Your child has birthday money to save and you want to open their first real account. But there are dozens of options, traditional banks, online accounts, credit unions, and custodial accounts. How do you cut through the noise?

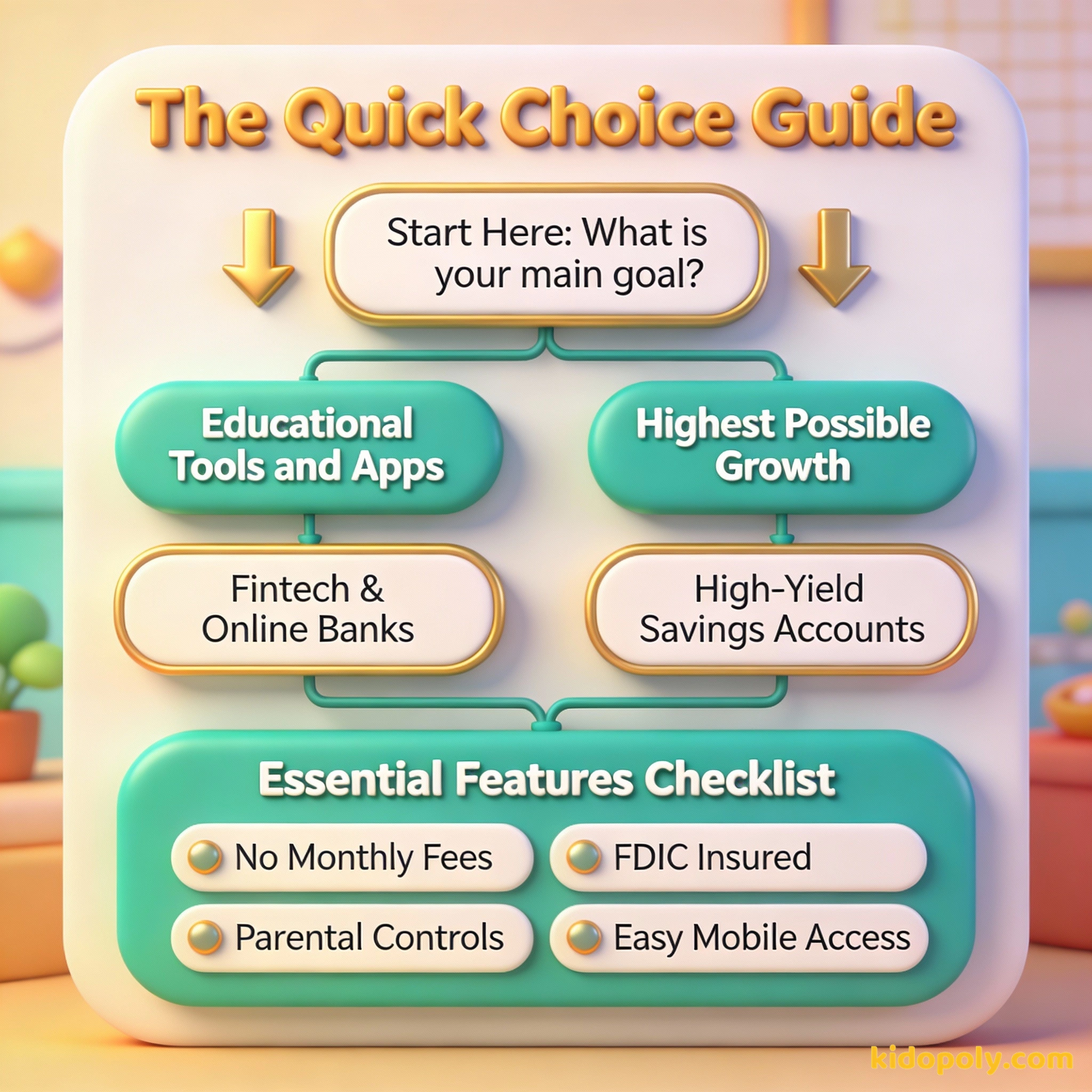

Choosing the right savings account is less about the bank's brand and more about the habits you want to build. Whether you prioritize a high APY or a kid-friendly mobile app, the best account is the one your child will actually use to learn about financial literacy.

Opening a savings account for your child is a major milestone. It moves money from a glass jar on a shelf into the real financial world. In 2026, the landscape of kids' savings accounts has shifted away from dusty passbook accounts at local branches toward high-tech, high-interest digital platforms.

The chains of habit are too light to be felt until they are too heavy to be broken.

The Evaluation Framework: What Actually Matters

When you compare accounts, it is easy to get distracted by sign-up bonuses. Instead, focus on these five core criteria to find a long-term fit for your family:

- Interest Rates (APY): Is the rate competitive enough to outpace inflation, or is it a symbolic 0.01 percent?

- Fees and Minimums: Avoid accounts that charge monthly maintenance fees or require a high minimum balance.

- User Experience: Does the bank have a dedicated app for kids, or will they have to log in through your portal?

- Parental Controls: Can you instantly freeze a card, set spending limits, or automate allowance transfers?

- Educational Content: Does the platform offer in-app lessons or quizzes about earning and saving?

Most traditional 'big name' banks only offer 0.01% interest on kids' accounts. That means if your child saves 100 dollars, they only earn one penny in interest after an entire year!

Comparing Account Types

Not all savings vehicles are built for the same purpose. Depending on your goals, you will likely choose from three main categories. Traditional banks offer the convenience of physical branches, which can be great for depositing lemonade stand cash. However, they often have the lowest interest rates.

Finn says:

"If the bank is just a website and I can't go inside a building to see the vault, how do I know my money is actually there?"

Online banks and Fintech apps are the modern leaders for kids. These accounts often provide much higher interest rates and robust apps designed specifically for children. They focus on the 'gamification' of saving, using progress bars and goal-setting features to keep kids engaged.

Physical branches allow kids to hand cash to a teller, which makes money feel real and tangible.

Online banks offer much higher rates and better apps, making it easier to track goals daily.

Finally, Custodial Accounts (like UTMA or UGMA) are different from standard youth savings. While a youth savings account is a tool for practicing money management, a custodial account is a legal way to hold assets for a minor. These are often used for larger long-term gifts rather than weekly pocket money.

Give your children a financial education. It's the best gift you can ever give them.

Age-Specific Recommendations

Your child's needs change as they grow. What works for a six-year-old likely won't satisfy a teenager looking for independence.

- Under age 8: Focus on simplicity. Look for accounts with high-visibility apps that show 'piles' of money or visual goals. Physical access to a branch can help make the concept of a bank more concrete.

- Ages 8 to 12: This is the sweet spot for educational features. Look for accounts that allow kids to create 'buckets' for different goals like 'Spend,' 'Save,' and 'Give.'

- Ages 13 and up: Teens need a hybrid of a savings and a checking account. Look for accounts that offer a debit card with strong parental oversight and the ability to earn higher interest on their growing balance.

Red Flags to Watch For

Even 'free' accounts can have hidden traps. Before you sign the digital paperwork, check the fine print for these common issues. Some banks offer a high 'teaser' rate that only applies to the first 500 dollars. Others might charge a fee if the account stays inactive for six months.

Sit down with your child and look at three different bank websites together. Ask them: 'Which of these apps looks the easiest for you to use?' Letting them have a say increases their 'buy-in' to the saving process.

Ensure the account is FDIC insured or NCUA insured (for credit unions). This guarantees that your child's money is protected up to 250,000 dollars if the bank fails. In 2026, most reputable fintechs partner with insured banks, but it is always worth double-checking.

Mira says:

"I like using the app because I can see exactly how many more weeks of chores it will take to buy my new telescope."

Teaching the Tech

The best account is the one that facilitates conversation. If you choose an online-only account, make sure you spend time showing your child how the digital numbers represent real-world purchasing power. Linking their account to a chores-and-allowance app can reinforce the connection between effort and reward.

In investing, you get what you don't pay for. Costs matter.

Comparing Growth over 10 Years (on a $500 balance): - At 0.01% APY: You earn $0.50 total. - At 4.00% APY: You earn $240.12 total. Choosing the right account can be the difference between a pack of gum and a new video game console.

How to Compare Rates Yourself

Interest rates fluctuate based on the economy. To find the best rate today, search for 'High-Yield Savings Accounts for Minors.' Look for the Annual Percentage Yield (APY). A 4.00 percent APY will grow your child's money 400 times faster than a standard 0.01 percent account found at many big-name traditional banks.

Imagine two friends, Sam and Alex. Sam keeps his $200 in a shoebox. Alex puts her $200 in a high-yield savings account. Five years later, Sam still has exactly $200. Alex has enough to buy a nice dinner for her family just from the interest the bank paid her.

Finn says:

"So if I find an account with a higher interest rate, my money basically works a job for me while I'm at school?"

Ultimately, the 'best' account is a balance between growth and education. If an account pays high interest but is too hard for your child to use, it loses its value as a teaching tool. Pick the platform that makes your child feel like a capable, informed owner of their own money.

Something to Think About

What is the most important thing you want your child to learn from their first bank account?

There are no wrong answers here. Some parents want to prioritize wealth growth, while others care more about the discipline of consistent saving. Your choice of account should reflect your family's personal values.

Questions About Saving

Can a child open a savings account by themselves?

Do I have to pay taxes on the interest my child earns?

What is the difference between a youth account and a custodial account?

Ready to open an account?

Now that you have a framework for comparison, your next step is to pick two or three finalists and look at their current rates. Remember, the 'best' account is simply the one that gets your child excited about watching their money grow. Check out our guide on kids-bank-accounts for more on how to manage the daily ins and outs of family banking.