Your child is excited about investing: maybe they want to buy shares of their favorite company or start building wealth for the future.

But here is the catch: you cannot just open a regular investing account for a 10 year old. There are special account types designed for exactly this situation, and choosing the right custodial vehicle matters for taxes, control, and your child's future.

The legal reality of investing for children is simple: minors cannot enter into legally binding contracts. This means your child cannot open a brokerage account at a major firm by themselves until they reach the age of majority, which is usually 18 or 21 depending on where you live.

To get around this, financial institutions offer specialized accounts where an adult manages the assets for the benefit of the minor. These accounts allow you to buy stocks, bonds, and index funds on their behalf, giving the money decades to grow before the child takes over.

Finn says:

"So if I want to buy a share of a video game company, I can't just download an app and do it? I have to ask my parents to be the 'boss' of the account first?"

The Three Main US Options

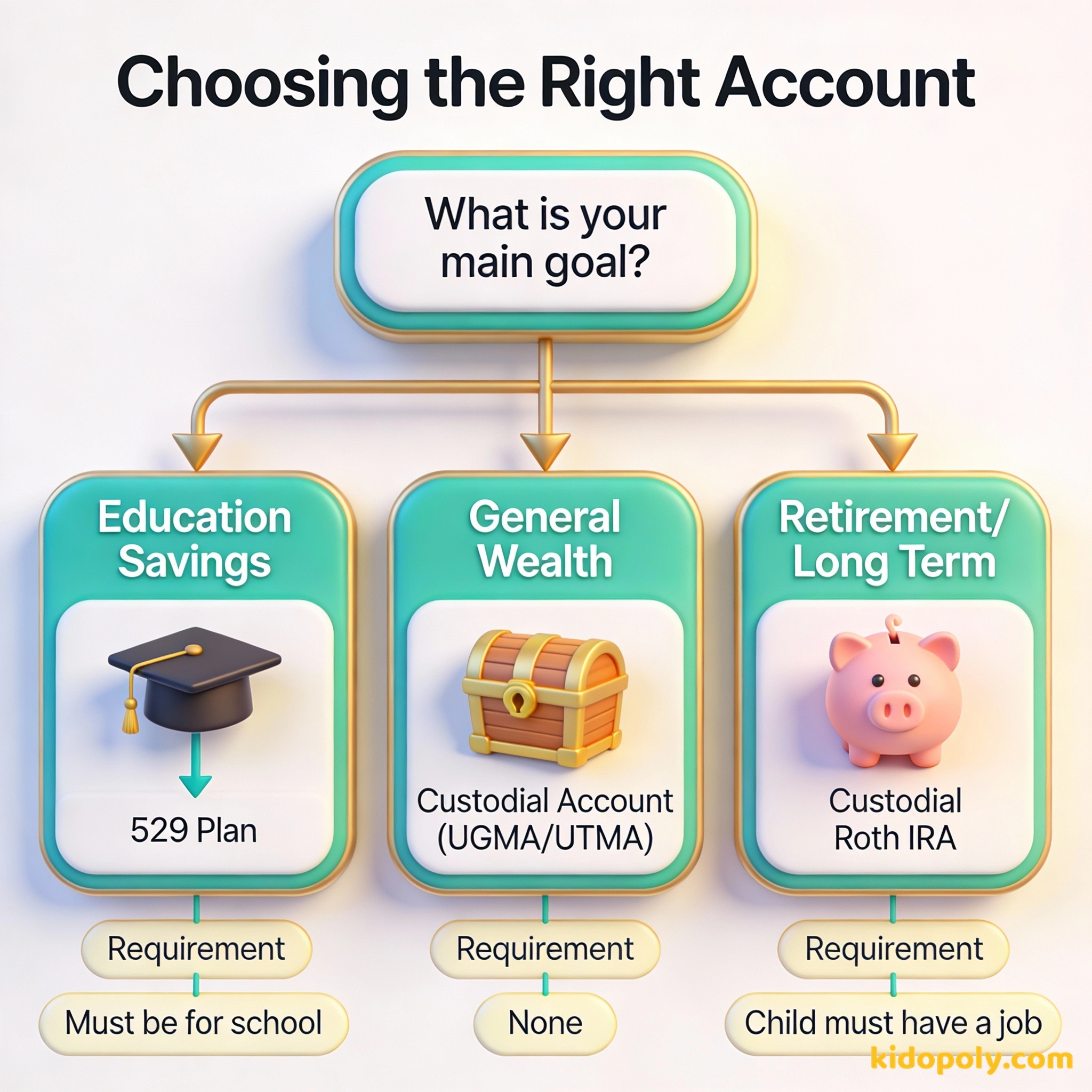

If you are in the United States, you generally have three primary paths to choose from. Each has different rules regarding how the money is taxed and what it can be used for later in life.

- Custodial Brokerage Accounts (UGMA/UTMA): These are the most flexible. The money can be used for anything that benefits the child, but the child gets full control once they reach adulthood.

- Custodial Roth IRAs: These are powerful for long-term wealth because the growth is tax-free, but they have a strict rule: the child must have earned income from a job.

- 529 Plans: These are designed specifically for education. They offer great tax perks, but you might face penalties if the money is not used for school-related expenses.

The best time to plant a tree was 20 years ago. The second best time is now.

For a deeper dive into the most common general-purpose option, you can read our full guide on custodial-accounts. If your child already has a part-time job, you might want to look specifically at the roth-ira-for-kids for those unique tax benefits.

In many US states, the 'Kiddie Tax' rule applies. This means that if a child's unearned income (like investment gains) goes above a certain limit, it might be taxed at the parents' higher tax rate instead of the child's lower rate.

Comparing Control and Taxes

When choosing an account, you need to weigh flexibility against tax savings. A regular custodial brokerage account (UGMA or UTMA) is technically owned by the child from day one, but you manage it as the custodian.

In a 529 plan, you (the parent) actually own the account, and the child is the beneficiary. This gives you more control if the child decides not to go to college, as you can often change the beneficiary to another family member.

The parent keeps total control of the money. If the child doesn't use it for school, the parent can take it back (though they pay a penalty).

The money legally belongs to the child. Once they hit the age of majority, they can use it for anything - from a house deposit to a world tour.

The UK Perspective: Junior ISAs and SIPPs

If you are in the United Kingdom, the options look a bit different but follow similar logic. The most popular choice is the Junior ISA (JISA). This is a tax-free wrapper where you can save or invest up to a certain limit each year.

- Junior Stocks and Shares ISA: Similar to a US custodial account, money grows tax-free and the child gains control at age 18.

- Junior SIPP (Self-Invested Personal Pension): This is for the ultra-long term. It provides a government tax relief top-up, but the money is locked away until the child reaches retirement age.

Mira says:

"It is like having a special 'future box.' We put the money in now, and the rules of the box help it grow bigger than a regular piggy bank ever could."

Age Milestones: What Changes When?

Investing for a child is not a 'set it and forget it' process. As your child grows, their legal relationship with the money changes. It is helpful to know these key ages:

- Birth to 12: The parent usually handles 100% of the decisions. The child is often unaware of the account's scale.

- Age 13: Many fintech platforms allow kids to have 'view-only' access or a debit card linked to their financial ecosystem, helping them learn by watching.

- Age 18 to 21: This is the 'age of majority.' For UGMA/UTMA accounts and Junior ISAs, the account must be legally transferred to the child. They now have full control over the best-stocks-for-kids you bought years ago.

Imagine you invest $1,000 for a baby at birth. If that money grows at 8% per year: - At age 18, it's worth about $4,000. - At age 65, it's worth over $150,000! This is why starting at age 0 is so much more powerful than starting at age 25.

Money is of a prolific generating nature. Money can beget money, and its offspring can beget more.

How to Pick the Right Platform

Not all banks or brokers offer every type of account. When looking for a place to open a kids investing account, check for three things: low fees, a wide range of investment options, and a user-friendly app for your child to use as they get older.

Finn says:

"What happens if I turn 18 and decide I want to spend all the money on a giant robot instead of college? Does the 'custodian' get to say no?"

Traditional brokers like Charles Schwab, Fidelity, and Vanguard offer robust custodial accounts with no account minimums. Newer 'fintech' apps like Greenlight or Acorns Early focus more on the educational experience, though they may charge a small monthly subscription fee.

Before opening an account, sit down with your child and look up the price of one share in a company they love, like Disney, Roblox, or Apple. Use a 'watch list' app to track that stock for a week together to see how the price moves before you put real money in.

Making the Final Decision

If you want the most flexibility for your child's future, a custodial brokerage account is usually the winner. If your goal is strictly education, the 529 plan is the gold standard. And if your teenager just got their first paycheck from a summer job, the Roth IRA is an unbeatable gift for their future self.

The stock market is the only place where when things go on sale, everyone runs out of the store.

Something to Think About

If you could only choose one goal for your child's future wealth, would it be flexibility, education, or retirement security?

There is no right answer here. Every family has different values. Talk with your child about what 'future success' looks like to them to help pick the right account.

Questions About Investing

Can a 13 year old open their own investment account?

What happens to a custodial account when the child turns 18?

Is it better to use a 529 plan or a custodial account?

Your Next Step: The Choice is Yours

Choosing an account is the first 'real' step in your child's investing journey. Whether you choose the flexibility of a custodial account or the tax-efficiency of a 529, the most important thing is to start early. Once the account is open, you can begin exploring which specific stocks or funds will fill it.