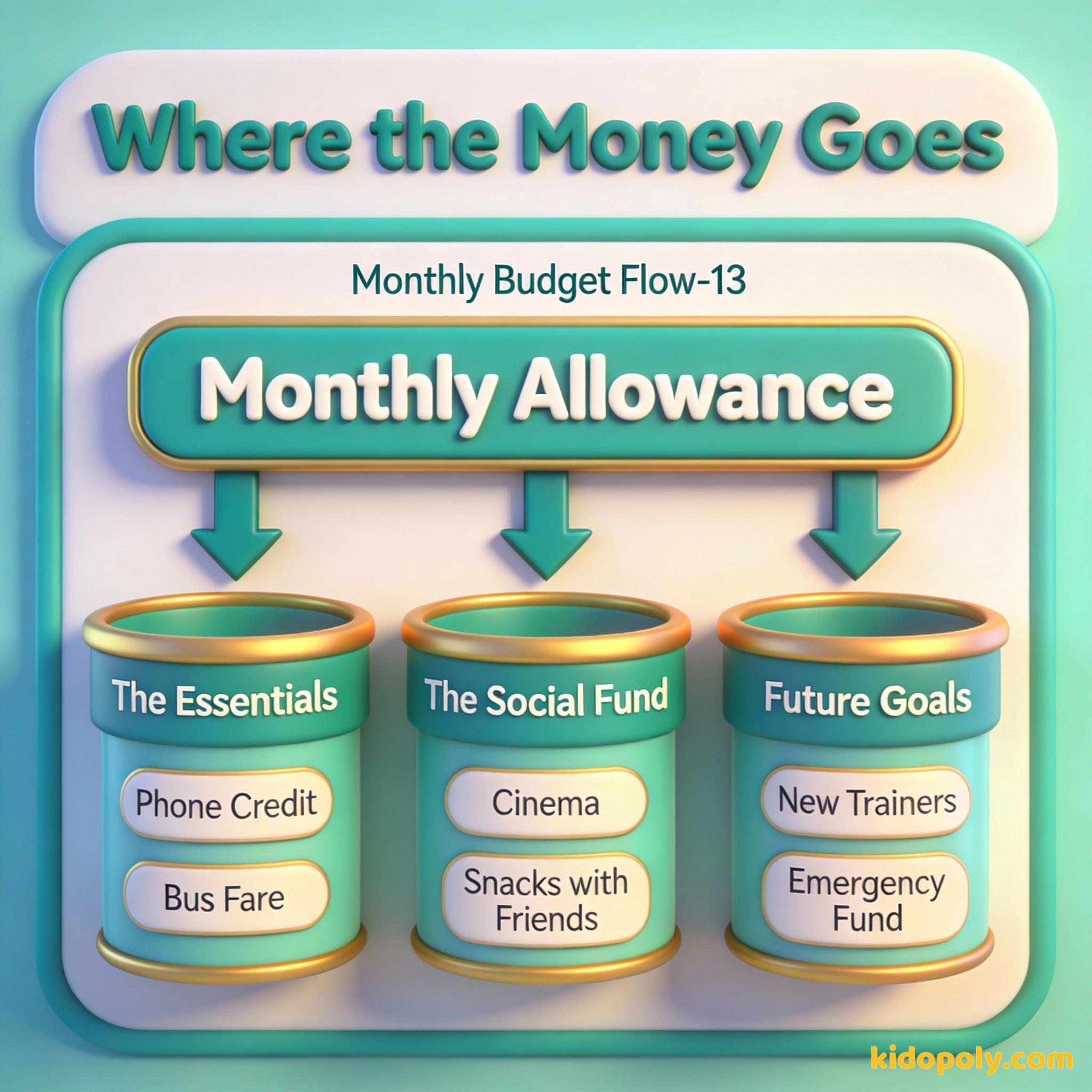

Your 13-year-old needs £8 for the cinema, £5 for a birthday present, and wants new headphones. They're old enough to manage this themselves, but only if you set up the right system.

At thirteen, your child is stepping into their first year of being a teenager. This is the ideal time to move from a simple reward-based system to a Monthly Budget that acts as a training ground for Financial Independence.

Thirteen is a milestone year. It is the age when social lives expand, digital needs grow, and the desire for independence becomes a daily conversation. In the world of money, this transition is vital. You are moving away from paying for 'good behavior' and moving toward giving them the tools to manage a mini-economy.

This guide will help you decide on the right amount of pocket money and, more importantly, how to teach your teen to manage it without running out by day ten. We will cover why 13 is the year to ditch the weekly coins in favor of a digital, monthly approach.

Do not save what is left after spending, but spend what is left after saving.

How Much Pocket Money Should a 13-Year-Old Get?

The most common question is: what is the going rate? While every family's budget is different, UK data suggests a typical range for 13-year-olds is between £7 and £15 per week. If you are moving to a monthly payment, this works out to roughly £30 to £60 per month.

Average UK Weekly Pocket Money (13 years old): £9.50 Monthly Total: £41.16 Yearly Total: £494.00 If you save 20% of that (£8.23/month), you would have nearly £100 in the bank by your 14th birthday!

However, the 'right' amount depends entirely on what you expect them to pay for. If they are only buying sweets, £15 a week is a lot. If they are responsible for their own phone data and cinema tickets, £15 might be a tight squeeze. It is best to sit down and list their typical monthly costs together.

Finn says:

"If I get my money once a month, what happens if I spend it all on a new game on day one? Do I really have to wait four whole weeks for more?"

The Big Switch: Moving to Monthly Payments

For younger children, a week feels like a lifetime. For a 13-year-old, the month is the new unit of time. Switching to a monthly Allowance is one of the best financial lessons you can give. It teaches them to pace their spending and understand that once the money is gone, it is gone until the first of next month.

- It mimics a real-world salary.

- It encourages long-term planning for bigger purchases.

- It forces them to prioritize needs over wants early in the month.

The 'First of the Month' Meeting. Sit down for 10 minutes when the allowance is paid. Look at the calendar together: Are there any birthdays? A new movie release? Use this to set a mini-budget before the spending starts.

What Should the Money Cover?

To make pocket money a real teaching tool, you need to hand over responsibility for certain costs. This is not about making them pay for their own dinner at home, but about letting them manage their 'out-of-house' life. Common expenses for 13-year-olds include:

- Social Activities: Cinema tickets, bowling, or trips to the local cafe.

- Digital Costs: Phone top-ups, gaming subscriptions like Xbox Live or Roblox, and app store purchases.

- Gifts: Buying birthday presents for their friends.

- Hobbies: Specific equipment or supplies for their interests.

Digital Money Management

At 13, physical cash is becoming less common. Most teens spend money online or via contactless payments. This is the perfect age to set up a Debit Card designed for teens. Providers like GoHenry, Rooster Money, or high-street bank teen accounts offer apps that let them see their balance in real-time.

Research shows that teenagers who manage their own money through a bank account are more likely to have higher financial literacy scores and better saving habits as adults.

Using an app helps them visualize their spending. Instead of a 'black hole' where cash disappears, they see a list of transactions. This makes it easier to talk about Budgeting because the data is right there on the screen. It also allows you to set spending limits or see where they are spending most of their money.

Mira says:

"I started paying for my own phone data this year. It made me realize how much I was wasting on videos when I wasn't on Wi-Fi!"

The Earning Conversation

Pocket money is a great base, but 13 is also the age where many kids want more than the standard allowance. This is a fantastic opportunity to discuss Earning. While they are usually too young for a formal part-time job in a shop, there are many age-appropriate ways to make extra cash.

A budget is telling your money where to go instead of wondering where it went.

- Babysitting: Looking after younger siblings or neighbors' children (with supervision).

- Tutoring: Helping younger kids with reading or basic maths.

- Neighbourhood Tasks: Dog walking, car washing, or gardening.

- Decluttering: Selling old toys or clothes on parent-managed apps like Vinted or eBay.

Imagine you really want a pair of trainers that cost £100. Your allowance covers your basics, but it would take a year to save up. If you wash two cars a weekend for £5 each, you could have those trainers in just 10 weeks!

Managing Social Pressure

One of the hardest parts of being 13 is realizing that friends have different amounts of money. Some friends might have a huge allowance, while others have very little. This is a sensitive but important topic. Talk to your teen about Values and the fact that money is relative to a family's unique situation.

Encourage them to suggest 'free' activities if they are running low on funds, like going to the park or a movie night at home. Helping them feel confident in saying "I can't afford that this week" is a high-level financial skill that will serve them well into adulthood.

Finn says:

"My friend always wants to go for pizza, but that’s half my weekly budget. I’ve started suggesting we just hang out at the park instead."

Introduction to Saving and Investing

Finally, use the 13th year to introduce the concept of Compound Interest. Even if they only save £5 a month, showing them how that money can grow over time is powerful. You might even consider an 'interest' scheme where you add 10% to whatever they have left in their savings account at the end of the month.

The way to wealth is as plain as the way to market. It depends chiefly on two words, industry and frugality.

Pocket money should be a flat rate for everyone, regardless of chores, so they learn to manage a base income.

Pocket money should be earned through extra tasks so they understand the link between work and pay.

By treating pocket money as a training ground rather than just a gift, you are giving your 13-year-old the confidence to handle the much bigger financial decisions coming their way in the later teen years.

Something to Think About

If you could choose between getting £10 a week with no responsibilities, or £20 a week but you have to pay for your own phone and snacks, which would you pick?

There is no right or wrong answer here! Think about whether you prefer the safety of a smaller amount or the freedom (and risk) of managing more money.

Questions About Earning & Pocket Money

Should I pay my 13-year-old for doing basic chores?

What if my child spends all their money in the first week?

Is 13 too young for a contactless debit card?

Ready to Level Up?

Transitioning to a more mature pocket money system is a big step. Once you have the basics down, you might want to look at our guide on budgeting for teens or explore more about pocket money for all ages to see what comes next!