Your 6-year-old comes home from school and announces that their friend Jake gets £5 a week. Suddenly, the £2 you were planning to give feels like a personal insult.

At age six, children enter a new social world in Year 1 where playground comparisons begin. They are developing the mathematical skills to count coins and the cognitive ability to understand that money is a limited resource used for making choices.

The transition into age six is a significant milestone for financial literacy. In Year 1, children are moving beyond the purely imaginative play of earlier years and starting to notice how the real world functions. They see their peers with new stickers or trading cards and begin to ask the big question: 'How do I get that?'

A study by University of Cambridge researchers found that many basic money habits are actually formed by the age of seven. This makes age six the 'golden window' for introducing positive financial behaviors.

How Much Pocket Money Should a 6-Year-Old Get?

The most common question parents ask is about the 'going rate.' In the UK, the typical range for pocket money for a 6-year-old is between £1 and £3 per week. While some families choose to give more, research often suggests that the specific amount matters far less than the consistency and the lessons attached to it.

Do not save what is left after spending, but spend what is left after saving.

At this age, the goal is not to fund their entire lifestyle. Instead, the money serves as a training tool. It should be enough to buy a small treat or a pack of stickers, but not so much that they never have to wait or save up for something they really want. Small amounts help teach the concept of scarcity: if they spend it all on Monday, it is gone for the rest of the week.

Mira says:

"I remember when my friend got a huge LEGO set for no reason. It felt unfair, but then my mum explained that we were saving our money for our summer holiday ice creams instead!"

Handling the 'Jake Gets More' Conversation

Comparison is the thief of joy, especially in the school playground. When your child mentions that a friend receives a much higher amount, it is a perfect opportunity to talk about family values without being preachy. You can explain that every family has a different budget and different rules for how money is used.

Focus the conversation back on what your child can do with their money. If they feel their £2 is 'small,' help them visualize what that £2 can actually buy. This shifts the focus from a social ranking to personal purchasing power. You might say, 'In our family, we think £2 is the right amount to help you learn how to choose between a snack or saving for that book you liked.'

Teaches that money is a tool everyone in the family gets to practice with, regardless of their ability to do chores.

Teaches the economic reality that money is earned through labor and helps prevent a sense of entitlement.

The Developmental Leap: Basic Math and Saving

By age six, most children are becoming comfortable with basic addition and subtraction. They can usually count to 20 and are starting to recognize the different denominations of coins. This makes it the perfect time to introduce very short-term saving goals.

Let's look at a 2-week saving goal: Week 1: £2.00 (Current Total: £2.00) Week 2: £2.00 (Current Total: £4.00) Target Price: £3.50 Result: You can buy the toy and have 50p left over!

At five, 'saving' can feel like losing money forever. By six, children have a better grasp of time. However, their horizon is still short. A 6-year-old can realistically save for one or two weeks. If a goal takes six weeks of saving, they will likely lose interest. Look for targets that cost £4 to £6, requiring them to skip spending for just a fortnight to see the reward.

Finn says:

"If I save my £2 this week and my £2 next week, does that mean I can finally buy that sparkly dinosaur that costs £4?"

Should They Earn It or Get It Freely?

The debate over 'allowance' versus 'commission' is one every parent faces. Some believe pocket money should be a right of being part of the family, while others feel it must be earned through chores. At age six, a hybrid approach often works best.

You might provide a small base amount of pocket money to practice management, while offering 'extra' ways to earn money for tasks that go above and beyond daily expectations, like helping to wash the car or sorting the recycling. This teaches the link between effort and reward without making basic household contributions a transaction.

I don't give 'allowances.' I give 'commissions.' You work, you get paid. You don't work, you don't get paid.

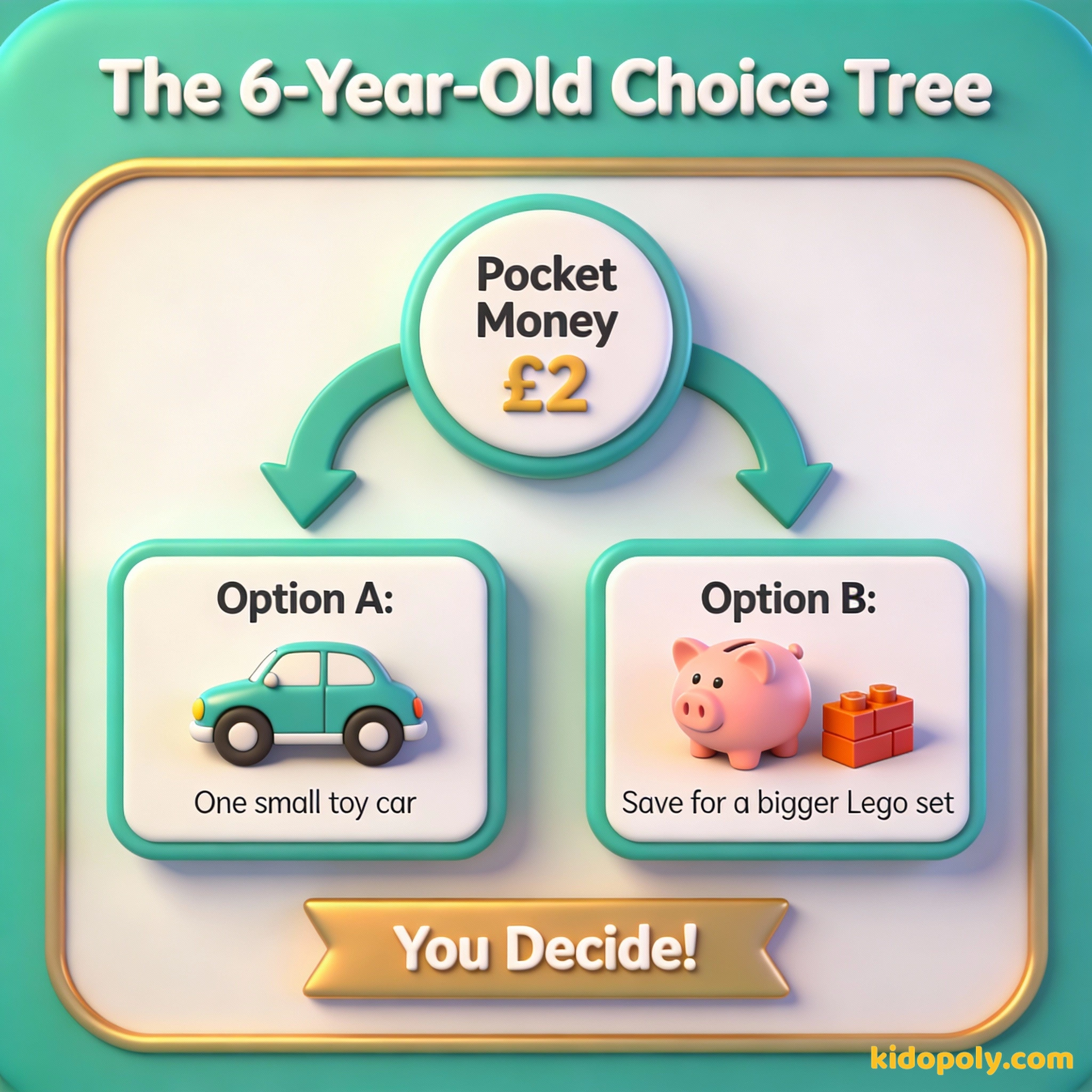

Teaching Spending Choices: The 'This or That' Rule

Open-ended spending can be overwhelming for a 6-year-old. When you are at the shop, they might want everything they see. You can help them build decision-making skills by using the 'This or That' rule. Instead of asking 'What do you want to buy?', give them two specific options that fit their budget.

The 'Three Jar' System: Label three jars as SPEND, SAVE, and GIVE. When your child gets their £3, they put £1 in each. It visually demonstrates that money has different jobs to do.

This framework prevents the 'meltdown' that often occurs when a child realizes they cannot afford a large toy. It also empowers them. By choosing 'this' over 'that,' they are taking the first steps toward understanding opportunity cost - the idea that choosing one thing means giving up another.

Finn says:

"Wait, if I buy the chocolate bar now, I have zero pounds left for the stickers? That seems like a bad trade."

Moving Toward Independence

As your child progresses through Year 1, you will notice their confidence growing. They might start calculating if they have enough money before you even get to the shop. This is the ultimate goal of pocket money at age six: moving from passive observers to active participants in the economy of your home.

An investment in knowledge pays the best interest.

Imagine your child is at the school book fair. They have their own £2 in their pocket. Instead of asking you to buy something, they are looking at the prices and checking their own 'wallet.' That pride of ownership is the real goal of pocket money.

Something to Think About

What is one small thing your 6-year-old has been asking for lately?

Think about whether this item could be their first 'saving goal.' There is no right or wrong amount, only the experience of waiting and then finally achieving the goal.

Questions About Earning & Pocket Money

Should I pay my 6-year-old for making their bed?

What if they lose their pocket money?

Is 6 too young for a digital pocket money card?

The First Step on a Long Road

Starting pocket money at six isn't about the coins themselves; it's about the conversations they trigger. By giving your child a small amount of control now, you are letting them make 'small' mistakes today so they can avoid 'big' ones later in life. Ready to see how the journey changes next year? Check out our guide on pocket money for 7-year-olds.