Have you ever wondered who pays the driver of the big red fire engine that zooms past with its sirens blaring?

That fire engine, the driver's salary, and even the water they use are all paid for by taxes. Taxes are a way for everyone in a community to share their money so they can buy big, important things that no single person could afford on their own. It is like a giant club membership fee for living in a country, and it helps turn a group of people into a working society.

Imagine you and your ten best friends want to play football, but none of you has enough money to buy a ball, a net, or a pump. You decide that every person will contribute one pound of their pocket money. Suddenly, you have eleven pounds: enough to buy everything!

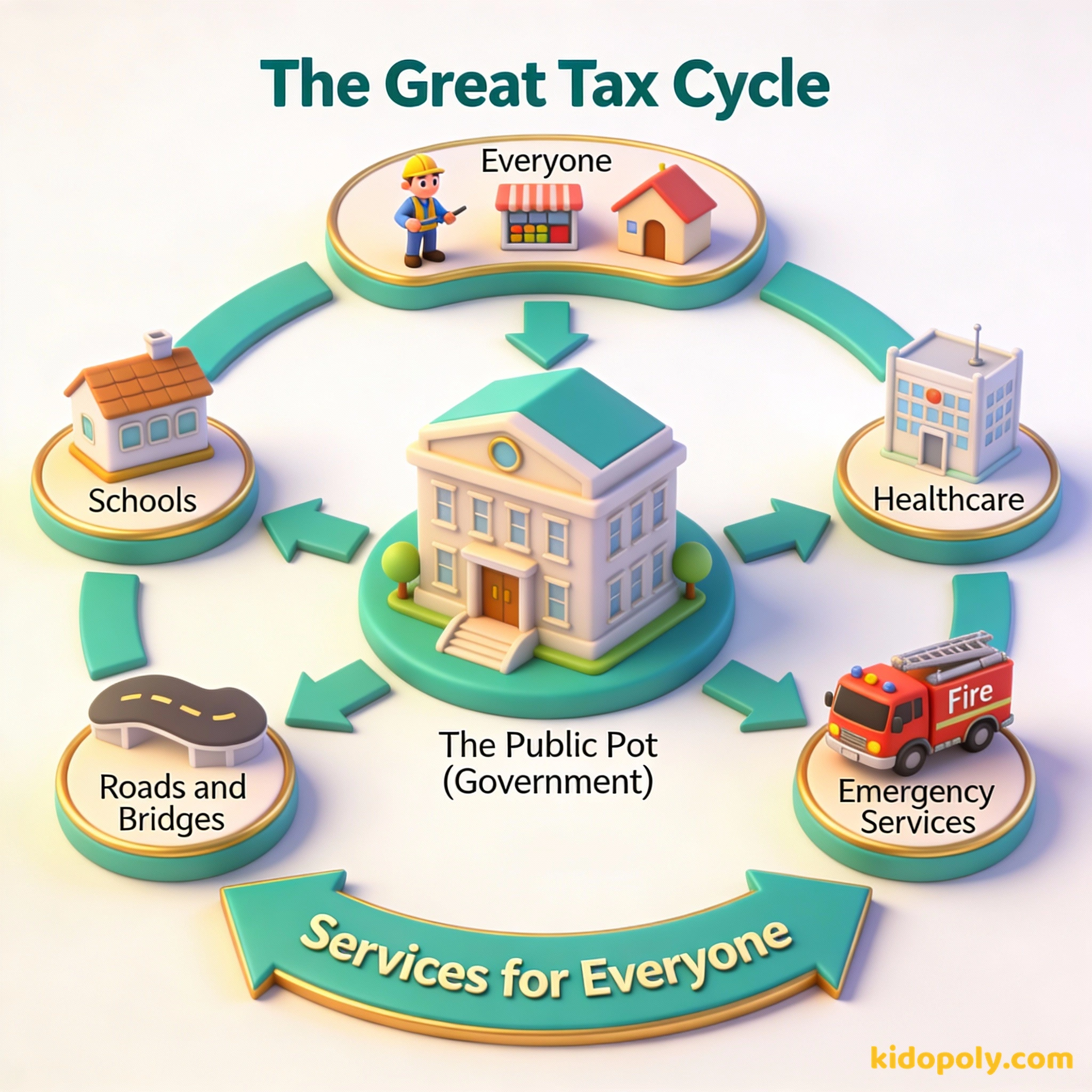

This is the core idea of taxes. Because everyone chips in a little bit, the whole group gets something amazing that they can all use. In the real world, the 'club' is your country, and the things you buy together are things like schools, roads, and hospitals.

In Ancient Rome, there was once a tax on urine! It was collected from public toilets because the ammonia in it was used by people to clean clothes and even whiten teeth.

The Magic of the Shared Pot

Most kids go to a school that feels 'free' because you do not have to pay a fee at the door every morning. However, building a school and paying teachers is very expensive. It costs about 6,000 pounds per year for just one student to attend a state school.

If your family had to pay that all at once, it would be very difficult. Instead, everyone who works and earns money pays a portion of their income into a giant 'shared pot' called the Treasury.

Finn says:

"Wait, if I don't have a car, do I still have to pay for the roads? That doesn't seem fair if I'm just walking!"

This system ensures that even if a family does not have a lot of money right now, their children can still go to a great school. It is one of the ways that taxes make life fairer for everyone.

In this world, nothing is certain except death and taxes.

Where Does the Money Go?

Governments collect billions of pounds every year, and they have to decide exactly how to spend it. This is called the budget. While every country is a bit different, most of them spend their tax money on the same big categories.

- Healthcare: Paying for doctors, nurses, and the medicine used in hospitals.

- Education: Building schools, buying books, and paying for teachers.

- Safety: Supporting the police, the fire service, and the military to keep people safe.

- Infrastructure: Building and fixing the roads, bridges, and train tracks your family uses to travel.

Do Kids Pay Taxes Too?

Many people think taxes are just for adults with jobs, but you have likely been paying taxes for years! Whenever you buy something at a shop, like a new Lego set or a chocolate bar, a small part of the price is actually a tax.

In many places, this is called VAT (Value Added Tax) or Sales Tax. If a toy costs ten pounds, the shop might keep eight pounds and fifty pence, while the other one pound and fifty pence goes straight to the government.

Let's look at a £20 video game with 20% VAT: - Price of the game: £16.67 - Tax (VAT) to the government: £3.33 - Total you pay: £20.00 That £3.33 might pay for a few bricks in a new school wall!

If you have a job when you are older, you will also pay income tax. This is a percentage of the money you earn that goes to the government before you even get your paycheck. It might seem like a bummer to see money disappear, but remember: that money is what keeps the streetlights on at night!

Mira says:

"Actually Finn, those roads are how the delivery truck brings your favorite snacks to the shop. So you're using the roads even when you're just eating!"

The 'Free Rider' Problem

Because taxes pay for things that everyone uses: like clean air, safe streets, and public parks: they have to be mandatory. This means that by law, if you earn money or buy things, you must pay the tax.

If taxes were optional, some people might choose not to pay but would still want to use the roads and the parks. This is called the 'free rider' problem. If too many people became free riders, there would not be enough money left to fix the roads or pay the firefighters.

Taxes are what we pay for civilized society.

People keep more of their own money to spend on things they want, but the government has less to spend on public parks and libraries.

The government has more money to build amazing hospitals and modern trains, but people have less money in their pockets to spend at the shops.

Why Do Adults Complain About Taxes?

You might hear grown-ups grumbling when they look at their bills or talk about 'tax season.' This is usually because they worked very hard for their money and it can be painful to see some of it go away.

Sometimes, adults also disagree about how the money should be spent. One person might want more money for parks, while another wants more money for the police. These disagreements are a normal part of how a democracy works, as people try to figure out the best way to use their shared resources.

The hardest thing in the world to understand is the income tax.

A World Without Taxes

To really understand why we have taxes, it helps to imagine a world without them. Picture a town where there are no taxes at all. You get to keep every single penny you earn, which sounds great at first!

But then, you notice the problems. If your house catches fire, you have to call a private fire company and pay them thousands of pounds before they will start the hoses. If you want to go to the shop, you have to pay a 'toll' to the person who owns the road in front of your house.

Imagine a city with no taxes for one week. The rubbish bins on the street start overflowing because no one is paid to empty them. The streetlights go dark at night. When you want to go to the park, you find it's locked because there is no money to mow the grass. Sometimes, the things we don't notice are the ones taxes pay for!

Mira says:

"It is like the ultimate subscription service. Instead of just getting movies or games, we get a whole functioning country!"

In a world without taxes, only the richest people would be able to afford good schools or clean water. Taxes are the tool we use to make sure that the basic things we all need to survive and thrive are available to everyone, not just those with the most coins in their pocket.

Something to Think About

If you were the leader of the country, what is the one thing you would spend tax money on to make life better for everyone?

There is no right or wrong answer here. Some people value nature, others value technology or helping people in need. What matters most to you?

Questions About Money & Society

Do I have to pay taxes on my pocket money?

Who decides how much tax we have to pay?

Is tax the same in every country?

You're Already a Contributor!

Now that you know taxes are just a way for us to build a better world together, you can see them everywhere. The next time you walk through a clean park or use a sturdy bridge, you can think: 'I helped pay for a tiny bit of this!' Want to see exactly which taxes you pay when you shop? Head over to our page on types-of-taxes to learn more.