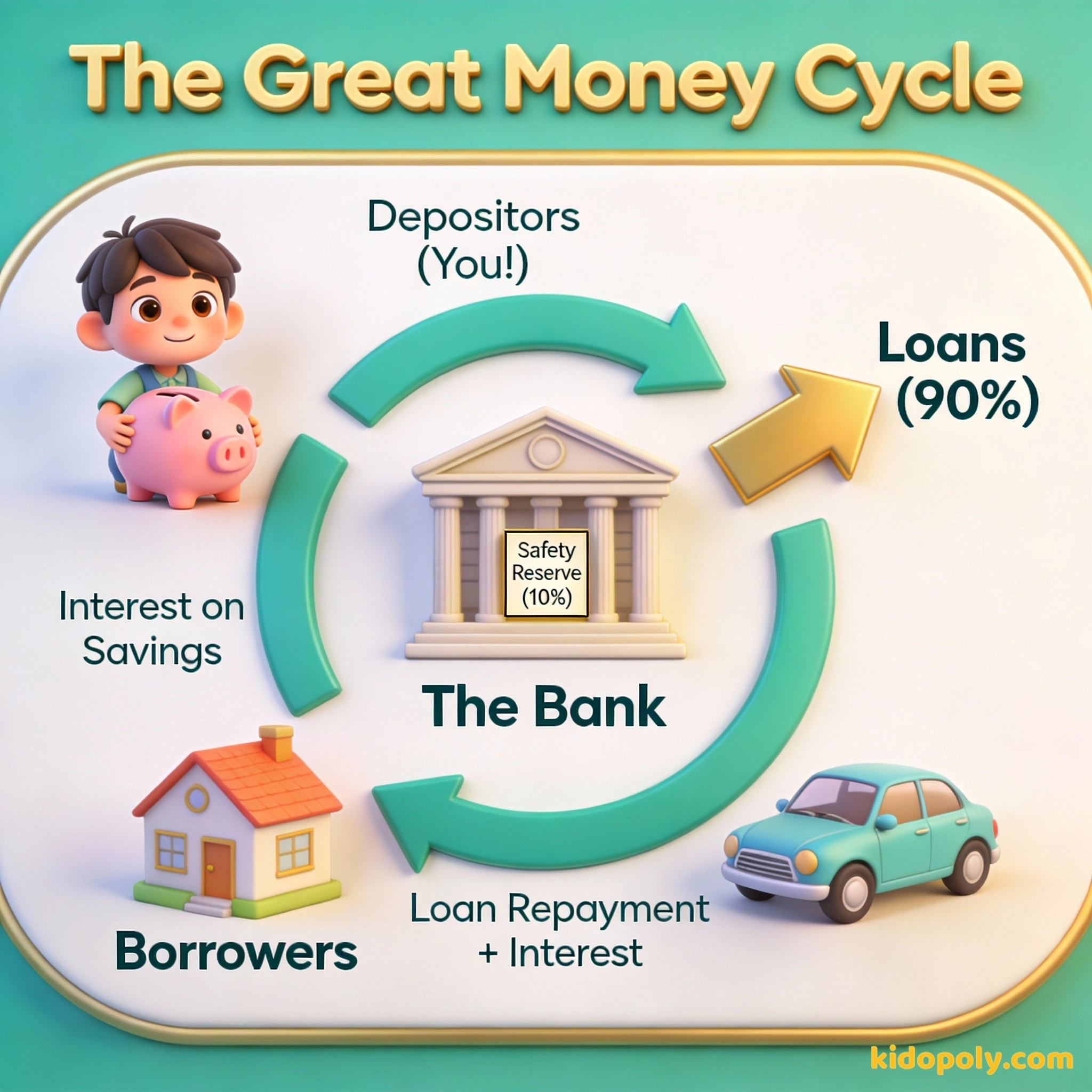

When you give your money to a bank, you are actually participating in one of the cleverest tricks in the history of economics. The bank takes your money and mixes it with everyone else's money. Then, they use most of that cash to help the community.

The Great Money Disappearing Act

If you could teleport inside a bank vault right now, you would not find rows of cubby holes labeled with people's names. You would see some cash, but nowhere near as much as you might expect. This is because banks are not just storage units: they are financial intermediaries.

Finn says:

"Wait, if they give my money to someone else, what happens if I want it back right now? Do I have to track down the person who borrowed it?"

That is a fancy way of saying they are matchmakers. They take money from people who have extra (savers) and give it to people who need it right now (borrowers). This is how the world builds big things like hospitals, schools, and homes.

Trust is like the air we breathe. When it is present, nobody really notices. When it is absent, everybody notices.

The Magic of Fractional Reserves

How can the bank lend your money away and still promise to give it back to you whenever you want? The answer is a system called fractional reserve banking.

- You deposit $100 into your account.

- The law says the bank only has to keep a small fraction of that money in their vault (usually around 10%).

- The bank keeps $10 as a reserve to handle daily withdrawals.

- The bank lends the other $90 to someone else to buy a bicycle or fix a car.

The Power of the 10% Reserve: - You deposit: $100.00 - Bank keeps (10%): $10.00 - Bank lends out: $90.00 - New money available for the community: $90.00 Total 'value' created from your one deposit: $190.00

This might sound scary, but it actually makes the whole world's economy move faster. Instead of $100 sitting lonely in a dark vault, that money is out in the world helping someone get to work or start a project.

Why the System Doesn't Break

If the bank lent out 90% of your money, you might wonder: what happens if I go to the bank tomorrow and want my $100 back? The bank only kept $10!

Mira says:

"It is like a library! A library does not have a copy of a book for every person in town. They just have enough for the people who want to read today. As long as everyone does not want the same book at 10:00 AM, it works perfectly."

This is where the "magic" of groups comes in. Banks have thousands of customers. On any given day, only a few people want to take their money out. Most people leave their money in the bank for weeks, months, or even years.

- Banks use math to predict how much cash they need every day.

- They make sure they always have enough to cover the people who show up.

- If you need a huge amount of money, you usually have to tell the bank a day or two in advance.

When Things Go Wrong: Bank Runs

Because banking is built on trust, it can break if people stop trusting the system. In the past, specifically during the Great Depression in the 1930s, people sometimes got scared that their bank was going to close.

I want to be the banker for the little fellow.

When thousands of people got scared at the same time, they would all run to the bank to take their money out at once. This is called a bank run. Since the bank had lent most of the money out, they physically did not have enough cash in the building to pay everyone. This caused many banks to fail.

The word 'Bank' comes from the Italian word 'banca,' which means bench! Hundreds of years ago, money changers in Italy would set up benches in the marketplace to do their business. If a banker failed, people would literally break his bench, which is where we get the word 'bankrupt' (broken bench).

Your Money is Protected Today

To make sure bank runs do not happen anymore, governments created a special kind of safety net. In the United States, it is called the FDIC (Federal Deposit Insurance Corporation). In the UK, it is the FSCS.

- These organizations promise that even if a bank fails, the government will give you your money back.

- This guarantee makes people feel safe, so they do not feel the need to run to the bank during a crisis.

- Because of this, your money is actually much safer in a bank than it is hidden under your mattress at home!

Keeping your money at home is physical. You can see it, but if there is a fire or a theft, it is gone forever. It also does not help anyone else.

Banks use digital records and government insurance to keep money safe. Even if the building disappears, your money is still yours, and it helps your neighbors in the meantime.

The Flow of Interest

Banks do not do all this hard work for free. To keep the system running, they use something called interest. When you leave your money in a savings account, the bank usually pays you a tiny bit of extra money as a thank you.

Finn says:

"So the bank pays me to use my money, then charges someone else more to borrow it? That sounds like a pretty clever business."

On the other side, when the bank lends money to a borrower, that person has to pay the money back plus a little bit extra. To learn more about how that extra money adds up, you can check out our page on what-is-interest.

An investment in knowledge pays the best interest.

Banks are the engines of our world. By taking your small deposit and combining it with others, they create the big piles of money needed to build the future. Understanding this secret makes you much smarter about how the adult world really works.

Something to Think About

If you were the manager of a bank, who would you choose to lend money to first?

Think about what your community needs most: new homes, a cool toy store, or maybe a better park. There is no right answer, but it shows how banks help decide what gets built in the world.

Questions About Banking

Does the bank have my exact physical coins?

How do I get my money back if the bank lent it out?

Is my money safe if the bank closes?

Your Money's Big Adventure

Now you know the secret: your bank account is not just a digital number. It is a ticket to a giant, worldwide system of sharing and building. By keeping your money in a bank, you are helping someone buy a car, start a restaurant, or build a home. Ready to see how banks make this all worth their while? Head over to our page on how-banks-make-money to see the business side of the vault!