Your 7-year-old spots a £12 Lego set but only has £2 in their hand. For the first time, they don't just ask you to buy it: they actually do the maths and realize, 'That's six weeks of waiting!'

This is the moment pocket money stops being a game of 'playing shop' and becomes a real-world lesson in financial literacy. At age seven, children undergo a significant cognitive shift that allows them to grasp the concepts of earning, saving, and the true value of a pound.

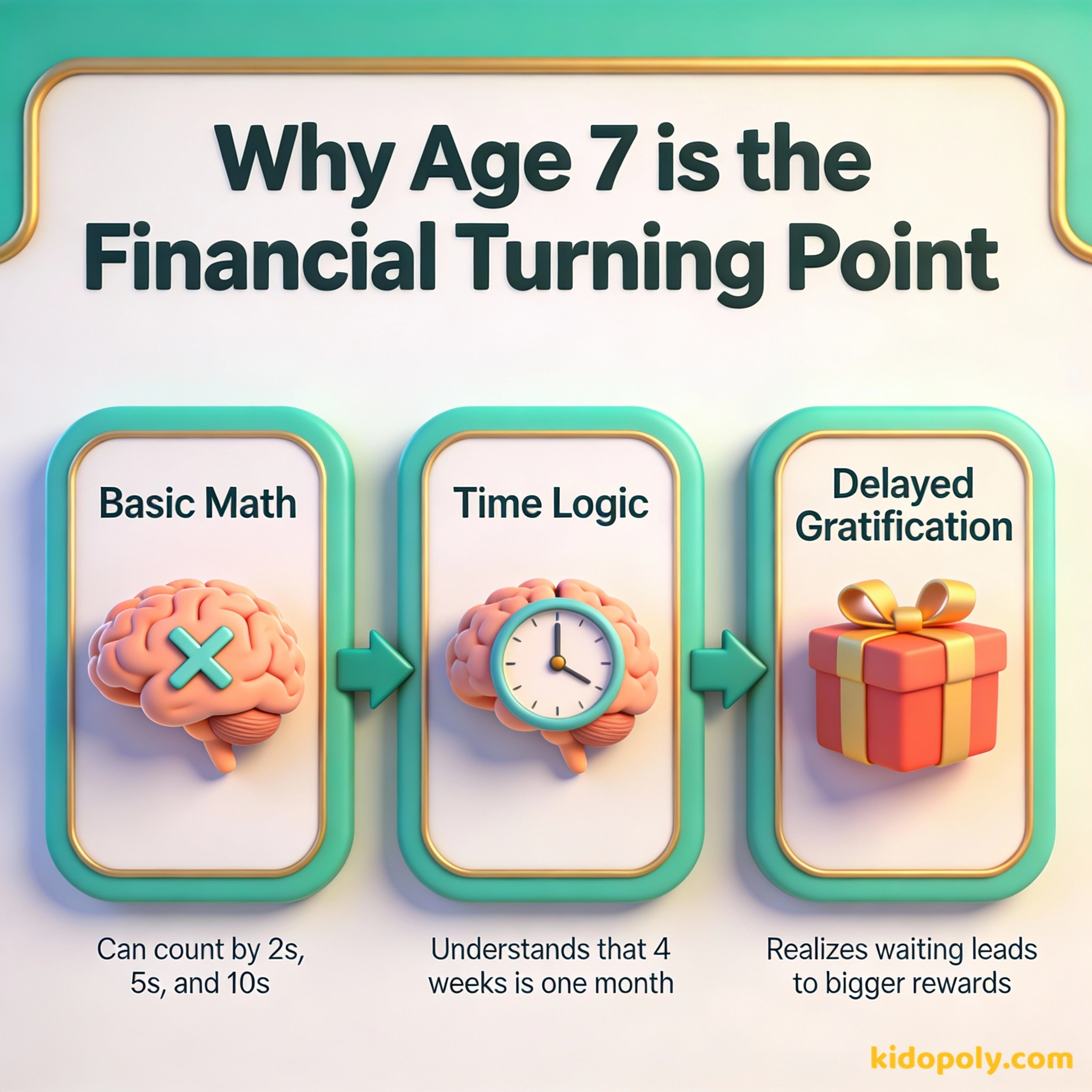

The Age 7 Turning Point

Around the seventh birthday, something clicks. According to researchers at the University of Cambridge, many of our lifelong habits around money are actually formed by age seven. This is because children at this age are developing the executive function required to plan ahead.

A study by the Money Advice Service found that by age 7, most children have already grasped how to recognize the value of money and can understand the difference between 'wants' and 'needs'.

At seven, your child is likely moving beyond simple addition to basic multiplication. They can understand that if they get £2 every Saturday, they will have £4 in two weeks and £8 in a month. This ability to project into the future is the foundation of budgeting.

Finn says:

"So if I get £2 every week, but the comic I want is £5, I have to wait three weeks? That feels like forever, but I guess I'll have £1 left over!"

How Much Pocket Money is Right?

While every family budget is different, the typical range for a 7-year-old in the UK is between £2 and £4 per week. This amount is small enough that a mistake doesn't hurt, but large enough that they can buy a small treat or save for a bigger one within a month.

The chains of habit are too light to be felt until they are too heavy to be broken.

Consistency matters far more than the specific number. If you choose £2.50, stick to it every week. This reliability helps your child learn to trust the system and plan their spending. If the 'payday' is random, the lesson in planning is lost.

The Savings Sprint: Weekly Pocket Money: £3.00 Goal: A £12.00 Card Game Week 1: £3.00 Week 2: £6.00 Week 3: £9.00 Week 4: £12.00 (Goal Reached!) Total Time: 28 Days

Earning and Chores

By age seven, children are physically capable of contributing to the household in meaningful ways. This is the ideal stage to introduce chore-linked earning. Many parents find success by splitting tasks into two categories: 'family contributions' and 'earning opportunities'.

- Family Contributions: Basic tasks like making their bed or clearing their plate. These are done because they are part of the family team.

- Earning Opportunities: Extra tasks like sorting the recycling, matching all the socks in the laundry, or helping to pull weeds in the garden.

Linking a portion of their pocket money to these extra tasks introduces the concept of effort and reward. It also allows them to 'earn extra' if they are saving for a specific goal, which builds a healthy work ethic.

First Saving Goals

At age six, a month feels like an eternity. At age seven, a four-week goal becomes achievable. This is the perfect window for their first real saving project. If they want a toy that costs £10, and they receive £3 a week, they can see the finish line.

Mira says:

"I noticed that if I help Mum match the socks on Sunday, I get an extra 50p. That means I can get my new glitter pens one week earlier!"

Money is one of the most important subjects in your entire life. Some of the most successful people were those who learned about it early.

To make this visual, move away from the traditional ceramic piggy bank that hides the money. Use a clear glass jar or a simple savings tracker on the fridge. Seeing the physical pile of coins grow provides the dopamine hit needed to keep them motivated.

Introduction to Budgeting

Seven is also the age where you can introduce the 'Three Jar System'. Instead of giving them all their money for spending, you can help them divide it the moment they receive it. This introduces resource allocation without using scary words like 'accounting'.

The 'Wait 24 Hours' Rule: If your 7-year-old wants to spend their money on a 'must-have' item at the shop, ask them to wait just 24 hours. If they still want it tomorrow, they can buy it. This is a simple way to practice impulse control.

- Spend: For immediate treats like a comic or a pack of stickers.

- Save: For a goal they want to reach in a few weeks.

- Give: A small amount for a charity or to buy a friend a birthday card.

Finn says:

"Why do I have to put money in the 'Give' jar? It's my money! Oh, wait: is that how we bought the flowers for Grandma's birthday last week?"

Spending Decisions and Mistakes

Part of the reason we give pocket money at age seven is to let children make spending mistakes while the stakes are low. If they spend their entire £3 on a plastic toy that breaks ten minutes later, they learn a lesson about quality and value that no lecture could ever teach.

An investment in knowledge pays the best interest.

Avoid the urge to 'bail them out' if they run out of money before the next payday. Let them experience the natural consequence of an empty jar. This temporary disappointment is actually a powerful tool for building financial resilience.

Giving a fixed amount regardless of chores. This focuses on learning to budget a limited, guaranteed resource.

Paying only for completed tasks. This focuses on the direct link between effort, work, and financial reward.

Moving from Age 6 to 7

Should the amount increase just because they turned seven? Not necessarily. An increase in pocket money is most effective when it is tied to an increase in responsibility. If they are now expected to manage their own school snack money or take on a more complex chore, a small 'raise' is a great way to acknowledge their growing maturity.

Imagine your child at the checkout counter. They count out the coins themselves, hand them to the cashier, and receive the change. This physical transaction makes the concept of 'spending' much more real than a parent tapping a card.

Something to Think About

What was the first thing you ever saved up for as a child?

Sharing your own 'first money' story with your child - including any mistakes you made - is one of the most powerful ways to show them that managing money is a skill everyone has to practice.

Questions About Earning & Pocket Money

Should I pay my 7-year-old for doing their homework?

Is 7 too young for a digital pocket money app?

What if they lose their pocket money?

From Playing to Planning

At age seven, you are no longer just giving your child 'sweet money'; you are providing them with a laboratory for life. By setting a consistent amount and encouraging a mix of saving and spending, you're helping them build the cognitive muscles they'll need for the rest of their lives. Ready to see which tasks they can handle? Head over to our guide on chores and money to find age-appropriate ways for them to earn those extra pounds.